In October 2024, the Goods and Services Tax Network (GSTN) announced a significant update, mandating automatic bank account validation during non-core amendments to GST registration. This validation process ensures that taxpayer bank account details are verified and compared with official records, reducing errors, discrepancies, and fraud. For businesses using Billing Software, this update enhances financial operations by ensuring secure, accurate, and verified banking data, streamlining GST compliance, and contributing to smoother transactions while maintaining data integrity in tax filings.

- The manual updating of bank account information prior to this, without verification, sometimes led to errors, discrepancies, and even fraudulent situations. The goal of this modification is to reduce risks and improve the overall reliability of data given by taxpayers.

- Additionally, the Oct 2024 GST update improves the GST system’s reliability. For seamless transaction processing, tax authorities can now rely on more precise and validated banking data. Businesses may now feel even more assured that their tax-related financial data is safe, validated, and appropriately documented.

- New guidelines for maintaining compliance in GST filings have been established by this notification from GSTN, especially for companies that deal with regular expansions or revisions that call for bank account updates.

How Businesses Benefit from GSTN’s New Validation Process:

Now, businessmen have relief because this update ensures that once the bank account details are linked to GST, it will protect the business from potential penalties or delays caused by inaccurate details.

Key Benefits of GST Linking for Businesses:

Improved accuracy:

GST linkage is another example of automatic details filling. This will help to enter the correct data or details, preventing data errors. So we don’t have to worry about manual data entry errors that result in the rejection of GST filings or income tax deductions.

Enhance complaints:

By keeping correct banking records, the validation phase guarantees that companies are always in compliance with GST requirements. By doing this, any discrepancies that can result in legal troubles or problems with tax returns are avoided.

Reduced fraud:

Automatic, valid tax filing will help to reduce the fraud deduction. This procedure makes it more difficult for fraudulent data to be submitted by ensuring that only validated banking information is linked to the taxpayer’s GST number.

Smoother operation:

Because the validation procedure guarantees that each transaction is founded on correct and validated bank account information, it will expedite tax-related activities. When it comes to saving time and effort on errors, this function is groundbreaking for companies that regularly update their bank information as a result of expansion or reorganization.

Data security:

Through the automatic cross-checking process, the sensitive data will be more secure. Businesses can be sure that the data they submit is verified through secure routes and is difficult to falsify.

Businesses may now handle their financial information more easily and securely while adhering to GST regulations thanks to the GSTN’s simplification of the registration amendment procedure. Nowadays, businesses are better able to make sure that their financial information and tax returns are accurate, which increases overall operational efficiency.

Why Does This Matter for Your Business?

The compliance situation for companies all over India has significantly improved with the October 2024 GSTN update. Businesses can now make sure that their GST changes are done without the typical risks associated with human submissions and errors thanks to the automatic bank account validation process.

This is the part of GST filling that helps to improve security, boost productivity, and enhance business stability. You are in a small or large business and your GST filings have correct and validated banking information regarding that. The verification of the account details and automatic filling can maintain the complaints, avoid costly mistakes, and ensure smoother operations moving forward. This process helps your business run smoothly by saving you time and effort through their automatic data-filling operation.

Businesses will now be responsible for paying the GST on behalf of unregistered landlords due to the implementation of the Reverse Charge Mechanism (RCM) for commercial property rentals. Because businesses could have to set aside more money up front for tax payments, this could have an impact on cash flow management. This shift necessitates quick changes to cash management and accounting procedures for companies leasing office space or commercial premises.

In addition to saving time and money on submitting returns, the modifications intended to streamline GST return filing procedures may lessen the burden of compliance. These changes may help companies that have found it difficult to handle the intricacies of GST filings by streamlining processes and freeing up more time for vital tasks.

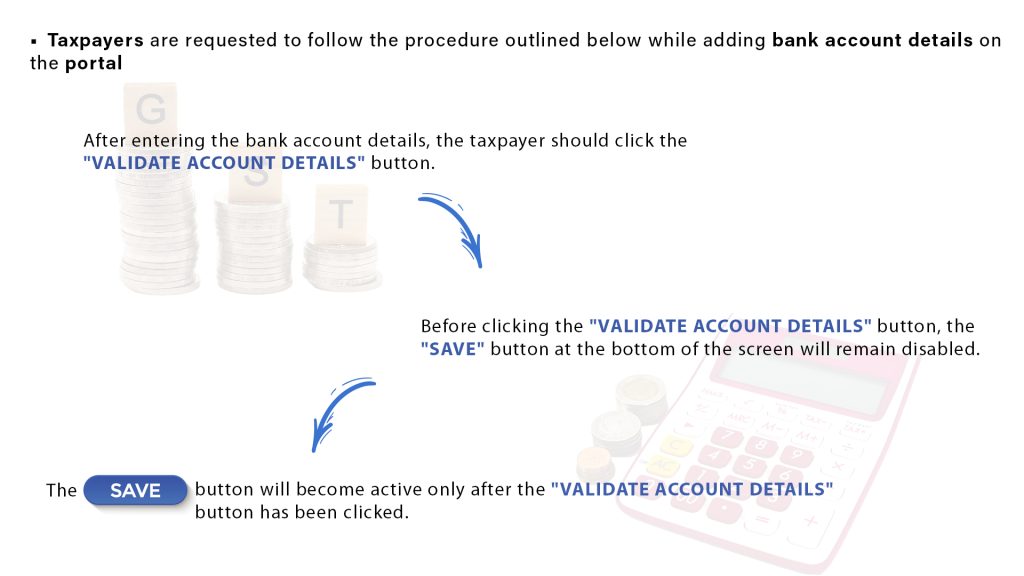

When adding a bank account as a non-core alteration, the details are validated. Kindly note that GSTN has instituted a validation procedure for situations in which a taxpayer tries to change bank account details through a non-core amendment. Taxpayers are asked to add bank account information on the portal by following the steps listed below. (Myself) After entering their bank account information, the taxpayer must click the “VALIDATE ACCOUNT DETAILS” option.

(II) Prior to clicking the “Validate Account” button, the “Save” button at the bottom of the screen as shown remains disabled.

(III) The “Save” button will become active only after the “Validate Account Details” button is clicked.

How Do I Do This?

These are the processes for your GST filing:

First register to the GSTIN:

In order to get the GSTIN number, unregistered taxpayers must register. This 15-digit number is produced using your PAN and state code of business.

Login to the GST protel

After entering your login and password to access the GST site (https://www.gst.gov.in/), you must select the “Services” tab.

Go to Services

- After logging in, go to the ‘Services’ menu.

- Click on ‘Registration’, then select ‘Amendment of Registration Non-Core Fields’.

Select bank account:

In the GST filing form, you have to select the bank account details.

Add or modify the account details

Clicking “Add New” and entering the necessary information, including the account number, IFSC code, and account type, will allow you to add a new bank account.

Click “Edit” next to the account you wish to update if it’s already there.

Validation process:

The bank data will be automatically verified by the portal against the bank’s records. To prevent validation problems, make sure the details are correct.

Submit the application:

- To submit the request for modifications for approval, click “Submit” after the bank account details have been verified.

- Depending on your line of work, you might need to use a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) to confirm the submission.

Approval

After submission, the GST authorities will review the request. Once approved, the updated bank details will be reflected in your GST registration.

Follow this instruction and procedure for changing your bank account information on the GST portal. It is simple and guarantees that your data is up-to-date for processing refunds and compliance. You may effectively maintain your GST registration by following the instructions, which include logging in, selecting the appropriate section, adding or changing your account details, and submitting the application. To prevent validation problems, it is essential to make sure that all entered information is correct. Following submission, the approval procedure will verify that your revised bank information is formally on file. Maintaining this data current is crucial for efficient financial operations and legal compliance in your business.

Read More:-

- Amendment in GST RegistrationIn case there is any change in particulars furnished in the application for registration, the registered taxable person will have to submit an application electronically, duly signed, in FORM GST REG-11, along with documents relating to such change at the Common… Read more: Amendment in GST Registration

- Updates on 16th GST council Meet held on 11th June 2017The 16th GST council just a few weeks before the rollout of GST has lowered the tax rates for more than 66 items. This meeting was held on 11th June on a Sunday. The meeting has provided relaxation in many sectors… Read more: Updates on 16th GST council Meet held on 11th June 2017

- Latest update on Return Filing in GSTThe return filing procedure is an important aspect of GST filing. In the case of return filing, every person registered under GST Act has to periodically furnish the details of sales, purchase, tax paid and collected thereon by filing a return… Read more: Latest update on Return Filing in GST

- GST : The Historic Reformation In Taxation HistoryWe are ushering in a new era with the outcome of GST which promises a stronger economy with a less corruption.The Goods and Services Tax is one of the biggest reforms in the Indian economic set-up and would streamline the taxation… Read more: GST : The Historic Reformation In Taxation History

- 18% GST Now On Food take away: Restaurant Owners & DinersPost GST the government has issued orders for restaurant industry that a GST rate of 18% will be charged on takeaways from AC or any non-AC hotel or restaurant with any of its parts having a facility of air conditioning. The… Read more: 18% GST Now On Food take away: Restaurant Owners & Diners