Investing your hard-earned money is a crucial decision that can significantly impact your financial future. With numerous investment options available in the market, selecting the right one can be a daunting task. Two popular investment vehicles that often come up in discussions are stocks and mutual funds. In this blog, we’ll discuss the differences between stocks and mutual funds and help you decide which investment vehicle is suitable for you.

What are Stocks?

Stocks, also known as equities, represent ownership in a company. When you buy stocks, you’re essentially buying a small portion of the company. As a shareholder, you’re entitled to a portion of the company’s profits, and your investment can increase or decrease based on the company’s financial performance. Stocks are considered high-risk investments because their value can be volatile and can fluctuate frequently based on market conditions.

What are Mutual Funds?

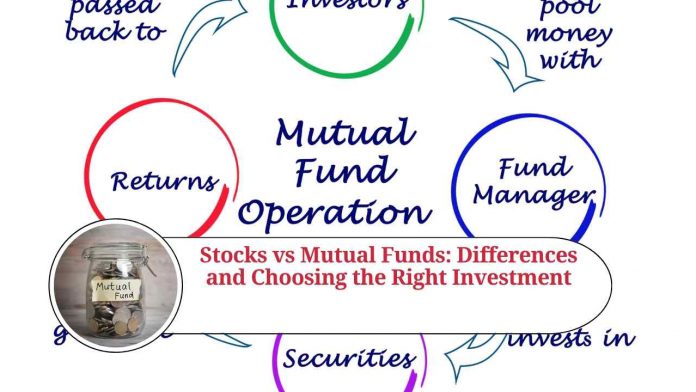

A mutual fund is a professionally managed investment vehicle that pools money from various investors to invest in a diverse portfolio of stocks, bonds, and other securities. Mutual funds are designed to provide investors with a way to invest in the stock market without having to buy individual stocks. Mutual funds offer a diversified portfolio, which reduces the risk of loss and maximizes returns.

Differences between Stocks and Mutual Funds

- Risk: Stocks are considered riskier than mutual funds as their value can fluctuate frequently based on market conditions. Mutual funds, on the other hand, are less risky as they are designed to diversify investments across various stocks and securities, reducing the risk of loss.

- Management: With stocks, investors must manage their investments, monitor market trends, and make decisions on when to buy and sell stocks. With mutual funds, professional fund managers handle all the investment decisions.

- Diversification: Stocks provide limited diversification as investors typically buy shares in a single company. In contrast, mutual funds invest in a diverse portfolio of stocks, bonds, and other securities, reducing the risk of loss and maximizing returns.

- Fees: When buying stocks, investors typically pay a commission to the broker. With mutual funds, investors pay annual management fees to cover the fund’s operating expenses.

Which Investment Vehicle is Suitable for You?

The choice between stocks and mutual funds depends on your investment goals, risk tolerance, and investment horizon. If you’re a new investor and have a low-risk tolerance, mutual funds may be the best option for you. They offer diversification, which reduces the risk of loss, and are managed by professional fund managers.

If you have a high-risk tolerance and are looking for the potential for higher returns, stocks may be a better option. However, it’s important to remember that stocks can be volatile, and you must be prepared for potential losses.

Final Thoughts

Investing in the stock market can be an excellent way to grow your wealth over time. Understanding the differences between stocks and mutual funds and selecting the right investment vehicle can make all the difference in achieving your financial goals. Before investing, it’s important to conduct thorough research, assess your risk tolerance, and seek professional advice if needed.

Read more useful content:

- How to invest in mutual funds

- All about mutual funds-types & importance

- The Power of SIP Investment in Mutual Funds

Frequently Asked Questions (FAQs)

Q. What is a stock?

A stock is a type of security that represents ownership in a company. When you buy a stock, you become a shareholder in that company and have the potential to earn a profit from the company’s financial performance.

Q. What is a mutual fund?

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. The fund is managed by professional fund managers who make investment decisions on behalf of the investors.

Q. What is the difference between stocks and mutual funds?

Stocks represent ownership in a single company, while mutual funds invest in a diverse portfolio of stocks and securities. Stocks are typically riskier than mutual funds, but they also offer higher potential returns.

Q. How do I buy stocks or mutual funds?

You can buy stocks and mutual funds through a brokerage account. You can open an account with a brokerage firm, deposit funds into your account, and then buy stocks or mutual funds through the broker.

Q. What are the fees associated with buying stocks or mutual funds?

When buying stocks, you may be charged a commission by the broker. With mutual funds, you may be charged an annual management fee to cover the fund’s operating expenses.

Q. Can I lose money investing in stocks or mutual funds?

Yes, investing in stocks and mutual funds involves risk, and you can lose money. The value of your investment can fluctuate based on market conditions and the performance of the underlying investments.

Q. How do I choose between stocks and mutual funds?

Choosing between stocks and mutual funds depends on your investment goals, risk tolerance, and investment horizon. If you’re a new investor with a low-risk tolerance, mutual funds may be a better option. If you’re comfortable with taking on more risk for higher potential returns, stocks may be a better choice.

Q. Should I invest in individual stocks or mutual funds?

Investing in individual stocks can be riskier than investing in mutual funds, as the value of individual stocks can fluctuate significantly. Mutual funds offer diversification, which reduces the risk of loss and maximizes returns.

Q. How long should I hold onto stocks or mutual funds?

The length of time you hold onto stocks or mutual funds depends on your investment goals and investment horizon. If you’re investing for the long-term, holding onto your investments for several years can help you ride out market fluctuations and potentially earn higher returns.

Q. Should I seek professional advice before investing in stocks or mutual funds?

It’s always a good idea to seek professional advice before investing in stocks or mutual funds. A financial advisor can help you assess your risk tolerance, set investment goals, and create a diversified investment portfolio that aligns with your financial objectives.