Investing is an essential activity for anyone looking to grow their wealth in the long term. Two popular investment options available to investors are SIPs and mutual funds. Although both offer opportunities to invest in the stock market, they differ in various aspects. In this blog, we will look at the key differences between SIPs and mutual funds.

What are SIPs?

SIP stands for Systematic Investment Plan. It is a method of investing in mutual funds. With SIPs, an investor invests a fixed amount of money at regular intervals, usually monthly or quarterly. The investment amount is automatically deducted from the investor’s bank account and invested in a mutual fund scheme of their choice.

What are mutual funds?

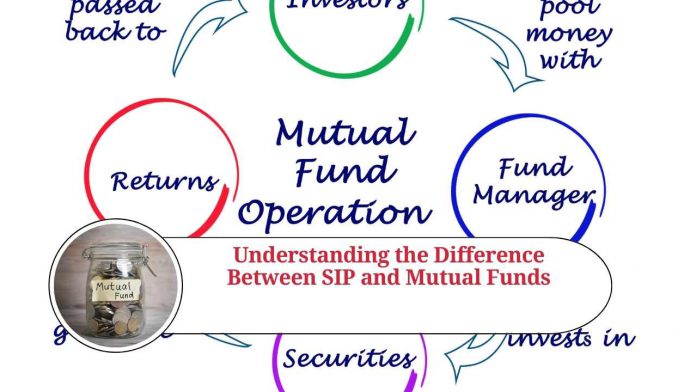

A mutual fund is an investment vehicle that pools money from several investors to invest in various financial instruments such as stocks, bonds, and money market instruments. A professional fund manager manages the pooled money and invests it in various securities, with the objective of generating returns for the investors.

Differences between SIPs and mutual funds

- Investment method

The primary difference between SIPs and mutual funds is the investment method. SIPs are a way of investing in mutual funds, while mutual funds are the investment vehicle that SIPs invest in. SIPs allow investors to invest a fixed amount at regular intervals, while mutual funds allow investors to invest a lump sum or a fixed amount at any time.

- Investment discipline

SIPs encourage investment discipline by requiring investors to invest a fixed amount regularly. This approach helps investors avoid the temptation to time the market and invest only when the market is doing well. Mutual funds, on the other hand, do not provide any investment discipline, and investors can invest whenever they want.

- Cost

SIPs and mutual funds have different cost structures. SIPs have a lower cost structure compared to mutual funds since investors invest a fixed amount at regular intervals, and the fund manager does not have to manage a large amount of money in a short time. Mutual funds have a higher cost structure because the fund manager has to manage a large amount of money at once, and the fund has to be actively managed to generate returns for the investors.

- Returns

The returns on SIPs and mutual funds differ based on the investment method and the fund’s performance. SIPs offer the advantage of rupee-cost averaging, where the fixed investment amount buys more units when the market is down and fewer units when the market is up. This approach helps investors average out the cost of investing and reduce the impact of market volatility. Mutual funds, on the other hand, can generate higher returns if the fund manager’s investment strategy is successful.

- Risk

SIPs and mutual funds have different levels of risk. SIPs are less risky since the investment is spread out over time, reducing the impact of market volatility. Mutual funds, on the other hand, can be more risky since the investment is made at once and is subject to market volatility.

Here are some additional details to help you understand the difference between SIPs and mutual funds:

Investment Amount and Frequency

With SIPs, investors can start investing with a small amount, as low as Rs. 500 per month. This makes it easy for anyone to start investing in mutual funds without having to accumulate a large amount of money. On the other hand, mutual funds require a lump sum amount to be invested upfront, which can be a barrier for many investors. Investors can choose to invest in mutual funds as a one-time investment or make additional investments as and when they have surplus funds.

Taxation

Both SIPs and mutual funds are subject to taxation. The tax implications of SIPs and mutual funds depend on the type of mutual fund scheme, investment amount, and investment horizon. The tax on mutual funds depends on whether they are held for more than one year or less than one year. Long-term capital gains on equity mutual funds are tax-free up to Rs. 1 lakh per year, while short-term capital gains are taxed at 15%. Debt mutual funds held for more than three years are taxed at 20% with indexation, while short-term gains are added to the investor’s income and taxed as per their income tax slab.

Investment Objectives

Investors can choose from different types of mutual funds based on their investment objectives, such as growth, income, or a combination of both. SIPs can be used to invest in any mutual fund scheme that matches the investor’s investment objective. Investors can choose to invest in equity mutual funds, debt mutual funds, balanced mutual funds, or any other mutual fund scheme. Mutual funds offer a wide range of investment options, and investors can choose a scheme based on their risk appetite, investment horizon, and financial goals.

Conclusion

Investing in SIPs or mutual funds can help investors achieve their financial goals in the long run. Both investment options have their own advantages and disadvantages, and the choice between the two depends on the investor’s investment objective, investment horizon, risk appetite, and investment amount. SIPs offer a disciplined approach to investing, while mutual funds offer a wide range of investment options and the potential for higher returns. It is important for investors to do their research, understand their investment goals, and choose the investment option that best suits their needs.

Read more useful content:

Frequently Asked Questions (FAQs)

What is an SIP, and how does it work?

An SIP is a Systematic Investment Plan. It is a method of investing in mutual funds, where an investor invests a fixed amount of money at regular intervals. The investment amount is automatically deducted from the investor’s bank account and invested in a mutual fund scheme of their choice.

How do mutual funds work?

Mutual funds pool money from several investors to invest in various financial instruments such as stocks, bonds, and money market instruments. A professional fund manager manages the pooled money and invests it in various securities, with the objective of generating returns for the investors.

What are the types of mutual funds?

Mutual funds can be classified into various types based on their investment objective, asset class, and investment style. Some of the types of mutual funds are equity funds, debt funds, balanced funds, sector funds, index funds, and international funds.

What is the minimum investment required for SIPs and mutual funds?

The minimum investment required for SIPs can be as low as Rs. 500 per month, while the minimum investment for mutual funds can range from Rs. 500 to Rs. 5,000, depending on the fund house and the type of fund.

What are the charges for investing in SIPs and mutual funds?

SIPs and mutual funds have different charges such as expense ratio, entry load, exit load, and transaction fees. The expense ratio is the annual fee charged by the fund house for managing the fund. Entry load is a one-time fee charged at the time of investing, while exit load is a fee charged when the investor redeems the investment. Transaction fees are charged for buying or selling mutual fund units.

What is the tax implication of investing in SIPs and mutual funds?

SIPs and mutual funds are subject to taxation based on the type of fund, investment amount, and investment horizon. Long-term capital gains on equity mutual funds are tax-free up to Rs. 1 lakh per year, while short-term capital gains are taxed at 15%. Debt mutual funds held for more than three years are taxed at 20% with indexation, while short-term gains are added to the investor’s income and taxed as per their income tax slab.

Can I switch from one mutual fund to another?

Yes, investors can switch from one mutual fund to another within the same fund house or across different fund houses. Switching from one mutual fund to another may attract exit load, depending on the fund house and the type of fund.

What is the difference between a dividend and growth option in mutual funds?

The dividend option in mutual funds pays out dividends periodically to the investors, while the growth option does not pay out any dividends but reinvests the profits back into the fund, thereby increasing the NAV of the fund.

What is the risk associated with investing in SIPs and mutual funds?

SIPs and mutual funds are subject to market risk, credit risk, interest rate risk, and other types of risks associated with the underlying securities. Investors should do their research and choose a mutual fund scheme that matches their risk appetite and investment objective.

How do I choose the right mutual fund for my investment?

Investors should consider various factors such as investment objective, investment horizon, risk appetite, asset allocation, and past performance before choosing a mutual fund scheme. Investors should also consult with a financial advisor or do their research before making an investment decision.