Table of Contents

ToggleArticle Content :

| Established | May 19,1894 |

| Founder | Dyal Singh Majithia Lala Lajpat Rai |

| Headquarters | New Delhi, India |

| Customer service | 1800 180 2222 |

| Founded | 19 May 1894 |

Founded in 1894, Punjab National Bank is the first domestic bank in India. Headquartered in New Delhi, Punjab National Bank has constantly updated its services as per the increasing demands of customers. It has successfully fulfilled all its consumers’ needs and offered internet banking solutions to its customers.

How to Sign up for PNB Internet Banking?

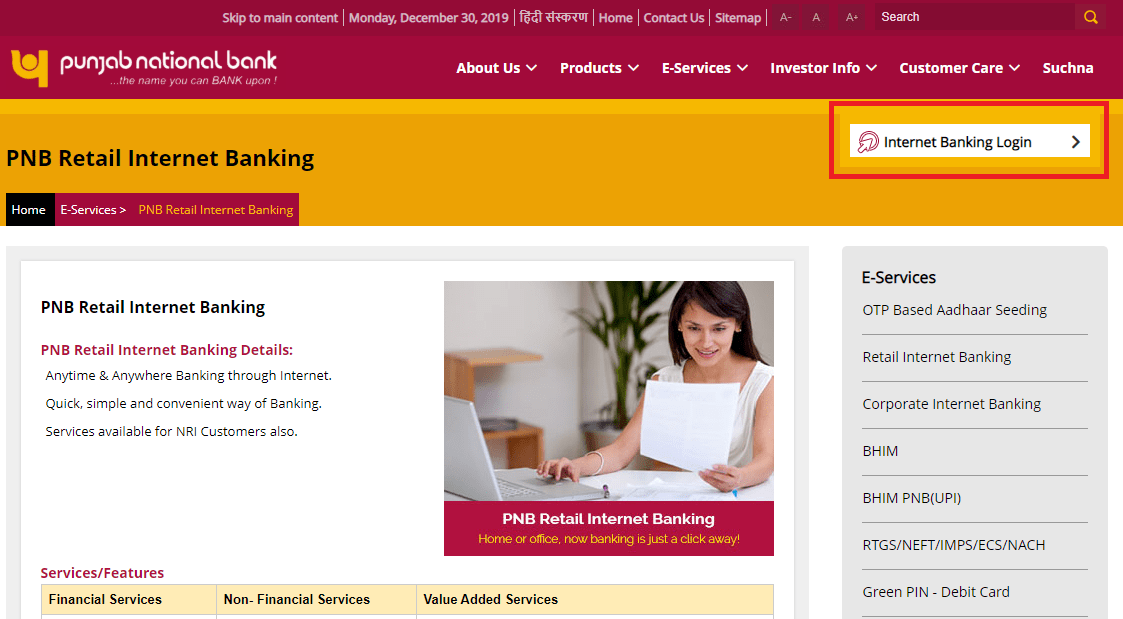

- Go to pnbindia.in/retail-internet-banking.html (official PNB net banking portal)

- Click “Internet Banking Login”

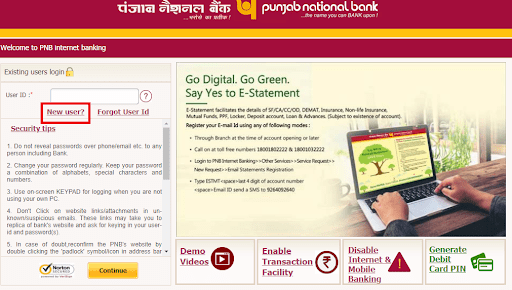

- It will open a new page to enter Login Id.

- Click “New User” under the field of User ID.

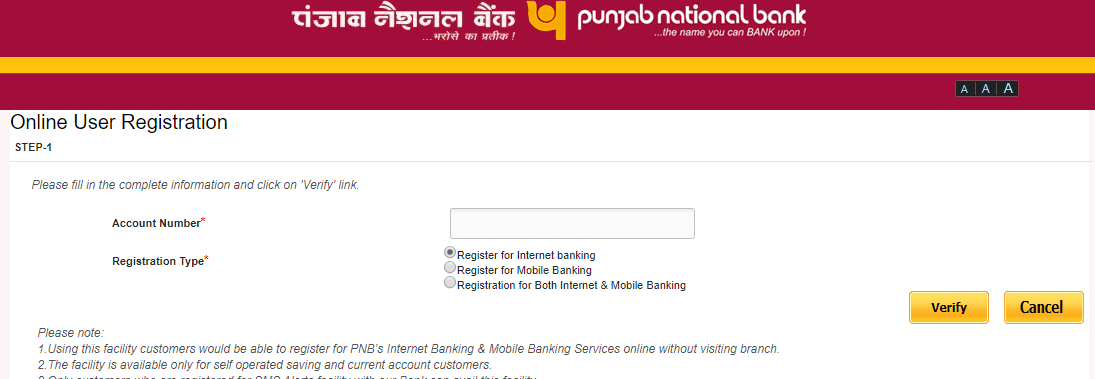

- Choose Registration Type after entering account number as “Register for Internet Banking”

- Click “Verify” to continue

- Enter “Type of Facility”

- You will get OTP at the registered mobile number. Enter the OTP to verify the mobile number and click “Continue”

- Enter the debit card number of PNB and ATM PIN to click on “Continue”

- Set the transaction password and login password. Enter both of these twice and transaction and login passwords shouldn’t be the same.

- Click on “Complete Registration” after clicking “Accept the Terms and Conditions” box.

- You will see a success message on screen showing that the process of registration is finished.

How to Login to net PNB Portal?

- Visit the official portal of PNB online banking.

- Enter the PNB net banking login ID and click “Continue”. User ID is similar to customer ID.

- Click “Login”

- You will get OTP on the registered mobile number linked to your bank account. Enter the OTP for successful login.

- There is a set of 50 security questions. When you log in for the first time, choose from 7 questions to answer. Enter the answers. Then you have to answer the selected question to verify that you are logging in to the account.

- Click “Register”

- Choose an image and write the phrase during the initial login

- Click “Submit”

Punjab National Bank Net Banking Services

- Account Opening – Open recurring deposit, fixed deposit, and PPF accounts online. It also enables you to close FD.

- Pay taxes via PNB net banking.

- Check account balance – Check account statement, PNB account balance, nominee details and past transactions on PNB mobile banking site.

- Cheque book request – You can request cheque book online, check issued cheque status, and request stop payment for cheque issued online.

- Other requests – You can add credit card reward points, renew FD and request to change the limit of your credit card.

How to Transfer Fund via PNB Internet Banking?

- Login to PNB online net banking account

- It has options to transfer funds from your account to any other account in PNB or another bank. Go to “Transactions” and choose an option accordingly.

- Choose the account you want to send money as well as the account where you want to send money. If you haven’t added the beneficiary, add details.

- Enter the amount you want to transfer.

- You can set the date of transaction by default to the existing date. You can also schedule your payment to the upcoming date.

- You can specify the amount to set up recurring payment as well as the payment frequency, including daily, quarterly, monthly and weekly.

- Click “Continue” to see the transaction details to verify.

- Ensure that the details you entered are correct before clicking the “Submit” button.

Transaction Charges and Limits

IMPS (Immediate Payment Service)

| Transfer Amount | Charges Applicable |

| Up to Rs.50,000 per day | Rs.5 + GST |

NEFT (National Electronic Fund Transfer)Transfer

| Transfer Amount | Charges Applicable |

| Below Rs.10,000 | Rs.2.5 + GST |

| Rs.10,000-Rs.1 lakh | Rs.5 + GST |

| Rs.1 lakh-Rs.2 lakh | Rs.15 + GST |

| Above Rs.2 lakh | Rs.25 + GST |

RTGS (Real-time Gross Settlement)

| Transaction Amount | 8 a.m.-11 a.m. | 11 a.m.-1 p.m. | 1 p.m.-4:30 p.m. | Beyond 4:30 p.m. |

| Rs.2 lakh-Rs.5 lakh | Rs.25 + GST | Rs.27 + GST | Rs.30 + GST | Rs.30 + GST |

| Above Rs.5 lakh | Rs.50 + GST | Rs.52 + GST | Rs.55 + GST | Rs.55 + GST |

| Charges/Transaction based on time of transfer | None | Rs.2 | Rs.5 | Rs.10 |

Steps to Reset PNB Internet Banking Login Password

- Visit the official PNB net banking site

- Enter User ID and click “Continue”

- Click “Forgot Password” on the next screen.

- Enter the User ID again and click “Submit”

- Enter the OTP you get on your phone and click “Continue”

- Enter the account number associated with PNB net banking, debit card number, and ATM Pin to “Continue”

- You can now reset your password on the next page. Change the transaction password, login password or both.

- Click “Continue” to proceed.

- You will see the success message on the screen.

Frequently Asked Questions

[sp_easyaccordion id="9647"]