Creating a proper GST bill format is important for businesses in India. It helps them comply with the Goods and Services Tax (GST) rules. The GST system requires invoices to follow a standard format. This ensures all important details are included to avoid any compliance problems.

What is GST Bill Format?

A GST Bill Format is a basic template used to create invoices under the Goods and Services Tax (GST) system in India. This format makes sure that all important details are included and follow the GST rules. It has the seller’s name, address, and GST number, as well as the buyers details if they are registered under GST. The invoice should have a unique number and the date it was created. It includes a clear description of the goods or services being sold, along with the quantity, price per unit, and total amount.

The bill also shows the GST rate and breaks down the tax amounts into Central GST (CGST), State GST (SGST), or Integrated GST (IGST). The total amount to be paid, including the GST, is clearly stated. It also mentions any payment terms and conditions. Finally, the bill is signed by the seller or their authorized representative. This standardized format helps keep everything organized and ensures that businesses follow the tax rules correctly.

Why a Proper GST Bill Format Is Important

The Goods and Services Tax (GST) is a tax on goods and services in India. The GST Council has set a specific format for invoices to ensure transparency and consistency. A proper GST bill format is important for:

- Compliance: Making sure your business follows GST laws.

- Transparency: Providing clear information to your customers.

- Claiming Input Tax Credit (ITC): Helping businesses claim ITC correctly.

Types of GST Invoices

Before we get into the details of the GST bill format, it’s helpful to know the different types of GST invoices:

- Tax Invoice: For the supply of taxable goods and services.

- Bill of Supply: For the supply of exempted goods or services or by a composition dealer.

- Debit Note: When you need to increase the taxable value of an invoice.

- Credit Note: When you need to decrease the taxable value of an invoice.

Parts of a Tax Invoice Under GST

A tax invoice under GST should include the following details:

1. Header Information

- Title: The document should say “Tax Invoice.”

- Logo (optional): You can include your business logo if you want.

2. Supplier Details

- Name: The full legal name of the supplier.

- Address: The complete address of the supplier.

- GSTIN: The GST Identification Number of the supplier.

- Contact Information: Email and phone number.

3. Invoice Details

- Invoice Number: A unique serial number.

- Date of Issue: The date the invoice is issued.

4. Recipient Details

- Name: The full legal name of the recipient.

- Address: The complete address of the recipient.

- GSTIN: The GST Identification Number of the recipient (if registered).

- Contact Information: Email and phone number.

5. Product/Service Details

- Description: Detailed description of the goods or services supplied.

- HSN/SAC Code: Harmonized System of Nomenclature (HSN) code for goods or Services Accounting Code (SAC) for services.

- Quantity: Number of goods or extent of services supplied.

- Unit Price: Price per unit of goods or services.

- Total Value: Total value before tax.

6. Tax Details

- Taxable Value: Value of goods or services on which GST is applicable.

- GST Rate: Applicable GST rate (CGST, SGST/UTGST, IGST).

- Tax Amount: Breakup of tax amounts for CGST, SGST/UTGST, and IGST.

- Total Tax Amount: Total tax amount.

7. Total Invoice Value

- Total Amount: The grand total including taxes.

- Amount in Words: The total amount written in words.

8. Other Information

- Terms and Conditions: Any terms and conditions related to the sale.

- Signature: Authorized signature and seal of the supplier.

Tax Invoice Format Example

To help you create a proper GST bill format, here is a example of tax invoice format:

TAX INVOICE

Supplier Details:

- Name: ABC Enterprises

- Address: 123 Business Street, New Delhi, India

- GSTIN: 07ABCDE1234F2Z5

- Contact Information: email@example.com, +91-1234567890

Invoice Details:

- Invoice Number: INV001

- Date of Issue: 17th June 2024

Recipient Details:

- Name: XYZ Traders

- Address: 456 Commerce Avenue, Mumbai, India

- GSTIN: 27XYZABC5678E1Z2

- Contact Information: contact@xyztraders.com, +91-0987654321

Product/Service Details:

| Description | HSN/SAC Code | Quantity | Unit Price | Total Value |

|---|---|---|---|---|

| Product A | 1234 | 10 | ₹500 | ₹5000 |

| Service B | 5678 | 5 hours | ₹1000 | ₹5000 |

Tax Details:

| Taxable Value | GST Rate | CGST Amount | SGST/UTGST Amount | IGST Amount | Total Tax Amount |

|---|---|---|---|---|---|

| ₹10000 | 18% | ₹900 | ₹900 | – | ₹1800 |

Total Invoice Value:

- Total Amount: ₹11800

- Amount in Words: Eleven Thousand Eight Hundred Rupees Only

Other Information:

- Terms and Conditions: Payment due within 30 days.

- Signature: Authorized Signatory

GST Bill Book Format

A GST bill book format can vary based on business needs, but it should always include the essential components mentioned above. Here’s a basic outline for a GST bill book format:

- Cover Page: Include your business name, logo, and contact details.

- Table of Contents: Index of invoice numbers and dates.

- Individual Invoices: Each page should represent an individual tax invoice, formatted as per the GST guidelines.

- Summary Page: At the end of the bill book, include a summary page that totals all invoices for easy reference.

Simple GST Bill Format Example

For small businesses and service providers, a simple GST bill format might be more practical. This simplified version should still include all mandatory details but can be less elaborate. Here’s an example:

TAX INVOICE

Supplier Details:

- Name: Simple Solutions

- Address: 789 Startup Lane, Bangalore, India

- GSTIN: 29SIMPL1234X1Z3

- Contact Information: info@simplesolutions.com, +91-1122334455

Invoice Details:

- Invoice Number: SIMP001

- Date of Issue: 17th June 2024

Recipient Details:

- Name: Easy Enterprises

- Address: 321 Market Road, Chennai, India

- GSTIN: 33EASY5678Y2Z4

- Contact Information: sales@easyenterprises.com, +91-5566778899

Product/Service Details:

| Description | HSN/SAC Code | Quantity | Unit Price | Total Value |

|---|---|---|---|---|

| Service C | 9012 | 8 hours | ₹800 | ₹6400 |

Tax Details:

| Taxable Value | GST Rate | CGST Amount | SGST/UTGST Amount | IGST Amount | Total Tax Amount |

|---|---|---|---|---|---|

| ₹6400 | 18% | ₹576 | ₹576 | – | ₹1152 |

Total Invoice Value:

- Total Amount: ₹7552

- Amount in Words: Seven Thousand Five Hundred Fifty-Two Rupees Only

Other Information:

- Terms and Conditions: Immediate payment required.

- Signature: Authorized Signatory

Practical Tips for Creating a GST Invoice

1. Use Invoice Generation Software

Use GST-compliant invoice generation software to automate the process. This ensures accuracy and saves time.

2. Maintain Consistency

Make sure your invoice format is consistent across all transactions. This helps in maintaining a professional appearance and makes reconciliation easier.

3. Double-Check Details

Always double-check the details on your invoices before sending them out. Incorrect details can lead to compliance issues and delayed payments.

4. Include Clear Payment Terms

Clearly mention the payment terms and conditions on your invoice. This helps in managing cash flow and reduces payment disputes.

5. Keep Records

Keep a digital and physical record of all issued invoices. This is crucial for auditing purposes and for claiming Input Tax Credit.

Common Mistakes to Avoid in GST Invoices

Creating GST invoices might seem straightforward, but there are common mistakes that businesses often make. Avoiding these can save you from compliance issues, penalties, and administrative hassles.

Incorrect GSTIN

Always ensure that the GSTIN of both the supplier and the recipient are correctly mentioned. An incorrect GSTIN can lead to the invoice being invalid, problems with claiming ITC, and potential fines from tax authorities.

Missing HSN/SAC Codes

Including the correct HSN (Harmonized System of Nomenclature) code for goods and SAC (Service Accounting Code) for services is mandatory. Missing or incorrect codes can lead to penalties and difficulties in identifying the nature of goods or services supplied.

Wrong Tax Rates

Applying the correct GST rate is crucial. Using the wrong rate can lead to underpayment or overpayment of taxes, both of which can have legal implications. Double-check the applicable tax rates for your products or services.

Unclear Product/Service Descriptions

Ensure that the description of goods or services is clear and detailed. This helps in avoiding any confusion or disputes with customers. A clear description also aids in the accurate classification of goods or services under GST.

Not Mentioning Payment Terms

Always mention the payment terms clearly. This includes due dates, late payment fees, and accepted payment methods. Clear payment terms help in avoiding disputes and ensure timely payments.

Ignoring Digital Invoices

While paper invoices are still common, digital invoices are becoming more popular due to their convenience and environmental benefits. Ensure your digital invoices comply with GST rules and are as detailed and accurate as paper invoices.

Conclusion

Creating a proper GST bill format is not just a compliance requirement. it is also a best practice that helps in maintaining transparency, ensuring smooth transactions, and supporting the financial health of your business. By following the guidelines and tips provided in this guide, you can create accurate and compliant GST invoices that meet the needs of your business and your customers. Remember to stay updated with the latest GST regulations, use reliable invoice generation software, and maintain consistency in your invoicing process. This will not only help you avoid penalties and compliance issues but also build trust and credibility with your clients.

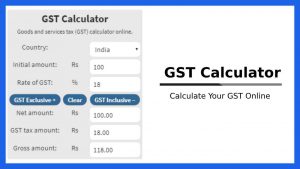

Read More:-

- A Step-by-Step Guide to Making GST PaymentsGoods and Services Tax (GST) is a value-added tax that is levied on the supply of goods and services in India. It is a comprehensive tax system that replaces all indirect taxes in the country.… Read more: A Step-by-Step Guide to Making GST Payments

- Calculate GST Online with GST CalculatorKeep reading to know more about what GST is and how to calculate GST. What is GST? Integrated GST (IGST) Stage GST and Central GST GST Calculation Formula Calculating GST using a GST Calculator Benefits… Read more: Calculate GST Online with GST Calculator

- Cancellation of GST RegistrationApplication for cancellation of registration A registered taxable person seeking cancellation of his registration shall electronically submit an application in FORM GST REG-14including the details of closing stock and liability thereon and may furnish, along… Read more: Cancellation of GST Registration

- Composition Levy in GSTUnder the composition levy scheme, a registered taxable person is qualified to pay, in lieu of tax payable by him, an amount calculated at such rate as may be prescribed by the proper officer of… Read more: Composition Levy in GST

Frequently Asked Question

What is a GST Bill?

A GST bill, also known as a tax invoice, is a document that a seller issues to a buyer, detailing the goods or services sold. It includes the GST amount charged. This bill is essential for both the buyer and seller for tax purposes and helps in claiming Input Tax Credit (ITC). Marg ERP offers a comprehensive solution to create and manage GST bills easily and accurately.

Why is it important to use the correct GST bill format?

Using the correct GST bill format ensures compliance with GST laws. It helps avoid penalties and legal issues. It also provides clear and detailed information to your customers, making it easier for them to understand the transaction and for businesses to claim ITC. Marg ERP provides templates that comply with GST regulations, ensuring your invoices are always accurate and compliant.

What details should be included in a GST invoice?

A GST invoice should include the supplier’s and recipient’s names, addresses, and GSTINs, the invoice number and date, a description of goods or services, HSN/SAC codes, quantity, unit price, total value, tax rates, tax amounts, and the total amount payable. Marg ERP simplifies this process by automatically populating these details, reducing manual errors.

What is an HSN/SAC code?

Yes, you can create a GST invoice manually, but using GST-compliant software. Marg ERP Software ensures accuracy, saves time, and helps manage records better. Manual invoices can be prone to errors, leading to compliance issues.

What is the difference between CGST, SGST, and IGST?

CGST (Central GST) and SGST (State GST) are levied on intra-state supplies of goods and services. IGST (Integrated GST) is levied on inter-state supplies. These taxes are collected and shared between the central and state governments to ensure uniform taxation across India.

How should I store my GST invoices?

You should store your GST invoices both digitally and physically. Keeping digital records helps in easy access and retrieval, while physical copies are necessary for audits and verification. Organized storage ensures compliance and simplifies tax filing. Marg ERP provides secure digital storage for all your invoices, making it easy to manage and retrieve them when needed.

How often should I update my GST invoice format?

You should review and update your GST invoice format regularly, especially when there are changes in GST laws or regulations. Staying updated with the latest requirements ensures compliance and helps in avoiding any legal issues or penalties.