Earlier from 1st October 2020, e-Invoicing process under GST for taxpayers with an aggregate turnover above Rs. 500 crores was implemented. It was then made mandatory for the taxpayers with an annual turnover above Rs. 100 crores from 1st January 2021. In the next phase the government plans to bring all businesses under e-invoicing process from 1st April 2021. Aggregate turnover for e-invoicing will include the turnover of all GSTINs under a single PAN across India. This article will cover all the questions that you may ask:

Table of Contents

ToggleBasic of E-Invoicing

Q-1: What is e-invoicing?

Ans: Electronic invoicing or e-Invoicing is a process of generating invoices, under which invoices created by one software can be accessed by other software, removing the requirement for any new data entry or errors. In less difficult words, it is an invoice generated utilizing a standard format, where the electronic information of the invoice can be shared to other people, consequently ensuring compatibility of information.

Q-2: Is e-invoicing mandatory?

Ans: E-invoicing is compulsory for all businesses with an annual turnover of Rs. 100 crore or more with effect from 1st January 2021. Earlier it was applicable on businesses with turnover exceeding the limit of Rs. 500 crore.

However e-invoicing is not applicable to the below-written categories irrespective of the business turnover, as stated in CBIC notification no. 13/2020- central tax:

- An insurer or a banking company or a financial institution, including an NBFC

- A Goods Transport Agency (GTA)

- A registered person supplying passenger transportation services

- A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax)

Q-3: How e-invoicing is beneficial?

Ans: Below are the main benefits of e-Invoicing:

- One-time reporting of B2B invoices at the time of generation, which reduces the time of reporting in multiple formats.

- The majority of the information in structure GSTR-1 can be saved prepared for documenting while at the same time utilizing e-invoicing format.

- E-way bills can likewise be created effectively utilizing e-Invoice data.

- There is no need to reconcile the books and GST returns filed.

- Invoices can be tracked in real-time by the supplier, with the quicker accessibility of information tax credit. It also reduces the tax credit verification issues.

- Better administration and automation of the tax filing process.

- Less fraudulent invoices.

Q-4: Does the e-invoice schema apply to RCM transactions?

Ans: Yes, the e-invoice schema is applicable to reverse charge mechanism (RCM) transaction.

FAQs on E-invoicing Process

Q-1: What is the process of e-invoicing?

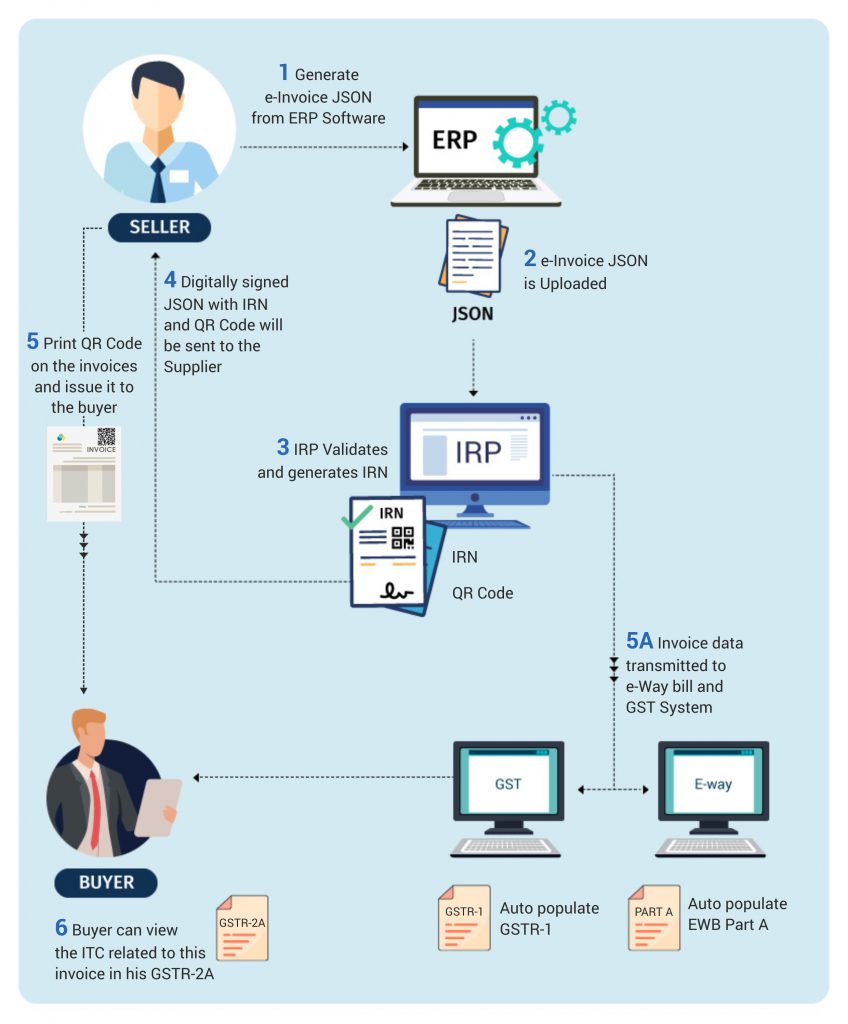

Ans: There are not many changes; businesses can continue to generate their invoices from their existing software just as before. To ensure a level of standardization only a standard format, the schema will be used to generate the e-invoices. The generation of these systematic invoices will be done by the taxpayer. While generating the invoices, he/she has to report it to the GST Invoice Registration Portal (IRP). Then the portal will generate a unique invoice reference number & adds the digital signature along with the QR code on to the e-invoice. The QR code contains all the required details of the e-invoice. After all this process the e-invoice will be returned to the taxpayer by the portal. IRP will also send a copy of the signed invoice to the registered email-id of the seller.

Q-2 How the process will look like?

Ans: The process of an e-Invoice involved two major parts-

- In the first part the business/supplier and the Invoice Registration Portal (IRP) is involved.

- In the second part the IRP and the GST/E-Way Bill Systems are involved.

Q-3: How to create an e-invoice?

Ans: You can create an e-invoice with the following four methods:

- Offline tool

- Using GST Suvidha Provider

- Through Direct Integration

- Via API integration with sister concern GSTIN

- Using E-way Bill API credentials

Offline method-

- To generate IRN for bulk using offline tool, you can simply download the offline tool from the portal: https://einvoice1.gst.gov.in/

- Then enter the details of the invoice & check it, validate it

- Generate the JSON file & upload it on to the portal

For all other methods the taxpayer has to first register the APIs by logging in to the portal. Then he/she has to use the API credentials to connect & generate IRN & e-way bill.

E-Invoice Format & Schema

Q-1 What information will be there in an e-invoice?

Ans: As per the standard format provided by the GSTN, e-invoice will contain the following details:

e-Invoice schema: This is the technical part which will consist the field name along with the description of each field. It also specifies the mandatory fields and has a few sample values along with explanatory notes.

Masters: the set of inputs for certain fields will be specified in the masters that are pre-defined by GSTN. It includes fields like

- UQC

- State Code

- invoice type

- supply type, etc.

E-Invoice template: The template is designed based on the GST rules and enables the reader to correlate the terms used in all books. Green fields in the template specify the mandatory fields & yellow fields are for the optional fields.

Q-2: e-invoice format will be same for all categories?

Ans: All businesses/ taxpayer who are liable to pay GST have to generate e-invoice using the same schema laid by the GSTN. The format has mandatory & non mandatory fields. All taxpayers need to fill the mandatory fields & non mandatory fields are used as per the requirements.

Q-3 What is the maximum number of lines allowed in an e-invoice?

Ans: Maximum 100 lines are allowed per e-invoice.

Q-4: Does the supplier need to sign the e-invoice again?

Ans: The invoice is digitally signed by the IRP after validation. It is not mandatory for the supplier to sign the invoice again.

Q-5: Can I use my business logo on the e-invoice template?

Ans: No, there is no such provision to add company logo in the e-invoice schema. You can add it is the invoice in your ERP software, however it will not be sent to the IRP.

Q-6 Is it mandatory to print the invoice registration number on the invoice?

Ans: No, it is option as the IRN is embedded in the QR code. You may or may not print the IRN number on the invoice.

Reporting of E-Invoice

Q-1 What documents are to be reported in the IRP?

Ans: The below documents need to be reported to the Invoice Registration Portal

- Invoices by the supplier

- Credit Notes by the supplier

- Debit Notes by the supplier

- Any other document as required by law

Q-2: How can be the invoice registered?

Ans: The invoices can be registered by the following modes:

- Web-based,

- API based,

- Offline tool based and

- GSP based.

Q-3 What are the requirements to generate e-invoice?

Ans: Below are the requirements to generate e-invoices:

The person who is generating an e-invoice must be registered on the GST portal and e-invoice.

He should submit valid document to report, such as an invoice, debit note, or credit note.

If the taxpayer wants to generate e-invoices in bulk, then it is must to have a valid JSON file as per the e-invoice schema, or have an integrated ERP system with APIs.

Q-4 How can I check whether the e-invoice is authentic or not?

Ans: You can upload the JSON to the e-invoice system to easily check the authenticity of an e-invoice, by selecting the ‘Verify Singed Invoice’ under Search option. You can also download the QR code verify app to verify the QR code printed on the invoice.

Q-5 Is it allowed to generate more than 1 IRN for the same invoice?

Ans: No, only 1 IRN should be generated for single invoice in the same financial year. If more than one IRN is generated, the portal will reject such invoices.

Q-6 Can I use the e-invoice number again if I cancelled it?

Ans: No, once an e-invoice is cancelled, it can’t be used again. If it is generate/ used again, the IRP will reject it.

Amendments/ Cancellation of E-Invoice

Q-1 Can e-invoice be partially or fully cancelled?

Ans: An e-invoice cannot be partially cancelled; it can only be cancelled fully. It is mandatory to report the cancelled e-invoice to the IRN within 24 hours. A cancellation after 24 hours cannot be done through the IRN; it needs to be then done manually on the GST portal before filing the return.

Q-2 How can the e-invoices be amended?

Ans: e-invoices can be only amended on the GST portal

E-Invoicing Integration With GST Return/ E-Way Bill

Q-1 How e-invoicing system will be integrated with GST returns?

Ans: An e-invoice can be only uploaded into the relevant GST return once it has been verified from the invoice registration system. After the validation process is complete, the taxpayer can view it in GSTR 1 for editing. The main purpose behind this is to reduce the reconciliation problems & enable the auto-population on invoices. Once it is implemented, the data can be auto-populated without the need to enter the data again.

Q-2 Is there any facility available on the common GST portal for invoice generation?

Ans: No, there is no such facility available. Invoices will be generated from the ERP system only. The system must check all the e-invoicing rules & implement the mandatory parameters.

E-Invoicing Portal

Q-1 Bulk uploading of invoices is possible or not?

Ans: Yes, details of invoices can be added in bulk in excel based bulk tool available in the e-invoicing portal. After this the JSON file must be uploaded on the portal.

Q-2 For how long the data will be available on the government portal?

Ans: Only for 24 hours, the data will be available on the IRP portal. Once the invoice is validated & generated it will be available for the entire financial year.

Q-3 What is the time limit of uploading e-invoice on the portal?

Ans: At present no time limit is specified. Once the invoice is uploaded on the IRP portal & the validation process is complete, it will be immediately registered on a real-time basis.

FAQs on Miscellaneous E-Invoicing

Q-1 Are e-invoices legal?

Ans: Yes, electronic invoices are legal & verified by the government IRP portal.

Q-2 Is e-invoice required to do export transaction?

Ans: Yes, it is mandatory for export transactions also.

Q-3 Is e-invoice required to do import transaction?

Ans: No, it is not applicable in case of import transaction.

Q-4 Can I print e-invoice?

Ans: Yes, the supplier & the buyer both can print e-invoice.

Q-5 is e-invoice mandatory for B2C transactions?

Ans: No, till date it is not applicable on B2C transactions.

Q-6 What data is embedded in QR Code?

Ans: The QR code contains below information

- Supplier and recipient GSTIN

- Invoice Number

- Invoice generation date

- Invoice value

- Number of line items

- HSN code of the item

- Unique IRN

- IRN generation date