Article Content:

- Introduction to Atal Pension Yojana (APY Scheme)

- What are the Objectives of Atal Pension Yojana?

- How to Get an APY Form From Banks or Download it From Websites?

- How to Apply for the Atal Pension Yojana?

- What are the steps to fill Atal Pension Yojana Form?

- What is the Investment Plan for Atal Pension Yojana (APY)?

- Contributions to the Atal Pension Yojana (Atal Pension Scheme)

- How to Withdrawal Atal Pension Yojana?

- What are the Atal Pension Yojana Penalty Charges?

- What are the Eligibility Criteria for Atal Pension Yojana?

- What are the Features of Atal Pension Yojana?

- Complete FAQs’ On Atal Pension Yojana

- Latest News About Atal Pension Yojana

Introduction to Atal Pension Yojana (APY Scheme)

The Atal pension yojana (APY) scheme focuses on providing support to the unorganized sector of the country. This will help them in getting a steady income after retirement. This scheme was introduced by the Government of India in the 2015-16 budget to help the working poor cultivate the habit of saving for retirement.

These are some characteristics of the APY scheme:

- Tax benefits from the government

- Risk-free and legit

- The Indian Government co-contribution this scheme.

What are the Objectives of Atal Pension Yojana?

The Atal Pension Yojana’s major goal can be summarized as follows:

- Security and protection of citizens from illness, accidents, and diseases, among other things.

- This program is primarily focused on the country’s unorganized sector.

How to Get an APY Form From Banks or Download it From Websites?

- An atal pension yojana form can be got from a nearby branch office or a participant bank or you can download apy form online from the official website of your banks and take a printout.

- You can also download the form from the official website of “PFRDA“.Note: The forms are in various languages like English, Tamil, Odia, Marathi, Kannada. Atal pension yojana in Hindi is most widely used and This has to be filled and submitted at the bank and on approval, a confirmation message will be sent to the registered number.

How to Apply for the Atal Pension Yojana?

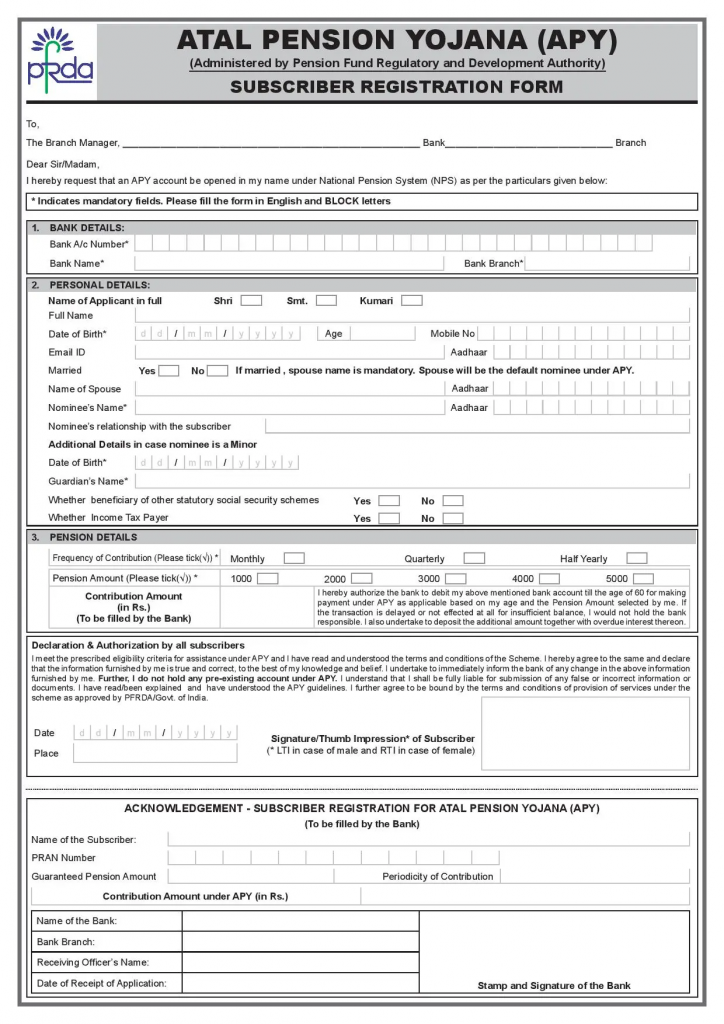

- To apply for APY, you need to collect the form from your nearest bank.

- The form must be addressed to the Bank manager, his/her/them name must be written on the form, along with the bank name and branch.

- The form has to be in BLOCK letters. Bank details of the person are to be filled in like the bank account number, bank name, and bank branch.

- The full name, date of birth, age, email address, phone number, and aadhar number are some of the personal details that have to be filled in the APY form.

- A nominee can also be appointed, in case of the death of the owner of the AYP scheme. The spouse will receive the money if the owner dies but if both of them are passed, then the nominee will get the amount.

- Once the approval is received through a confirmation message, you are a proud owner of an AYP account.

What are the steps to fill Atal Pension Yojana Form?

Once you have obtained the form for Atal Pension Yojana Scheme, you can easily fill it out following the below steps:

Step 1: Address the form to the Branch manager First, you have to address the form to the Branch Manager. You can call or visit the bank to know the name of the branch manager. Don’t forget to enter your bank name and branch.

Step 2: Fill in Bank details Remember to fill the form in BLOCK letters only. Enter all the mandatory fields like your bank account number, bank name, and bank branch.

Step 3: Fill the Personal details After filling in the bank details you need to fill in the personal details. Select your name prefix by selecting the appropriate box. Tick ‘Shri’, ‘Smt’ or ‘Kumari’ as per requirement. ‘Shri’ is for male applicants. ‘Smt’ is for married female applicants. ‘Kumari’ single/ unmarried female applicant. It is mandatory for married applicants to enter their spouse’s name. Then enter your full name, date of birth, age, mobile number, email address and Aadhaar number. You can then nominate any family member and state their relationship with you. A nominee receives the amount in case of your death. If the nominee is a minor, you need to provide their date of birth and guardian’s name.

Step 4: Add Pension details You can select the contribution you wish to do towards your pension, in the form as Rs.1,000, Rs.2,000, Rs.3,000, Rs.4,000, and Rs.5,000. Make sure you leave the box below titled; ‘Contribution Amount (Monthly)’ blank as the bank will fill that in after calculating the amount you have to pay every month to receive the pension. The calculation will be based on your entry age. For example, for a pension of Rs.2,000, if your entry age is 25 years, you will have to pay Rs.151 per month.

Step 5: Declaration and Authorisation You have to declare the form is filled by you & it is correct. You can either sign the form or put a thumb impression. By signing the document, you confirm that you meet the Atal Pension Yojana eligibility criteria. This also certifies that you have read and understood the terms and conditions of the scheme. You also declare that you do not have any account under NPS (National Pension System). Please cross check all the details before signing the form as you will be held liable for any false or incorrect information.

Step 6: To be filled in by the bank The last section of the Atal Pension Scheme form, titled ‘Acknowledgement – Subscriber Registration for Atal Pension Yojana (APY)’ is for bank purpose only. This section is to be filled by the bank. It is an acknowledgment from the bank that they will subscribe to the Atal Pension Yojana Scheme for you. After you submit the form, the bank agent will fill it out.

What is the Investment Plan for Atal Pension Yojana(APY)?

The government guarantees the amount that each individual has to receive, in their 60th year. According to the type of investment, you get a quantum of investment from it. Government securities get a quantum of 45% to 50%, while Term deposits of banks get 35% to 45%.

Contributions to the Atal Pension Yojana (Atal Pension Scheme)

The key elements that determine the monthly contribution to Atal Pension Yojana are the monthly pension that you intend to earn and your age when you start the scheme. To obtain a pension of Rs.1,000, Rs.2,000, Rs.3,000, Rs.4,000, or Rs.5,000, an individual must pay a monthly contribution of Rs.2,000, Rs.3,000, Rs.4,000, or Rs.5,000.

| Entry Age | Number of years of contributions | Monthly pension of Rs.1,000 and a return of corpus of Rs.1.70 lakh (Rs.) | Monthly pension of Rs.2,000 and a return of corpus of Rs.3.40 lakh (Rs.) | Monthly pension of Rs.3,000 and a return of age corpus of Rs.5.10 lakh (Rs.) | Monthly pension of Rs.4,000 and a return of corpus of Rs.6.80 lakh (Rs.) | Monthly pension of Rs.5,000 and a return of corpus of Rs.8.50 lakh (Rs.) |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1,087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1,196 |

| 39 | 21 | 264 | 528 | 792 | 1,054 | 1,318 |

How to Withdrawal Atal Pension Yojana?

- The major rule of the APY scheme is that you cannot exit from the scheme until you complete 60 years of age.

- Above mentioned can be modified as per any consideration made by the government.

- When you reach 60 years, you can leave the scheme with the complete pension amount.

- Exit is permitted in advance only in exceptional circumstances like the death of the applicant where the ownership is transferred to the spouse. If both are dead, the ownership is passed onto the nominee.

Download Atal Pension Yojana Withdrawal Form

What are the Atal Pension Yojana Penalty Charges?

If payments are delayed, then a penalty will be levied, monthly.

- The penalty of Re.1 will be levied on payments of Rs.100 per month

- The penalty of Rs.2 will be levied on payments of Rs.101 to Rs.500 per month

Depending on the amount, the penalty amount will increase.

In case of payments are terminated,

- In case of no payment for 6 months, the account will be frozen.

- In case of no payments for a year, the account will be deactivated.

What are the Eligibility Criteria for Atal Pension Yojana?

This scheme is handled by the pension fund regulatory and development authority (PFRDA) and there are certain requirements that have to be met before being approved for the Atal pension yojana scheme.

Here are the apy scheme details which is mandatory by the government of India:

- Deposits from INR 1000 to INR 5000

- Must be between 18 years- 40 years for applying

- Contribution is for a minimum of 20 years

- The exit age from the scheme is 60 years.

- Should have an active mobile number

- Must have an active bank account linked to the aadhar number.

- Has to submit, “Know your customer” details form, provided by the bank.

Note: Atal pension yojana online apply can be done by any citizen of India if they meet the above criteria.

Click to Apply for APY Scheme Online

What are the Features of Atal Pension Yojana?

- The Government guarantees the minimum pension of each individual after retirement.

- According to Section 80CCD, AYP Scheme will help you to avail tax benefits.

- Bank account holders are all eligible for this scheme.

- Pension from this scheme will be allowed at 60. You cannot exit from the scheme before that except in unprecedented circumstances.

- People who work in the private sector and have no pension benefits can also apply and benefit from this scheme.

The atal pension yojana chart is available on the official website of PFRDA and it shows the amount which every individual is supposed to save, every month in order to get the minimum pension, which is based on the starting age.

Complete FAQ’s On Atal Pension Yojana

[sp_easyaccordion id=”10661″]

Latest News About Atal Pension Yojana

APY surpass 3 crore subscribers in FY21.

11 May 2021

During the fiscal year 2020-21, approximately 79 lakh people enrolled in the Atal Pension Yojana (APY), according to the Pension Fund Regulatory and Development Authority (PFRDA).

State Bank of India was able to source 22.07 lakh users out of a total of 79.14 lakh who opted for the APY plan in FY 2020-21. During the same period, Canara Bank and Indian Bank sourced 5.89 lakh and 5.17 lakh subscribers, respectively, while Airtel Payment Bank, Bank of Baroda, Central Bank of India, Bank of India, Union Bank of India, Punjab National Bank, Indian Overseas Bank, HDFC Bank, Axis Bank, Baroda UP Bank, and Aryavart Bank added new APY accounts ranging from 1 to 5 lakh for FY 2020-21.

The government list out a plan to increase enrolment in the Atal Pension Yojana

24 Mar 2021

The Central govt. has taken several initiatives to expand the number of people enrolled in the Atal Pension Yojana (APY). Union Minister of State for Finance and Corporate Affairs Anurag Singh Thakur announced some of the steps the government is doing to promote APY enrollment.

The pensioner can now choose between monthly, quarterly, or half-yearly contributions.

Subscribers can now choose to upgrade or downgrade their Pension amount at any time during the financial year. This facility, on the other hand, can only be used once every fiscal year.

The APY accounts can be accessed with an official mobile application. Other services are also available through the app.

Subscribers to APY can now join without using the net banking function by using an alternative paperless option.

In the event of a complaint, APY subscribers will now have access to a Grievance Module.

Within nine months, SBI enrolled 15 lakh, new customers

07 Jan 2021

According to a report by PTI, more than 15 lakh new subscribers have joined the Atal Pension Yojana (APY) through the State Bank of India (SBI) for the fiscal year 2020-21.

According to the Pension Fund Regulatory and Development Authority (PFRDA), over 52 lakh new subscribers will be enrolled in this pension program by the end of 2020. The total number of students enrolled has already surpassed 2.75 crores.

Despite the financial impact of the coronavirus pandemic, APY, a government-sponsored pension system, has witnessed a significant increase in enrollments. SBI offers both online and offline registration options for the Atal Pension Yojana.,