Article Content:

- What is Deferred Income Tax Asset and Liability?

- Temporary and Permanent Differences

- Deferred Tax (DT)

- Virtual Certainty

- Deferred Income Tax Calculation – DTA and DTL

- Deferred Tax Asset

- DTA/DTL Calculation

- Tax Holiday on DTA/DTL

- Tax Holiday Example

- How DTA/DTL will affect Minimum Alternate Tax?

- Is MAT credit a deferred tax asset?

What is Deferred Income Tax Asset and Liability?

Deferred Tax Asset (DTA) or Deferred Taxes Liability (DTA) plays a huge role in financial statements. This adjustment is made while closing the Books of Accounts at the end of the year and it affects the outgoing income tax for the business for the financial year and in the future.

Temporary and Permanent Differences Between Deferred Income Tax Asset and Liability

The book profits of the company are calculated from its financial statements prepared as per the Companies Act and its taxable profit is calculated as per the Income Tax Act.

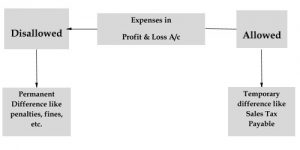

Due to some timing differences, there are some differences between taxable profit and book profit. For tax purposes, these are sometimes allowed or not allowed every year. The timing difference occurs between taxable income/expenses and the book and it can be one of these:

-

Temporary – When the difference lies in between tax income and book income which can be reversed in the future.

-

Permanent – When the difference is between tax income and book income which cannot be reversed in the future.

Deferred Tax (DT)

The deferred income tax is effective because of differences in timing. It is completely referred to as the delayed taxes. Deferred tax is recognized on permanent and temporary differences. The deferred income tax in cash flow statement is effective with deferred tax liability and deferred income tax assets.

| S. No. | Status of Entity Profit | Current Entity | Future Entity | Effect |

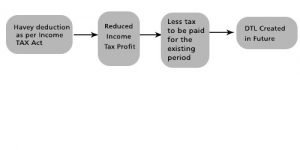

| 1. | Profit is booked that is above taxable profit | Less tax payable now | More tax is payable in future | Deferred Tax Liability (DTL) |

| 2. | Profit is booked that is lower than taxable profit | More tax is paid now | Less tax has to be paid in future | Deferred Tax Asset (DTA) |

Considering the timing differences based on carrying forward losses or unabsorbed depreciation, DTA is well regarded only in case of certainty in the future. It means deferred tax assets are realized when sufficient taxable income in the future is estimated by the company properly. For virtual certainty, this test should be done on the balance sheet every year. Those DTL/DTA must be written off when you don’t fulfil the condition. Only profits related to the profession or business must be taken into consideration when calculating taxable income in the future, instead of considering other sources of income.

Virtual Certainty

Based on experience, capital expenditure in the future, restructuring in the future, sales estimation, etc, a future profit projection from an entity submitted for loan purposes to the banks is a great example of virtual certainty. But if this virtual entity is based only on some export orders with the chances of cancellation, it is not convincing anymore. Virtual certainty should rely on most likely projections shortly.

Deferred Income Tax Calculation – DTA and DTL

Deferred Tax Asset – Suppose an entity has book profit without taxes is Rs. 1000 including bad debts’ provision of Rs. 200. Bad debts will be included in the future for tax profit when it’s written off. After this disallowance, the taxable income is Rs. 1200. The tax will be levied on Rs. 1200. Suppose 20% is the rate of income tax, it would be Rs. 240 (i.e. 1200×20%).

The tax would have been paid on Rs. 1000 if bad debts were not allowed, i.e. Rs. 200 (1000×20%). Since Rs. 40 is paid already, the deferred tax asset would be entered as –

Deferred Tax Asset Dr 40

To Deferred Tax Expenses Cr 40

(Being Rs. 40 as DTA recorded in the books)

Deferred Tax Liability – Depreciation is the most common example of Deferred Tax Liability. When the rate of depression is higher according to the Income Tax as compared to the rate of depreciation according to the Companies Act, less tax would be paid for the existing period. This way, deferred tax liability would be recorded in the books.

There is no deferred tax on provisions for permanent changes. For example, penalties and fines belong to book profits but they are disallowed for taxation. So, it is known as the permanent difference.

Deferred Tax Asset

The deferring tax asset falls under non-current assets and deferred tax liabilities under non-current liabilities. As they are enforceable legally and there is no intent to settle the liabilities and assets on a net basis, one can adjust both DTA and DTL with one another.

DTA/DTL Calculation

Here’s the illustration of creating DTA/DTL in books:

| Particulars | Book | Tax | Difference | DTA/DTL

30% |

| Total income | 1000 | 800 | 200 | |

| Op. Balance (DTA/DTL) | – | – | – | – |

| Depreciation | 100 | 200 | 100 | 30 |

| Sales Tax to be paid | 50 | 0 | (50) | (15) |

| Encashment of leave | 200 | 100 | (100) | (30) |

| Closing Balance (DTA/DTL) | – | – | – | (15) |

Tax on Taxable income = 240 (800×30%)

Deferred Tax = (15)

Net effect on tax = 225

- The above rate applies to the companies with an annual turnover of above Rs. 400 Cr. and that hasn’t opted under Sections 115BA, 115BAB, and 115BAA.

Tax Holiday on DTA/DTL

The tax holiday is a deferred tax benefit for new businesses in free trade zones under sec. 10A and 10B of Income Tax Act 1961 for 100% export-based undertakings. Some taxes have been exempted by the government to promote the consumption and production of some goods for a while. For the timing difference, the deferred tax reverses during the period of a tax holiday. It shouldn’t be considered during the tax holiday for an enterprise. The deferred tax which reverses after that period should be recognized in the year of incorporation.

Tax Holiday Example

In 2015, XYZ Ltd was founded as a tax-free business as per section 10A. So, it will be tax-free till 2025. In terms of depreciation, there is a timing difference (suppose the rate of tax is 30%).

| Year | Depreciation deducted from timing difference |

| 1 | 200,000 |

| 2 | 300,000 |

Deferred tax liability is not considered in tax-free companies for timing differences which reverse and originate in the period of the tax holiday. DTL can be formed only in the origination of timing differences in tax holiday and reverse after the period. The FIFO method is used to make adjustments. In the example above, suppose Rs. 80,000 reverses in the period of the tax holiday, the deferred tax liability is created on the balance only and it will be formed as follows:

| Year | Difference of timing | Deferred Tax Liability @30% |

| 1 | 1,20,000 (200000-80000) | 36,000 |

| 2 | 300,000* | 90,000 |

- Full reversal of timing difference followed by the period of the tax holiday.

In the end, the total Deferred Tax Liability balance is Rs. 1,26,000 after the second year.

How DTA/DTL Will Affect Minimum Alternate Tax?

A company has to pay Minimum Alternate Tax (MAT) if the tax payable is less (according to the provision of the Income Tax Act) as compared to 18.5% of book profit. MAT tax is paid as per section 115JB of the Income Tax Act and computed as per the book profit of the entity.

The following factors increase the book profit :

- Deferred tax provision

- Provision or payment of income tax

- Amount moved to a reserve

- Provisions for unascertained liabilities

The following factors are responsible to decrease the book profit:

- Deferred tax Cr. to Profit & Loss account

- Carry forward of Lower of Loss or unascertained depreciation

- Amount from any provision or reserve

- Depreciation Dr. to Profit & Loss A/c (excluding depreciation related to revaluation)

Whether DTL debited to Profit & Loss must be included in the book income for calculating MAT is still a controversial topic. It is not correct to hold back the DTL as per Kolkata Tribunal in the case of Balrampur Chini and it should be held otherwise as per the Chennai Tribunal in the case of Prime Textiles Ltd.

“Deferred tax is a provision for the effect of tax for the difference in accounting income and taxable income instead of being a tax provision. Also, deferred tax cannot be called income tax payable or paid. The reserves are different that are given in Section 115JB and it can be used for bonus shares and transferred to Profit & Loss A/c. But amounts for a deferred tax cannot be utilized or transferred.”

“According to the Chennai Tribunal, AS-22 is important according to Companies Act section 211(3). But the Central Government hasn’t notified it under IT Act section 145(2). Alongside, the DTL is not a liability, and the assessing officer can make changes in this regard as it is not termed for audited accounts tinkering prepared as per the Companies Act.”

In this regard, there are conflicts and it needs further clarification from the high court or government.

Is MAT credit a deferred tax asset?

DTA and DTL exist because of the difference between taxable income and book income, according to AS22. They don’t increase as the tax expense. There is no rise given by the deferred tax credit to any difference in taxable income and book income. So, MAT shouldn’t be considered as a DTA as per AS22.