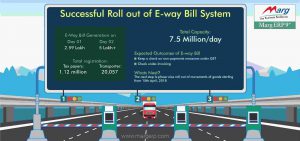

The E Way Bill system in India, introduced under the Goods and Services Tax (GST) regime, has changed how goods are transported across states. This system ensures transparency and compliance with tax rules, making business operations smoother.

What is an E Way Bill?

An E Way Bill is an electronic document that must be generated on the GST portal when moving goods. It includes details such as the goods being transported, the sender, the receiver, and the transporter.

The main purpose of the E Way Bill is to ensure that goods are moved in line with GST laws, preventing tax avoidance and promoting accountability.

E Way Bill Applicability

General Applicability

An E Way Bill is required for moving goods if the value of the consignment exceeds Rs. 50,000. This rule applies to both interstate (between states) and intrastate (within the same state) transportation.

All registered businesses under GST must generate an E Way Bill before starting the transportation of goods. There are some exceptions based on the type of goods and specific situations, which can be checked on the GST portal.

Specifics for West Bengal E Way Bill Applicability

In West Bengal, the rules for the E Way Bill generally follow national guidelines but with some state-specific limits. For intrastate transportation, West Bengal had initially set a higher limit but has revised it recently.

Now, the intrastate E Way Bill limit in West Bengal is Rs. 50,000, similar to the national standard. This change was made to improve compliance and reduce tax evasion within the state.

Interstate E Way Bill Limit in West Bengal

Standard Interstate Limit

For moving goods across state borders, the interstate e way bill limit in West Bengal is Rs. 50,000. This means any consignment worth more than this amount must have an E Way Bill.

This limit ensures that high-value goods transported between states are tracked, promoting transparency and compliance with GST rules.

Compliance and Penalties

Following the interstate e way bill limit in West Bengal is essential to avoid penalties. Non-compliance can lead to fines and the detention of goods by authorities.

Therefore, businesses must ensure all consignments above this value are accompanied by a valid E Way Bill. Regular audits and checks can help businesses stay updated with the latest rules and avoid any legal issues.

Intrastate E Way Bill Limit in West Bengal

Initial Limit

Initially, West Bengal had a higher limit for the intrastate E Way Bill. The state allowed goods up to Rs. 1 lakh to be transported without needing an E Way Bill.

This higher limit was meant to ease the burden on small businesses and facilitate smoother trade within the state.

Revised Limit

To align with national standards and improve tax compliance, West Bengal has reduced its intrastate E Way Bill limit to Rs. 50,000. This change means that any movement of goods within the state valued above Rs. 50,000 must now have an E Way Bill.

This revision helps in better tracking of goods and ensures that all high-value transactions are recorded under the GST system.

E Way Bill Distance Limit in West Bengal

Validity Based on Distance

The validity of an E Way Bill depends on the distance the goods need to travel. In West Bengal, as per national guidelines, the E Way Bill is valid for one day for every 100 kilometers or part thereof.

For example, if the distance to be covered is 200 kilometers, the E Way Bill will be valid for two days. This validity period ensures that the transportation of goods is completed within a reasonable timeframe, reducing the chances of delays and ensuring timely delivery.

Importance of Distance Limits

Understanding the e way bill distance limit in West Bengal is important for businesses to plan their logistics effectively. It ensures that goods are moved efficiently within the specified time frame.

Transporters must adhere to these distance limits to avoid any legal issues. The validity period helps in managing the supply chain better, ensuring that goods reach their destination without unnecessary delays.

How to Generate an E Way Bill?

Generating an E Way Bill is straightforward. Here are the steps involved:

- Login to the GST Portal: Access the E Way Bill portal using your GSTIN and password.

- Navigate to the E Way Bill Generation Page: Select the ‘Generate New’ option from the menu.

- Enter Details: Provide necessary details like the GSTIN of the supplier and recipient, place of dispatch and delivery, invoice number, and date.

- Add Transport Details: Enter the mode of transport and vehicle number or transporter ID.

- Generate E Way Bill: Once all details are provided, click on ‘Submit’ to generate the E Way Bill. The system will provide a unique E Way Bill Number (EBN) which must be carried along with the goods during transit.

Challenges in Generating E Way Bills

- Data Accuracy: Ensuring that all details entered are accurate is crucial. Incorrect data can lead to delays and penalties.

- Connectivity Issues: In remote areas, internet connectivity can be a challenge. Businesses must have backup options like mobile hotspots.

- Understanding Compliance: Staying updated with the latest regulations is essential for compliance. Regular training and updates can help in this regard.

Benefits of the E Way Bill System

The E Way Bill system offers several benefits for businesses and the economy:

- Enhanced Transparency: The system promotes transparency by tracking the movement of goods.

- Reduced Tax Evasion: By ensuring that all high-value transactions are recorded, the system helps in reducing tax evasion.

- Streamlined Logistics: The E Way Bill system ensures smooth and efficient transportation of goods, reducing delays and bottlenecks.

- Improved Compliance: Businesses can avoid legal issues and penalties by adhering to the E Way Bill regulations.

Important E Way Bill Tips for Businesses

- Regular Audits: Conduct regular audits to ensure compliance with E Way Bill regulations.

- Training: Invest in training for your staff to stay updated with the latest regulations.

- Use Technology: Utilize technology to streamline the process of generating and managing E Way Bills.

- Stay Informed: Keep abreast of any changes in the regulations to avoid any compliance issues.

Conclusion

Understanding the E Way Bill limit in West Bengal is crucial for businesses involved in the transportation of goods. Whether it’s the interstate e way bill limit or the e way bill distance limit, compliance with these regulations ensures smooth operations and avoids legal complications. The E Way Bill system, while sometimes challenging to navigate, offers significant benefits, including enhanced transparency, reduced tax evasion, and streamlined logistics. By staying informed and compliant with the E Way Bill regulations in West Bengal, businesses can ensure smooth and efficient transportation of goods, contributing to their overall success and growth.

- Login – E-Way BillClick Here To Login E-way Bill Login-E-waybill Electronic way bill i.e. E-Way bill is the bill generated on the E-Way Bill Portal for the movement of goods. Without an E-Way bill generated through ewaybillgst.gov.in, a GST Registered person… Read more: Login – E-Way Bill

- Registration Mechanism and process to Generate E-WAY BillsIn the previous blog – “E-Way Bill – Get ready” bit.ly/2FtB0ez we had discussed the implementation dates of E-way Bill and how it will bring in uniformity across the states for seamless inter-state movement of goods. Here we… Read more: Registration Mechanism and process to Generate E-WAY Bills

- How the recently implemented E- Way bill will benefit your businessWhen E-way bill was first implemented in February, it could only handle near about 26 lakh transactions per day and encountered multiple technical glitches. This highly undermined its effectiveness and most businesses became concerned at the motive that… Read more: How the recently implemented E- Way bill will benefit your business

- The Journey from Way Bill to E-Way BillIn India, an e-way bill was used by businesses even before GST came. Earlier termed as way-bill/entry tax, it has been in existence and was implemented in certain states from the days of service tax and value-added tax… Read more: The Journey from Way Bill to E-Way Bill

What is the E Way Bill limit in West Bengal?

The E Way Bill limit in West Bengal means that if the value of goods being transported within the state or across state borders exceeds Rs. 50,000, businesses need to generate an E Way Bill. This electronic document is mandatory under GST rules to track the movement of goods and ensure proper tax compliance. It helps in documenting high-value transactions transparently. Adhering to this limit is important to avoid fines and ensure that goods transport operations run smoothly. Businesses should stay updated with any changes in E Way Bill regulations to comply effectively.

When is an E Way Bill needed for intrastate transport in West Bengal?

An E Way Bill is required for intrastate transport in West Bengal if the value of the goods exceeds Rs. 50,000. This means any goods moved within the state with a value above this amount must have an E Way Bill. This requirement aligns with national GST regulations and aims to ensure that all high-value transactions within the state are properly documented and taxed, reducing the risk of tax evasion.

How long is an E Way Bill valid for in West Bengal?

The validity of an E Way Bill in West Bengal is based on the distance the goods need to travel. For every 100 kilometers or part thereof, the E Way Bill is valid for one day. For example, if the distance to be covered is 200 kilometers, the E Way Bill will be valid for two days. This validity period helps ensure that goods are transported within a reasonable timeframe, reducing delays and ensuring timely delivery.

How does the E Way Bill system benefit businesses?

The E Way Bill system benefits businesses by promoting transparency, reducing tax evasion, and streamlining logistics. It ensures that all high-value transactions are recorded and taxed appropriately, which helps in reducing tax evasion. The system also promotes smooth and efficient transportation of goods, reducing delays and bottlenecks. Overall, adhering to E Way Bill regulations helps businesses avoid legal issues and penalties.

What are the penalties for non-compliance with E Way Bill regulations?

Penalties for non-compliance with E Way Bill regulations can include fines and the detention of goods by authorities. The specific penalties can vary based on the nature of the non-compliance, but they generally involve significant costs and delays for the business. To avoid these penalties, businesses must ensure that all consignments requiring an E Way Bill are properly documented and that all details are accurately entered and up-to-date.