Table of Contents

ToggleArticle Content

- Introduction

- How New User Can Register for Axis Bank Internet Banking?

- How to Login to the Axis Bank Internet Banking Portal?

- What are the Services Available on Axis Bank Internet Banking Portal?

- What are the Steps to Transfer Money Through Axis Bank Internet Banking?

- What are the Transaction Limits & Charges Applicable on Axis Bank Internet Banking?

- What are the Steps to Reset Password in Axis Bank Net Banking?

- What are the Steps to Check the Account Balance Through Axis Bank Internet Banking?

- How Can You Pay Credit Card Bills Through the Axis Bank Internet Banking Portal?

- FAQ’s

Introduction

Axis Bank is the third-largest private sector bank in India. In addition to serving customers, Axis Bank offers a large array of financial services to the big corporates, MSMEs, agriculture & retail sector businesses.

The users can avail Axis Bank Net banking services by the following:

- Internet Banking

- Mobile Banking

- Phone Banking

- Doorstep Banking

Below are the details you must know about Axis Bank Internet banking.

Ownership Type | Private |

CEO | Amitabh Chaudhry |

Headquarters | Mumbai |

Customer Service | 1860 419 5555 |

Founded | 1993 |

How New User Can Register for Axis Bank Internet Banking?

There are two ways to log in to your Axis Bank internet banking.

There are two ways to log in to your Axis Bank internet banking.

Method 1: Through an Online Portal

- Visit the Axis bank net banking portal Click To Visit

- Click on ‘First-time User? Register’

- Enter your 9 digit Login ID. You will find your 9 digit customer ID on your welcome letter & your cheque book. Your customer Id is your Login ID.

- Click ‘Proceed’ after entering the Login ID.

- Enter the user details & other required details. Then click ‘Proceed’ to reach the next step.

- Enter the new password, & re-enter the password. Enter 4 Digit Pin & the registered mobile number to complete the registration.

Method 2:

Send your 9-digit customer ID via SMS to 5676782 Now after registration is complete, you will have to log in to the Axis bank internet banking portal for using the net banking services.How to Login to the Axis Bank Internet Banking Portal?

You can Login to your Axis Bank Internet Banking Accounting in three ways:

- Login ID

- Debit Card No

- mPIN

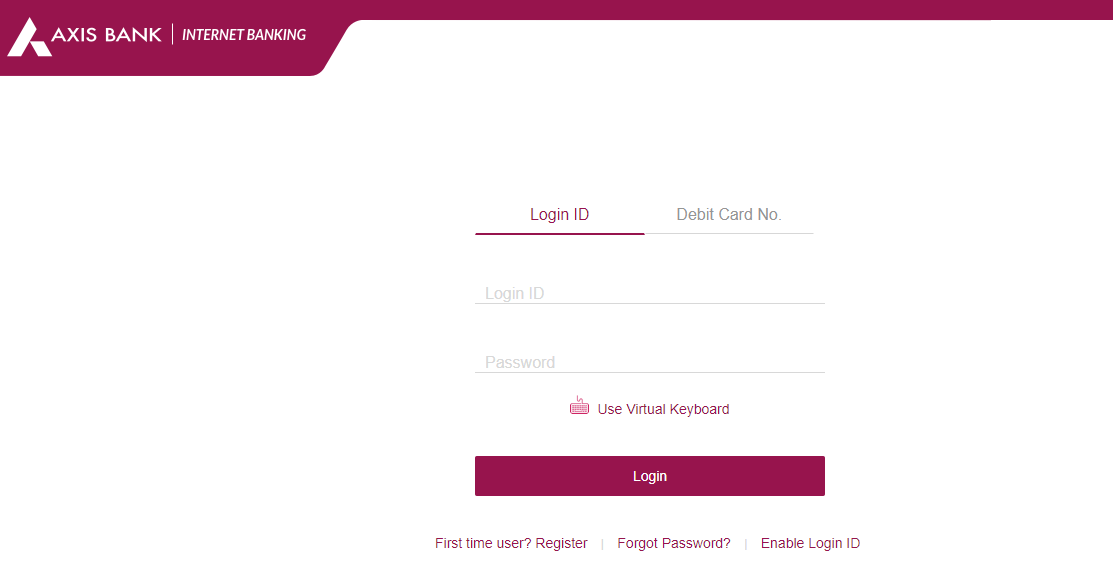

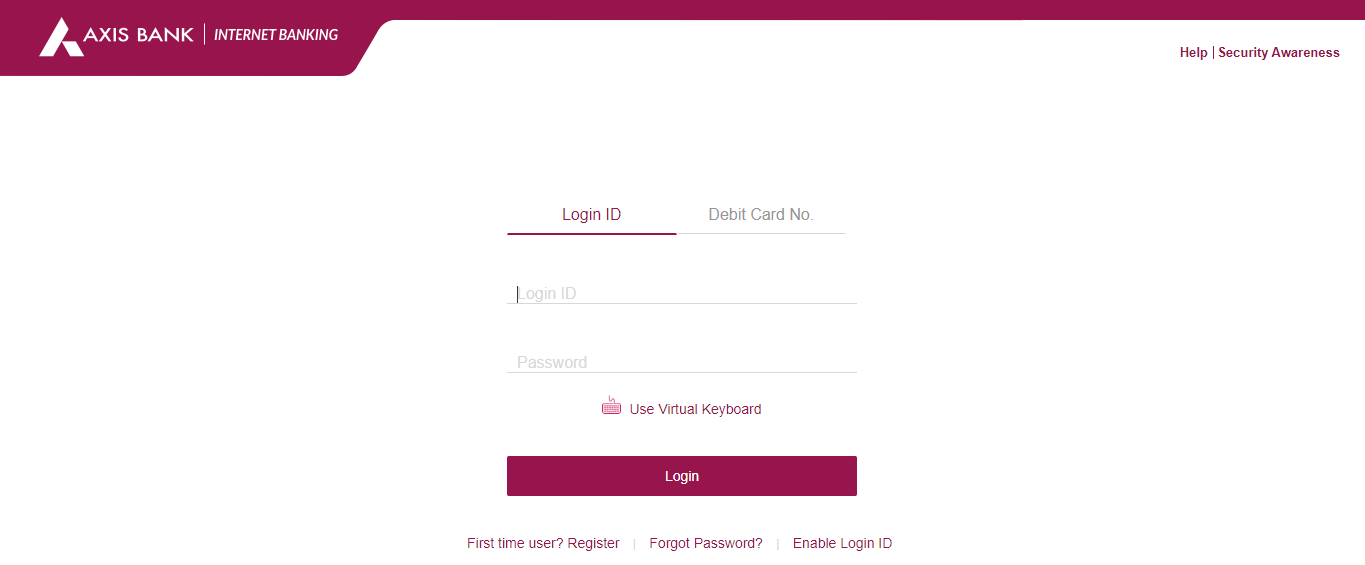

Method 1- Login ID

It is a simple three-step process to Login into your axis bank online banking account. Simply follow the steps below:

- Visit the Axis Bank login portal Click To Visit

- In the field labeled as Login Id, enter your 9 digit customer ID

- Then enter the password you have set, and click ‘Login’

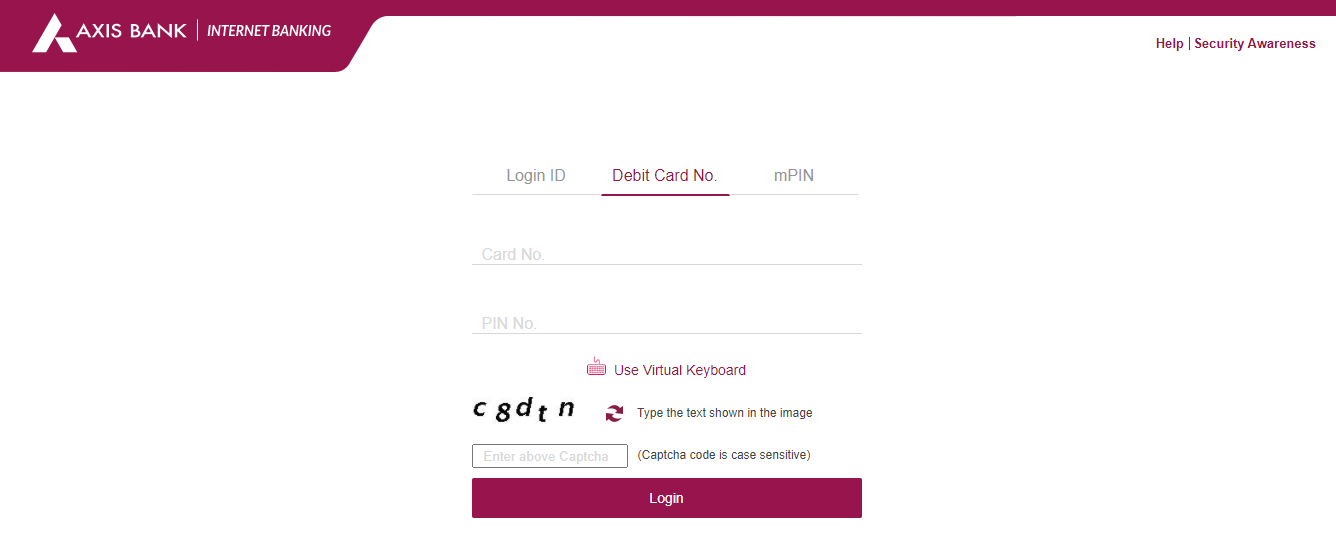

Method 2- Debit Card No.

- Visit the Axis Bank Internet Banking login portal Click To Visit

- Select the ‘Debit Card No’ tab

- In the field labeled as card no, enter your 16 digit Debit card number

- Then enter the debit card pin & the captcha as shown.

- Click ‘Login’ to proceed

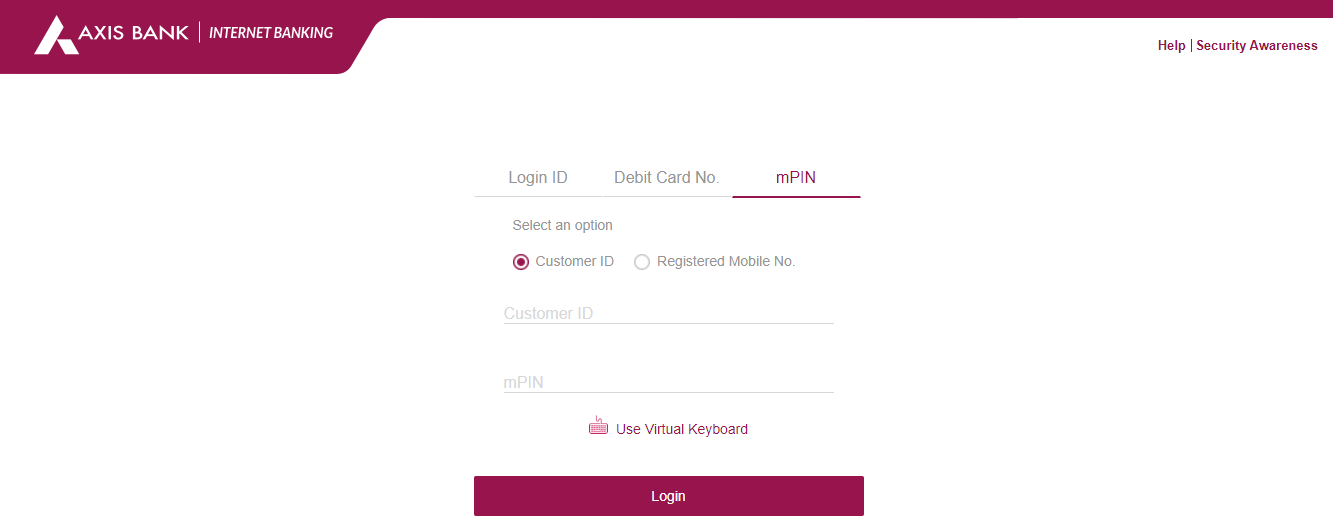

Method 3- mPin

- Visit the Axis Bank login portal Click To Visit

- Select the ‘mPIN’ tab

- Now select ‘Customer ID’ or ‘Registered Mobile No’

In the case of ‘Customer ID’

- In Customer ID enter your Customer ID & mPin as required.

- Click ‘Login’ to proceed

In the case of ‘Registered Mobile No:’

- In Registered Mobile No. enter your Mobile no & mPin as required.

- Click ‘Go’ to proceed. You will receive an OTP on the registered mobile no.

- Enter the received OTP

What are the Services Available on Axis Bank Internet Banking Portal?

Through Axis Bank Internet Banking portal your take benefit of the below-mentioned services:

- View your account details

- View your account balance

- Download account statement (monthly, quarterly, yearly or custom)

- Access your demat, loan details

- Access & manage your credit cards

- Fund Transfer through RTGS, NEFT, IMPS, Quick Transfer to your or other bank accounts, either within the bank or outside.

- Request for cheque book and demand draft

- Stop cheque payment

- Update PAN and address

- Block Credit/ debit Cards

- Open FD/ RD/ or investment plans

What are the Steps to Transfer Money Through Axis Bank Internet Banking?

If you want to transfer money to any bank account within Axis bank or in any other bank, follow the below steps:

Step 1: Open your Axis bank net banking login portal, enter your login ID and password.

Step 2: Under the ‘Accounts’ tab, click on the ‘Transfer Funds’

Step 3: Choose the type of transfer you are going to have—’My Own Axis Bank Account’, ‘Other Axis Bank Account, and ‘Other Bank Account’.

Step 4: First select your own account from which you want to transfer the money. Then select the account you’re transferring the money to. One thing you need to know here is, for transferring the money via net banking you must add the recipient account as a beneficiary to your account.

Step 5: Enter the amount of money in digits you wish to transfer. You can also add remarks if needed (it later helps you in recognizing the transactions) & then click the ‘Transfer’ button.

Step 6: Carefully verify the information displayed and click ‘OK’.

Step 7: Enter the login ID and password to confirm that the transaction is being carried out by the authorized person.

Step 8: A successful transaction message will be displayed on your screen.

What are the Transaction Limits & Charges Applicable on Axis Bank Internet Banking?

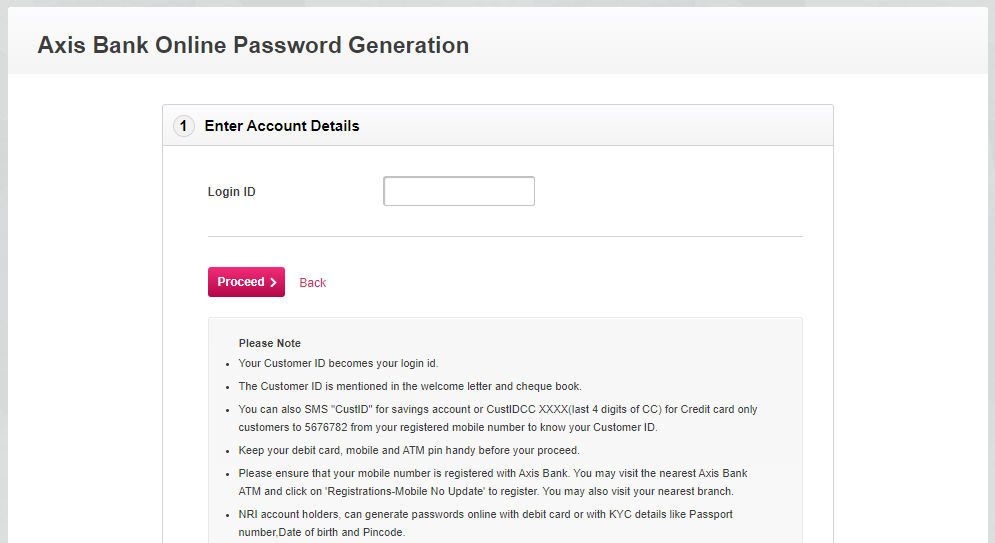

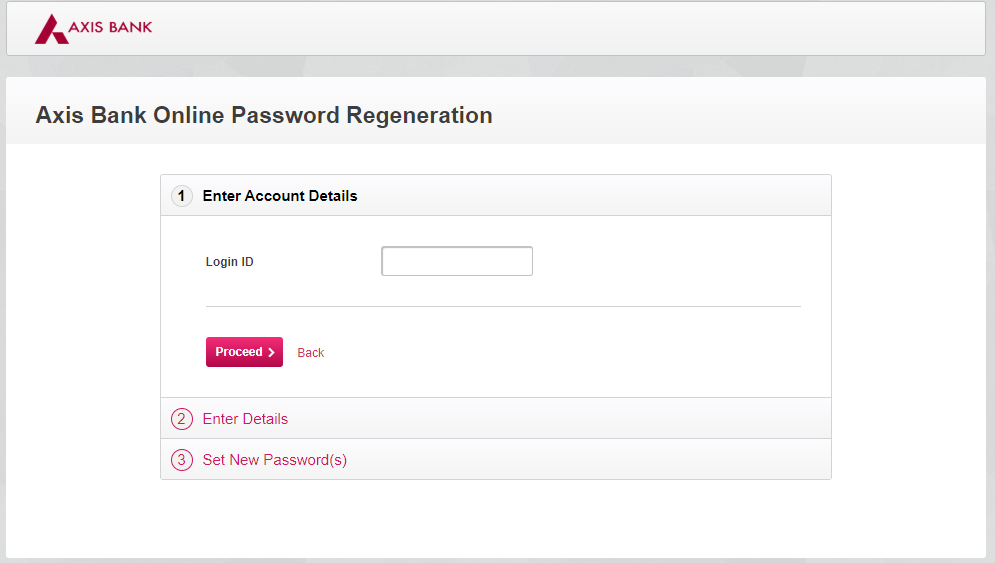

What are the Steps to Reset Password in Axis Bank Net Banking?

Step 1: As stated above, visit the Axis Bank internet banking portal by following the steps and login into your account.

Step 2: At the bottom of the screen, you will see a ‘Forgot Password’ option. Click on that.

Step 3: After entering the login ID (your customer ID) click ‘Proceed’

Step 4: Enter the required details like debit card number, PIN, and the registered mobile number to authenticate your ownership of the account before proceeding to the next step.

Step 5: Set a new password by entering the chosen password twice

Step 6: A password change success message will be displayed on your screen.

After resetting the password, you can log in to your Axis bank net banking account with the new password.

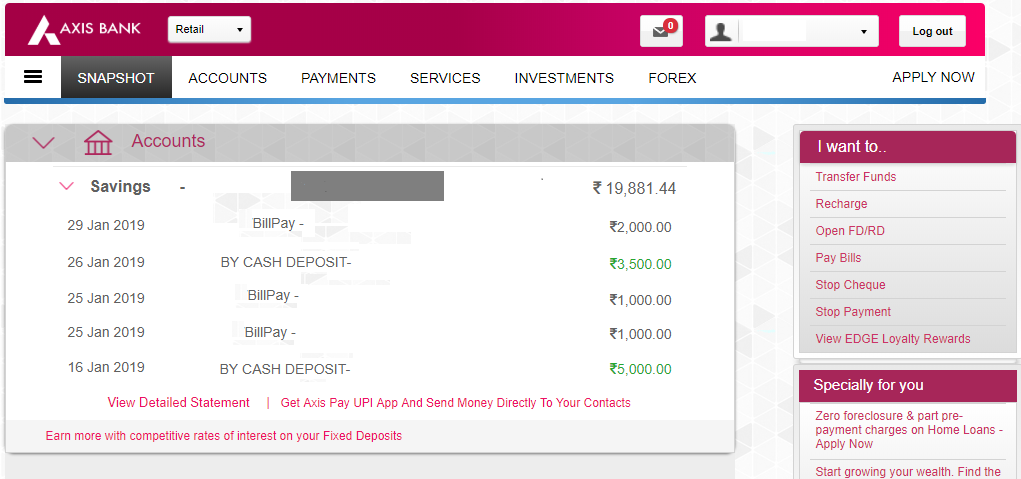

What are the Steps to Check the Account Balance Through Axis Bank Internet Banking?

Step 1: Log in to your account on online Axis bank net banking to view the dashboard

Step 2: All your accounts, RD, FD will be displayed on the dashboard along with the account balance of each such account.

Step 3: Further, you can click on any of the displayed accounts that you own to see the account details, recent transactions, account balance, etc.

How Can You Pay Credit Card Bills Through the Axis Bank Internet Banking Portal?

In addition to all other services, Axis bank online net banking gives your many more options like paying your bills. You can easily pay your credit card bills via Axis bank Internet banking portal.

Step 1: First thing you need to do is log in to your account

Step 2: Go to the ‘Payments-Pay Bills’ section on the dashboard

Step 3: If your card is not added to the account click on ‘New Biller’ to add card details

Step 4: After adding the details, Select ‘Pay Bill’ under ‘Credit Card Biller’

Step 5: Enter the required details & the amount you wish to pay

Step 6: Click ‘Proceed’. Keep your mobile with registered mobile number handy

Step 7: To successfully complete the transaction, enter the OTP you received on the registered mobile number