Article Content

- ITR-1 Form

- What Are Eligibility Criteria For The ITR 1 or Sahaj Form For The AY 2020-21?

- What Is The Structure Of ITR1 Form?

- How To File the Income Tax Return ITR1 Form?

- What Documents Are Required To File The ITR1 Form?

ITR-1 Form

The income tax department has divided all the taxpayers based on total income earned yearly, source or sources of the income generated, and who is paying the tax an individual or company. Now, according to these categories, taxpayers are supposed to file the Income-tax return form suitable to their situation.

ITR1 form is also known as Sahaj form. ITR Sahaj applies to individuals whose total annual income is up to Rs. 50 lakh. This article contains the detailed knowledge of the ITR1 or Sahaj form where you will learn who is eligible to file this form, how you can file the ITR1, and the structure of the ITR1 form.

What Are Eligibility Criteria For The ITR 1 or Sahaj Form For The AY 2020-21?

ITR1 or Sahaj is the simplest one-page Income Tax Return form for individuals whose income does not exceed the set limit of Rs. 50 lakh. The Individual must be a resident of India. People who generate income from these sources are eligible to submit the ITR1 form.

ITR 1 form includes individual residents:

- Total earning from salary or pension

- Income earned from one residential property except for the cases where loss incurred in previous years

- Income generated from other sources such as lottery

- Income generated from agriculture up to Rs.5000

ITR 1 form excludes:

- An individual whose total annual income more than Rs. 50 lakh

- An Individual whose income generated from agriculture is more than Rs.5000

- Gains from the taxable capital- both short and long terms

- Individuals who generate income from business or profession cannot submit the ITR1 form

- Any individual who own multiple residential properties and rent received from these properties is his/her source of Income cannot file the Sahaj form

- If the income generated from foreign assets or sources such as rent received from the residential property outside India or salary received from a foreign source cannot be a part of the Sahaj ITR

- If you are a director of a company

- Any individuals with investments from unlisted equity shares during the financial year

- Owning assets outside India or if you are a signing authority

- Income generated by RNOR and non-residents

- Income generated by other partner and you are assessable as well for the tax deduction

What Is The Structure Of ITR1 Form?

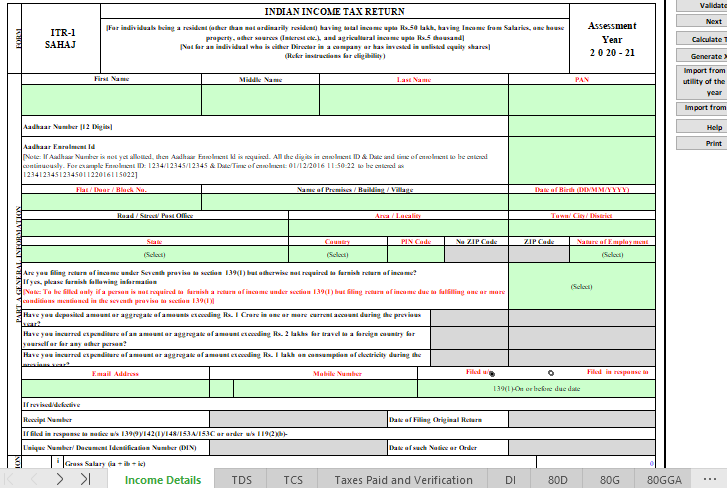

As we told you above ITR1 is a very simplified one-page form that includes several small sections. All the information asked in the Sahaj form is very basic and everyone is required to fill them unless if the specific section does not apply to you.

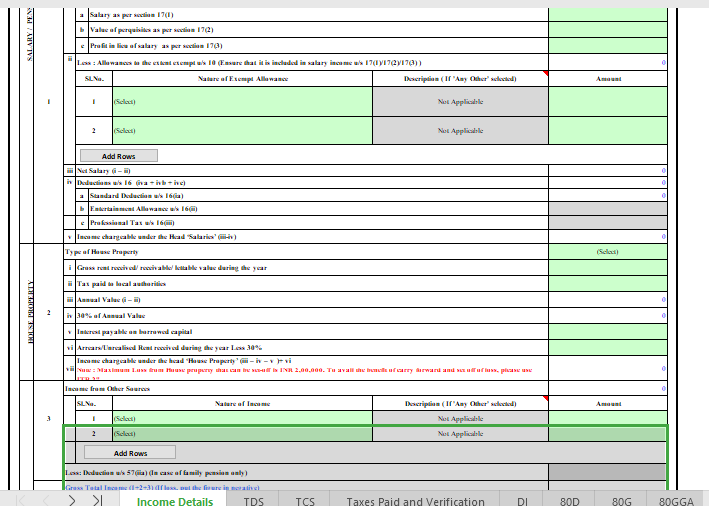

The structure of the Form ITR1 is:

- Section 1- asks for all the general information such as name, address, mobile number, and PAN card details.

- Section 2- asks for the gross annual income of the Individual

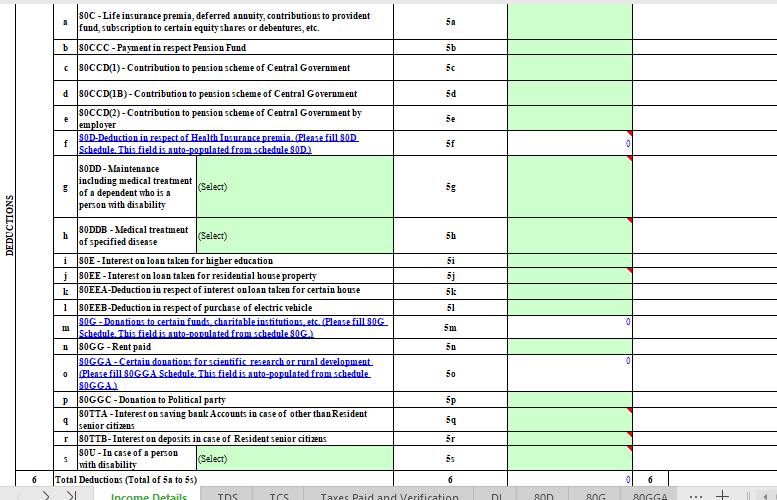

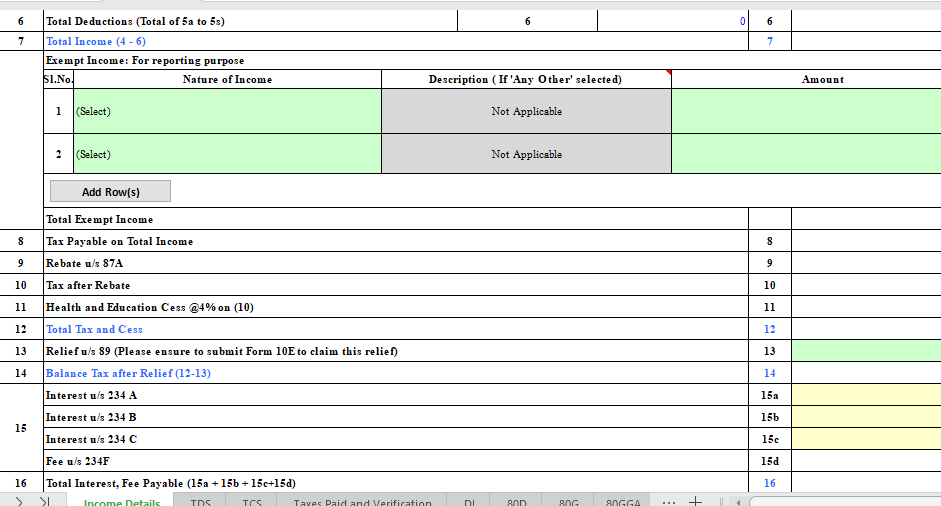

- In section 3- an individual is supposed to fill in the details of the total tax deductions made in the year and the total taxable income

- In section 4- you are supposed to show your calculation of the tax payable for the financial year

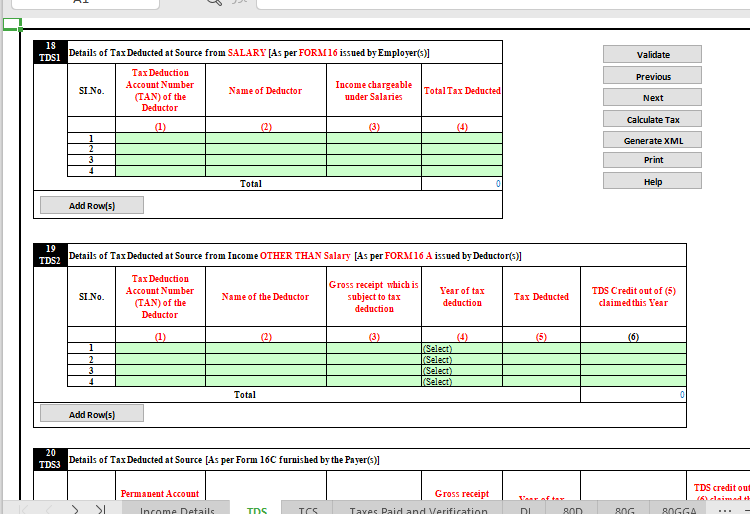

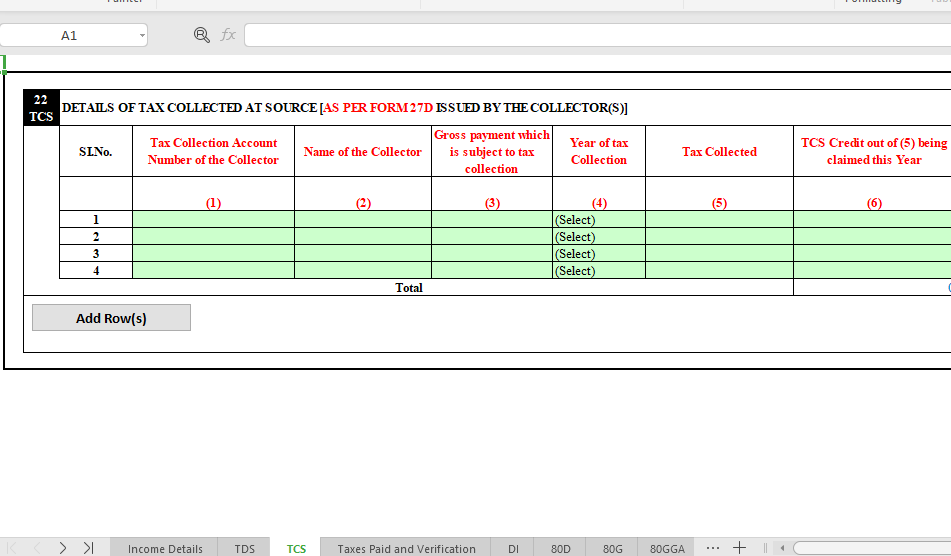

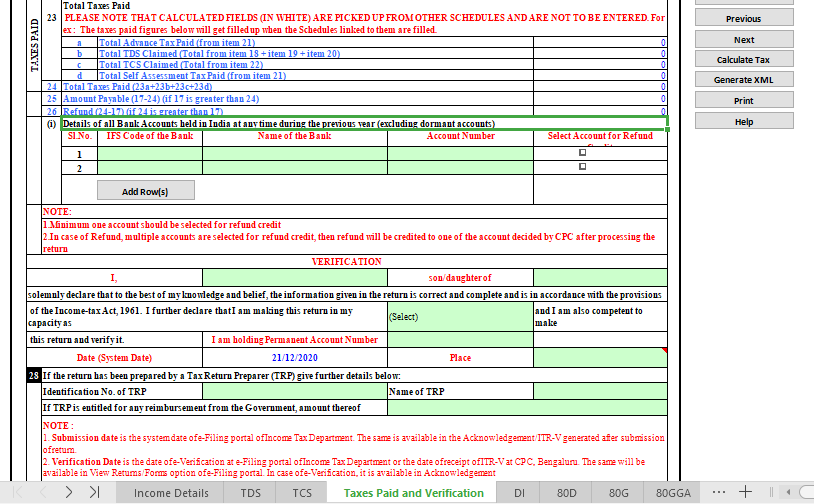

- Section 5- demands for the details of TDS and TCS all over the year

- Section 6- includes the individual who made the self-assessed tax payments and advances tax on their total taxable income. They can also verify this information in the ITR1 form

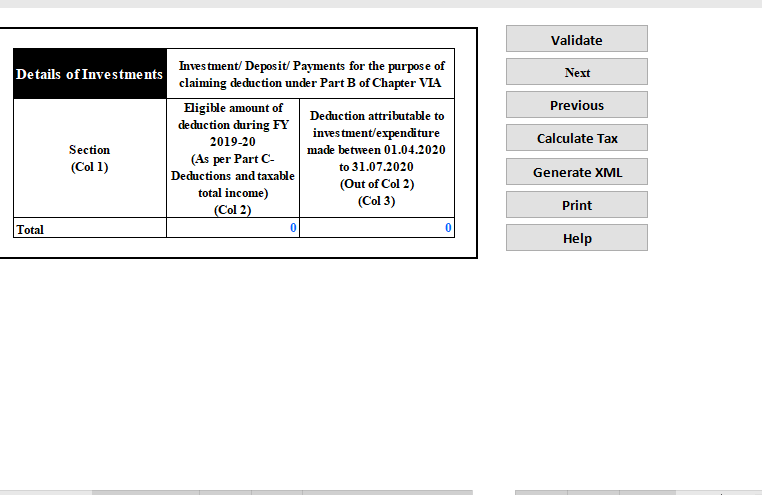

- Section 7 demands all the tax-saving investments you have done between 1st April 2020 and 31st July 2020 ( if any)

How To File the Income Tax Return ITR1 Form?

The income tax department urges everyone to file the ITR forms online but there are few exceptions too. Here we will explain, how you can file the Sahaj form offline and online. Follow these steps carefully:

Offline Method

There are only 2 categories of a taxpayer who can file the ITR1 form offline and will be accepted by the Income Tax department are:

- A taxpayer whose age is or above 80 years old can file the Income Tax Return ITR1 form offline or in paper form

- An Individual or HUF whose total annual income is below Rs.5 lakh and does not wish for any refund can file the ITR1 form personally in a paper form

- For the offline method, any one of the above is supposed to fill out the ITR1 or Sahaj Form on a paper form and submit it to the Income-tax department. Once the submission is done, you will receive an acknowledgment slip or a paper receipt in return.

Online Method

Now, you are already familiar with the structure of the ITR1 form and you are aware of all the information you need to fill in the Sahaj form. To submit the ITR form online, you need to visit the official income tax department website www.incometaxindia.in and log in by entering your PAN card number, password, and Captcha code given on the screen.

If you don’t have an account then you need to click on the “create new account” and then enter all the information and set a password to log in. In case, if you don’t remember your password then you can click on “forget password” and generate a new password by submitting the OTP you have received on your registered mobile number and email address.

- You can transmit your data electronically from your accounting software and submit the verification of the return in the form of ITR-V to CPC, Bengaluru.

- the second option is you can file the Income Tax Return online and e-verify the ITR-V via net banking, Aadhaar OTP, or EVC.

Once you submit your ITR-1 form online. You will receive the acknowledgment slip at your email address. If you want you can download a copy of your acknowledgment slip manually. You need to sign the acknowledgment slip and send it to the CPC office of the income tax department in Bangalore within 120 days of online submission or you can e-verify your return within 120 days.

What Documents Are Required To File The ITR1 Form?

There are few documents you will need while submitting the ITR1 form or Sahaj form:

- You need Form 16s issued by your employer for the specific financial year

- Keep Form 26AS to verify the TDS mentioned in form 16 which matches part A for the Form 26AS

- Receipts of the deductions and exemptions made by your employer but you don’t have any other proof like HRA allowance or section 80C or 80D

- PAN card

- Bank Investment certificates or receipts from the interest from a bank account.