Article Content:

- What Is Form 26AS

- Different Parts of Form 26 AS?

- Major Changes In Form 26AS

- Mandatory Personal Information To Be Provided By Every Taxpayer For The Right Assessment

- Information Regarding Tax Paid and Income Generated During The Year

- Banks Registered With NSDL For Providing Tax Credit Statement View

- Why Form 26AS is Important

- Steps To Download Form 26AS?

- Structure of Income Tax Form 26AS

- FAQ’s

What is Form 26AS?

Form 26AS is one of the important forms while filing for your Income-tax return at the end of every accounting year by every taxpayer. This form is a statement against the tax that has been collected on your behalf through your employer, bank, tenant. It also includes all the information regarding any advance tax such as withholding tax or self-assessment tax you have paid throughout the year. Form 26AS is a solidified statement and declaration of income for the particular accounting year by a taxpayer under section 203AA of the Income Tax Act,1961. This form contains detailed information on the income generated from multiple jobs against your PAN (Permanent Account Number). If the records don’t match the Income-tax department records of the particular accounting year. You can be held against that so always make sure to check the Form 26 AS before submitting. Apart from your Income declaration, you also need to fill out the detailed information of all taxes you have paid during the year such as TCS ( Tax Collected at Source). Except if you are a salaried employee then you can only fill up the Form16 provided by your employer or download it yourself from the income tax department’s official website.

In simple terms, you can say Form 26AS is a detailed assessment of the income generated by a taxpayer and tax paid by himself, the bank, or other deductees at the source. If the Income Tax department finds any discrepancy then you can be charged with a penalty. Punishment can vary for different individuals as per the offense. These mistakes also happen due to some errors such as the wrong accounting year, PAN number, or mentioning wrong income by the employer.

Different Parts of Form 26 AS

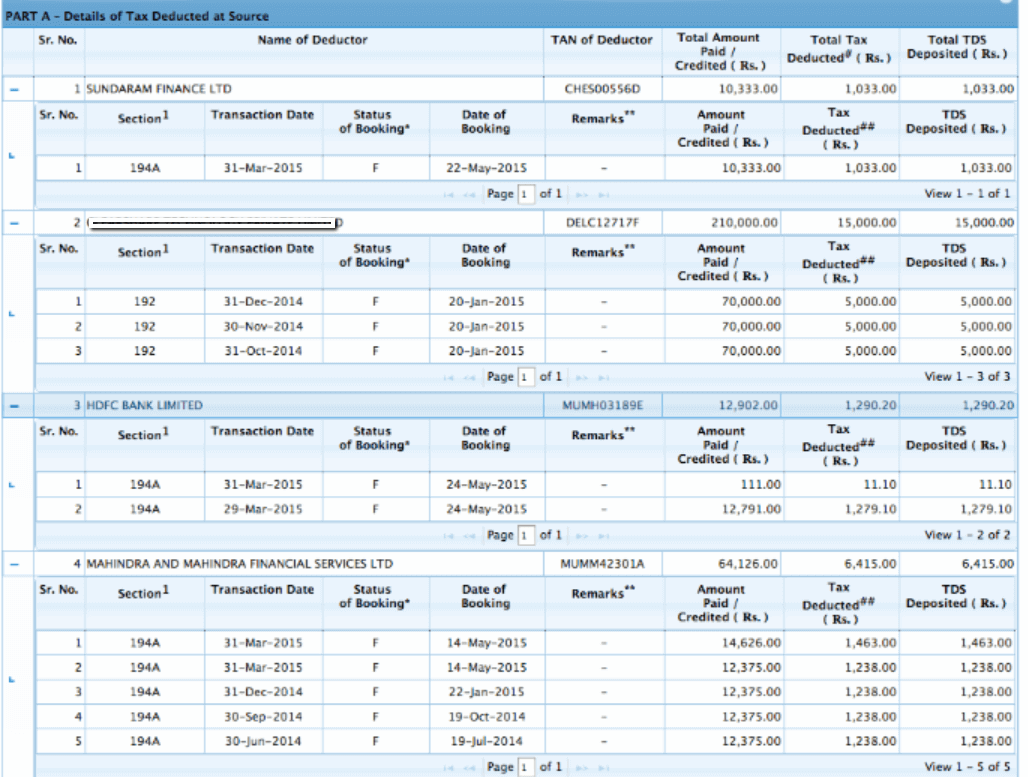

- Part A: Details of Tax Deducted at Source

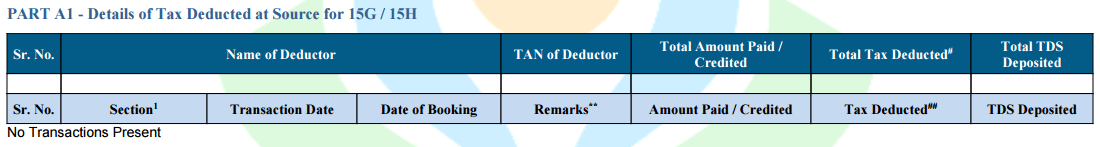

- Part A1: Details of TDS for Form 15G/Form 15H

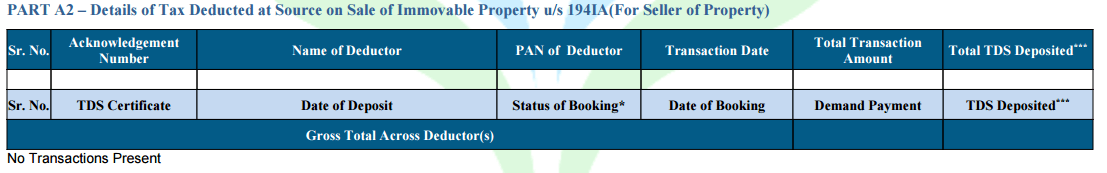

- Part A2: Details of TDS on sale of Property u/s194(IA)

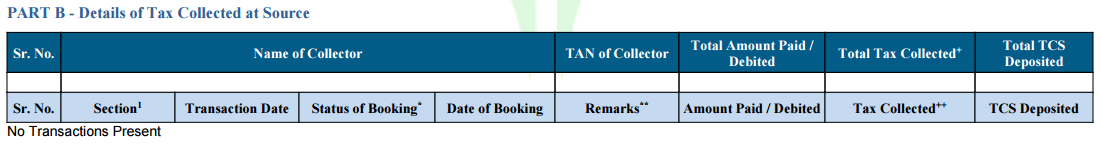

- Part B: Details of Tax Collected at Source

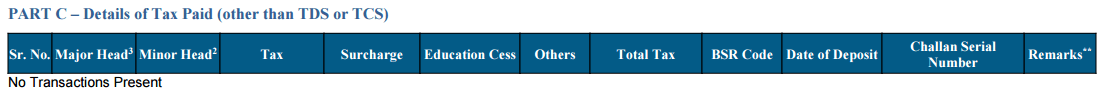

- Part C: Details of other Tax Paid than TDS or TCS

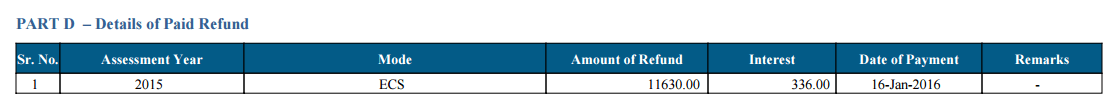

- Part D: Details of Paid Refund

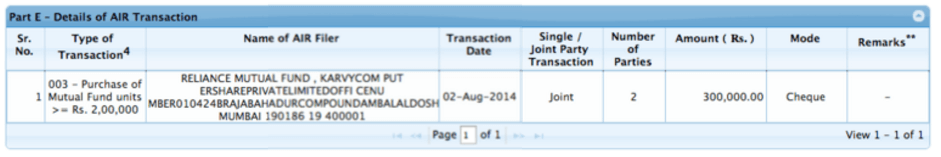

- Part E: Details of AIR Transaction

- Part F: Details of Tax Deducted on sale of immovable property u/s194IA (For Buyer of property)

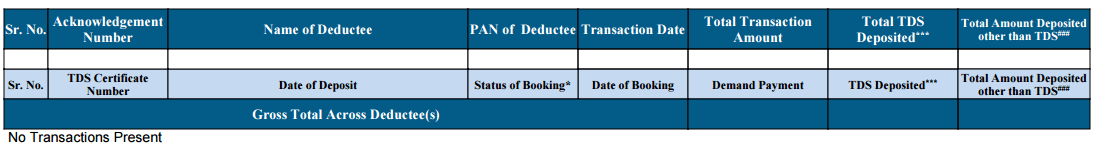

- Part G: TDS Defaults* (processing of defaults)

Part A: Details of Tax Deducted at Source:

Part A of Form 26AS- Details of Tax Deducted at Source contains details of TDS deducted on all income sources such as salary, interest income, pension income and winning prize, etc. The amount of TDS deducted and deposited is also mentioned. It also carries the details of the TAN of the deductor. The information in Part A is provided on a quarterly basis.

Part A1: For Form 15G/ Form 15H the details of Tax Deducted at Source

Since the taxpayer submitted Form 15G or Form 15H, it contains the details of income where no TDS has been deducted. The taxpayer can check the status of TDS deducted if he/she has submitted Form 15G or Form 15H. If Form 15G or Form 15H is not submitted by the taxpayer, ‘No transactions present’ will be displayed on this section.

Part A2: Details of Tax Deducted at Source on Sale of Immovable Property u/s194(IA) (For the seller of Property)

This section is relevant for you if you have sold the property during the year. You will get the details of the TDS deducted from your receipts in entries here.

Part B: Details of Tax Collected at Source

The details of the tax collected at source (TCS) by the vendor are listed in this section. Here are the entries if you are a vendor & collected the taxes.

Part C: Details of Tax Paid (Other than TDS or TCS)

In case you have deposited taxes other than TDS or TCS then the details will be listed here. Details of advance tax, self-assessment tax, etc. are shown here. The details of the challan will also appear here through which you have deposited the tax.

Part D: Details of Paid Refund

Details of your refund will be displayed in this section. The details of the assessment year, mode of payment, amount paid, interest paid, the payment date is mentioned.

Part E: Details of AIR Transaction

It is mandatory for the Banks and other financial institutions to report high-value transactions to the tax authorities. Here you will get the details of Mutual fund purchases of high value, property purchases, high-value corporate bonds, etc.

Part F: Details of Tax Deducted on Sale of Immovable Property u/s 194IA (For Buyer of Property)

This section will have the details of the tax deducted & deposited on the sale of a property. When you buy a property you deduct the tax from the seller & deposit it with the government.

Part G: TDS Defaults*(Processing of Defaults)

The details of the Defaults of the processing of statements are listed over here. They do not include demands raised by the assessing officer.

Major Changes in Form 26AS

You can now easily divide the form 26AS into two sections. Unlike earlier instead of filling out the details about tax deduction at various points during the financial year, now you need to make an Annual Information Statement on the form. As you are aware, previously you only used to fill in the information regarding the various taxes deducted throughout the year such as TDS, TCS, and other advance taxes against your PAN Card. Now you also need to fill in the personal information before proceeding.

The First Section Consists of Mandatory Personal Information To Be Provided By Every Taxpayer for The Right Assessment are as Following:

- Permanent Account Number (PAN)

- Name

- Date of Birth for individuals and incorporation for the establishments

- Mobile Number

- Email Address

- Permanent Address

It is important to notice here that the income tax department is emphasizing too much on the email address and mobile number of a taxpayer to keep everything in a systematic and organized way as the whole assessment process will be done electronically.

Now The Next Section Consists of The Information Regarding Tax Paid and Income Generated During The Year.

- All the information regarding TDS and TCS throughout the year at multiple jobs.

- Detailed information on financial transactions during the year that exceeds the pre-determined limit such as saving up to 10 lakh or investing in a mutual fund worth more than 2 lakh.

- Detailed information regarding the payment of taxes.

- Information regarding demand and refund against the PAN.

- Any kind of pending proceedings must be mentioned in detail.

- Information regarding the proceedings completed

- Any other information in regards to sub-rule(2) of Rule 114-I.

Banks Registered With NSDL For Providing Tax Credit Statement View

You can download form 26as directly through net banking if your bank account mapped with your PAN. It is free of cost Facility.

Below is the list of the banks which is registered with NSDL for providing a view of (Tax Credit Statement)

| Axis Bank Limited | (BOI) Bank of India | (BOM) Bank of Maharashtra |

| Bank Of Baroda | Citi Bank N.A | Corporation Bank |

| City Union Bank Limited | ICICI Bank Limited | IDBI Bank Limited |

| Indian Overseas Bank | Indian Bank | Kotak Mahindra Bank Limited |

| Karnataka Bank | Oriental Bank Of Commerce | (SBI) State Bank Of India |

| State Bank Of Mysore | State Bank Of Travancore | State Bank Of Patiala |

| UCO Bank | Union Bank Of India | The Federal Bank Limited |

Why 26AS is Important?

Before filing for your ITR, you need to fill the Form 26AS which can provide you a whole overview of your income, savings, and expenses. You can easily verify all the differences between the tax deducted at source (TDS), Tax collected at source(TCS), or any other advance of self-assessed taxes. You also need to mention in detail your income and the multiple sources. For example, your yearly income is 5 lakh but your expense record for the year is 7 lakh through your credit card. In such cases you are liable to pay more taxes and strict action will be taken against you as not disclosing the proper income is a punishable offense.

In India, the Central Board of direct taxes manages all the tax-related issues. When you fill the Form 26AS it helps you to minimize the error for certain financial transactions. Form 26AS also helps you to verify the details of Form 16/ Form 16A. You can easily verify your TDS details deducted by your employer or bank.

The Form 26AS will not just help to minimize the error but also help to reveal the effect of any specific financial transaction while filing for return such as huge profits from shares or cash transactions. Form 26AS is the best way of verifying the income and savings details that you might have forgotten. It helps you to provide a clear view of your financial statement.

Steps To Download Form 26AS

Overview

To get to your Form 26 AS, you have to visit the Income Tax website incometaxindiafiling.gov.in and click on “View Form 26AS”. You have to give your login credentials to get to the form. You can download the particular form by choosing the accounting year from the “My Account or Quick Links” option.

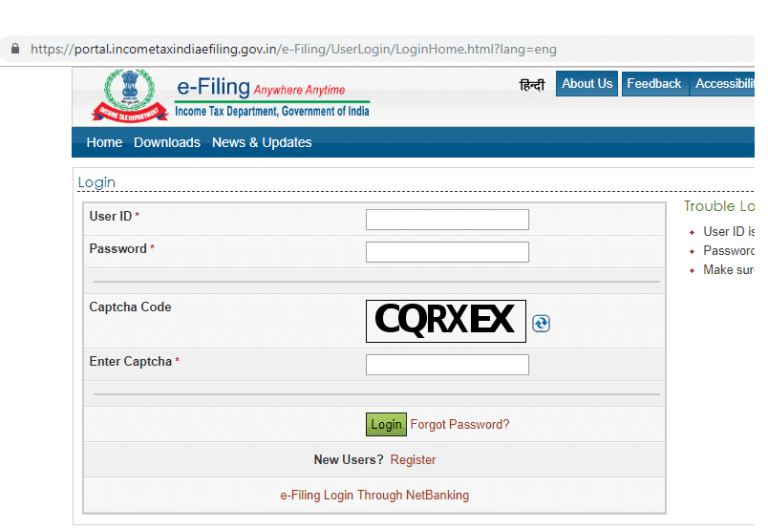

Step 1: Visit the official government e-filing website at incometaxindiaefiling.gov.in . Now log in using your income tax portal Login ID & password. If you have not registered yet, then the first register at the portal by clicking on the ‘Register Now’ button at the top.

Step 2: Enter your PAN card number as required, then enter the password & captcha carefully in DD/MM/YYYY format. Then click on ‘Login’ button to proceed. It will redirect you to PAN e-filing website.

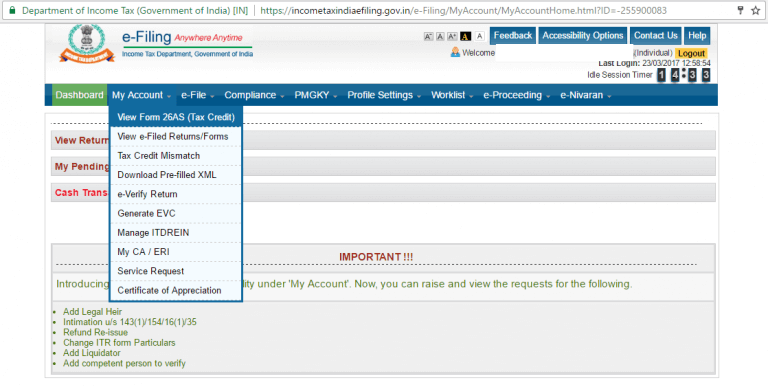

Step 3: From the following screen, click on ‘My Account’. In the next drop-down, ‘View Form 26AS’. You can view the Form 26AS.

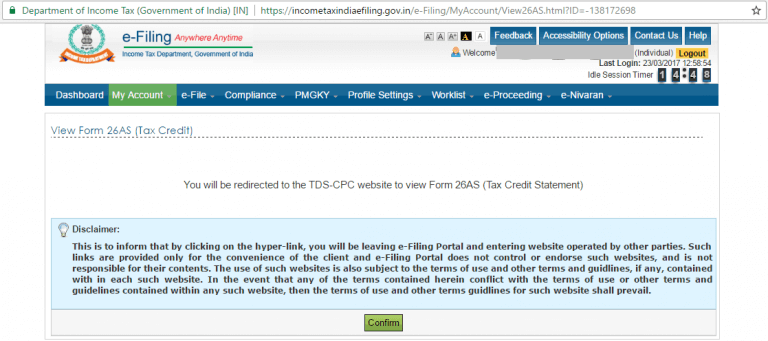

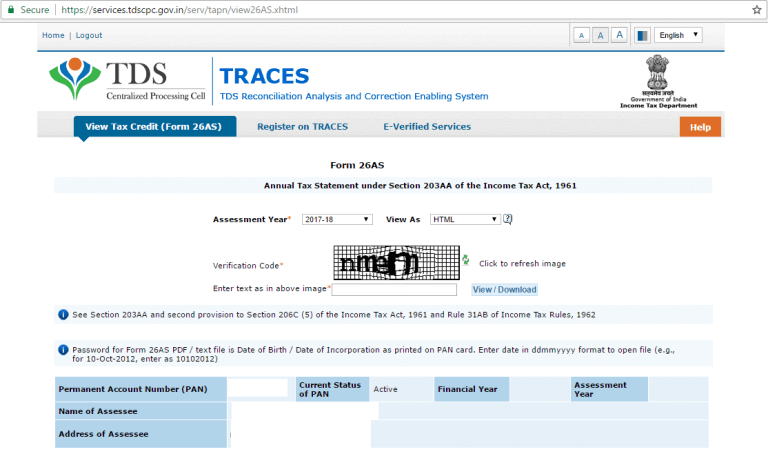

Step 4: Click on ‘Confirm’ to submit & you will be redirected to the TRACES website. This government website is completely safe so you don’t need to worry about it.

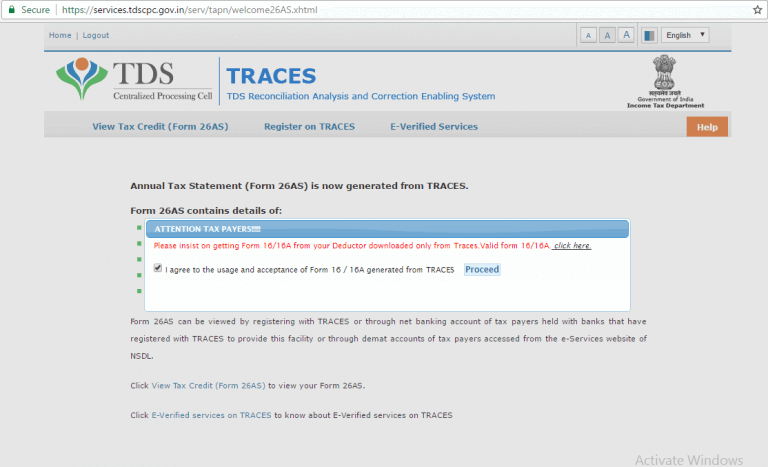

Step 5: You will be redirected to the TRACES (TDS-CPC) website. After selecting the box on the screen click on ‘Proceed’ to confirm your submission.

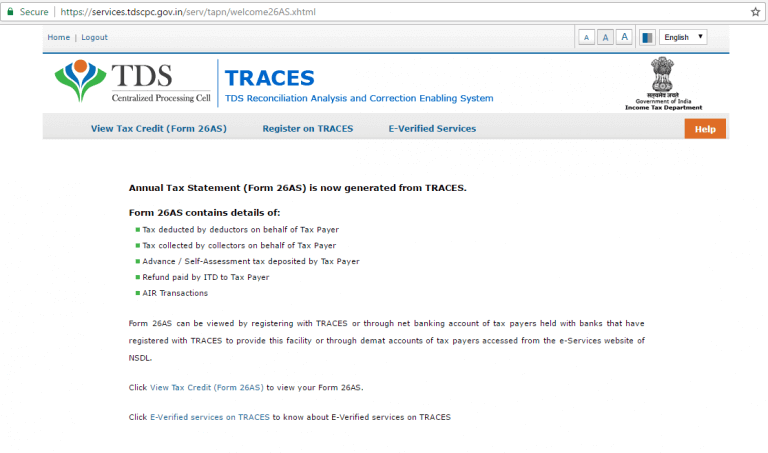

Step 6: You will see a link at the bottom of the page stated as-‘Click View Tax Credit (Form 26AS) to view your Form 26AS’. Click on the said link to view Form 26AS.

Step 7: Now choose the Assessment Year and the format to view the Form 26AS. To view online select ‘HTML’. If you wish to download the form you can select download as PDF. After this, you need to enter the ‘Verification Code’ & click on view/ download.

Step 8: It will be downloaded automatically. You can simply view the Form 26AS with a PDF reader.

Structure of Income Tax Form 26AS

Now, apart from verifying TDS and TCS, there is some specific financial statement that taxpayers must keep in mind while filling the Form 26AS as per the section 285BA under rule 114 E of the Income Tax Act,1961. A person is obligated to mention these financial transactions in the form if they exceed the pre-defined limit. Let us find out what they are:

- Any payment made in cash of equal or more than 10 lakh to purchase banker’s cheque, bank draft, or pay orders for the pre-paid instruments issued by the reserve bank of India must be mentioned on the form.

- Cash deposited or cash withdrawals for the amount of Rs. 50,000 or more for the financial year from the current account need to be mentioned under section 18 of the payment and settlement systems act,2007.

- Cash deposited of more than 10 lakh or equal in a financial year of one or more accounts of an individual.

- Payments made in regards to the credit card of more than 1 lakh in cash or 10 lakh through different modes against the generated bill in a financial year.

- Must mention the time deposit/deposits made by an individual of more than 10 lakh in a financial year.

- Receipt of any acquired bonds, debentures issued by the company worth more than Rs.10 lakh for the financial year.

- A taxpayer must mention the buyback of shares except for the open market purchase of equal or more than Rs.10 lakh.

- Receipt of purchasing mutual funds of equal or more than Rs.10 Lakh for the financial year.

- Receipt from the sale of foreign currency with the value equal or more than Rs.10 lakh.

- Sale or Purchase of any immovable asset or property worth Rs. 30 lakh or more according to the Stamp Valuation authority under section 50C of the Income-tax act.

- Receipt from the cash payment worth Rs.2 lakh on goods and services for the financial year.

FAQ’s

[sp_easyaccordion id=”5297″]