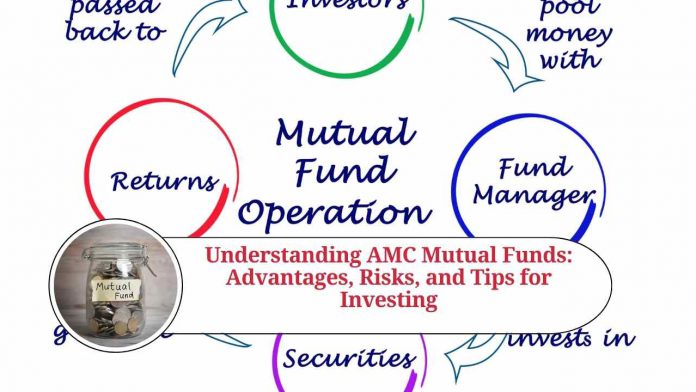

Mutual funds are a popular investment option for people looking to grow their wealth in the long term. These funds pool together money from different investors and invest them in a diverse range of securities such as stocks, bonds, and other assets. In recent years, a new type of mutual fund has emerged that is managed by an Asset Management Company (AMC). In this blog post, we will take a closer look at AMC mutual funds, their advantages, risks, and provide some tips for investing in them.

What are AMC Mutual Funds?

AMC mutual funds are mutual funds that are managed by a specialized Asset Management Company. These companies are responsible for making investment decisions on behalf of the fund’s investors. The primary goal of AMC mutual funds is to provide higher returns than traditional mutual funds by actively managing the portfolio of investments. AMC mutual funds have gained popularity in recent years as investors seek higher returns from their investments.

Advantages of AMC Mutual Funds

There are several advantages to investing in AMC mutual funds:

- Active management: AMC mutual funds are actively managed, which means that the fund’s portfolio is frequently reviewed and adjusted to take advantage of market opportunities. This can result in higher returns compared to traditional mutual funds.

- Professional management: AMC mutual funds are managed by professionals who have a deep understanding of the financial markets. They have access to research and tools that individual investors may not have, which can lead to better investment decisions.

- Diversification: AMC mutual funds invest in a diversified portfolio of securities, which reduces the risk of losses due to fluctuations in any one asset class.

- Liquidity: Like traditional mutual funds, AMC mutual funds are highly liquid, which means that investors can easily buy and sell their shares.

Risks of AMC Mutual Funds

While AMC mutual funds offer several advantages, there are also some risks that investors should be aware of:

- High fees: AMC mutual funds typically charge higher fees compared to traditional mutual funds. These fees can eat into the fund’s returns over time, reducing the investor’s overall gains.

- Market risk: Like all investments, AMC mutual funds are subject to market risk. If the market experiences a downturn, the fund’s value may decline, resulting in losses for investors.

- Manager risk: The performance of an AMC mutual fund is largely dependent on the investment decisions made by its fund manager. If the manager makes poor investment decisions, the fund’s returns may suffer.

Tips for Investing in AMC Mutual Funds

If you are considering investing in an AMC mutual fund, here are some tips to keep in mind:

- Understand the fund’s investment strategy: Before investing in an AMC mutual fund, it is important to understand the fund’s investment strategy and whether it aligns with your investment goals.

- Compare fees: Since AMC mutual funds typically charge higher fees than traditional mutual funds, it is important to compare fees across different funds to ensure that you are getting a good deal.

- Diversify your investments: While AMC mutual funds offer diversification benefits, it is still important to diversify your investments across different asset classes to reduce risk.

- Monitor the fund’s performance: Keep a close eye on the fund’s performance to ensure that it is meeting your expectations. If the fund is underperforming, consider switching to a different fund.

In conclusion

AMC mutual funds offer several advantages to investors looking to grow their wealth in the long term. However, investors should also be aware of the risks involved and take steps to mitigate them. By following the tips outlined above, investors can make informed decisions about investing in AMC mutual funds.

Read more useful content:

- How to invest in mutual funds

- All about mutual funds-types & importance

- The Power of SIP Investment in Mutual Funds

Frequently Asked Questions (FAQs)

Q: What is an AMC Mutual Fund?

A: An AMC mutual fund is a mutual fund that is managed by an Asset Management Company (AMC). These companies are responsible for making investment decisions on behalf of the fund’s investors.

Q: What are the advantages of investing in AMC Mutual Funds?

A: AMC mutual funds offer several advantages, including active management, professional management, diversification, and liquidity.

Q: What are the risks associated with investing in AMC Mutual Funds?

A: The risks associated with investing in AMC mutual funds include high fees, market risk, and manager risk.

Q: How do AMC Mutual Funds differ from traditional mutual funds?

A: AMC mutual funds are actively managed, which means that the fund’s portfolio is frequently reviewed and adjusted to take advantage of market opportunities. They also charge higher fees compared to traditional mutual funds.

Q: How do I invest in an AMC Mutual Fund?

A: You can invest in an AMC mutual fund by opening an account with a brokerage firm or directly with the Asset Management Company. You will need to fill out an application form and provide documentation such as your PAN card, address proof, and bank account details.

Q: Can I redeem my investment in an AMC Mutual Fund at any time?

A: Yes, you can redeem your investment in an AMC mutual fund at any time. However, there may be exit loads or other charges associated with early redemption.

Q: How do I choose the right AMC Mutual Fund to invest in?

A: When choosing an AMC mutual fund to invest in, consider factors such as the fund’s investment strategy, past performance, fees, and your investment goals and risk tolerance.

Q: Are AMC Mutual Funds suitable for beginners?

A: AMC mutual funds can be suitable for beginners who are looking to invest in the stock market but do not have the time or expertise to manage their investments. However, it is important to do your research and choose the right fund based on your investment goals and risk tolerance.