E-invoices must be created within the notified time limit of 30 days from the invoice date. Earlier, the e invoice generation time limit was seven days, but the government postponed the implementation by three months. However, currently, the law applies to only some notified taxpayers. The limitation obliges businesses to adopt Live invoicing.

Before jumping to the time limit of e-invoice, let’s first understand it and its process.

What is e-invoicing?

An e-invoice is a digital document that is exchanged by buyers and suppliers and validated by the Government Tax Portal. E-invoicing is the proposed system where B2B invoices are prepared online in the e invoice format and certified by the GSTN. this system ascertains that the same format is implemented by all businesses before reporting invoices to the e invoice portal login.

In August 2019, the government published a draft of an e-invoice for public view, later, modified by the GST Council to adhere to their regulations. The standard format makes adherence easier and because it’s applied across industries, it ensures interoperability between GST ecosystems.

What is the e invoice time limit?

The time limit to create an e-invoice on the Invoice Registration Portal for all tax invoices and Credit & Debit notes issues is thirty days from the given date in the invoice and debit or credit note. For example, if an invoice’s date is 2nd April 2024, then it must be reported by 1st May 2024 on the IRP.

Who must comply with the e-invoicing time limit?

GSTN defined that all taxpayer organizations with an Annual Aggregate Turnover of Rs. 100 crore or more must abide by the time limit. The thirty-day time limit applies to Reporting Tax Invoices, Credit & Debit notes to any notified IRP, entailing any outdated documents unreported as of 1st April 2023.

However, the validation or rule doesn’t apply to taxpayers with AATO of less than INR 100 crore.

The legal status of the e-invoicing time limit

The latest notification for the e invoice generation time limit, the GST law doesn’t limit any time limit for taxpayers for documents reporting on the e-invoice portals or IRP to generate e-invoice. By default, the GST provision on the supply time and time limit to generate invoices would apply to all taxpayers. Nevertheless, the limitations of 30 days time limit to report documents on IRP are put by the GSTN.

Consequences of not abiding by the e-invoicing time limit

The IRP has internal validation to accept only tax invoices and credit & debit notes within 30 days. Such taxpayers cannot create e-invoices and will be considered non-compliant under the law of GST.

- If the team fails to meet the e-invoicing deadline of 30 days, they must re-raise the invoice and report it to IRP. it leads to late reporting or an automatic population of e-invoices in GSTR1.

- It influences the input tax credit flow and supply chain because of delay. Consequently, it deteriorates relationships with customers.

- The GST legislation enforces a huge penalty in the following manner-

- For incorrect invoicing – Rs.25,000 / invoice (for the issued invoice with no IRN and signed QR code).

- For non-generation of e-invoice – 100% tax due or Rs.10,000, whichever is higher, for each invoice. (if the invoice is not issued)

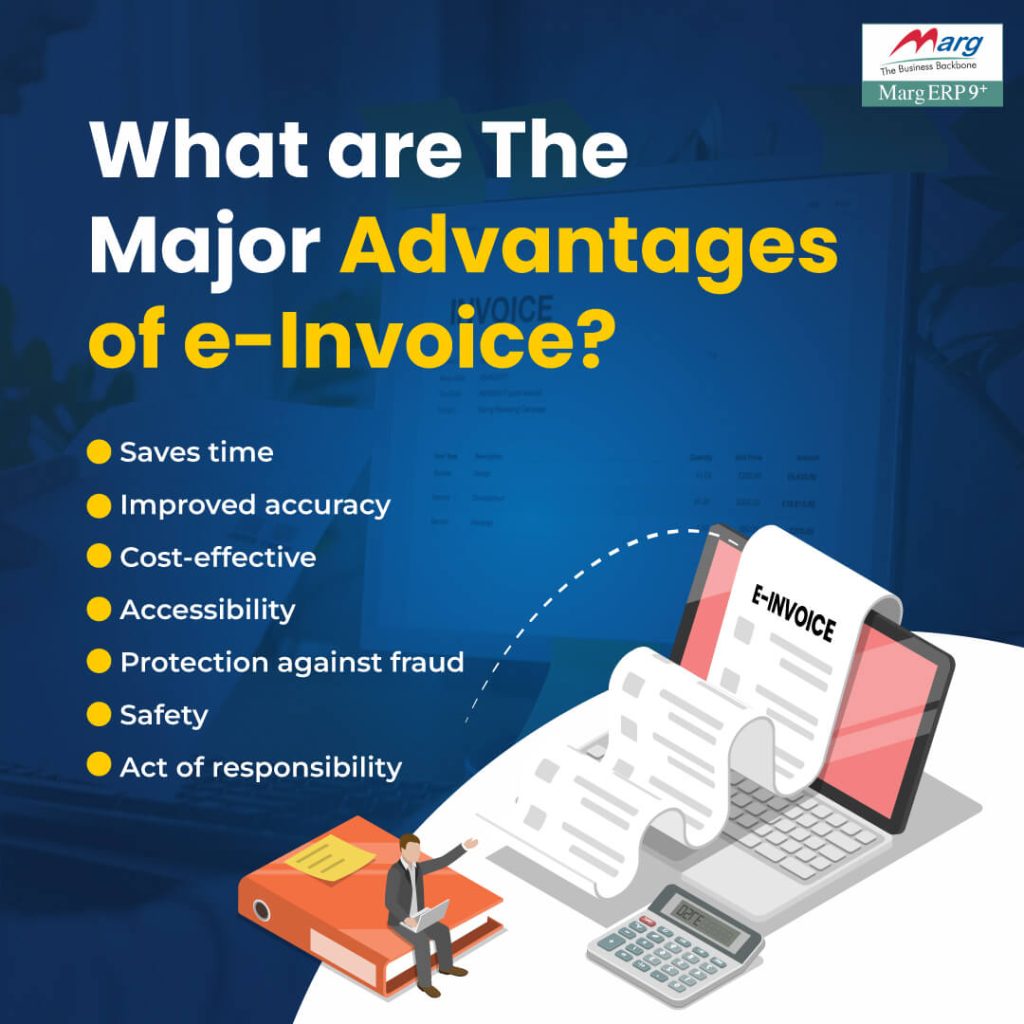

What are the major advantages of e-invoice?

The business world after the pandemic is different from how it was pre-pandemic. With a larger adoption of digital techniques, e-invoicing has proven extensively beneficial for everyone involved. Let’s move forward to know the benefits of e-invoicing.

1. Saves time

E-invoicing saves time for businesses which is a key advantage for them. E-invoicing is a digital process that takes only a few minutes. Earlier, traditional invoicing needed so much time to create and upload details of invoices to the government portal for return filing. Whereas, e-invoicing doesn’t require processing, sending, tracking, and approving invoices. Hereby, it has made productivity better as it saves employees time that they can use on other crucial aspects that require more attention. E-invoicing makes the payment process faster and information aggregation is done fluently.

2. Improved accuracy

E-invoice eliminates human errors, resulting in improved accuracy. You don’t have to manually enter the data which minimizes the probability of errors. Additionally, the information is directly fetched from the e-invoices and the billing systems also manage information, which ensures no errors during the e-invoice process. The communication between vendors and buyers will be improved and consequently, processing time will be saved due to no errors in the e-invoices.

3. Cost-effective

E-invoicing is more affordable for businesses as compared to the traditional way of invoicing and reporting. As the whole process is digital, it shortens it automatically. Unlikely the traditional method, you don’t have to spend more energy on e-invoicing.

4. Accessibility

On the contrary heavy folders with tons of paper, digital allow you quick access with a great safety level.

Search Anywhere: With a digital management platform, documents can be easily accessed without a physical search at a store. You can access it anytime and anywhere whenever you need.

Intuitive categorisation: A general problem that occurs when accessing physical copies of documents is not knowing the right way to search. Electronic invoices are classified as per the accurate and large fields, so searching for them is easier. Additionally, files may be stored in various e invoice format

, such as pdf, jpg, HTML, and more.

5. Protection against fraud

Electronic invoicing has designed a very secure system lowering the chances of document forgery or fraud.

Digital Track: E-invoicing records payments, as well as other monetary-related operations, so money tracing becomes easier to monitor. The lesser the physical money circulation persists, the larger the frauds are reduced.

Digital seals & certificates: Contrary to printed invoices, e-invoices are generated with online techniques, issuing unrepeatable and unique certificates or seals. That way, cases of document duplicity or forging are decreased.

6. Safety

Other than the protection against fraud, e-invoicing has many other safety benefits:

Assurance of integrity &sender authentication: SERES electronic invoicing security system generates access to authentication through credentials encrypting a mailing to ensure a secured exchange.

Reliable compilation & data copy: Data are safeguarded against potential losses on documents or third-party intrusions.

Preservation: Document readability and properties are managed safely and undamaged for a longer time.

7. Act of responsibility

E invoicing process is a commitment to the company itself, as well as its employees, and the shareholders as well.

Environment: Supports the environment by saving paper, ink, electricity on printing, energy, and more.

Clients and suppliers: The institution offers easy, fast, and secure services that help save time and money for both parties.

Society: A company that integrates a known e-invoicing system, such as Marg ERP is engaged in transparency, safety, and avoiding any fraud events.

Recommended Read

E-Invoicing Eligibility- Know Who is Eligible for E-Invoice?

E-Invoice API FAQs – Answers to Frequently Asked Questions on E-Invoice API

E-Invoice Registration on IRP – Requirement, Procedure & Purpose

E-Invoice Portal – How to Register & Login to E-invoice Portal?

Invoice Registration Portal – Process, Benefits & Mode of Registering in E-invoicing portal

Conclusion:

E-invoicing, a digital document has transformed the whole invoicing process that must be generated within a notified e invoice generation time limit; otherwise, the company may have to pay a large price. It is also associated with a set of laws that must be applied by all taxpayer companies. E-invoicing also ensures so many benefits that ascertain safety, accuracy, improved accuracy, and more.

To generate the invoice, you can seek the integration of a profound e-invoicing software, like Marg ERP that has been providing services since 1992 and has earned the trust of 1crore users. They have also expertise in managing inventory & accounting. Join them today!

Frequently Asked Questions

To whom will e-invoicing apply?

E-invoicing is applied to GST-registered individuals whose aggregate turnover exceeds Rs.20 crore. in any previous financial year. However, from 1st August 2023, it is followed by those whose turnover is more than 5 crore to 10 crore. But, there are some exceptions.

How to make e invoice?

Step 1. Invoice Generation

Step 2. Creation of Invoice Registration Number

Step 3. Upload it on the Invoice Registration Portal

Step 4. IRP Validation of Invoice Information

Step 5. QR Code & Digital Signature Generation

Step 6. Transmission of e-invoice Data to E-way Bill Portal and GST System

Step 7. E-invoice Receipt Sent to ERP of supplier

What are the benefits of generating e-invoices on time?

There are various perks of creating e-invoices on time. Including timely reporting for payments of tax in compliance with supply GST rules time. Further, it allows the timely passing of credits of input tax to the buyers. The applicable taxpayers can leverage the invoice financing facilities from the electronic invoices generated during a period, motivating a quick and more secure approach for working capital finance for businesses.

e-Invoicing and B2C transactions?

B2C, business-to-customer invoices are those invoices where the end-user or consumer will not be climbing ITC (input tax credit). As of now, B2C invoices are somehow exempt from e-invoicing. However, a taxpayer is needed to create a dynamic QR code for allowing digital payments on each B2C invoice based on Notification No.

Which is the best software for e-invoicing?

Marg e-Invoicing is currently the best and most profound software that is known for its easy and automated features. This e invoice generator software allows its users to create 100% Free e-invoices, and instant professional and personalized invoices that can be sent to customers on their WhatsApp. It is not only about billing & invoicing, even it eases inventory & accounting also. This means you can manage inventory effectively – expiry, shortage, exceed, and expired products with MRP, Serial No., Category, Name, & Rack-wise that you can track any time and anywhere.