Keep reading to know more about what GST is and how to calculate GST.

What is GST Calculator?

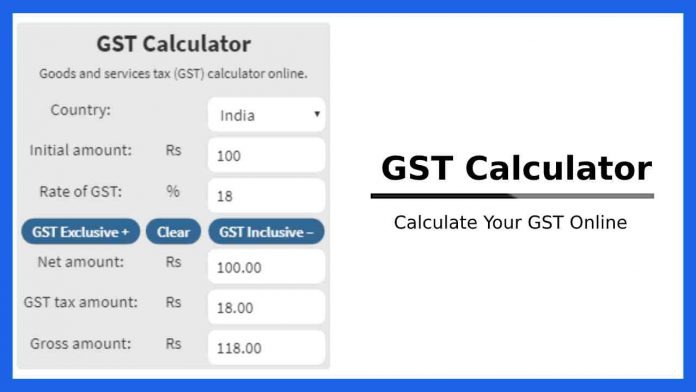

GST calculator is a simple, ready-to-use online calculator, designed to help you compute your total GST amount. It enables you to determine the net or gross price of your product based on percentage-based GST Rates.

What is GST?

GST is a type of indirect tax levied on the supply of goods and services. GST came into effect on July 1, 2017, after the bill was passed on March 29, 2017. It replaced most of the indirect taxes, including VAT, customs duty, Octroi, surcharges, and much more. A few products like alcoholic drinks, petroleum products, and more are not taxed under GST.

The current rate of GST in India is 18%. However, certain luxury items are taxed at 28%, whereas some goods and services have reduced rates of 0%, 5%, and 12%.

Every organization gets a unique GST Number after registering under the GST policy. There are different forms of GST collected by the government.

Integrated GST (IGST)

When any kind of sales transaction is made inter-states, Integrated GST is levied by Central Government.

Stage GST (SGST) and Central GST (CGST)

When any kind of sales transaction occurs within the same state, Central GST and State GST are levied. CGST is collected by the Central Government, whereas SGST is collected by the State Government.

GST Calculation Formula

The formula for GST calculation is quite easy.

Where GST is added to the base amount:

GST Amount = (Value of supply x GST%)/100

Net Price = Value of Supply + GST Amount

Where GST amount is included in the value of supply:

GST Amount = Value of supply – [Value of supply x {100/(100+GST%)}]

Net Price = Value of Supply — GST Amount

An example to illustrate how to calculate the GST amount:

- Let’s say the value of the supply of goods is INR 1000.

- The standard GST rate in India is 18%. To calculate the tax amount, multiply the value of supply by GST rate i.e., INR 1000 * 18% = INR 180

- So the total cost of goods round up to INR 1000 + INR 180 = INR 1180

Calculating GST using a GST Calculator

The core rule of calculating GST is the same all over India. Every online GST calculator has pretty much similar steps:

- You need to first enter the net price of a good or service and the rate of GST — 5%, 12%, 18%, and 28% — into the tool.

- Click on the ‘Calculate’ button.

- The screen will display the final or the gross price of goods and services.

Benefits of Using GST Tax Calculator

The two main benefits of using GST calculator online are:

- It helps saves time.

- It reduces the chances of human error while calculating the total cost of goods and services.