Table of Contents

ToggleWhy do you need to Link your Aadhar with PAN Card?

The Income Tax department has extended the deadline to link PAN card to the Aadhaar to 1st April 2020. This is the eighth time the deadline has been extended. After the Supreme Court announced its verdict about the Aadhaar in 2018, the 12-digit identification number is mandatory for filing your income tax returns and also to acquire a Permanent Account Number (PAN) card.

From Now onwards Income Tax Department made it compulsory for all the taxpayers to link their Aadhar with PAN card so that further process of income can be processed.

If there is a failure to do so till April 1, 2021, then your PAN will become inoperative i.e. you can’t be able to use your PAN card for any financial transaction where PAN card is compulsory (opening of bank A/c).

After April 1, 2021, the one can’t be able to file ITR without linking the first two.

What Points Should be Considered while linking Aadhar with PAN card?

Conditions need to be considered while linking Aadhar with Pan Card:

- The name of the applicant on both the documents (Aadhar & PAN) should be the same; however minor changes can be further processed.

- You must have available the mobile number registered with the Aadhar.

- Date of Birth on both the documents (Aadhar& PAN) should be the same and in the correct format (DD/MM/YYYY).

- No discrepancy related to gender will be processed further.

What is the Process to Link Aadhar with PAN Card?

There are two ways to linking your Aadhar with PAN:

Method 1: By logging your e-filling A/c (4 steps involved):

Note: If you are not registered on the e-filling portal then firstly register yourself.

Step: 1 Firstly Log in to the e-filling portal of the Income Tax by entering the login credentials (ID, password, and date of birth).

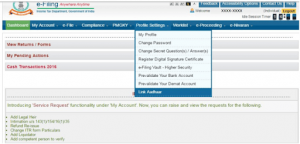

Step: 2 After logging In, you need to go to the tab ‘Profile’ and click on ‘Link Aadhar’.

Step: 3 Now on the ‘Link Aadhar’ window you need to mention the following details;

- Name as per the Aadhar Card.

- Date of Birth as per the PAN Card.

- Gender (It will be automatically updated by the server)

- Now mention your Aadhar Number.

- At last mention the Captcha code and click on the ‘Link Now’ button.

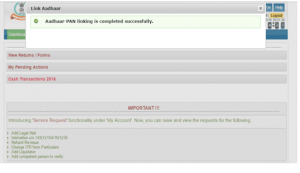

Step: 4 Now you will get the Pop-up message that your Aadhar will get successfully linked to your PAN.

Method 2: Without Logging your e-filling A/C (2 steps involved)

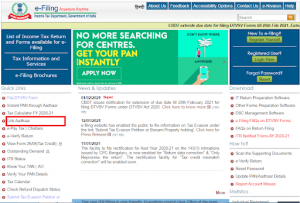

Step 1: Go to www.incometaxindiaefiling.gov.in and click on the option displayed on the left side i.e. ‘Link Aadhar’.

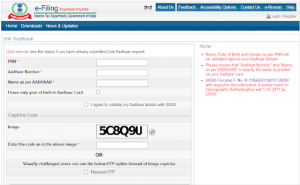

Step 2: Now on the ‘Link Aadhar’ window you need to mention the following details;

- Now mention your PAN Number.

- Mention you Aadhar Number.

- Mention your Name as per the Aadhar card.

- If your date of birth on the Aadhar card is only in the Month i.e. March 2020 then place a checkmark beside the option otherwise remain the option as untick.

- Finally, mention the Captcha code and click on the ‘Link Now’ button.

Now after the verification you will get the confirmation by the UIDAI.

How to Link Aadhar with PAN via SMS?

Income Tax Department made it easy to link your Aadhar with PAN only Via SMS therefore, follow the given step for the same:

Firstly Send SMS to 567678 or 56161 from your registered mobile number in the following format:

UIDPAN<SPACE><12 digits Aadhaar><Space><10 digits PAN>

Example: UIDPAN 123456789123 AKPLM2124M

Thereafter UIDAI will send you the confirmation text while it will get successfully done.