SBI Corporate Internet Banking (CINB) is aimed to provide a huge range of customized banking facilities to businesses, including corporate loans to keep their operations running smoothly. Relationship Managers (RMs) or Corporate Bankers are appointed to improve client relationships with the bank in the long run.

SBI Corporate Banking

With a huge network of whopping 15000 branches across India along with 5 associated banks in the remotest corners of India, State Bank of India is considered the largest bank in India. The SBI offers a vast range of banking services and products to its retail and corporate customers. It provides banking services to its customers round-the-clock with internet banking. As per the type of entities, businesses may use different features. This way, the bank has a separate service for corporate customers.

SBI Corporate Net Banking enables non-individual customers or corporate customers like trusts, companies, proprietorships, and partnerships to conduct online banking operations on the go. They can open various types of SBI corporate accounts, such as SBI Khata Plus, SBI Khata, SBI Vistaar, SBI Vyapaar, and SBI Saral.

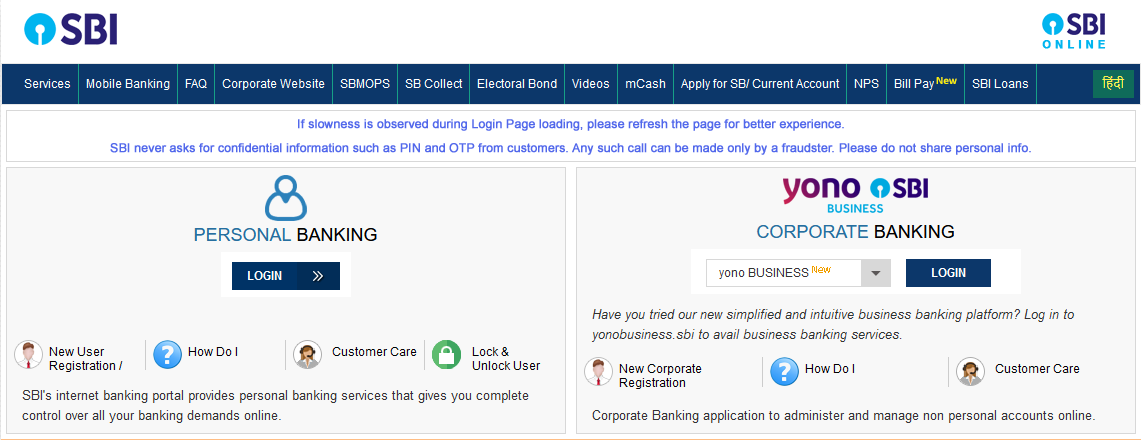

What is Online SBI?

Online SBI is the official internet banking portal provided by SBI in India. The portal offers online access to corporate and retail customers to their accounts in SBI on the go. The Online SBI platform has been developed with the latest tools and technologies. It has secure and unified access in its infrastructure. It means you don’t have to worry about security. It facilitates accounts in all of its branches pan-India.

With the help of SBI Corporate Login, you can use and manage corporate accounts anytime, anywhere. The corporate module consists of roles like admin, regulator, transaction maker, uploader, auditor, and authorizer. Here are the functions that can be performed with these roles –

SBI Online Corporate Banking – Key Facilities

- Define usage rights, manage users, and set transaction rules.

- Single sign-in to access accounts in multiple branches.

- Upload files to do bulk transactions to suppliers, third parties, tax collection agents, and sellers.

- Use features related to online transactions like funds transfer to self-accounts, issue drafts, and Send and Receive payments from both intra-bank and inter-bank parties.

- Online bill payments.

- Modify, authorize, cancel, and reschedule transactions on the basis of user’s rights.

- Request current balance/transaction info and create account statements using Online SBI.

Types of SBI Corporate Account

SBI Khata

It enables users to access their accounts round-the-clock. It has great advantages over other types of SBI Net Banking Corporate accounts. SBI Khata is available in all SBI branches across the country.

Here are the benefits of opening this account –

- Rights related to account enquiry

- View account details and download account statement

- Best for individual users

SBI Khata Plus

If you own a larger institution or firm with accounts in several SBI branches, you can open Khata Plus. With this product, several users in your organization can make inquiries. However, this account doesn’t allow online transactions.

Here are the benefits of Khata Plus –

- Access and download statement of several accounts in SBI branch

- Authorize users with the rights to get account information

- Rights related to account enquiry

SBI Saral

SBI Saral Corporate account is best suited for sole proprietors, individual businessmen, and MSMEs who need online transaction rights to their accounts. It is a single-user operational product which enables single users to transfer funds to self and third-party accounts. It has the transaction limit of Rs. 10 Lakh/day.

Key features of SBI Saral –

- User-friendly and operated by a single user

- Account rights

- View and download account statement

- Transactions can be scheduled for later

- Set separate tax payment limits and DD requests

- Set limits on recipient level

- OTP while doing fund transfers, adding beneficiaries, and conducting merchant transactions

SBI Vistaar

This SBI Online Corporate account is best suited for large-scale corporate businesses, institutions and government organizations. It provides complete freedom from relying on branches. It is a multi-user account with optional transaction rights and provides access to accounts operated in multiple branches.

It enables the Corporate Administrator to assign rights to different accounts and create multiple users. It has a max transaction limit of Rs. 2000 Cr. per transaction, and around Rs. 10,000 Cr. for Tax/Government transactions. There is also no limit on the number of daily transactions.

Here are the benefits of SBI Vistaar –

- Enables companies to operate in any location without geographical restrictions

- Freedom to take financial decisions urgently in any situation

- Flexibility to do business in your own framework

SBI Vyapaar

This multi-user account is offered to SMBs and companies having accounts with one SBI branch and looking forward to providing transactional/optional access rights to the users. In this SBI Online Corporate Banking account, the Administration can create other users with rights assigned for various accounts. The max transaction limit with this account is Rs. 50 Lakh per transaction. However, it is Rs 2 Cr. per transaction for Tax/Government transactions. It also has no daily limit for the number of transactions.

- Benefits of doing transactions all over the web and make online payments

- Best suited for businesses with multiple users

Key Features of SBI Corporate Banking

With State Bank of India Corporate Login, you can generate account statements on the basis of the date range for any account. The statement consists of all details like transactions, accumulated balance, opening and closing balance, and others. Here’s what you can get with SBI Login Corporate –

- Issue Banker’s Cheque/DD online. Collect the Banker’s Cheque/Demand Draft from the branch or give a mandate to the bank to send the same through courier to the beneficiary.

- SBI Net Banking Corporate Banking allows companies to use direct debit facilities. If you have an SBI Vistaar account, you can use this facility and supply goods to the dealers (with or without internet banking), while suppliers can debit the accounts of their dealers maintained at branches located in various locations.

- ERP systems come with integrated security for customers. Here are the facilities provided to transfer data from ERP to online SBI –

- Encrypted file upload – Customers can easily encrypt their data with their own encryption or use the same provided by SBI. It supports digital certificates.

- Automatic file uploads from ERP to SFTP Server owned by the bank – Enjoy smooth file transfer from your in-house ERP to the bank’s server with SFTP client. The bank installs a Secured File Transfer Protocol client to the gateway server of the company. This way, the company can schedule and manage pull and push frequencies for file transfer between the company and bank server.

- Open Corporate Demat account with SBI Net Corporate Banking. You can view your account info and generate these statements –

- Billing

- Transactions

- Ownership

SBI offers a huge range of funded/unfunded facilities, including cash to structured loans, to meet the diverse needs of all businesses, service providers, and industry segments.

In a nutshell, the SBI Online Banking Corporate portal is very safe and secure. It is certified by Verisign. It means all the transaction information passes through a 256-bit SSL encryption tunnel, which is the highest security level on the web till date.