Table of Contents

ToggleNew Income Tax Portal

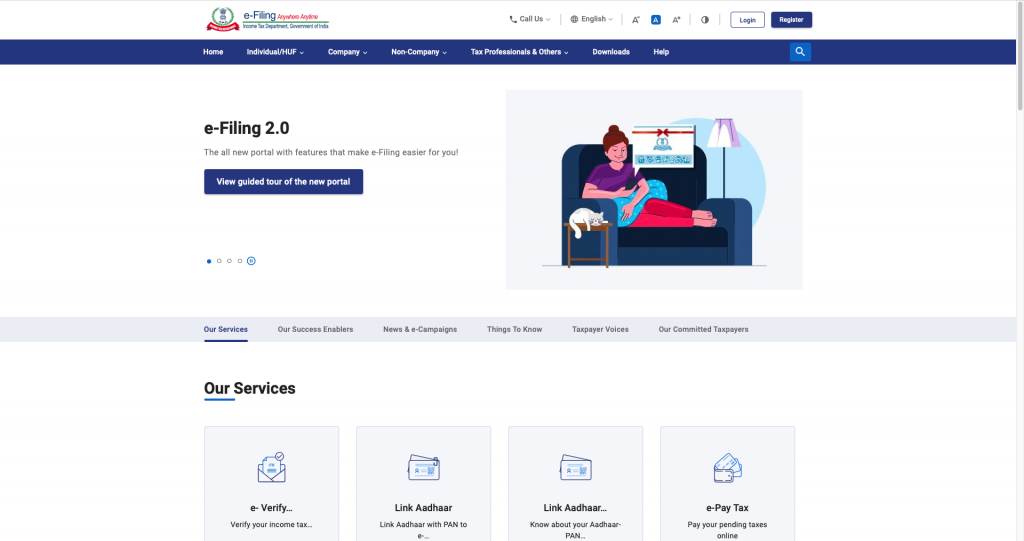

On June 7, 2021, the central board of direct taxes has launched its new income tax portal, www.incometax.gov.in. this new income tax portal website has replaced the old e-filing income tax website, www.incometaxindia.gov.in.

They have launched this new income tax portal for the convenience of the taxpayers. Income tax new portal is easy-to-use, moderate, and user-friendly. Now, the taxpayers can easily submit their taxes, file ITR, and do other tax or verification processes without any hassle.

The income tax department has not just redesigned the existing portal but also has introduced some major changes. This new income tax portal is not just soothing for the eyes but has a practical approach as well.

Many new features have been introduced along with the existing ones. We will explain all-new features, existing features from the old portal, things to do by taxpayers at the income tax new portal. We will also explain how to log in new income tax portal?

Features Of The New Income Tax Portal

1) Fast ITR Processor

Now, all your data is stored separately in a single file which allows quick response to the actions. Enabling the new income tax portal website is more efficient and handy.

2) ITR Preparation Software

Earlier, filing for income tax returns was a very hectic and tiresome process, due to which many taxpayers don’t even use to file for their tax returns. This new income tax portal provides free ITR preparation software for the convenience of taxpayers.

New ITR preparation software is free and asks several interactive questions to guide the taxpayers at every step and ensure the smooth filing of Income tax returns. At the moment, only ITR-1 and ITR-4 forms are available both in online and offline modes, and the ITR-4 form is only available online.

3) Call Centre And Chat Services

the new income tax portal has introduced 2 customers services feature for the convenience of the taxpayers. at the dashboard, you can see a calling feature that allows the taxpayers to directly address their issues, ask queries, and so on.

4) Single Dashboard Interactions

5) Multiple Modes Of Payment

6) Mobile App

7) Automatic Filled ITR Forms

This new income tax portal saves and stores every single piece of information of every taxpayer in a separate single file. It has simplified the whole data management process. Due to the single restoration and data management system, the new income tax portal provides automatically pre-filled ITR forms to the taxpayers.

Information like salary, residential property, business or profession, interest, dividend, and capital gains will be pre-filled on the ITR forms for the comfort of the taxpayer. However, this will only happen if there is already some information has uploaded by different entities on your behalf’s such as an employer, buyer of the property, and banks while submitting the TDS and SFT statements.

Carry Forward Features From Old Portal

- E-verification of the income tax returns

- Check the status of outstanding income tax returns and submitting a response

- Filing audit reports and certifications

- Checking and verifying tax credit statements (Form 26AS)

- Check and view tax credit mismatch

- Requesting and initiating refund re-issue

- Filing request for intimations

- Linking Aadhaar with PAN

- Submitting online grievances

- Requesting changes in ITR details

- Response to e-proceedings

Benefits Of New Income Tax Portal Website

By Taxpayers- Things To Do Section

There are few things that taxpayers need to do before they can start using the new income tax portal to its full extent.

One needs to re-register their Digital Signature Certificate (DSC). as it is a security concern so the taxpayers need to do it themselves instead of transferring the old digital signature from the existing portal.

The income tax department has advised every taxpayer to change or update their user ID, password, mobile numbers under primary contact information in their profiles while registering or at the time of new income tax login.

Taxpayers are also advised to link their Aadhaar with their pre-validate bank accounts if not have done before.

There is a high-security option offered to all the taxpayers. It is advisable to reset their income tax portal logins and e-filing to higher security options so that only you can access your account.

How To log in new income tax portal?

The login process at the new income tax portal is quite easy and secure. The portals itself provide the guideline on how to login new income tax portal.

A taxpayer can log in using their PAN, Aadhaar, and other user IDs and reset their accounts to higher security options.

Let us guide you, how to log in new income tax portal using PAN and Aadhaar.

Step 1- visit the new income tax portal www.incometax.gov.in

Step 2- Click on the login option at the top right corner of the website

Step 3- Enter your PAN/Aadhar into the user ID box and click on continue

Step 4- You need to confirm your Secure Access Message by entering the password in the box and click continue

Step 5- tick the option to receive a 6-digit OTP on your primary registered mobile number or via voice message or text. Click again on Continue

Step 6- Enter your 6-digit OTP correctly within 15 minutes and click LOGIN.