As we already know, a taxpayer will have to create the invoices on his own accounting/ERP software and will have need to upload the same on the IRP i.e. Invoice Registration Portal.

The portal then generates a unique IRN (Invoice reference number) to transfer the invoice details to the GST & E-way bill portal (If required). Therefore it reduces the efforts and need of manual entry each time.

Table of Contents

ToggleWho should need to register themselves for e-invoicing?

E-invoicing is applicable from 1st October 2020 for all businesses whose aggregate turnover exceeds Rs.500 crore specified limit in any of the preceding financial years from 2017-18 to 2019-20.

From 1st January 2021, e-invoicing will be applicable to transactions exceeding the Rs.100 crore turnovers between 2017-18 to 2019-20.

Therefore, the business lying between the conditions mentioned above need to register them for e-invoicing.

However, e-invoicing shall not be applicable to the following categories of registered persons without considering the turnover

- An insurer, banking company or a financial institution.

- A registered person from passenger transportation services.

- A Goods Transport Agency (GTA).

- A registered person supplying services in the form of admission to the exhibition of cinematographic films in multiplex services.

- An SEZ unit (excluded from CBIC Notification No. 61/2020 – Central Tax)

Steps for Registration on the IRP

Step 1: Firstly visit to IRP portal.

Case A: If a taxpayer is already registered on the e-way bill portal: In this case, a taxpayer can use the same login credentials to login the e-invoice portal.

Case B: If a taxpayer is not registered on the e-way bill portal: In this case, he/she can register on IRP by GSTIN and mobile number registered with the GST system.

Suppose, in our case we are explaining the further process of Case2.

Thereafter you will get redirected to the home page of IRP.

Step 2: Now go to the ‘Registration’ tab.

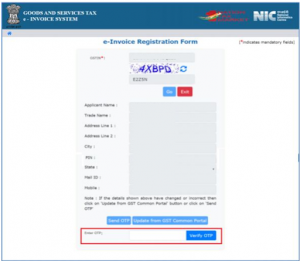

- A registration form will get opened in which firstly mention your GSTIN.

- Then mention the required Captcha code.

- Click on ‘Go’ to submit the request.

Step 3: Here, are the description of details required to be filled to register on IRP are as follows:

- Applicant Name:

- Trade Name:

- Address Line 1&2

- City

- Pin Code

- State

- Mail ID & Mobile No

Then click on ‘Send OTP’.

- Now mention the OTP received on registered mobile number.

- Then click on ‘Verify OTP’.

- Once the OTP has been successfully verified, then the system prompts the user to enter a user name of choice (consisting of minimum 6-15 characters) and enter a password.

- Then re-enter the password for verification and click on ‘Save’.

The user can now log into the e-invoice system using the generated credentials.

Additional Information:

1. In case of Forgot Password, follow the given steps:

- ‘Login -> Go to Forgot Password’ option, and enter the username, GSTIN and mobile number on the e-invoice system. After the successful validation, user can reset his password.

- In case a user forgets his username, follow the given steps:

- ‘Login -> Forgot User Name’ option, and then enter his GSTIN and the registered mobile number. The system will validate the process and send a username to his registered mobile number through SMS.