Table of Contents

ToggleArticle Content | Proforma Invoice Under GST

- What is a Proforma Invoice?

- Proforma Invoice Definition

- What is the purpose of Proforma Invoice?

- What is the difference between an invoice & a proforma invoice?

- How to create a proforma invoice under GST?

- What are the components of the proforma invoice format?

- Can Payment be done on a Proforma Invoice?

- FAQs on Proforma Invoice

What is a Proforma Invoice?

A proforma invoice is a preliminary bill or invoice of sale that is sent to the customer requesting payment against the goods or services before they are delivered. A proforma invoice includes a detailed description of the goods, the total amount, the quantity, and other details of the products or services.

It is a ‘good faith’ agreement between the seller & the buyer so that the customer can have an idea of what’s coming at what price.

Since the proforma is not an invoice, it cannot be legally used for accounting purposes by the seller or the buyer. It’s not a demand or request for payment, instead, it is commonly used as a preliminary invoice that is sent with a quotation to the customers.

For example: if you need the payment in advance to ensure financial security before you start manufacturing goods, a proforma can be used to propose the details to the customers.

Proforma Invoice Definition

Proforma Invoice means preliminary invoices that inform clients about the terms of sale and the amount to pay. The proforma invoice is prepared by the seller for internally checking invoices or for enabling customers to keep a check on the sale deed. The proforma invoices are not included in accounts receivable and payable.

What is the purpose of Proforma Invoice?

A Proforma invoice means a simple document that is prepared by the seller to streamline the sales process. Once the seller sends a proforma invoice to the customer, the customer agrees to the price and after that, the seller delivers the goods or services to the customer. Instead of being a demand for payments, proforma invoices act as an estimation document for the customers.

Below are some of the other uses of a Proforma Invoice:

- It is sent to customers to declare the price of goods.

- A Proforma invoice is also used in case you don’t have all the details required for a commercial invoice.

- Some clients use it for the internal approvals process.

- Proforma invoices are commonly used in trade and imports transactions.

What is the difference between Invoice & Proforma Invoice?

An invoice is a legal document that states the amount due against a sale or purchase deed, whereas the proforma invoice is a declaration by the seller to provide products at a specified rate.

Topic | Invoice | |

Definition | A legal document sent to the customer by the seller confirming the final sale & requesting the payments. | Proforma Invoice is a good faith document sent to the buyer with a written proposal of price against the required goods & services yet to be delivered. |

Invoice Issue | Invoice is issued before payment is made | Proforma Invoice is issued before order placement |

Purpose | It is a legal binding document to inform the buyer about the amount due for the sale of products | It helps the buyer to know how much he has to pay for the services |

Format | The invoice includes company logo, contact details, billing address, product information, terms and conditions, price | Proforma invoice format should include all the information as a standard invoice but should be clearly labelled “proforma” |

Accounting | A commercial invoice is necessary for paying the bill and is used to reconcile the accounts during audit | Proforma invoices are not used for accounting purposes. It gives the buyer a general idea of the amount that must be paid |

How to create a Proforma Invoice under GST?

Proforma invoices can be generated as normal invoices using billing software. Most of the billing software includes proforma invoice templates for easily creating proforma with a single click.

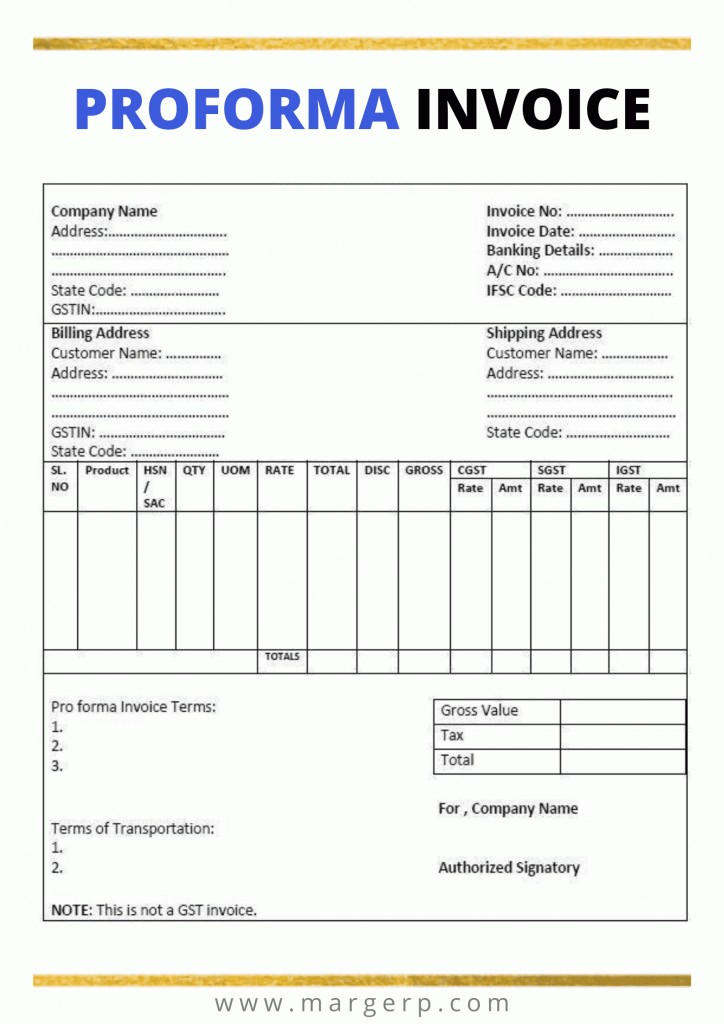

What are the components of the proforma invoice format?

The main purpose of a proforma invoice is to show the customer the details of the proposed transaction. It should include the following information:

- Unique Invoice number

- Company name, address and contact details

- Customer’s name, address & contact details

- Date of Issue

- Payment due date

- Details of goods/ services

- Price

- Validity of price

- Applicable terms and conditions

- Payment terms

- GST

- The term ‘Proforma Invoice’

- The phrase ‘This is not a tax invoice’’

Can Payment be done on a Proforma Invoice?

The customer can make an advance payment against the proforma invoice. Once the sale is complete, a reference proforma invoice number can be made on the standard invoice to avoid any duplication of payments against the same bill.