E-way bills are receipts or documents with details and instructions related to the shipment of goods consignment issues by the carrier and anybody can create an e way bill online easily. The details may include the consignor’s name, recipient, and the point of consignment’s origin, route, and destination. An e-Way Bills is an adherence mechanism

Where a person causes the movement of goods and the right information through a digital interface to be equipped before the movement of goods gets started and creates an E-way bill on the portal of GST.

What is the meaning of an E-way bill?

An E-way bill means an electronic waybill. The e-way bill will apply to the goods movements in inter and intra State Transportation. As the name suggests, it’s an electronic document created from the eway bill portal demonstrating the goods movement. It’s an obedience system under the GST through a digital interface for the person who causes the goods movement must upload the right details before the movement of goods starts and make an e-way bill on the GST portal.

It contains the following details-

- Name of consignor

- Consignee

- The point of origin of the consignment

- Destination details and

- Route

E-Way Bill Requirements For Transporter

If a transporter needs to transfer goods from one means to another during transit then the transporter has to create a new e-way bill in Form GST EWB-01 before such transition.

Where the goods are carried from the area of the transporter to the business place and such distance is less than 10 kilometers, at that, time details of such vehicle (Transporter to Business Location) is not needed to be furnished.

If the transporter has to deliver consignments in bulk in a single vehicle then they may indicate a Serial No. of e-way bills created for all consignments and a consolidated E way bill in FORM GST EWB-02 can be generated before the goods movement.

If the sender has not made an e-way bill then the transporter must generate Form GST EWB-01 as per the invoice or bill of delivery or supply challan, if the goods’ value is more than Rs. 50,000.

The Commissioner may need a class of transporters to get a unique RFID (Radio Frequency Identification Device) to receive the said device underlined onto the vehicle and find the e-way bill to the RFID before the goods’ movement.

Now, let’s move on to explore the advantages of the e-way bill.

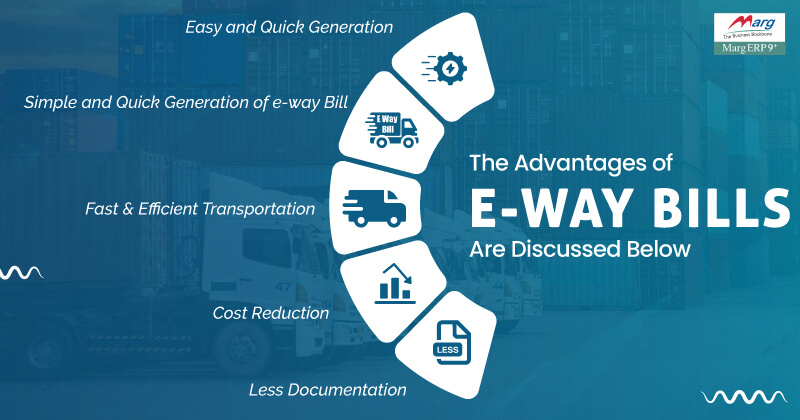

5 Top Advantages of E-way Bills Are Discussed Below:

A few key benefits of the e-way bill are listed below:

1. Less Documentation

No state-particular documentation would be required for goods transportation. The RGID device inside the carrier providing regular consignments is another perk for transporters. The driver is not required to carry the e-way bill’s physical copies as it’s mappable now and confirmed utilizing the RGIC device is in the vehicle, avoiding the inconvenience of carrying tangible documents.

2. Cost Reduction

Electronic billing removes management costs by accepting suitable invoicing and preventing tax avoidance. Additionally, the portion of logistics costs to GST is forecasted to go down, which is now relatively high compared to other countries.

3. Fast & Efficient Transportation

The introduction of the e-way bill has made the whole ewaybill systems faster and more efficient. It minimized the number of checkpoints that crossed national routes and state lines. Furthermore, it fulfilled the gap between around 85000 yearly average kilometers covered by Indian trucks and nearly 150000 to 250000 kilometers in already developed countries.

4. Simple and quick generation of e-way bill

The creation of e-way bills is done via the government-set online portal. However, the e way bill portal and e-way bill mechanism are simple and user-friendly. Through the system, it’s likely to be possible for dealers to a self eway bill generate, and it’s like a no bigger task nowadays. In the coming days, the procedure is anticipated to be more simplified so that a layman can generate an e-way bill and ease the movement of commodities.

5. Easy and Quick Generation

The generation of the e-Way bill process is simple and quick with an easy-to-use interface. In addition, this can assist in maximizing tax compliance through units covered under the GST administration.

When E-way bill is required?

When the goods movement is worth more than Rs. 50,000, the registered person bounds to generate an E-way bill before the goods movement starts. The reason for goods movement may be Supply, reasons besides supply or inward supplies got from a non-registered individual.

The E-way bill can be created even for consignments below Rs. 50,000.

The limit of Rs. 50,000 is not applied under the situations given below (An electronic bill is needed in each case):

1. When goods are delivered by the major interstate for the job task.

2. When handmade goods are sent interstate by an individual who has been liberated from the requirement of getting registration under clauses 1 & 2 of section 24 of the Act.

Who should generate an e-way bill?

- Every registered individual who might be a consignor, consignee, transporter, or recipient must create an e-way bill, if the transportation through their own or rented means of transport is done (air/ train/ road).

- An unregistered individual who wants to supply to an individual who is registered. In this case, the receiver will be required to follow the compliance process because the supplier is not a registered individual.

- The transporter must create an E-way bill, if both the consignor and the consignee are not able to generate an e-way bill, even though retaining handed over the commodities to the transporter for conveyance by road.

- The transporter should generate an e-way bill, if both the consignor and the consignee fail to generate an e-way bill despite having handed over the goods to the transporter, for conveyance by road.

- An e-way bill should also be created irrespective of the consignment’s value, if the worth is less than Rs. 50,000 in two conditions:

- An e-way bill should be generated irrespective of the value of the consignment (even if the value is less than Rs.50,000) in two cases:

- When the goods are delivered by a principal to a job worker in an inter-state transaction.

- During an inter-state shift of handcraft goods by a supplier who has been exempted from GST registration.

How to generate an e-Way Bill on Portal?

Below is given step-by-step guide to logging into the eway bill portal:

Step 1: First, login eway bill to the e way bill portal, fill in the required details, and click on the ‘Login’ button.

Step 2: Secondly, click on ‘Generate new’ under the option of the ‘E-waybill’ option.

Step 3: Now, enter the compulsory fields required to be filled.

Step 4: Next, click on ‘Submit’, an e-way bill in Form EWB-01 form with a unique 12-digit number is created.

Step 5: Then, take a printout of the E-Way Bill that should be carried for transporting the goods in the selected mode of transport and the selected means.

Recommended Read

E-waybill Generation: A complete guide of E-way bill

The 26th GST Council Meet: E Way Bill Roll Out from April 1, 2018

Unblocking E-way Bills: A Step-by-Step Guide to Resolving Common Issues

Conclusion:

One key thing that the e-way bill has effortlessly achieved is the dilution process of inter-state boundaries. The quantity of time expansion at state borders for verification, of documents was an obstacle to all sizes of businesses. It often demotivated them from moving beyond their home state. However, the new system has changed the whole scenario. Furthermore, the government has been tirelessly endeavoring to establish a seamlessly functioning system—one that doesn’t impede the logistics industry’s operations. Despite these persistent efforts, some imperfections require rectification for optimal functionality. The government anticipates achieving this gradually over time.

Frequently Asked Questions

What are the benefits of an e-way bill?

The e way bill mechanism benefits in various ways:

Facilitate faster goods’ movement.

Make the turnaround time of trucks better because the check post has been terminated. Plus, it will benefit the logistics industry by decreasing travel time and cost, and maximizing the e-way bill distance travelled.

Easy-to-use e-way bill generating system, means, there is no necessity to visit the e-way bill department for the creation of the e-way bill since this’s a major hardship in the current system. The e-way bill can be made directly online.

The whole system is online, thus eliminating tax evasion.

When is an e-way bill not needed to be created?

E-way bills not be required in the below-mentioned conditions:

Where the goods are being delivered by non-motorized means or vehicles, such as animal carts.

In case goods are transported for clearance by customs from the custom port, air cargo complex, airport, and land custom station to an inland container depot.

When the goods move within such area as specifically by the specific state or union territory as per the GST rules

Where the tax-exempt goods being transported

Where the goods displayed in the negative list are being shifted. These entail alcoholic liquor for home consumption, high-speed diesel, petroleum crude, petrol, natural gas or aviation turbine fuel.

What documents are required to create e-way bill?

The documents that are required for generating E a bill are:

Tax invoice, Bill of Supply, & Delivery Challan

Transporter ID & Vehicle Number

Transport Document Number

Which is the best software for e-way billing?

Marg ERP is the best solution to create an e-way bill directly from the software within a minute. This software for e-way bill creation is equipped with robust features that make the whole business process easy, be it billing, inventory, or accounting. Further, Marg has been providing its services since 1992. Therefore, understand all issues of business very well and provide the appropriate solutions to make them streamlined.