Electronic invoicing, also known as eInvoicing, is a form of electronic billing.

This method was used by trading partners, customers, and their suppliers to

represent and track transactional documents between one another to ensure the

terms of their business agreements are being met.

The reason behind the introduction of electronic invoices or e-invoicing is:

The primary duty of the accounts payable department is to guarantee that all

unpaid invoices from its suppliers are authorized, handled, and paid. Processing

an invoice involves capturing relevant data from the invoice and entering it

into the business’s accounting or financial systems.

Once the feed is completed, the bills must travel through the business procedure

of the company to be paid.

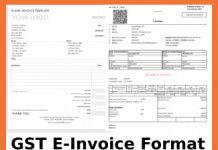

An e-invoice is a structured invoice issued in EDI or XML formats, sometimes

through online web forms. These papers can be transmitted through EDI, XML, or

CSV files, among other methods. Emails, virtual printers, web apps, and FTP

sites can all be used to upload them.

Data from PDF or paper invoices may be extracted using imaging software by the

business and entered into their invoicing system. Moreover, To avoid mismatch

mistakes, the GST data reconciliation process has a significant gap that is

closed and plugged using e-invoice.

Data exchange and a decrease in data entry errors are made possible by the

ability of different applications to read electronic invoices. E-invoice makes

it possible to track supplier-prepared invoices in real-time.