An invoice is a document that is given by the buyer to the seller after making a successful product or service sale. It includes all the costs of products, services, taxes that the buyer needs to pay to the seller. The invoice also serves as a legal document with the name of the customer & seller, description of price & terms of payments.

Article Content

- What is an Invoice?

- What is the Definition of Invoice?

- For what purpose Invoice is used?

- What are the Functions of Invoice?

- What are the different types of an invoices?

- What is an Invoice ID?

- What are the elements of an Invoice?

- How does an Invoice look?

- How to generate an Invoice?

- What are the Advantages of Invoice Software?

- Faq's

What is an Invoice?

As discussed, an invoice is a simple document with a list of all products, price descriptions, tax breakups that establishes an obligation on the buyer to pay the seller for the purchased goods or services. An invoice is also referred to as a bill in general terms. A bill or invoice can be easily generated by billing software ready with GST. In the market, there is n number of billing software available for invoice generation. You only need to pick the right one.

What is the Definition of Invoice

For what purpose Invoice is used?

For business accounting invoice is used as a source of legal document. Invoices are useful for maintaining a record of sales transactions a business makes. Invoices may be used for a variety of purposes, such as:

- To keep track of sales

- To forecast future sales using historical data

- To request timely payment from customers

- To track inventory, for businesses selling products

- To record business revenue for tax filings

What are the Functions of Invoice?

Businesses need to give invoices in order to demand payments. An invoice is a legal document abiding the customer to pay the said amount. It has some other functions, such as:

Maintaining Records

The most important function of an invoice is to maintain legal records of each & every transaction. With an invoice, you can easily identify the seller, buyer, date of transaction etc.

Tracking of Payment

An invoice is an important tool for accounting. It helps both the seller and the buyer to keep track of their payments and amounts owed.

Legal Protection

An invoice is a legal document that acts as proof of transaction between the seller & the buyer on a described price. It protects the merchant from fraudulent lawsuits.

Tax Filing

The Invoice also helps in proper tax filing. The company can maintain records of sale invoices & ensure the proper amount of taxes are paid.

Business Analytics

Analyzing invoices can help businesses gather information from their customers’ buying patterns and identify trends, popular products, peak buying times, and more. This helps in effective market forecasting.

What are the different types of an invoices?

There are various types of invoices that you (as a business) can send to your customers:

- Standard Invoice

- Pro forma Invoice

- Commercial Invoice

- Credit Invoice

- Timesheet Invoice

- Retainer Invoices

- Recurring Invoice

- Expense report

- Interim Invoice

- Final Invoice

- Past due Invoice

- E-invoice

What is an Invoice ID?

An invoice number also referred to as invoice ID is a unique number that’s assigned to each invoice. The invoice number is a crucial invoice element because it allows a business to easily identify and refer to individual transactions with clients.

An invoice ID can include both numbers and letters. The Invoice ID system ensures that you don’t assign an invoice number more than once.

What are the elements of an Invoice?

The elements of the invoice may vary from company to company based on the requirements of the business. A good invoice includes the following elements:

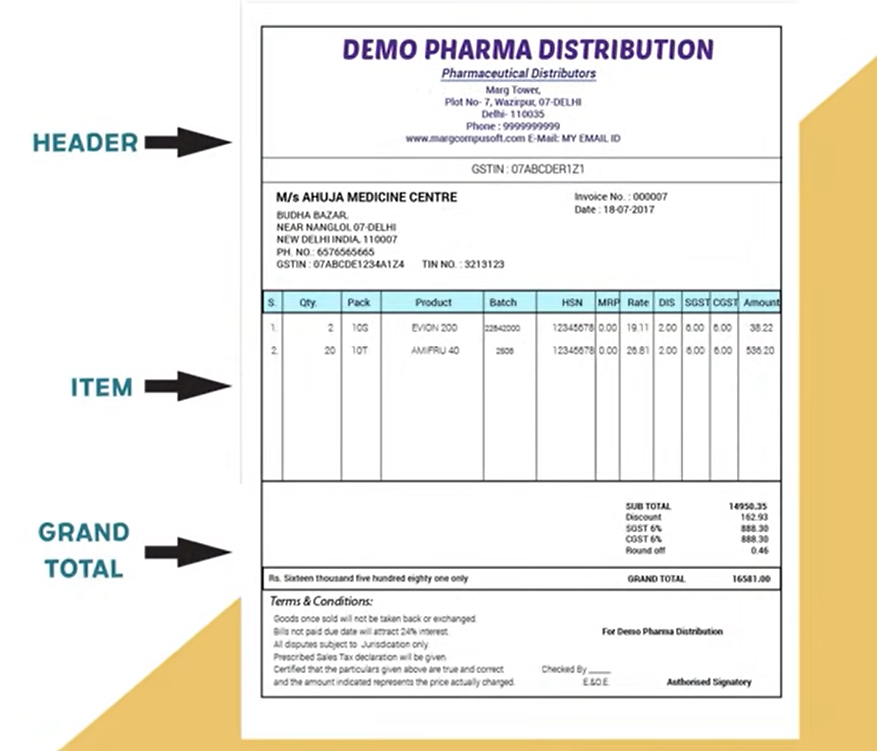

How does an Invoice look?

How to generate an Invoice?

What are the Advantages of Invoice Software?

Apart from generating invoices, there are a few advantages also for using invoice software. Let us discuss the advantages in brief. Invoice software helps to streamline your accounting and financial processes by automating important tasks. By doing so, you can:- Reduce expenses by cutting staff costs in the invoicing and billing department

- No need to follow up and chase for late payments

- Improve your cash flow with faster payment

- Improve security by reducing fraud

- Offering faster error resolution to enhance customer satisfaction