The journey of evolution in the field of technology has a remarkable impact on the way the business process is carried out. With technological advancement, there is a reshaping in the way business handles their finance, decision-making processes, and communication with their stakeholders. From manual data entry to automated processing system technology has remarkable contributions to the field of business and finance.

To stay ahead in this technology-driven competitive market and to achieve operational excellence, business organizations are constantly turning to automation to streamline their process. This evolution has given rise to the need for Purchase invoice automation to increase efficiency and accuracy in the accounts payable cycle of the business.

What Is Purchase Invoice Automation?

Purchase invoice automation means the use of technology in digitalizing and automating business processes from issuance of the purchase order to receipt of purchase invoice, reviewing, reconciling, and verifying purchase invoice with purchase order, to approve and make payment of the invoices.

The key components of vendor invoice automation are extracting data automatically by using technology like IDP, verifying the data, identifying errors and discrepancies, and flagging it, automating approval routes as per requirement, providing alerts and notifications to approvers, and the finance team to release the payment, real-time tracking of invoice status and provides dashboards and reports for decision making.

With these key components, business process automation software increases the efficiency in the way the account payable cycle works, increases data accuracy by automation in data extraction and verification, helps in cost savings by avoiding undue interest and fees for delay in payments, and availing benefits of early payment discounts. Further, it provides insight that helps the finance team to analyze the cash flow and accounts payable cycle and make business decisions.

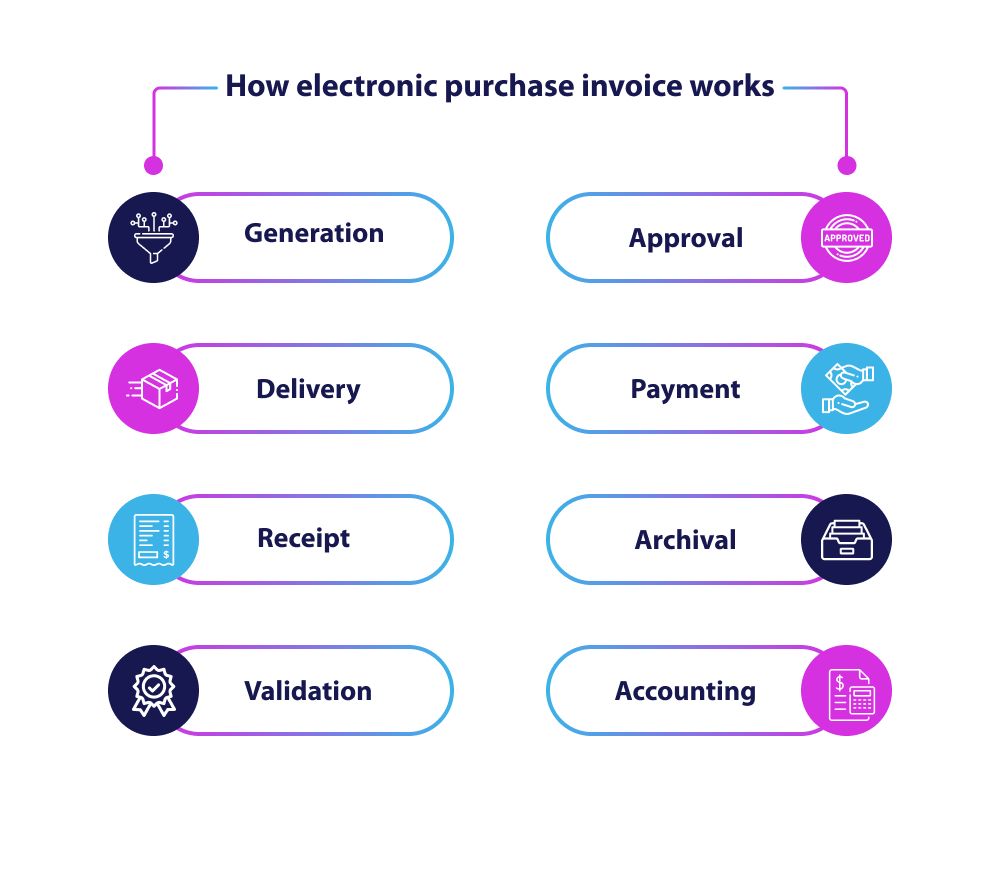

How Does Purchase Invoice Automation Work?

Purchase invoice automation uses technologies such as IDP, machine learning, and natural language processing to extract and capture invoice data with maximum accuracy.

The extracted data are verified and validated based on predefined business rules and logic. Any error or discrepancy in an invoice will be flagged for review by the authorized person. The validated invoice is then automatically routed to the appropriate approvers based on factors such as invoice amount, vendor, and department. If the invoice is validated and approved, the payment will be released automatically.

Further, API enables the integration of purchase invoice automation software with ERP and accounting systems. When an invoice is verified and processed further, the integration triggers the automatic creation of corresponding entries in the accounting system.

Advantages of Embracing Purchase Invoice Automation

- Enhanced Efficiency and Productivity: – Purchase invoice automation streamlines the entire invoicing process and reduces human intervention which leads to expediting the invoice process from procurement to payment. Since the entire process is automated the accuracy and efficiency of the data are enhanced and the workforce resources can be allocated to more productive business areas.

- Cost Savings and Reduced Manual Errors- The Automated system extracts data automatically from invoices which reduces manual errors, and eliminates the need for paper-based invoices and, the need for manual data entry thereby reducing costs related to labor, paper, printing, etc.

Further, approval systems get faster reducing delays and late payment fees or penalties. - Mitigating Fraud and Compliance Risks – The automation solution provides real-time visibility of the entire cycle, making it easy to identify any suspicious or unusual activity that may indicate fraud. It can identify duplicate entries and flag them until it gets resolved which eliminates siphoning of funds.

Once the invoice is validated, the approvals and payments are done by authorized persons only, which prevents unauthorized access or intervention.

It also generates comprehensive audit trials that track every action taken from procurements to payment on an invoice.

Implementing Purchase Invoice Automation

Evolution necessitates implementing new technological solutions in an organization to work efficiently and accurately. Understanding business needs and bottlenecks clearly and implementing automation accordingly with employee support is important. A few factors to be kept in mind before implementing an automated solution are as follows:

- Selecting the Right Purchase Invoice Automation Solution: Selecting the right purchase invoice automation solution is vital for the organization. Proper research and evaluation of different automation solutions available in the market considering factors such as features, scalability, integration capabilities, and cost will help in selecting the right solution.

- Ensuring Smooth Integration with Existing Systems: Choosing automation that seamlessly integrates with the organization’s existing ERP or accounting software and technology infrastructure is crucial.

Evaluation of existing manual invoice processing system and technology infrastructure such as software systems, hardware, and network capabilities to ensure compatibility with automation solutions.

Working closely with the IT team to understand the technical requirements for integration, such as data formats, API, and protocols.

Further mapping the data fields between existing systems and the automation solutions to ensure accurate and consistent data transfer and testing various scenarios to identify and address any issues.

The Role of Artificial Intelligence in Purchase Invoice Automation

- AI-powered Invoice Processing Techniques: AI-powered technologies like IDP would extract data from any format say PDF, scanned document, or captured image, and NLP is used to extract information from unstructured text, such as invoice descriptions and notes, and convert it into machine-readable format.

AI algorithms help to validate key data points from invoices, including vendor name, invoice date, due date, line-item details, and total amount.

- Machine Learning for Continuous Improvement- Machine Learning models learn from historical data to automatically assign expense categories to invoices. It can continuously learn from user interaction and improve over time, enhancing accuracy and efficiency in invoice processing.

- Future Prospects of AI in Finance- AI-driven algorithms can use historical and real-time data to predict invoice processing time, optimize cash flow, and enhance financial planning by ensuring that funds are available during payment and speeds up process and approval workflow thereby ensuring cost savings in terms of unnecessary fines and penalties due to delays in payments.

AI identifies trends and anomalies within invoice data helps the finance team predict potential bottlenecks, compliance issues, and cost overruns, and assists in creating accurate budget plans and identifying potential cost-saving opportunities.

The Human Touch in an Automated Finance Landscape

- Emphasizing the Importance of Human Oversight – Purchase invoice automation does not eliminate the need for human intervention – when the invoice is verified, any discrepancies or anomalies flagged by the system need to be resolved by the user.

Regular compliance often demands human-reviewed records and approvals to ensure transparency, accountability, and adherence to rules. Humans can provide feedback to enhance the automation process over time.

- Fostering Collaboration between Humans and Machines: Humans and Machines must collaborate to leverage the strength of both and achieve optimal results. The roles of both in workflow can be clearly outlined. Automation solutions should be designed with a focus on user-friendliness and ease of interaction.

The protocol can be developed to determine when human intervention is required if anomalies or errors are detected and collaborative decision-making and continuous learning between machine and human can be encouraged. - Upskilling Finance Professionals for the Future- Strong data analysis skills can be developed to extract insights from automated invoice data and use them for strategic decision-making. Staying updated with Fintech solutions and their impact on the finance process, including invoice automation tools can help.

Measuring Success and ROI of Purchase Invoice Automation

- Key Performance Indicators for Automation- Key Performance Indicators such as invoice processing time, invoice accuracy, reduction in processing cost per invoice, percentage of straight-through processing without human intervention, percentage of early payment discounts received, vendor satisfaction, invoice volume, and exception handling, system downtime, data security metrics, error rates, etc should be evaluated to get a clear picture of the implementation of automated solution.

- Evaluating Return on Investment (ROI) – To evaluate ROI the cost and savings is required to be compared. From initial investment cost to ongoing operating cost related to the implementation of automated solutions needs to be evaluated.

- Continuously Improving Automated Processes- Based on feedback and suggestions received from the system user, automated processes need to be improved on a time-to-time basis to meet the organization’s needs and increase the efficiency of business workflow.

Future Trends and Innovation in Finance Automation

Blockchain and Smart Contracts in Invoice Management

- Blockchain’s cryptographic security features make it difficult for invoices to be tampered with or duplicated.

- It creates a distributed ledger where all participants have access to the same, immutable records of transactions that cannot be altered or deleted.

- Auditors can access transactions on a real-time basis and can have a quick resolution of invoice disputes.

- Blockchain can also simplify cross-border invoice processing by eliminating intermediaries and currency conversion fees.

- Smart Contract can be programmed to automatically execute payments upon receipt of verified invoices. It can also encode payment conditions, on fulfilment of the same the payment is released.

- It acts as an escrow service, holding funds until both parties agree upon the terms of the invoice.

- It also sends automatic reminders of invoices, resolves disputes quickly, tracks transactions on real real-time basis, etc. which helps in reducing administrative and processing costs.

Predictive Analytics for Finance Decision-making –

- Predictive analytics assist in budgeting and financial planning by analyzing past invoice data and predicting future expenses, allowing organizations to manage their working capital efficiently and helping capture early payment discounts by analyzing supplier behavior and payment terms.

- The predictive model identifies potential financial risk by analyzing invoice data anomalies, and late payments and detects fraud by identifying irregular patterns or behavior in invoice data which can help prevent siphoning of funds.

- It also provides executives and finance teams with data-driven insights to support strategic financial decisions related to procurement, vendor management, supplier negotiation, and cost control.

Integration with IoT and Supply Chain Automation-

- Integration with the Internet of Things (IoT) and supply chain automation can enhance the capabilities of purchase invoice automation by creating a seamless end-to-end procurement and invoice process.

- IoT sensors on products and packages can trigger invoice creation automatically on receipt of goods, it helps in real-time tracking of goods, matches purchase orders with invoices and GRN (goods receipt notes), and releases payment upon fulfillment of predefined conditions.

- It can trigger alerts on delays in shipment and goods damaged in transit which allows quick issue resolution and adjust invoices if necessary.

- It gives insights into supplier performance like on-time deliveries, product quality, In-transit damage, etc. which is helpful in contract negotiations.

- Supply chain automation generates PO (Purchase order) automatically when the inventory level reaches below a threshold level.

- It can facilitate direct integration with the supplier’s system and allow the automatic exchange of PO, invoice, and shipping notes reducing manual data entry.

- It automatically matches the PO or GRN with the invoice received.

- It adjusts inventory level based on demand forecast which reduces carrying cost and improves working capital management.

Impact of Purchase Invoice Automation on Vendor Relationship

- Streamlining communication and collaboration with vendors in purchase invoice automation is essential for efficient and productive business relationships.

- The streamlined onboarding process of the new vendor is carried out and are provided with the necessary tools and information to submit invoices electronically.

- A secure vendor portal is created where the supplier can find PO, submit invoice check payment status, and flag any discrepancies.

- Automated notification is set up to inform when an invoice is received, approved, or paid. Further, a real-time chat within the vendor portal is provided for vendors to ask questions and seek clarification regarding invoices and payments.

- Maintaining open and transparent communication, prompt invoice processing, and early payments can create good relationships and enhance the business partnership and mutually beneficial terms that align with automation capabilities and supplier needs can be implemented.

Regulatory and Compliance Implications of Purchase Invoice Automation

- Adapting to Changing Regulations: Automated solutions need to be adaptable to the change in regulatory requirements. Regularly updating automation solution to incorporate change, learning and training sessions to be conducted to implement change and test the changes implemented, regular assessment to be done to verify that it aligns with the latest regulation.

- Ensuring Compliance in Automated Processes When an automated solution is modified with a change in regulations, the procurement to payment cycle should be ensured to comply properly with set standards and any discrepancies need to be flagged and handled by authorized personnel. It should be ensured that the system retains historical records and documentation, including past versions of compliance rules and invoices.

- Auditing and Reporting in an Automated Environment Automated solution maintains a robust audit trail that logs all actions related to invoice processing and approvals. Any error or anomalies will be flagged and reported to an authorized person which helps in identifying and preventing error or fraud and helps in securing the financial cashflow of the company.

Assessing the Scalability of Purchase Invoice Automation

- Assessing the scalability of automated solutions is crucial to changing business needs including invoice volume, additional suppliers, expanded product lines, and organizational growth.

- Estimating future growth and evaluating current automation solutions including hardware, software, and infrastructure to determine if it can handle growth.

- Examining the scalability features of the automation system to ensure it offers the ability to scale vertically by adding more resources to a single server and horizontally by adding more servers or nodes to distribute the workload.

- Further to ensure that the current deployment model, either cloud-based or on-premises, is conducive to scalability.

Conclusion

Automation in business processes increases the accuracy and efficiency of the business. It helps with cost saving and improves productivity, which would help in the growth of business. Automated solutions will change the way the finance team makes decisions thus improving cashflow cycles and profits of the organization.

Read More:-

- Top 8 Advantages of Mobile Apps within Pharmacy Management Software. According to Neil Shah, Co-Founder of Counterpoint Research, India has world’s second largest smartphone users base at 69 million in 2025. Gen Z and Millennials are more comfortable on mobile devices for checking mail, WhatsApp, tracking orders and payments, and more. Mobile apps integrated… Read more: Top 8 Advantages of Mobile Apps within Pharmacy Management Software.

- Connected Banking in Marg Pharmacy Software: Streamlining Financial Workflows for Modern Pharmacies. Running a pharmacy today goes far beyond stocking medicines and dispensing prescriptions. Pharmacists juggle billing, inventory management, GST compliance, supplier payments, bank reconciliations, and customer receipts, all while trying to deliver excellent healthcare service. Traditionally, pharmacy owners and… Read more: Connected Banking in Marg Pharmacy Software: Streamlining Financial Workflows for Modern Pharmacies.

- How Billing Software with Barcode Billing Improves Operations at FMCG Stores. In the fast-paced world of fast-moving consumer goods, every second saved and every error reduced counts. FMCG stores from local kirana shops to supermarkets, face high transaction volumes, frequent stock movement and stringent tax compliance requirements. In such a competitive business environment, FMCG billing software… Read more: How Billing Software with Barcode Billing Improves Operations at FMCG Stores.

- Zero-Stock or over-Stock? How does a Pharmacy Software Brings Balance. Running a pharmacy is a daily balancing act. On one hand, zero-stock situations lead to lost sales and unhappy customers. On the other, over-stock ties up capital and increases the risk of expired medicines. For most chemists,… Read more: Zero-Stock or over-Stock? How does a Pharmacy Software Brings Balance.