- What Is Income Tax?

- What is Income Tax Refund Status?

- What are The Eligibility Criteria for Income Tax Refund?

- What is The Due Date To Claim Income Tax Refund?

- How To Claim Income Tax Refund?

- How To Check Income Tax Refund Status?

- Steps To Check Income Tax Refund Status Through E-Filing Portal

- Steps To Check Income Tax Refund Status Through NSDL Portal

- How Will You Receive Your ITR Refund?

- Meaning of Income Tax Return Status

- How to Claim Refund Re-issue Request?

- Summary

- Faq’s on Income Tax Refund Status

Table of Contents

ToggleWhat Is Income Tax?

It is a type of tax that is imposed on the income generated by the individual (via business or job). It can be paid quarterly or annually and is used by the government to fund various public services. To define the obligations of this tax, in 1961, Income tax was introduced and stated the regulations for administration/collection of Income Tax and Income Tax Refund.

What is Income Tax Refund Status?

Income Tax Refund Status shows that your ITR (Income Tax Return) has been processed by the Income Tax Authorities, and the status of the excess amount has been refunded to the taxpayer account.

Refund arises when you pay higher taxes in the form of TDS or advance tax than your actual tax liability. In such cases, taxpayers will get the difference (Advance tax paid – Actual Tax Liability). To get a Refund, first, you need to file an Income Tax Return, after filing Income Tax Return, you can check Income Tax Refund Status, to verify that your ITR is processed by the IT authorities, and for tax refund details too.

What are The Eligibility Criteria for Income Tax Refund?

There are many situations in which one is eligible for an Income tax refund. These are:

- If the TDS paid based on salary and other revenue resources is higher than tax chargeable on the income.

- If the tax amount is paid in advance or negative after considering the paid taxes ( income tax & TDS).

- If someone pays the tax in advance according to the self-assessment and then finds out the payable tax (as per regular assessment ) was comparatively lower.

- If the payable tax is reduced after the resolution of any error or any other reason.

- When you have already paid tax in a foreign country (a country with which the Indian government has agreed to waive off income tax to avoid double-taxation)

- If you have invested in some investment options which offer tax benefits like insurance plans, housing authority bonds, etc.

What is The Due Date To Claim Income Tax Refund?

One should claim his Income Tax Refund within one year after the assessment year for which he has filed his tax. But under certain conditions, you may be notified to claim your ITR till a specific date. Before filing your Income-tax refund, there are a few things that one must always keep in mind to get a refund on time.

These are:

- After the completion of 6 successive assessment years, your request for a refund will not be accepted.

- Refunds amounting to more than Rs. 50L for a single assessment year is dismissed.

- You are not eligible for any interest on a refund request that is submitted late.

- In case the ITR requires verification from the authorities to process the refund, then the concerned officer will reconsider the Income Tax Return claim.

How To Claim Income Tax Refund?

You can directly submit Form 16 at the time of ITR filing to mention all the investments that can help in getting tax exemptions. But, in case there is a difference in the paid tax and payable tax after ITR filing, then you can submit form 30 to claim it.

How To Check Income Tax Refund Status?

As everything is shifted to digital mode, hence you can Check Your Income Tax Refund Status Online with a single click. There are two online platforms to check your Income Tax Refund. These are:

- Official e-filing portal of the income tax department

- The NSDL Portal

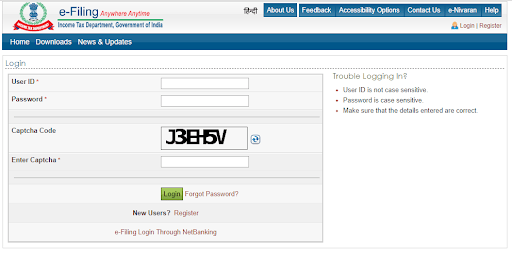

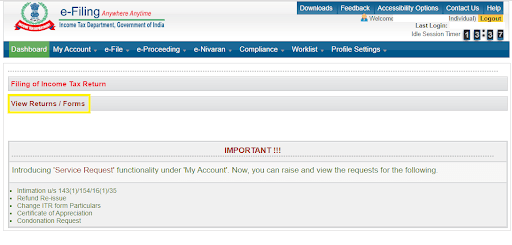

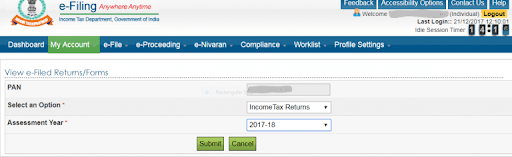

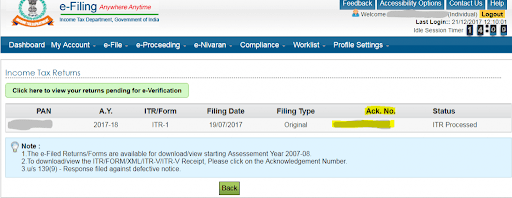

Steps To Check Income Tax Refund Status Through E-Filing Portal

To check your income tax refund status on the Income Tax e-filing portal, you can follow these steps:

- Visit the Income-tax department e-filing portal and enter your details to login to the portal: User ID (PAN Number), password, and captcha code.

- Select the highlighted option ‘View Returns/Forms’.

- Select an option ‘Income Tax Returns > select assessment year and click on ‘submit’.

- Click on the highlighted option Ack. No. (acknowledgment number).

- The refund status with all the details appears as highlighted in the box.

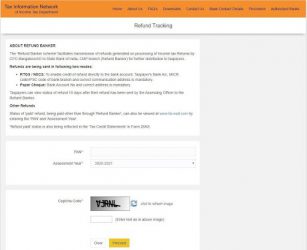

Steps To Check Income Tax Refund Status Through NSDL Portal

To check your income tax refund status on the NSDL portal, you can follow these steps:

- Visit NSDL Portal or click on the Button Official NSDL Website

- Enter your details like Pan Number, Assessment Year, and Captcha Code after feeding all the details click on ‘Submit’

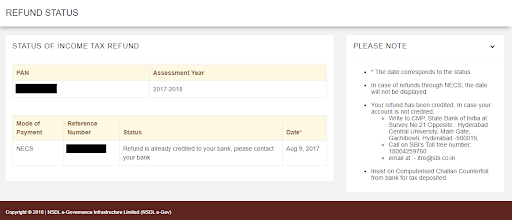

After submitting, NSDL Portal will show your refund status.

How Will You Receive Your ITR Refund?

- Direct Transfer:- If you have chosen the option of bank transfer while e-filing, then the authorities can pay the refund directly in the bank account via NECS/RTGS.

- Via Cheque:- In case if your bank details are incomplete, then you may receive a cheque at your home.

Meaning of Income Tax Return Status

While checking the income tax refund status taxpayer might come across different messages like these:

- Expired

- Refund Returned

- Processed through direct credit but failed

- Refund processed through NEFT/NECS but failed

- Adjusted against outstanding demand of the previous year

- ECS refund advice received but not reflecting in your bank account

- Not Determined

- No e-filing for this assessment year

- Refund Paid

- ITR Proceeds determined and sent to Refund Banker

- Refund unpaid

- No Demand No Refund

- Demand Determined

- Contact Jurisdictional Assessing Officer

- Rectification Proceeds, refund determined, sent out to refund banker

- Rectification Proceeded on, No Demand, No refund.

- Rectification processed, demand determined.

Let’s discuss all status in detail.

Expired – Refund Status

It means that the tax refund cheque is not presented for payment within the stipulated time and it got expired. It might happen when you receive a tax refund cheque from the Income Tax Department and you fail to present it to the bank within 90 days.

In this situation, a taxpayer can submit a ‘refund re-issue request’ under the ‘my account’ tab on the e-filing portal.

Refund Returned – Refund Status

It means that the refund is not processed and returned, due to some wrong information provided by you. This happens when a tax refund is processed through ECS (electronic clearing service) but you have provided the wrong details the transfer will not happen. A cheque or Demand Draft sent to your address but not delivered due to the wrong address, or in case one is available.

In this situation, a taxpayer can correct his/her details and then submit ‘refund re-issue request’ under ‘my account’ tab on the e-filing portal.

Processed Through Direct Credit But Failed – Refund Status

Refund claims processed by State Bank of India and while processing the refund claim, due to some technical error taxpayer refund was not credited to the taxpayer account due to any of the following reasons:

- If the Taxpayer Account is not active due to any reason.

- Accounting Operations in the Taxpayer account has been on hold or restricted by the bank.

- The account details you have provided belongs to a fixed deposit (FD), Public Provident Fund (PPF), loan account or It is a non-resident Indian (NRI) account.

- The account holder may be passed away.

- The account details you have provided are incorrect.

In this situation, the taxpayer has to update bank details before submitting a ‘refund re-issue request’ on the e-filing portal.

Refund Processed Through NEFT/NECS But Failed – Refund Status

This means that refund issued by the income tax department through NEFT/NECS has been failed and not credited to the taxpayer account. This could be because the account details provided by the taxpayer are not correct or the bank is using the wrong account details to transfer the tax refund.

In this situation, a taxpayer must verify the bank details and the taxpayer should contact the bank and enquire about the status of the NEFT/NECS.

Adjusted Against Outstanding Demand of Previous Year – Refund Status

This status means that your this year tax refund has been adjusted against your previous outstanding demand by the Income Tax Department. The tax department has full authority to adjust against outstanding demand but they have to inform taxpayers through intimation about this action.

ECS Refund Advice Received But Not Reflecting in Your Bank Account – Refund Status

This status means that the tax refund issued through NEFT/NECS but not reflecting in your bank account due to some error. In this case, the taxpayer must verify your bank details like; IFSC Number, Account Number, and Bank Name, etc.

In this situation, a taxpayer must verify the bank details then submit a ‘refund re-issue request’ on the e-filing portal, or the taxpayer should contact the bank and enquire about the status of the NEFT/NECS.

Not Determined

It states that the authority has not processed your ITR return & hence is not able to determine the refundable amount. Hence, check your refund status later (after a week or so).

No e-filing for this assessment year

It means that you have not filed ITR via online mode. You may have filed it manually or forgot to file it. You can contact your bank or post office to track the refund.

Refund Paid

It means that your ITR refund is already credited to your bank account. If you still have not received it, then track the transfer by contacting your bank or post office (in case of the cheque).

ITR Proceeds determined and sent to Refund Banker

This status indicates that your Income Tax Refund has been initiated. You need to wait for some time to receive the amount in your bank

Refund unpaid

It means that the refund amount is determined but has not been delivered. You have to check if the address or bank account that you have provided is accurate. You can correct the information by logging into the official website of Income Tax and thereafter apply for Refund Reissuance.

No Demand No Refund

This indicates that no refund applies to your paid tax amount. In case you think that you should get a refund, then you need to revise the ITR return to cross-check if you have forgotten any details.

Demand Determined

This status indicates that your claim for a refund is declined, and you need to pay more tax (as per regular assessment). You should cross-check your filed ITR to check if you have forgotten any record.

Contact Jurisdictional Assessing Officer

This ITR status defines that the authorities require a few more details before determining your refund amount. To provide details, contact your jurisdictional Assessing Officer.

Rectification Proceeds, refund determined, sent out to refund banker

It means that the revised/rectified Income Tax Refund is accepted by the authority. To track your ITR refund, wait for a few days and check again.

Rectification Proceeded on, No Demand, No refund.

This status means that your request for rectification is accepted, but according to the regular assessment, no refund is applicable.

Rectification processed, demand determined.

After the submission of a rectified ITR refund, if you see this status, then it is clear that no refund is applicable, and you have to pay more tax to the authorities. Remember, you need to pay this tax amount within 30 days of the notice. You can tally your ITR filing to cross-check for your reference.

How to Claim Refund Re-issue Request?

In case you receive any of these status mentioned above, you need to submit a refund re-issue request or to update the account details you can do it by following these steps:

Refund Re-issue Request

- Visit the Income-tax department e-filing portal and enter your details to login to the portal.

- Go to ‘My Account’ tab on the Dashboard and select the third last option ‘Service Request’.

- Select request type from the drop-down menu as ‘New Request’ option and from request category select from the drop-down menu as ‘Refund Reissue’ option.

- A new screen will display the details like Your PAN Card Number, your return type, assessment year, acknowledgment number, communication reference number, and response. Click on ‘Submit’ under ‘response’ for the tax return you are claiming Refund reissue request.

- You need to feed your details and click on the ‘Submit’ option.

Update the Account Details

- Visit the Income-tax department e-filing portal and enter your details to login to the portal.

- Go to the ‘Profile Setting’ tab on the Dashboard and select the first option ‘My Profile’.

- Update your details.

Summary

Anyone can file an Income tax refund easily via online mode. All you need to do is follow the above-provided steps. Even the request for refund reissue can proceed via online mode. Make sure that you file your ITR before the deadline to save yourself from the late fee.

Faq's on Income Tax Refund Status

You Can Also Read These Related Articles: