Introduction

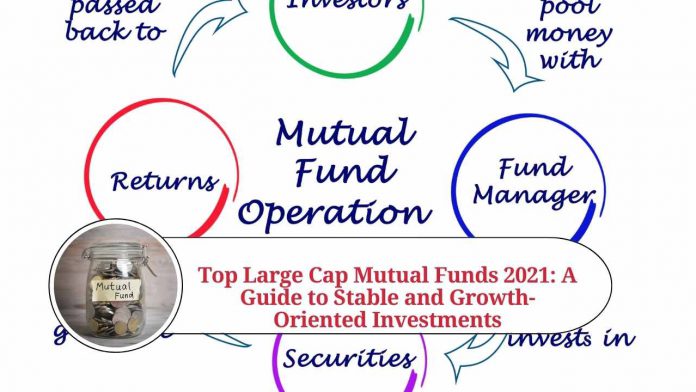

When it comes to investing in mutual funds, large cap funds are often considered a safe and reliable option for investors looking for stability and long-term growth. Large cap mutual funds invest in companies with a large market capitalization, typically considered to be the top 100 companies in terms of market value. These companies are often leaders in their respective industries and have a proven track record of performance.

Why Choose Large Cap Mutual Funds?

Large cap mutual funds are known for their stability and lower risk compared to mid-cap or small-cap funds. They are ideal for conservative investors who prioritize capital preservation and are willing to trade off slightly lower returns for lower risk. Here are some key reasons to consider large cap mutual funds for your investment portfolio:

- Established Companies: Large cap funds invest in well-established companies that have a strong presence in the market. These companies typically have a long history of stability and growth, making them less prone to sudden price fluctuations compared to smaller companies.

- Diversification: Large cap funds invest in a diversified portfolio of stocks from different sectors, which helps spread out the risk. This diversification can provide a cushion against market volatility and reduce the impact of a downturn in any specific industry or sector.

- Lower Risk: Large cap funds are considered to be less risky compared to mid-cap or small-cap funds due to the stability and size of the companies they invest in. This makes them suitable for conservative investors or those with a low risk tolerance.

Top Large Cap Mutual Funds in 2021

- SBI Bluechip Fund SBI Bluechip Fund is one of the most popular large cap mutual funds in India, with a proven track record of consistent performance. It has a diversified portfolio of blue-chip companies across sectors, with a focus on large cap stocks. The fund has delivered impressive returns over the years and has consistently outperformed its benchmark index.

- ICICI Prudential Bluechip Fund ICICI Prudential Bluechip Fund is another top-performing large cap mutual fund in India. It follows a growth-oriented investment approach and invests in companies with a dominant position in their respective sectors. The fund has a strong track record of delivering competitive returns and has a low expense ratio, making it an attractive option for investors.

- Axis Bluechip Fund Axis Bluechip Fund is known for its consistent performance and has a proven track record of generating alpha over its benchmark index. The fund follows a bottom-up stock picking approach and invests in high-quality large cap companies with a focus on long-term capital appreciation. It has a well-diversified portfolio and has delivered attractive returns over the years.

- Aditya Birla Sun Life Frontline Equity Fund Aditya Birla Sun Life Frontline Equity Fund is a popular choice among investors seeking large cap exposure. The fund has a disciplined investment approach and invests in companies with a proven track record, strong competitive positioning, and growth potential. It has a well-diversified portfolio and has consistently delivered competitive returns.

- HDFC Top 100 Fund HDFC Top 100 Fund is one of the oldest and most trusted large cap mutual funds in India. The fund follows a research-driven approach and invests in companies with a sustainable competitive advantage, strong cash flows, and growth potential. It has a diversified portfolio and has delivered consistent returns over the years.

Conclusion

Large cap mutual funds can be an attractive option for conservative investors looking for stability and long-term growth. The funds mentioned above are some of the top large cap mutual funds in 2021 in India, with a proven track record of performance. However, it is important to note that mutual fund performance can vary over time, and past performance is not indicative of future results. It is always advisable to do thorough research, consider your investment goals, risk tolerance, and consult with a qualified financial advisor before making any investment decisions.

In conclusion, large cap mutual funds can be a prudent choice for investors seeking stability and long-term growth in their investment portfolio. The top large cap mutual funds in 2021 mentioned above are known for their consistent performance, diversified portfolios, and experienced fund managers. However, it is crucial to carefully analyze your investment needs, risk tolerance, and overall financial goals before investing in any mutual fund. It is also recommended to review your investments periodically and make adjustments as needed to align with your financial objectives. With proper research, due diligence, and a well-structured investment plan, you can confidently invest in large cap mutual funds and potentially reap the benefits of long-term wealth creation.

Read more useful content:

Frequently Asked Questions (FAQs)

What are large cap mutual funds?

Large cap mutual funds are a type of mutual fund that invests in companies with large market capitalization, typically the top 100 companies in terms of market value. These companies are generally well-established and have a proven track record of performance.

How do large cap mutual funds differ from other types of mutual funds?

Large cap mutual funds differ from other types of mutual funds, such as mid-cap or small-cap funds, in terms of the size of companies they invest in. Large cap funds invest in larger companies with a higher market capitalization, which are generally considered to be more stable and less risky compared to smaller companies.

What are the benefits of investing in large cap mutual funds?

Some benefits of investing in large cap mutual funds include stability, lower risk compared to mid-cap or small-cap funds, diversification, and potential for long-term growth. Large cap funds are ideal for conservative investors looking for a balance between stability and growth in their investment portfolio.

What are the risks associated with investing in large cap mutual funds?

While large cap mutual funds are generally considered less risky compared to mid-cap or small-cap funds, they are not completely risk-free. The value of the investments in the fund can still fluctuate based on market conditions, and there is a possibility of loss of principal. Additionally, there may be specific risks associated with the companies or sectors the fund invests in.

How can I choose the best large cap mutual fund for my investment portfolio?

Choosing the best large cap mutual fund for your investment portfolio requires careful research and analysis. Factors to consider include historical performance, fund manager’s experience and track record, expense ratio, portfolio diversification, risk tolerance, and your overall investment goals. It is recommended to consult with a qualified financial advisor for personalized advice.

Can I invest in large cap mutual funds through a Systematic Investment Plan (SIP)?

Yes, many large cap mutual funds offer the option to invest through a Systematic Investment Plan (SIP), which allows investors to invest a fixed amount at regular intervals, such as monthly or quarterly. SIPs can be a disciplined approach to investing and can help in mitigating the impact of market volatility.

What are the tax implications of investing in large cap mutual funds?

In India, large cap mutual funds are treated as equity funds for tax purposes. Long-term capital gains (LTCG) tax of 10% is applicable on gains exceeding Rs. 1 lakh per financial year, if the units are held for more than one year. Short-term capital gains (STCG) tax of 15% is applicable if the units are held for one year or less. Additionally, dividend income from mutual funds is subject to Dividend Distribution Tax (DDT) at the rate of 10% plus applicable surcharge and cess.

Can I redeem my investment in large cap mutual funds at any time?

Yes, most mutual funds offer the option to redeem or sell your investments at any time. However, it is important to note that mutual funds are subject to market risks, and the value of your investments may fluctuate based on market conditions. It is advisable to consult with a financial advisor and consider your investment goals before making any redemption decisions.

Can I invest in large cap mutual funds for short-term goals?

While large cap mutual funds are generally considered as long-term investment options, they can also be used for short-term goals depending on your risk tolerance and investment horizon. However, it is important to carefully assess the risks and potential returns before investing in large cap mutual funds for short-term goals.