Registration & Login Guide on Income Tax Department Portal:

Everyone who earns or gets an income in India is subject to income tax if they are above basic exemption limit, and it is mandatory for every taxpayer in India to register as a user on the income tax department website for filing Income Tax Returns

According to the Income Tax Department’s e-filing website, income tax e-filings in FY 2018-19 was 6.68 crore and grew by 15 percent to 8.45 crore as on March 31, 2019. This depicts that every year several new taxpayer Register on Income Tax Portal and file Income Tax Return.

Things you need to Register on Income Tax Portal

- PAN Card

- Aadhaar Card (Mandatory for Filing Tax Return)

- Mobile Number

- Current Address

- Email Address

Before registering on the Income Tax Department website, one must ensure that they must have all the above-mentioned things.

Step by Step guide for Registering Process on the Income Tax Portal.

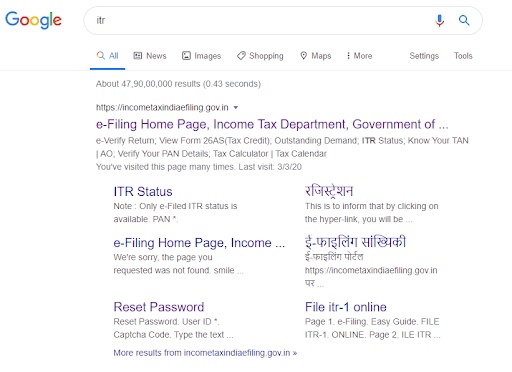

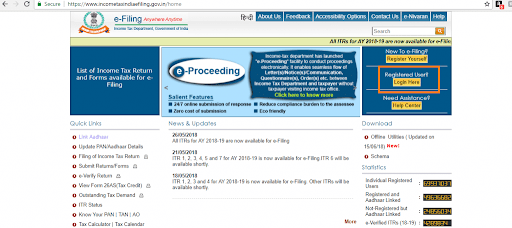

Step 1: Visit the income tax department portal

In web browser and just search for ITR or Income Tax Department click on the first result, or directly go to https://www.incometaxindiaefiling.gov.in/home

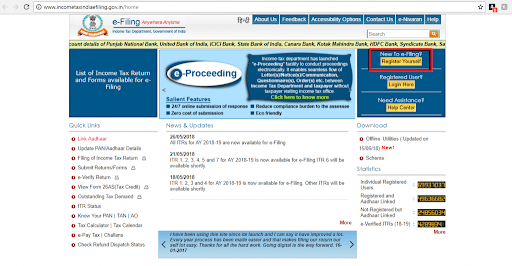

Once you click on the e-filing home page you will be directed to the homepage of the Income Tax portal, and after entering on Income Tax portal click on ‘Register Yourself’ on the top right-hand side of the page.

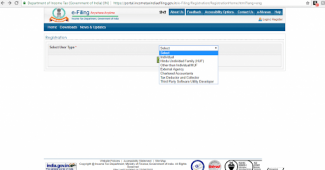

Step 2: Select the user type

Once you click on ‘Register Yourself’ you will be directed to the page where you have to select your user and then press continue. User types like; Individual, HUF or other than Individual/HUF etc.

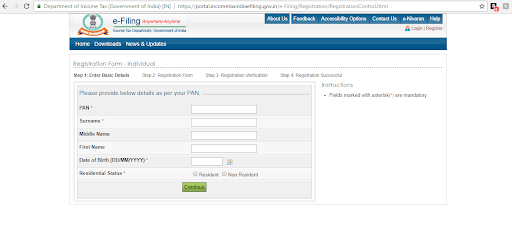

Step 3: Enter Your Pan Card Details

Enter your Pan Card Details, like; Pan Number, Name and DOB, etc. After entering all the details then press continue.

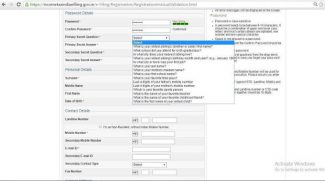

Step 4: Fill in the Registration Form

After filling Pan Card details you will get Registration Form where you have to enter your basic details like; Mobile No, Email ID, Current Address, Password and Security Questions & answer, etc.

In the Registration Form, there are some Mandatory details having red star marks are compulsory to fill like; Password Section, Contact Section and Current Address Section.

After entering all the details, press submit.

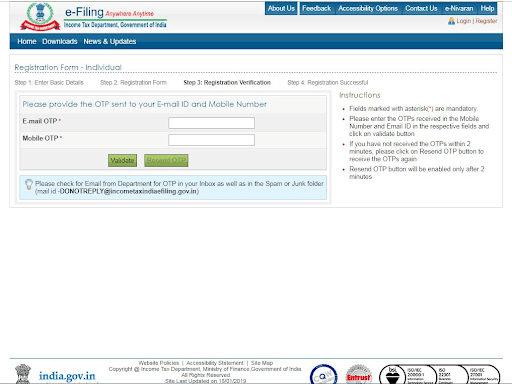

Step 5: Verification

As you submit the registration form, you will get a six-digit One Time Password (OTP) on your mobile number and the email ID which you have provided on the registration form. Enter both the OTP received in email and mobile correctly to successfully verify the details.

The OTP will expire after 24 hours. If you fail to enter and verify the OTP, then the entire registration must be initiated again.

Steps of Income Tax Department Portal Login

Step 1: Visit the income tax department portal

To access the Income Tax Portal for login go to Income Tax Department Portal and when you enter on the portal click ‘Login Here’ button for registered users located at the right side of the home page

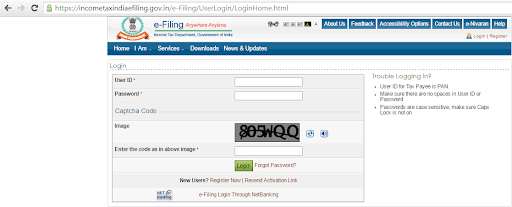

Step 2: Enter the Details

Once you have clicked on the ‘Login Here’ button, you will be directed to the login page where you have to enter your income tax login details Username and Password.

Pan Card Number will be your User Name