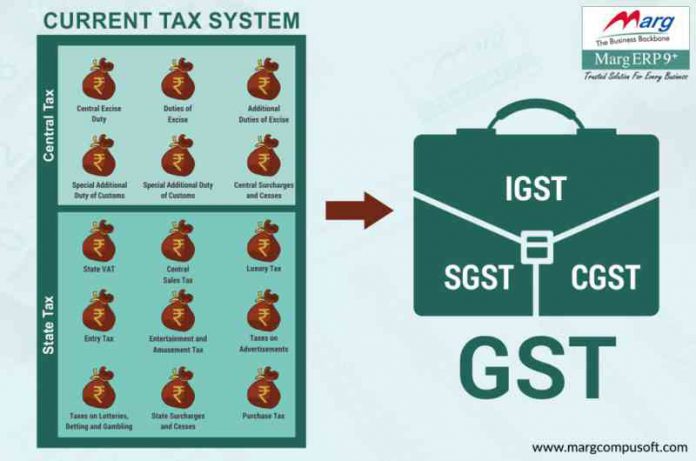

In current tax system, there are multiple taxes levied by the states and the center at different levels from manufacturing to supply of goods. Multiple taxes at different levels cause the cascading effect; the diverse taxation system in the sates is also hindrance in doing business. The GST subsumes over a dozen state and central taxes, creates a uniform tax regime across the country and mitigates the cascading effect of tax.

SGST : Sate GST, levied by the States on intra-State supply of goods and services.

CGST: ): Central GST, levied by the Centre on intra-State supply of goods and / or services.

IGST: Integrated GST, levied by the Centre on inter-State supply of goods and services.

Taxes to be subsumed under GST:

| Taxes currently levied and collected by the Centre | State taxes |

| Central Excise duty | State VAT |

| Duties of Excise (Medicinal and Toilet Preparations) | Central Sales Tax |

| Additional Duties of Excise (Goods of Special Importance) | Luxury Tax |

| Additional Duties of Excise (Textiles and Textile Products) | Entry Tax |

| Additional Duties of Customs (commonly known as CVD) | Entertainment and Amusement Tax (except when levied by the local bodies) |

| Special Additional Duty of Customs (SAD) | Taxes on advertisements |

| Service Tax | Taxes on lotteries, betting and gambling |

| Central Surcharges and Cesses so far as they relate to supply of goods and services

|

State Surcharges and Cesses so far as they relate to supply of goods and services |

| Purchase Tax |

| Current Tax Structure | GST |

| There are separate laws for separate taxes and respective VAT on states. | Only one law for GST |

| There are separate tax rate | There will be once CGST rate and uniform SGST rate across all the States |

| Cascading effect of taxes | Cascading effect is mitigated |

| High tax burden on tax payers | Tax burden is reduced |

| Cascading effect causes high rates of commodities | Prices are expected to be reduced |

| Multiplicity of taxes causes complex tax compliance | Subsuming of taxes makes compliance easy |

Who will decide rates for levy of GST?

Ans. The CGST and SGST would be levied at rates to be jointly decided by the Centre and States. The rates would be notified on the recommendations of the GST Council