We pay taxes to the authorities in various forms. One of the most common ones is TDS deducted by banks even if your income exceeds Rs. 40,000 per annum. But if the income is below his limit, you can request banks to waive off the taxes by submitting a form 15H. Although to get the benefit of tax exemption above 75 (presented in budget 2021), one needs to prove the eligibility.

Note: this income limit can be changed according to the budget presented for the year.

Article Content on Form 15H

- What Is Form 15H?

- Sample of 15H Form & How to Fill Form 15H?

- Download Form 15H

- Who Can Submit Form 15H?

- The Purposes For which Form 15H Used

- Conclusion

What is Form 15H?

In some cases, people are exempted from paying taxes, and they need to fill a form to prove and avail of the benefit. Form 15H is one such form in which one can declare his income under sub-section 1C of section 197A of the Income-tax Act, 1961. So form 15H is used for availing tax exemption by the people aged above 60 years to claim receipts in their bank without any deduction of TDS.

Sample of 15H Form & How to Fill Form 15H?

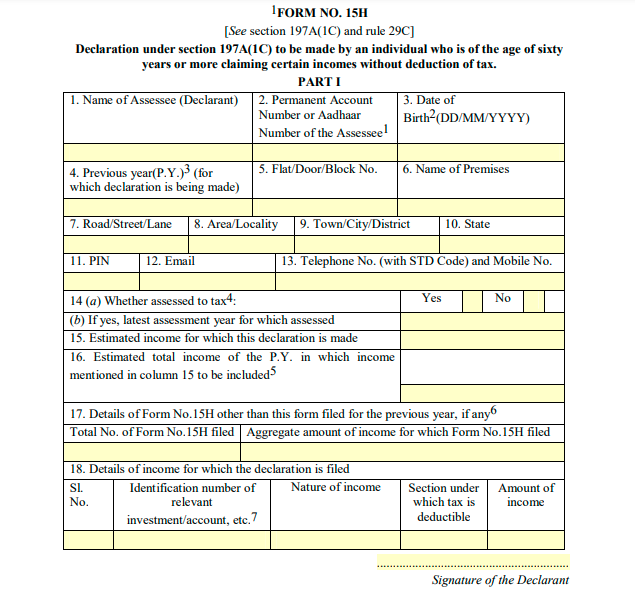

The form is divided into two parts. If you are searching for how to fill Form 15H, then the answer is that you can fill it by mentioning the below information in the form.

Part 1

- Basic information like Name, PAN/Aadhaar number, DOB

- Past tax filing details

- Everything about investments

- Declaration

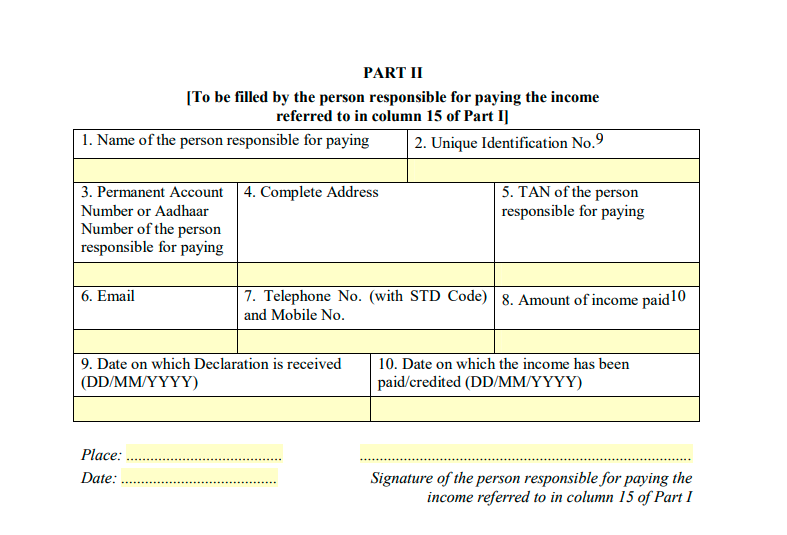

Part 2

- Name & address of the declarant

- Rate of investment and when the taxpayer received its dividend.

Download Form 15H

Form 15H can be filed online from the websites of most banks operating in India. However, incometax website also provides the option to download Form 15H for free. Once you have downloaded the form, it has to be printed, filled out, and submitted with the appropriate bank/authority. Form 15H is basically filed to reduce your TDS burden. It is important to submit separate Form 15H to each bank/post office you have deposits with to reduce your overall TDS burden.

Who Can Submit Form 15H?

This form is planned to provide benefits to a specific section of society and is used by elderly people who want to save the TDS deduction on their income. So only a few people are eligible to submit Form 15H.

The criteria to become eligible for submission of form 15H as follows:

- People who are neither self-employed nor salaried but financially dependent on pension and dividends.

- The aggregate income, including dividends on investments, and should be under a limit defined in the Income-tax slabs for that year.

- The person must be a resident of India, and thus NRIs are not eligible

- There is no tax liability on the applicant

- The person’s age is at least 60 years old during the financial year for which the form is submitted.

The Purposes For which Form 15H Used

Apart from availing the exemption from TDS reduction on the bank deposits, there are many other purposes for which form 15H is used.

Below is the list of situation answering where to submit Form 15H:

-

TDS on dividends

There are maybe incidents wherein the TDS deduction is performed on the dividends gained from corporate bonds. If this income is more than Rs. 5,000, then there will be TDS deduction on the income by the bank.

-

TDS for EPF withdrawal

If an employee withdraws his EPF before five years of service and the withdrawal amount is more than 50,000, he may expect a TDS deduction on the withdrawal amount. Hence, one can use Form 15H for PF withdrawal.

-

TDS on rent

In case if one gets rental income that exceeds Rs. 1.8L annually, then TDS deduction is imposed on such income. If the total income from other sources is nil, then that individual can request TDS relief.

-

TDS on income earned from post office deposit

If any individual gets income from post office deposits, then it may attract TDS deduction, and hence for TDS exemption, one may need to submit form 15H.

-

TDS on insurance commission

If the insurance commission exceeds Rs. 15,0000 in the financial year, TDS is deducted from the commission. To get relief, the insurance agent can submit Form 15H (only in the case if the income apart from insurance commission is nil).

-

TDS on LIC premium receipts

If the sum assured of the LIC policy is more than Rs. 1L, then it is taxable, and TDS is deducted. For exemption, you can submit form 15H.

Conclusion

We discussed who can submit Form 15H and where to submit Form 15H. It should be kept in mind that every piece of information provided in the form should be true. Incorrect information can lead to harsh punishments like imprisonment for three months. Also, each form is valid for one year, and every year, one needs to submit form 15H for evaluation of income and tax exemption.