- What is TDS Online Payment?

- What Are The Steps to Make Online TDS Payment?

- In Which Situation TDS Online Payment is Applicable?

- What Are The Different Methods Of Making The TDS Payment?

- TDS Applicability in Different Forms

- Know The Deadlines And Due Dates for TDS E-Payment

- Which Requirements Should Be Met Before Making The TDS Payment?

- Steps To Check Your TDS Payment Status

- Benefits Of E-TDS Payment

- FAQ's

Table of Contents

ToggleWhat is TDS Online Payment?

TDS or Tax Deducted at Source is a process of collecting the tax at the time of payment such as interest, salary, bonuses, commission, rent, etc. TDS is a type of advance tax. Under the TDS provisions of the Income-tax Act, 1961, the government can deduct the advance tax in the form of TDS from the salaried individual.

All the salaried individuals are liable to pay the TDS on their salary beforehand, It is called “credit of the Central Government” directly through the banks. In 2004, the digitalization of the payment of the income tax started. Further, this idea was extended for the TDS payment online or e TDS payment.

Then another category was introduced and implemented from April 1st, 2008 under the provisions of the TDS payment. Now, All the entities such as all corporate companies and other parties who come under the provision of section 44AB of the Income Tax Act, 1961 are liable to pay TDS online by selecting the Challan or ITNS 281 for the online TDS payment.

What Are The Steps to Make Online TDS Payment?

Here we are showing you how to make the online TDS payment using the e-payment portal. Deductors can now easily deposit the deducted amount online at and before the due date of the payment. Follow these steps carefully and get rid of complicated and hefty TDS payment procedures:

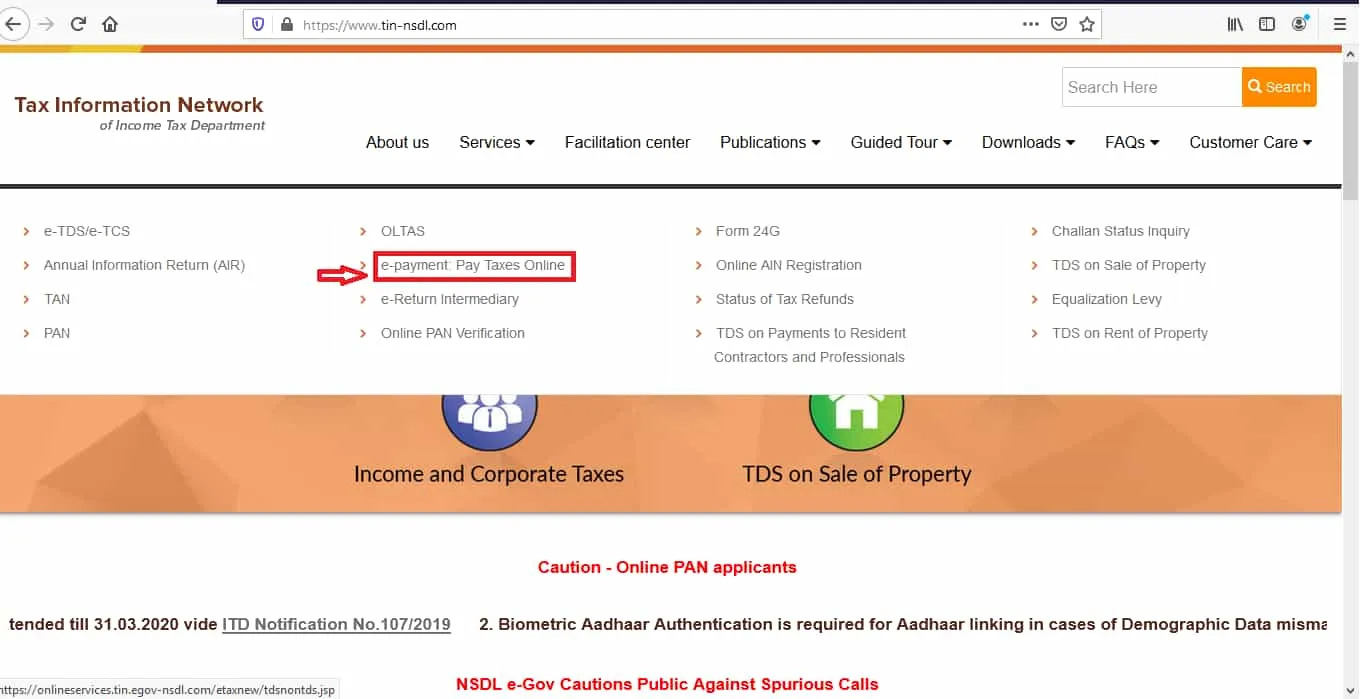

Step 1– visit the TIN-NSDL official website or type this URL https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

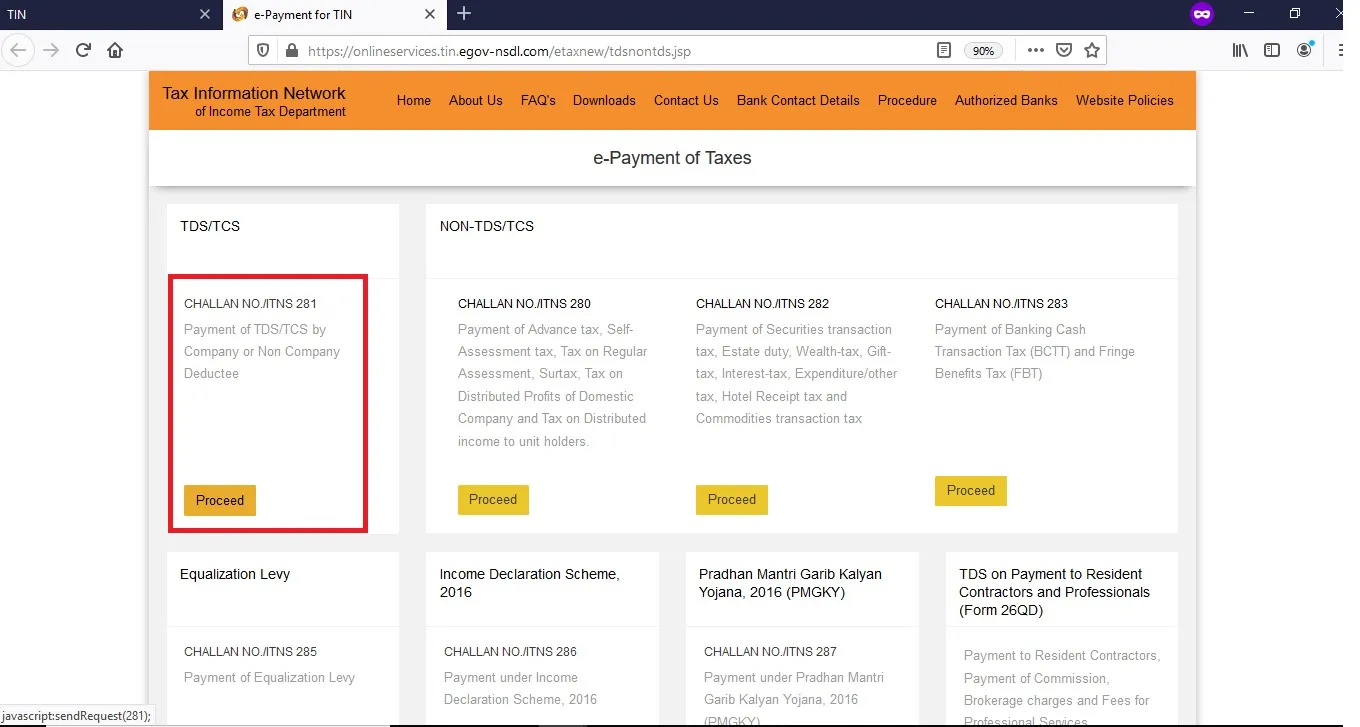

Step 2– Click on the Challan no. Or ITNS no. 281 for the payment of the TDS and TCS. Once you click on the box you will be directed to the e-payment page of the TDS/TCS deposit.

Step 3– Once you are on the page you have to fill the respective columns in detail as in the “ Tax Applicable section” you have to choose from the company deductees or non-company deductees. (as applicable).

Step 4– Then you need to enter your correct TAN number and accounting year for which you are making the payment. Note: if you enter the incorrect TAN then you have to pay the penalty of Rs. 10,000. always make sure that you are entering the correct TAN or it will be considered fraud.

Step 5– Now select your state from the drop-down box and enter your Pin code in the respective field.

Step 6– Then you have to select the nature of your TDS payment. Whether it is a TDS deducted payable by you or TDS on regular assessment.

Step 7– Now you have to choose the method of your online TDS deposit. You can select it from the drop-down box of “Nature of Payment” and “Mode of Payment”

Step 8– Then click on submit button

Step 9– After the submission, the verification process will start to confirm the validity of your TAN. If the TAN is valid you will receive a confirmation message on your screen with the full name of the taxpayer as mentioned in the records.

Step 10– Once the data is verified you will be directed to the e-payment page where you can log in to your bank’s net banking account with your bank’s login ID and Password.

Step 11– After the completion of the payment, a Challan counterfoil will appear on your screen containing your CIN, payment details, bank details. You have to save and download this counterfoil as proof of your TDS deposit online.

In Which Situation TDS Online Payment is Applicable?

- TDS or Tax deducted at Source payment

- Self- Assessment of Income Tax for the particular accounting period

- For the payment of TCS or Tax collected at Source

- Tax of regular assessment of Income Tax

The e-tax portal is regulated a maintained under the TIN-NSDL authority. One can visit their website www.tin-nsdl.com and go to the service page to make the TDS deposit online via an authorized bank.

What Are The Different Methods Of Making The TDS Payment

There are mainly two ways to make the TDS payment at different platforms by the taxpayer via banks authorized by the Income-tax department. These two ways are :

TDS Cash Method Payment

In this method, an individual or consumer can pay their TDS tax liability from any authorized bank in the form of cash. If you don’t have the account in the authorized bank then you don’t have to open the account in the respective bank to make payment via cash. However, It is a time taking process involving several documents such as identity documents, PAN card, or TAN number.

TDS Online Payment

Through this method, an individual or company can make the TDS payment online by login into the e-tax portal of the TIN-NSDL via selecting any authorized bank. In TDS e-payment, you gain have 2 ways to make the payment from your respective authorized bank. The taxpayer can make the online TDS payment via Debit card or using a Net Banking account. At the e-tax payment portal, you need to select the Challan to open the TDS payment online 281 forms.

TDS Applicability in Different Forms

TDS applied on the following incomes.

- Income earned from interest accumulated on securities, funds, dividends and EPF

- Income in the form of commission

- Income earned as contractor, subcontractor and freelancer

- Income derived from providing technical or professional services

- Income derived from games and lotteries

- Income derived from royalty.

Know The Deadlines And Due Dates for TDS E-Payment

Due Dates and Deadline for TDS Online Payment

The due dates of TDS payment for government employees differ from the non-government employees. Individuals who have been allowed quarterly payment options need to keep the due dates in mind as well. The due dates for TDS e-payment based on payment types are:

Deadline for government employees

| Payment Type | Due Date |

| Payment with challan | 7th of the following month. |

| Payment without challan | Day of deduction |

| Payment charged on additional earnings paid by the employer | 7th of the following month |

Deadline for non-government employees

| Date for Tax Deduction | Due Date |

| Tax to be deducted in March | April 30 of the following year |

| Tax to be deducted in any other month than March | 7th of the following month |

Deadline for quarterly payment

| Quarter Ending | Due Date |

| On June 30 | July 7 |

| On September 30 | October 7 |

| On December 31 | January 7 |

| On March 31 | April 30 |

Which Requirements Should Be Met Before Making The TDS Payment?

- You must have a valid PAN/TAN

- To make the online payment, you must have an account with the authorized bank

- You also need enough balance to make the successful payment of your online TDS deposit

- You need a fast and secure internet connection to make the process smooth

Steps To Check Your TDS Payment Status

Follow these steps to check your TDS payment status:

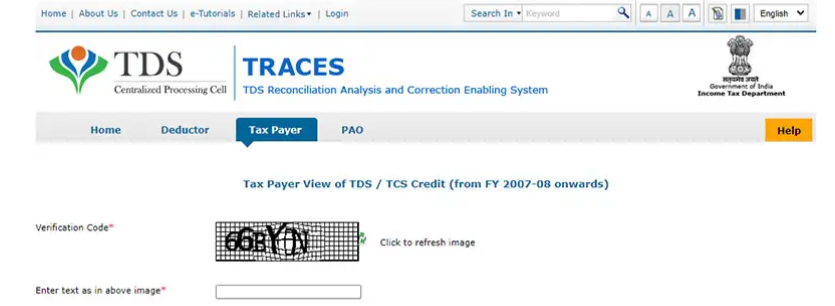

1 – Visit the official website of the Central Processing Cell of TDS https://www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml.

2 – Type the captcha as shown in the image Then tap on ‘Proceed’ to go on TDS / TCS Credit page.

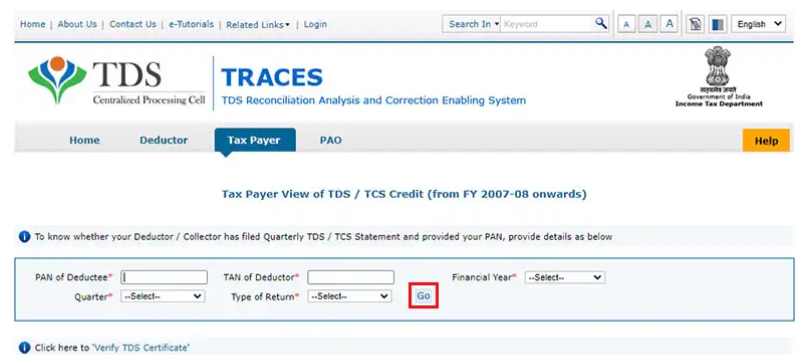

3 – On the page, provide the following details.

- PAN of Deductee

- TAN Deductor

- Financial Year

- Quarter

- Type of Return

4 – Tap on ‘Go’ and the TDS online payment details will be auto-generated.

Benefits Of E-TDS Payment

There are several advantages of making the online TDS payment. Therefore from April 1st, 2008 Income tax department has mandated the TDS payment online for the income taxpayers.

- There is no time restriction on the TDS payment online. TDS deposit online is available 24*7*365 days.

It is convenient for the deductor to make the online TDS deposit from any place at any time as they only need access to a good and secure network and don’t have to present personally and spend a whole day submitting the documents.

- E-tax portal allows you to easily upload and download the required documents and acknowledgment copies. One can even save these documents for further use to save time and effort.

- Online TDS payment has reduced the tax frauds significantly. The e-tax payment portals are more secure and transparent and they verify the details of the tax payment in real-time. Thus, frauds like getting unnecessary credit of tax deductions are reduced in comparison to manual TDS certificates filing.

- Last but not least, e TDS payment has made the process Eco- friendly and paperless. Before, making the tax payment involves a lot of paperwork every single time. Now you can save your documents online and use them according to your need.