Introduction

Many countries have implemented GST Billing Software and have experienced a drastic change in their businesses particularly in the billing & invoicing process. The changes in technology such as moving from traditional billing methods to digital invoicing have become essential to ensure a smooth workflow of the business operations. So, for smooth business operations, businesses are implementing GST Billing Software that digitizes the complete billing process and along with that also ensures tax compliance.

On the other hand, managing Goods and Services Tax (GST) can be a complex task for businesses of all sizes. From generating compliant invoices to filing accurate returns, staying on top of regulations can be time-consuming and prone to errors. This is where GST billing software comes into the picture.

Meaning of GST Software

GST software, or GST filing software, GST return software, or GST invoice software, simplifies your GST processes, saving you time and ensuring compliance.

In this blog, let’s explore the top features to look for when selecting the best GST billing software for your business, including how Marg ERP can be a powerful GST solution.

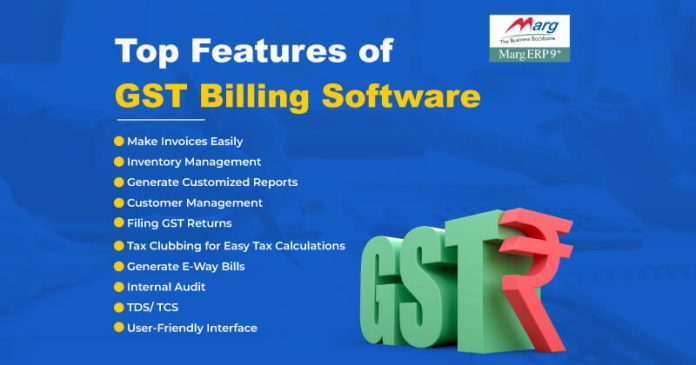

Top Features to Consider in a GST Billing Software

All Indian business owners need to select the appropriate GST billing software. Considering the complexity of GST rules, the reliable software solution can save you time and money while ensuring compliance. The following are the top features to consider when purchasing your GST billing software.

1. Make Invoices Easily

The most important feature to look for when purchasing GST Billing Software is the ability to simply generate GST Compliant Invoices. It must include pre-defined templates, the company’s logo and brand, and automatic tax calculations according to GST rates.

2. Inventory Management

For any organization, keeping track of inventory is essential. Effective inventory management facilities must be available in the best GST billing software. The features like creating new items/products, maintaining stock levels, and the software should send an alert/reminder when the stock is low to avoid stock shortages resulting in simplifying the complete inventory process and meeting the customer demands.

3. Generate Customized Reports

The best GST billing software provides advanced reporting and analysis tools. With the help of these tools, you can create customized reports on different business-related topics, including market trends, top-selling products, tax obligations, and customer purchasing behavior. With the help of GST Billing Software, the user must be able to make well-informed decisions for future growth and success, evaluate which are top-selling items, discover areas that require improvement, etc. all at your fingertips.

4. Customer Management

One of the top features the user must consider while purchasing GST Billing Software is that the software must save the complete information i.e., Name, Mobile No., Address, Bill history, discount provided, etc. of their customers at one place so that it can be easily accessible at any time and also helps to manually eliminate the entering of customer’s details every time.

5. Filing GST Returns

As we all are aware filing GST Returns is a very challenging and time-consuming task. Every business requires software in which the process of filing GST Returns is made simple and easy without the need for manual work. The best GST Software is integrated with the government’s GST Portal which enables the user to file GST Returns easily from the software itself and without visiting the GST Portal. Along with this, the best GST Billing Software eradicates the possibility of manual errors that occur in the transactions if done manually, and along with this, it saves the user’s time and effort.

6. Tax Clubbing for Easy Tax Calculations

This feature is especially helpful for businesses whose earnings from sources must be clubbed with the owner’s or any other specified person’s earnings for taxation purposes. These calculations must be automatically managed by the best GST software to guarantee correct tax filing and compliance with the appropriate laws, increase tax benefits, and reduce mistakes.

7. Generate E-Way Bills

It is essential for a business to generate E-Way Bills if the business transports goods exceed a specific value limit. This process is made easier if we select the best GST billing software, that allows the user to create and generate & manage single or multiple e-way bills right from the software. This ensures e-way bill compliance while improving the workflow.

8. Internal Audit

A GST Invoice software has the facility to help the users to run the Internal Audits smoothly and without any errors. By using the best GST Software for your business, you can automatically verify the data as the software only identifies the errors, provides alerts, and facilitates you in quickly solving the errors. It also validates your suppliers’ GSTINs providing accuracy of data and helping you in filing error-free GST reports. With the help of these inbuilt features in the software, the user can easily run internal audits at their fingertips, quickly identify errors, evaluate possible issues, and ensure that their financial records are always proper and legal.

9. TDS/ TCS

Generally, businesses spend hours calculating complex TDS/TCS calculations. But by purchasing the GST software automates the complete process thereby eliminating the manual data calculations or errors. The best GST Billing software enables you to identify how much the TDS/TCS needs to be deducted for each transaction resulting in saving a lot of your time and avoiding penalties for non-compliance.

10. User-Friendly Interface

The user must look for GST billing software that has a user-friendly interface i.e. it is simple to operate, and no technical skills are required to operate the software. The software must be easy to understand so that the user can concentrate on other important tasks that can boost the overall productivity of his business rather than spending more time learning the software.

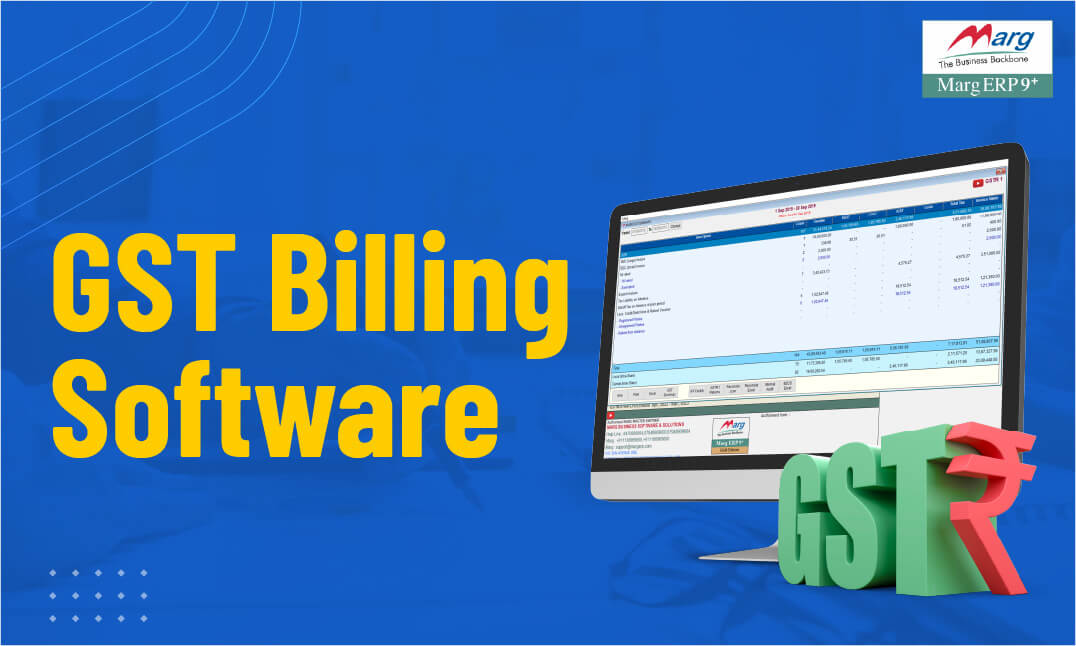

How Marg ERP is a Powerful GST Solution for Your Business

Getting a suitable GST billing software becomes essential for any business that deals with the complexities of Goods and Services Tax in India. Marg ERP comes up as the most powerful solution, providing a wide range of features to help you with GST compliance and processes.

Marg ERP provides features that cater to a variety of business requirements, rather than just billing. With pre-defined templates and computerized tax calculations, you can create error-free many type of GST bills. The features like creating new items/products, maintaining stock levels, and the software should send an alert/reminder when the stock is low to avoid stock shortages resulting in simplifying the complete inventory process and meeting the customer demands.

With the help of Marg ERP GST Billing Software, the user must be able to make well-informed decisions for future growth and success, evaluate which are top-selling items, discover areas that require improvement, etc. all at your fingertips.

Marg GST Billing Software helps you to file GST Returns easily from the software itself and without visiting the GST Portal. Apart from this, the software also allows the user to create and generate & manage single or multiple e-way bills right from the software.

Recommended Read

GST Software: Taxation Made Easy

GST Software – How GST Software Works, Features & Benefits?

GST Software: Uniqueness and Features

How to file GST Return in a Single Click: A Game-Changer for Businesses

The Complete Overview of Marg GST Billing Software

Conclusion

Finally, managing the GST complications doesn’t have to be a hassle for your business. Selecting the best GST billing software will help you maintain compliance, reduce errors, and save time. Consider features like inventory management, quick invoicing, and advanced reporting tools. A user-friendly interface allows you to stay focused on managing your business operations, while the software handles the complex requirements of GST. Consider Marg ERP to be a powerful solution with a wide range of features to help you streamline your GST needs.

Frequently Asked Questions

What is GST Billing Software?

GST software, also known as GST invoice software, is specially designed for any business size It allows you to keep proper track of the expenses and simplifies your GST processes like generating GST invoices, easily filing GST Returns, and calculating taxes that results in saving you time and ensuring compliance.

Which software is used for GST billing?

Each month, many business owners invest time and energy in the GST Filing process. but by using Marg ERP GST billing software, you can create GST reports, manage inventory, and improve the GST filing process.

Which is the best software for GST return filing?

The best software for GST Return filing depends on the needs and requirements of the business. Marg ERP is considered the best software as it files GST Returns easily from the software itself and without visiting the GST Portal.

Can I do billing without GST?

Yes, but in some cases like if the supplier is not registered under GST or the goods/services are exempted from GST then in both these cases, the user can accept a bill without GST. But in case, the supplier is registered under GST, then they are required to collect GST and issue a tax invoice.

How much does the GST portal cost?

The business registration under the GST Registration Portal is free of cost. The process is entirely online and free of charge.