GST Amendments Due To Covid19

The spread of Novel Corona Virus (COVID-19) across many countries of the world, including India, has resulted in huge loss to the lives of the people. In view of emerging situation and challenges which are faced by the taxpayers, the government has eased the burden of GST Compliance on the taxpayer.

In order to meet the compliance requirements under various provisions of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the “CGST Act”), the government has announced various relief measures to the taxpayers in various GST compliances.

Compliance Date of GSTR 1

- Returns Covered:

- Monthly Returns: For the months of March 2020, April 2020 & May 2020 (February-2020 Monthly return not covered for waiver of late filing fees)

- Quarterly Returns: For the quarter ending 31st March 2020 only.

- The Relief will be available only if filed on or before the compliance date.

- Most important thing is that the due date of filling of Form GSTR-1 is not extended. Only the late filing fees for covered period is waived off.

- This waiver of late filing fees for the covered period is available only if you file Form GSTR-1 for covered period by 30th June 2020.

- What if GSTR-1 returns are filed after 30th June 2020: If Form GSTR-1 for covered period is not filled by 30th June 2020 then late fees shall be levied from the original prescribed due date till the date of actual filing of Return.

| Tax Period | Original Prescribed Due Date | Compliance

Date |

| March 2020 | 11th April 2020 | 30th June 2020 |

| April 2020 | 11th May 2020 | 30th June 2020 |

| May 2020 | 11th June 2020 | 30th June 2020 |

| Jan-March 2020 | 30th April 2020 | 30th June 2020 |

Compliance Date of GSTR 3B

- Basically the due dates for filling of GSTR-3B for the month of February 2020 to April 2020 is NOT extended & only Late filing fees is waived off.

- This waiver of late filing fees for delay in filing of return is available with a condition that taxpayer file his Form GSTR-3B by revised dates notified for each of this month.

- For the purpose of the revised due date of filing of Form GSTR-3B taxpayers are divided in three categories i.e.

-

- Category I: Taxpayer having gross aggregate turnover exceeding Rs.5.00 Cr. in preceding financial year

- Category-II: Taxpayer having turnover during preceding financial year is exceeding Rs.1.50 Cr. but up to Rs.5.00 Cr.

- Category-III: Taxpayer having turnover during the preceding financial year is not exceeding Rs.1.50 Crore.

- Thus, in case if the taxpayer does not file his Form GSTR-3B within this revised due date then late filing fees is payable from the date of originally prescribed due date.

- As per the notification No. 31/2020- Central Tax, dated April 3, 2020, for those registered persons/Taxpayers having aggregate turnover more than 5 Crore; a lower rate of interest of 9% and no late fees, if return is filled by 24 June 2020.

- And for those registered persons having turnover up to Rs. 5 Crore, NIL rate of interest has also been notified.

- The various revised due dates for FORM GSTR-3B from the month of Februay-2020 to April-2020 are explained as below:

| Category | Interest | Late Fees | Tax Period | GSTR – 3B

Compliance Date (Condition) |

| Aggregate

Turnover > 5 Crores |

9% p.a.

after 15 days delay from original due date. |

Nil | February 2020, March 2020, April 2020. | On or before 24th June 2020 |

| 1.5 Crores

< Aggregate Turnover > 5 Crores |

Nil | Nil | February 2020, March 2020. | On or before 29th June 2020 |

| Nil | April20 | On or before 30th June 2020 | ||

| Aggregate

Turnover < 1.5 Crores |

Nil | Nil | February 2020 | On or before 30th June 2020 |

| Nil | March 2020 | On or before 3rd July 2020 | ||

| Nil | April 2020 | On or before 6th July 2020 |

Interest Relief – Exact date

-

- The ‘Aggregate Turnover’ should be of previous financial year. As a result, the criteria might change between two financial years.

- No extension of due dates. Relief for Interest and late fees are given provided filing is done by compliance date.

-

- Even if delay of one day from compliance date, no relief will be available. Interest & late fees applicable from original prescribed due date.

For Aggregate Turnover exceeding 5 Crore:

| Month | Regular Due Date | Relief Provided Till |

| February 2020 | 20th March 2020 | 4th April 2020 |

| March 2020 | 20th April 2020 | 5th May 2020 |

| April 2020 | 20th May 2020 | 4th June 2020 |

Calculation of Interest – At above 5 Crores

| Due date for March

2020 |

Actual Date of filing | No: of days delay | Whether condition fulfilled | Interest |

| 20.04.2020 | 02.05.2020 | 11 | Yes | No Interest |

| 20.04.2020 | 20.05.2020 | 30 | Yes | No Interest for 15 days

+ 9% for 15 days |

| 20.04.2020 | 24.06.2020 | 65 | Yes | No Interest for 15 days

+ 9% for 50 days |

| 20.04.2020 | 30.06.2020 | 71 | NO | No BENEFIT

Interest @ 18% for 71 days |

Due date for GSTR 3B for the month of May 2020

| Category | Original Due Date | Revised Due Date |

| Aggregate Turnover> 5 Crores | 20th June 2020 | 27th June 2020 |

| Aggregate Turnover< 5 Crores | 22nd June 2020 | 12th July 2020 |

| 24th June 2020 | 14th July 2020 |

Composition Taxpayers

- Return Covered:

CMP-08 Ending March-2020 Quarter

GSTR-4 for the Financial Year ending 31/03/2020

- The due dates have been extended for various returns and intimations in respect of Composition Taxpayers by CGST Notification No. 30 & 34/2020 dated 03.04.2020.

- The same is summarized as under:

| Form | Description / Period | Actual Prescribed Due Date | Extended Due date |

| CMP 02 | Last date to opt Composition Scheme / FY 20 – 21 | 31st March 2020 | 30th June 2020 |

| ITC 03 | Reversal of ITC | 31st May 2020 | 31st July 2020 |

| CMP 08 | Jan – March 2020 / Statement for Payment of Tax | 18th April 2020 | 7th July 2020 |

| GSTR 4 | Annual Return | 30th April 2020 | 15th July 2020 |

Validity of E-Way Bill

- As per notification No. 35/2020- Central Tax, dated April 3, 2020, issued under the provisions of 168A of the CGST Act, where the validity of an e-way bill generated under rule 138 of the CGST Rules expires during 20 March 2020 to 15 April 2020, then the validity period of such e-way bill has been extended till 30 April 2020.

39th GST Council Meeting: IT Roadmap, GST Rates and Law & Procedures

- The 39th GST Council Meeting was held on March 14, 2020 (Saturday) under the chairmanship of union finance and corporate affairs minister Smt Nirmala Sitharaman.

- This Council meeting was also attended by union minister of state for finance and corporate affairs Shri Anurag Thakur, senior officers of Ministry of Finance and finance ministers of various states and UTs.

- The GST Council in its 39th GST Council Meeting provided some recommendations mainly in respect of:

- Recommendations on IT Roadmap: The current IT issues faced by the taxpayers in the GST system and road ahead with regards to resolving such issues.

- Changes related to GST Rates: GST rate changes on supply of goods and services.

- Certain Amendments/Changes in GST Law and procedures.

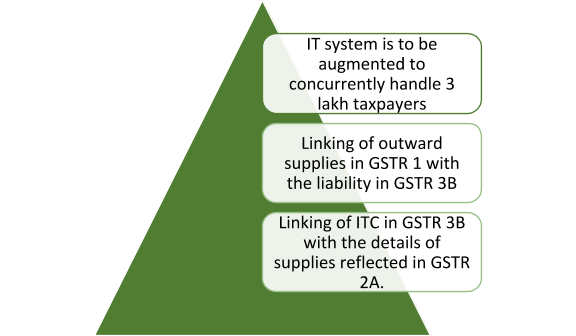

a) Recommendations on IT Roadmap

- A presentation was made by Shri Nandan Nilekani (IT implementation partner) in this GST Council meeting on behalf of Infosys addressing the issues related to the system that are being faced by the taxpayers in the GST system and how to bring in changes in the GSTN working System.

- For smooth functioning of the whole process and to ensure a better uptake of the new return, the transition to the new return system may be made in a cumulative manner.

- He also informed the Council that to augment the capacity of the IT system to concurrently handle 3 lakh taxpayers from the present level of 1.5 lakh taxpayers, hardware procurement process has been introduced which is slightly impacted by the Covid-19 pandemic.

b) Changes Related to GST Rates

- The GST on mobile phones and specified parts has been increased from 12% to 18%. This decision has been taken in order to avoid the difficulties due to the inverted duty structure.

- Till now, the handmade ones were taxed at 5% and the rest was taxed at 18% but now all types of matches have been rationalised to a single GST rate of 12%.

- The GST on Maintenance, Repair and Overhaul (MRO) service in respect to aircraft has been decreased from 18% to 5% with full ITC.

- The GST Council has made some suggestions in respect of GST rate changes with regards to goods and services which are mentioned below:

| PARTICULARS | OLD RATES | NEW RATES | REMARKS |

| Mobile phones and specified parts | 12% | 18% | NA |

| Handmade matches | 5% | 12% | Rates made uniform to remove ambiguity in classification. |

| Other matches | 18% | 12% | |

| Maintenance, repair and overhaul services (MRO) on aircraft | 18% | 5% |

|

- All the above recommended GST rate changes will come into effect from 1st April 2020.

Certain Amendments/Changes in GST Law and procedures

- GST Annual Return and GST Audit (GSTR 9 & 9C)

- The GSTR-9 & 9C deadline is extended to 30 June 2020 for the financial year 2018-19 (earlier date for filing the said returns was 31.03.2020).

- The turnover limit will be increased from Rs 2 crore to Rs 5 crore for mandatory annual return filing. So, the filing GSTR-9C is optional for the taxpayers having the turnover less than Rs 5 crore.

- The taxpayers with an aggregate annual turnover of less than Rs 2 crore for the financial year 2017-18 and 2018-19 will not pay any late fee for delayed filing of GSTR-9.

GST Audit Relaxation

- GST New Returns

- In the 31st GST Council Meet, it was decided that a New Return System under GST would be introduced for taxpayers.

- This return system will contain simplified return forms, for ease of filing across taxpayers registered under GST and was due for implementation from 1st April 2020

- However the same has now been extended and shall be implemented from 1st October 2020.

- Thus, the existing system of furnishing FORM GSTR-1 & FORM GSTR-3B will be continued till September 2020.

- GST E-invoicing and Dynamic QR code

- ‘E-invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal.

- All invoice information will be transferred from this portal to both the GST portal and e-way bill portal on a real-time basis.

- E-invoicing and QR Code system were to be implemented from 1st April 2020.

- However, the same has been extended to 1st October 2020.

- Due Date Notified: GSTR 1 and GSTR 3B (Period Apr’2020 to Sep’2020)

GSTR 1:

- Such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, for each of the months from April 2020 to September 2020 till the 11th day of the month succeeding such month.

- Registered persons having aggregate turnover of up to 1.5 crore rupees in the preceding financial year or the current financial year for the first two quarter of the financial year 2020 – 2021 shall be 31st of the month subsequent to the quarter.

GSTR 3B:

- The Due date for filing of GSTR – 3B from April 2020 to September 2020 is as follows:

| Aggregate Turnover | States | Due date |

| Upto Rs. 5 Crores | Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry,

Andaman and Nicobar Islands or Lakshadweep, |

22nd of the next month |

| Upto Rs. 5 Crores | Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh,

Chandigarh or Delhi, |

24th of the next month |

| Above Rs. 5 Crores | Taxpayers registered in all the states | 20th of the next month |

The Council also suggested that certain amendments would be made in the GST law & procedures.