Table of Contents

ToggleWho is Eligible for e-invoicing?

The e-Invoicing process has to be followed by every taxpayer who:

- Has a turnover of INR 100 crores (as per the latest update of 1st January 2021) or more (based on PAN card) in the previous financial year.

- B2B Issued invoices.

- Those who Supplies goods or services or both to a registered person.

Note:

- Taxpayers involved under Exports and Deemed Exports are only liable for e-Invoices.

- Suppliers to SEZs will be eligible under e-Invoicing.

- SEZ Developers who have the defined turnover are required to generate e-Invoices.

- DTA units are required to issue e-Invoices if all the guidelines are met.

Who are exempted from e-invoicing?

The following categories of taxpayers are exempted from the e-Invoicing process:

- Any Insurance Company.

- Banking Company including a Financial Institution, including a Non-Banking Financial Company (NBFC)

- Goods Transport Agency (GTA) transporting goods by road in a goods carriage services.

- Any transport service provider agents, who are providing passenger transportation service

- A registered person who is providing services of – admission to an exhibition of cinematograph films in multiplex screens.

- Special Economic Zone (SEZ) units

- Free Trade & Warehousing Zones (FTWZ)

Note:

- B2C invoices issued by notified persons are not under the provision of e-Invoicing currently.

- E-Invoicing is not applicable for the Entry of import Bills.

- When notified persons receive supplies:

- From an unregistered person under GST (attracting reverse charge) or through the services of import, e-invoicing is not applicable.

How to Check E-Invoicing Eligibility on IRP?

Taxpayers can view eligibility of a GSTIN on the e-invoice portal. To do the same follow the given steps:

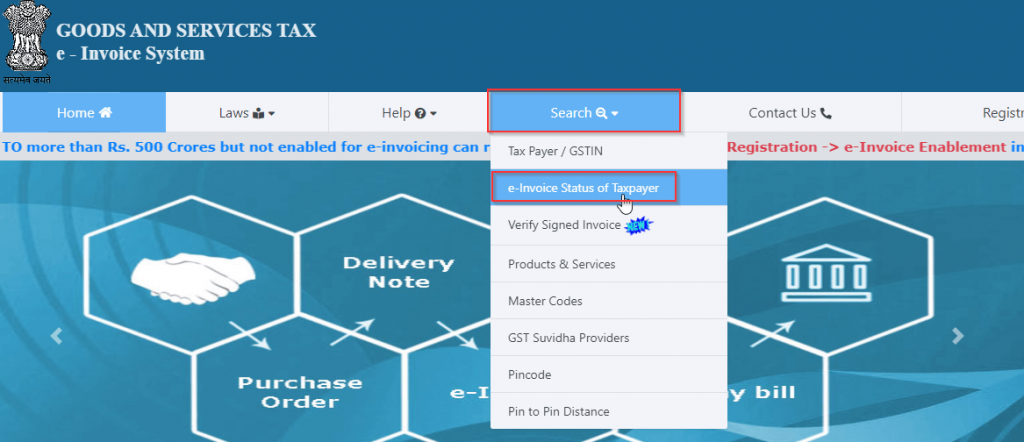

Step 1: Firstly go to https://einvoice1.gst.gov.in/

Step 2: Under the ‘Search’ tab, select ‘e-Invoice Status of Taxpayer’.

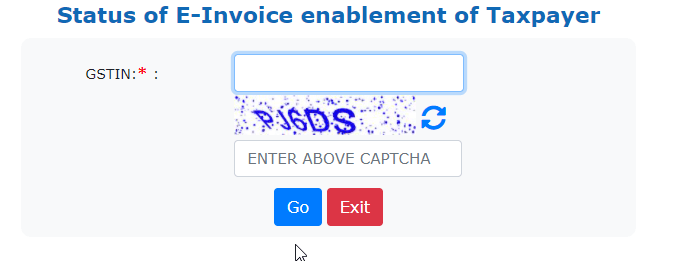

Step 3: Enter your ‘GSTIN’ and ‘Captcha’ code then click on ‘Go’.

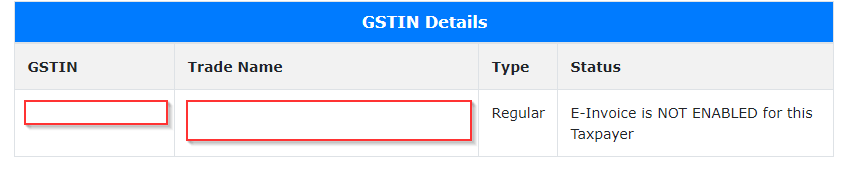

Step 4: View the submitted details on the IRP.

Note: In case of person is not registered with the e-invoice portal then firstly they need to register themselves on the portal.

How to Do Registration on IRP?

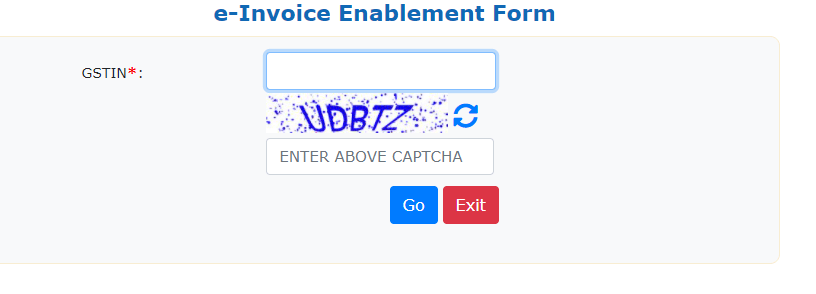

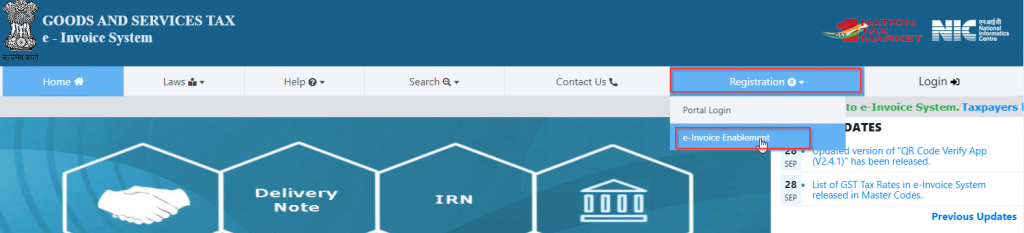

Step 1: Vist https://einvoice1.gst.gov.in/

Step 2: Under the Registration tab, select ‘e-Invoice Enablement’.

Step 3: Add the required details and proceed.

- Mention the GSTIN & captcha code.

- Then click on ‘Go’