Article Content

- What is Form 15G?

- How To Download Form 15G Online?

- What is The Structure of Form 15G?

- Who Can Submit Form 15G?

- How To Fill Form 15G Offline?

- How To Fill Form 15G Online?

- When To Submit Form 15G?

- What is The Penalty For Submitting a False Declaration Using Form 15G?

- What Happen If You Forgot To Submit Form 15G?

- Faq’s

What Is Form 15G?

Form 15G is a declaration form that needs to be filled by an individual or HUF below 60 years of age who generate income from the interest of fixed deposit account they hold in the bank. It is to ensure that no Tax Deduction at Source or TDS is deducted from the interest of the fixed deposit for the financial year.

Earlier, banks were supposed to deduct the tax at source on the interest income from the fixed deposit of individuals below 60 years of age. Now, the TDS limit on the interest income has been increased from 10,000 to 40,000 per financial year according to the Interim Budget 2019.

How To Download Form 15G Online?

An individual or HUF fill Form 15G to get a rebate on the TDS deduction on the interest income Fixed Deposits in the bank. One can either download form 15G online from their respective bank’s Official website or the website of the Income Tax Department or click below the button to download form 15G online.

If you want to download the form 15G online from your bank’s website then you need to log in to your online account. We just want to remind you that you can only download form 15G online or can submit form 15G online from the major banks of India.

What is The Structure of Form 15G?

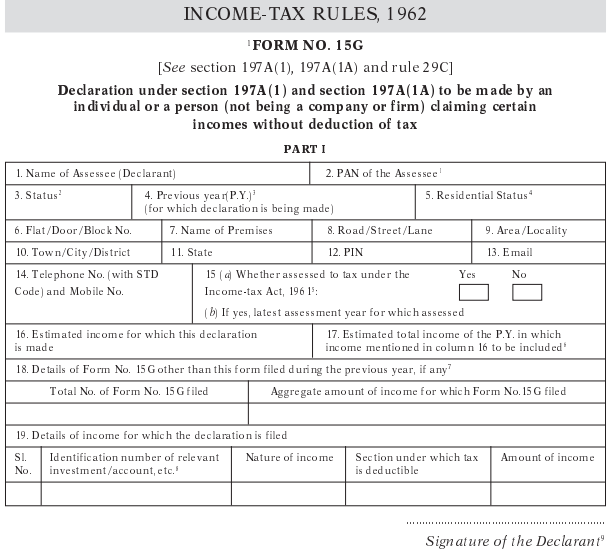

Form 15G falls under the Income Tax Act, 1962. It is a 3-page declaration form consisting of 2 parts. Before the form, 15G begin income tax department has given general guidelines regarding the section 197A (1) and 197A (1A) and the rule 29C under which form 15G falls and you can learn about when, why, and who can fill the form 15G.

Part-1

Part 1 includes all the general information such as Name of the assessee/ Declarant, Complete address, PAN, mobile number, email address, previous year of the declaration and a total number of the declarations filled, the aggregate amount of income for which form 15G filed and so on.

The assessee must need to enter all the information correctly and then sign at the bottom of this information. Then assessee has to make a declaration or verification under the general information and then sign their name and write the date and place of the form submission.

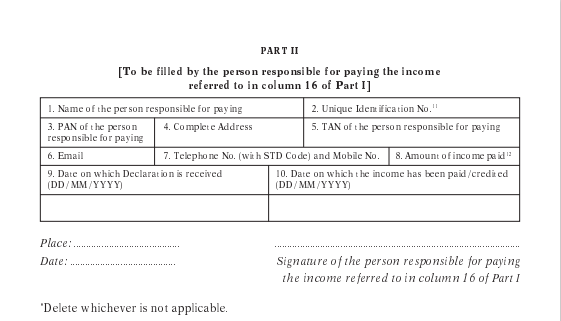

Part-2

Part 2 needs to be filled by the person who is responsible for paying the income in this case bank and then sign and enter the date and place.

Form 15G is quite easy to Download and fill but you must understand all the features of form 15G which are essential for filling and submitting the form correctly.

Who Can Submit Form 15G?

There are few conditions one need to meet to submit form 15G which are the following:

- An individual or a person can submit the form 15G only, not any company or firm

- An individual must be a resident of India

- The age of the Assessee should be lower than 60 years

- There shouldn’t be any kind of tax liability on the assessee for the specific financial year

- The total interest income of the assessee should be less than the basic exemption limit

How To Fill Form 15G Offline?

As we told you above form 15G income tax is consists of two parts. The first part is for the Declarant or Assessee to fill who are seeking the rebate on the deduction of tax at source and the second part is supposed to be filled by the person who is paying the income.

Let’s start with how an individual can fill the form 15G Income Tax:

Step 1 – Start with entering your Name as stated in your PAN card

Step 2 – Enter your correct UID or PAN Card number. If you enter the wrong details then your form 15G of income tax TDS rebate will be invalid.

Step 3 – Then you have to state whether the assessee is an individual or not. If you are not an individual then this form will be invalid.

Step 4 – Then comes the section of the previous year, you don’t have to write the previous year you claim the non-deduction of TDS. Enter the financial year for which you are seeking the rebate on the TDS now.

Step 5 – Now, enter your residential status if you are an NRI then you can’t submit form 15G

Step 6 – Please mention your permanent or current physical address correctly with the PIN code.

Step 7 –Mention your valid email ID and contact number for further communications

Step 8 –Tick on the “yes” box if you have been assessed by the income tax department under the provisions of Income Tax Act, 1961 in any previous assessment years.

Step 9 –Then state your latest assessment year for which your returns were assessed.

Step 10 –Mention the estimated annual income of the financial year for which you are seeking the non-deduction of TDS

Step 11 –Enter the total estimated annual income of the financial year (including any other source of income)

Step 12 –In case if you have filled form 15G previously then you have to enter all the previous details along with the aggregated annual income of the current declaration.

Step 13 –In the last section, you need to enter the account number of the investment such as fixed deposit, life insurance policy number, employee code, etc.

How To Fill Form 15G Online?

As you know already major banks of India provide the facility to fill form 15G online directly on the bank’s website and submit from 15G there only. If your investment account is in one of these banks such as SBI then you can also submit form 15G online here.

Instructions to fill form 15G online are :

Step 1– Log into your internet banking account with your User ID and Password

Step 2- Now, click on the fixed deposit tab and you will be redirected to the fixed deposit page where you can see all the information about your account.

Step 3- You can also see the option of filling the form 15G or 15H on the same page. Click on that option.

Step 4- Your form 15G will appear on your screen, enter all the information carefully as told your above

Step 5- You need to mention the branch details of your bank where you have opened the FD/RD. In case you don’t remember these details exactly then you can locate this information on the bank’s branch locator tool.

Step 6- Then fill out the rest of the investment details and submit form 15G online on the bank’s website.

When To Submit Form 15G?

There are only a few scenarios when forming 15G can be submitted to get the non-deduction of the TDS by an individual below 60 years of age.

These scenarios are as following:

- TDS On Interest Income Of Fixed Deposits

It is the most common type of interest income for which people submit form 15G online or to the income tax department. Banks are supposed to deduct the TDS regularly but at the end of the financial year, an individual can request for the non-deduction or rebate on interest income of fixed deposit by submitting the form 15G. Now, the TDS deduction limit is exceeded from Rs.10,000-Rs.40,000 so now many individuals can submit from 15G every financial year to get the TDS rebate.

-

TDS On Employees Provident Fund Withdrawal

Many times people withdraw PF amount before their service tenure of 5 years is completed in the current organizations then they have to pay the TDS on the withdrawn amount. However, one can fill from 15G EPF if their total annual tax liability is zero. In such cases, you are allowed to submit form 15G EPF for the non-deduction of TDS on early employee’s provident fund withdrawal.

-

TDS On Interest Receive From Post Office Deposits

Just like the major banks, you can also fill and submit form 15G to the post office itself to get the rebate on the TDS on the interest income from post office savings only if you are eligible to submit form 15G.

-

TDS On Income From Corporate Bonds And Debentures

If anyone generates the income from corporate bonds and debentures more than Rs.5000 annually then they are subjected to pay the TDS but if the individual is eligible to submit from 15G income tax then they can request the issuer for the non-deduction of the TDS.

-

TDS On Proceeds From Life Insurance Policy

According to the provision of section 194DA of the Income Tax Act, 1961 has set the limit on Rs.1 lakh to get a rebate on the TDS on proceeds from life insurance policy but if the maturity amount exceeds the limit but the individual meets all the declaration conditions then they are eligible to submit form 15G to their life insurance company for the non-deduction of the TDS.

-

TDS On Rental Income

The Government has set a limit on the deduction of the TDS on the income generated from the rent which is Rs. 8 lakh. If your annual rental income exceeds the set limit then you are liable to pay the TDS but if it below the limit then you can submit form 15G for getting exemption on the TDS.

What is The Penalty For Submitting False Declaration Using Form 15G?

Section 277 of the Income Tax Act, 1961 states that fine or imprisonment can be imposed on individuals who provide a false declaration in Form 15G just to avoid TDS. The following are the details of punishments u/s 277 of the IT Act, 1961.

If a false declaration is provided to evade tax above Rs. 1 lakh, the taxpayer may receive Imprisonment for a period of 6 months to 7 years, In all other cases, imprisonment is given for 3 months to 3 years.

Hence, you should be very careful before submitting form 15 G instead of making a false declaration. You should only fill form 15 G if you are eligible to do so.

What Happen If You Forgot To Submit Form 15G?

Here’s what you can do, in case you forget to submit Form 15G on time and TDS has already been deducted:

Option 1: Claim your TDS refund by filing the income tax return.

One & the only way to get an income tax refund is to file ITR, income tax refund. Once any bank or deductor deducts TDS, they must deposit the amount with the Income Tax department. After verification, the income tax department will process the request & return the deducted amount.

Option 2: Immediately submit Form 15G to avoid further deductions for the current financial year.

Normally, banks deduct the TDS at the end of each quarter when applicable interest is calculated on the fixed deposit. It is always better to submit Form 15G to avoid any excess deductions.

Faq’s

[sp_easyaccordion id=”8613″]