Click Here To Login E-way Bill

Electronic way bill i.e. E-Way bill is the bill generated on the E-Way Bill Portal for the movement of goods.

Without an E-Way bill generated through ewaybillgst.gov.in, a GST Registered person cannot transport goods of which value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan). Besides this, the E-Way bill can also be generated or cancelled through Andriod App, SMS or site-to-site integration through API.

After the generation of the E-Way bill, a unique e-way bill number i.e. EBN is allocated and is available to the supplier, recipient and the transporter.

Supply in case of E-Way bill

Supply E-Way bill may be a Bill which may be in the course or may not be in course of business and may include supplies without payment. To use way bill all the registered business taxpayers will need to upload details in a prescribed format decided by GSTN officials website.

The transporter and the trader will need to mention all the details of goods or commodities which they wish to move in or out of the state. As of now, GSTN has created various waybills which will be valid for 1-15 days and one day will be considered as 100km. Once generated the E-Way bill a unique E-Way bill number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal.

E-Way Bill is coming at a time when GST base is set to cross one crore mark in India and the government feels it’s the right time that all the States must have a common electronic Waybill which will bring in uniformity across the states for seamless inter-state movement of goods.

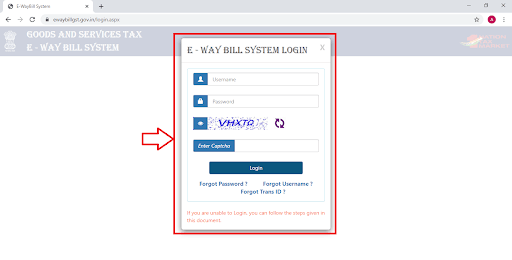

How to login in E-waybill?

Firstly, go to ewaybillgst.gov.in.

Click on ‘Login’.

An E-Way Bill System Login window will appear.

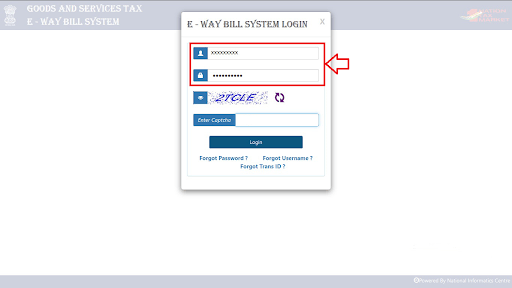

Enter the Username and Password.

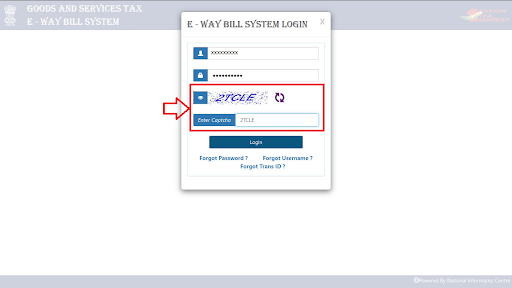

Enter the Captcha code displayed on the screen.

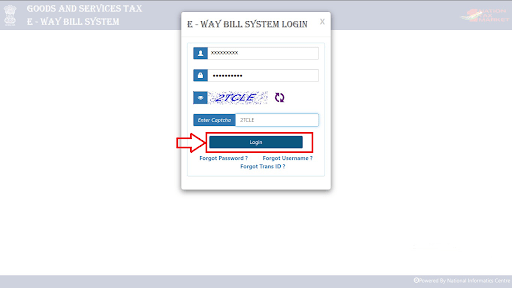

Now click on ‘Login’.

An E-Way Bill Dashboard will appear where the user can easily generate E-way Bill as per the requirement.

Click Here To Login E-way Bill

Electronic way bill i.e. E-Way bill is the bill generated on the E-Way Bill Portal for the movement of goods.

Read Other Related Blogs:

Frequently Asked Questions

Why is my e-Way bill login not Working?

There are various situations when eWay doesn’t work. Such as-

Server issues

The e-way bill website can cause temporary issues, interrupting its functionality. However, the issues can be tackled once the site administrators solve the server-related concerns.

Maintenance periods

The e-way bill site sometimes undergoes scheduled maintenance to enhance its efficiency and features. It’s suggested to assess the maintenance notifications or wait till the maintenance is done.

Internet connectivity problems

Problems with your internet connection can prevent access to the e-way bill online page. Unstable internet can result in difficulties in browsing the site.

How do I generate a new e-way bill?

Find the step-by-step guide below to know the way to generate a new e-way bill-

Step 1: First Log in to the e-way bill on your system.

Step 2: Next, click on Generate new under the ‘E-waybill’ option reflecting on the left side of the dashboard.

Step 3: Now, enter the following fields on the screen that appears:

Transaction Type

Sub-type

Document Type

Document No.

Document Date

From/ To

Item Details

Transporter details

Step 4: Click on ‘Submit’. The system verifies the data entered and shows an error if found.

How do I extend the validity of my e-waybill?

You can extend E-way Bill validity by following given steps:

Step 1– Firstly, visit the E-way Bills Website

Step 2– Find the option ‘Would-be-Expiring E-way Bills’

Step 3– Now, choose a Particular E-way Bill for its Extension

Step 4– Then, opt for the Option of Extending the E-way Bill Validity

Step 5– Affirm about the E-way Bill Extension

Step 6– Next, feed the Mandatory Details associated with the E-way Bill Extension

Step 7– Finally, you’ll get the Successful Extension of the E-way Bill

Who should Generate an eWay Bill?

Registered Person – E-way bill must be created when there are goods carried out of more than Rs 50,000 in value to or from a registered person. A Registered person or the transporter may opt to create and carry away a bill even if the goods’ value is less than Rs 50,000.

Unregistered Persons – Unregistered persons are also needed to make an e-Way Bill. However, where a supply is done by an unregistered individual to a registered person, the receiver will have to make sure all the compliances are fulfilled as if they were the supplier.

Transporter – Transporters carrying goods by rail, air, roads, etc. also need to make an e-Way Bill if the supplier has not made an e-Way Bill.

Is the e-Way bill mandatory for below Rs. 50000?

As per the e-way bill algorithms, an e-way is required to carry the goods during transportation, if the worth is less than Rs. 50,000/-. In this situation, the consumer may get an e-way bill generated by the taxpayer as per the bill or invoice issued by them.

Thanks for sharing this information.have shared this link with others keep posting such information.

Visit for any digital marketing related services.

Thanks for sharing this information.have shared this link with others keep posting such information..

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest.

I like how you wrote about Login – E-Way Bill.

Thanks and keep it up!

Good way of explaining, and nice post to get information concerning my presentation subject, which i am going to deliver in institution of higher education.

These are really fantastic ideas in concerning blogging.

You have touched some nice things here. Any way keep

up wrinting.

I think this is one of the most significant info for me.

And i’m glad reading your article. But want to remark on few general things,

The web site style is wonderful, the articles is really great : D.

Good job, cheers

I was able to find good information from your articles.

This website was… how do you say it? Relevant!!

Finally I have found something which helped me.

Thanks!

My brother recommended I might like this blog. He was totally right.

This post actually made my day. You can not imagine simply how much time I had

spent for this information! Thanks!