When E-way bill was first implemented in February, it could only handle near about 26 lakh transactions per day and encountered multiple technical glitches. This highly undermined its effectiveness and most businesses became concerned at the motive that government was trying to achieve. This was not even the major concern as more companies grew weary of extortionists and checkpoint inspectors who can be quite pesky while dealing with.

Most business owners felt, that adding a digitized consignment inspection process would only increase the risk of unwanted bribes. However, experts hold a strong opinion that if done right, the E- Way Bill in India will have significant long-term benefits for Indian logistics industry and e-com companies along with many others.

So, how exactly will the E-way bill leverage existing information technology to improve processes, reduce tax evasion and still protect e-com companies? More importantly, what benefits will these businesses gain and is it worth the efforts of managing everything digitally? Worried? Confused? Well, don’t be!

To understand this, we need to take a look at some of the biggest challenges faced by the transport and logistics industry in our country.

Also Read: The Registration Mechanism and the process to Generate E-WAY Bills on GST Portal

E-Way Bill to reduce waiting times and queues at checkpoints

E-Way bill in India was primarily implemented to counter tax-evasion by providing an additional layer for accountability. According to Finance Secretary Hasmukh Adhia, the technology will provide documentation showing the goods a given company transported, thereby providing grounds for questioning whether GST returns were filed for those goods or not.

While this is a breakthrough for the tax authorities, businesses have much bigger issues at hand including delays and long waiting queues. Yes, you will have to accept this and treat it as the teething issues of any newly-implemented concept. Businesses have to deal with slow consignment inspection at checkpoints on a daily basis and this may take its toll on profitability and convenience. Hopeful situations in near future will take a lot lesser time and with practice, management will get easy.

Once the bill has been generated through the GSTN online portal, inspectors will be able to verify consignments using RFID technology. This is faster and more effective than the conventional practice.

The bill can be generated by anyone including registered and unregistered persons or even the transporter. This is done before goods even leave the warehouse, which relieves some of the work that inspection officer does on the roads. The system has also been

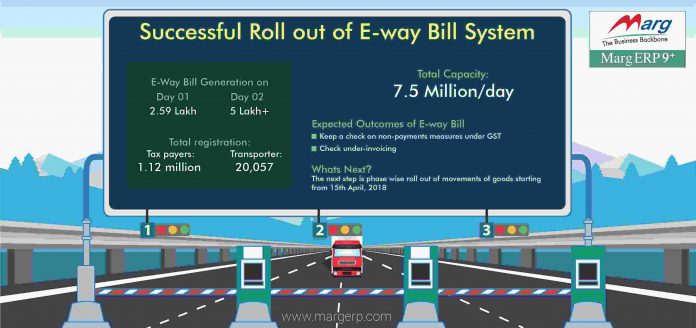

improved and can handle up to 75 lakh transactions per day, which are triple than what was initially possible when the bill was rolled out for trial in February.

Countering bribes and harassment

It is expected that any consignment truck can be prone to the so-called ‘under-the-table’ money. Transporters have been facing these challenges throughout the years. The E-Way Bill can be revamped to rectify this situation and reduce instances of harassment. There is already a guideline on all compliances that companies need to abide by.

When this is done and bills are generated as advised, checkpoint officials will have little cause to extort bribes from transporters. The GSTN portal also provides a section for posting questions and reporting any ill-treatment at checkpoints. Stops longer than 30 minutes can be reported and necessary actions can be taken against inspection officials involved.

One thing that would be more effective is the installation of surveillance cameras to record every truck stop so that government can bring more transparency and things can improve in future.

Fewer en-route stops

Another benefit the E-way bill in India will bring to businesses in future is fewer inspection stops. To start with, no business will actually be required to travel with a physical document of the bill. All that is needed is to generate it before transporting the goods and the rest can be verified using existing technology.

Transporters will only be stopped once in their journey and need not fear any other inspection stop even if they travel through multiple states in the country. Besides contributing to the faster transportation of goods, this will prevent the return of “inspector Raj”, the feared stereotype inspector who thrives on coercing bribes from transporters.

The plan is to maintain minimum random checks and reduce the number of stops that require actual matching of goods with details of the E-Way Bill. If this can be combined with regular assessment and evaluation at senior level, it will create room for improvement to achieve a streamlined framework that is ideal for all parties involved.

Summary

The E-way bill in India comes with its unique set of concerns and benefits. While it does not offer a total solution for all challenges faced in the transport and logistics industry, but the bill has a great potential. Most experts believe it is poised to surprise many business owners who are at the moment skeptical of its effectiveness.

Nonetheless, the government will need to carefully evaluate their system and adapt it accordingly to meet the rising needs of its users. Upgrading network systems and countrywide e-literacy campaigns, for instance, will be essential to any accomplishments the bill will have over the years.