Article Content

- What Is Form 16?

- Parts Of Form 16

- Types Of Form 16

- Who Is Eligible For Form 16?

- What Is The Benefit Of Form 16?

- How To File Income Tax Return With Form 16?

- How To Download Form 16 Online?

What is Form 16?

Form 16 is a type of document that an employer-issued to their salaried employees at the time of filing for the income tax return for the particular financial year. It is compulsory to issue form 16 by an employer under section 203 of the Income Tax Act, 1961, if the tax is deducted at the source.

Every employer or organization is liable to deduct TDS before salary unless the employee’s salary is not taxable according to the income tax slab rates of that particular financial year.

Income tax form 16 is also known as the “salary certificate” as it contains all the financial detail of the employee such as annual salary and investments details with PAN number as given by the employee itself.

In short, Form 16 is the proof of tax deducted and deposited to the government by the employer on behalf of his/her employees.

Parts Of Form 16

Now, let’s discuss what is in form 16? As it is one of the most important income tax forms for salaried individuals. Well, income tax form 16 is divided into 2 parts.

- Part A

- Part B

Here we will not only explain to you what these parts contain but also how to fill the form 16 online?

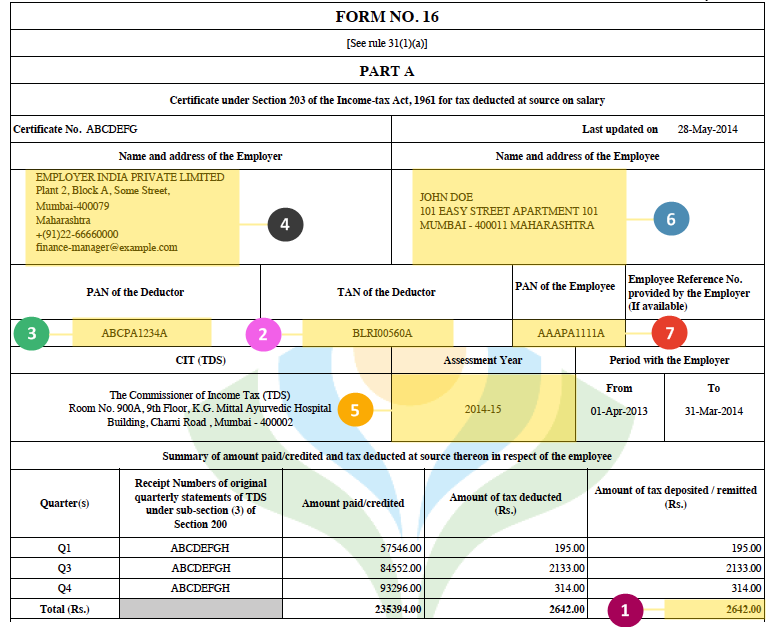

Form 16 – Part A

Part A asks for the following details that are necessary to be answered correctly. This part contains all the details regarding your salary income and Tax Deducted at Source.

- Name and address of the employer and employee

- PAN and TAN details of the deductor or employer

- PAN of the employee

- Employee reference number (if have any)

- Details of tax deducted and deposited by employer quarterly

- Assessment year

- Period with the employer since a particular employee is working

- Date of the tax deducted and deposited

- Acknowledgement number received from the TDS payment

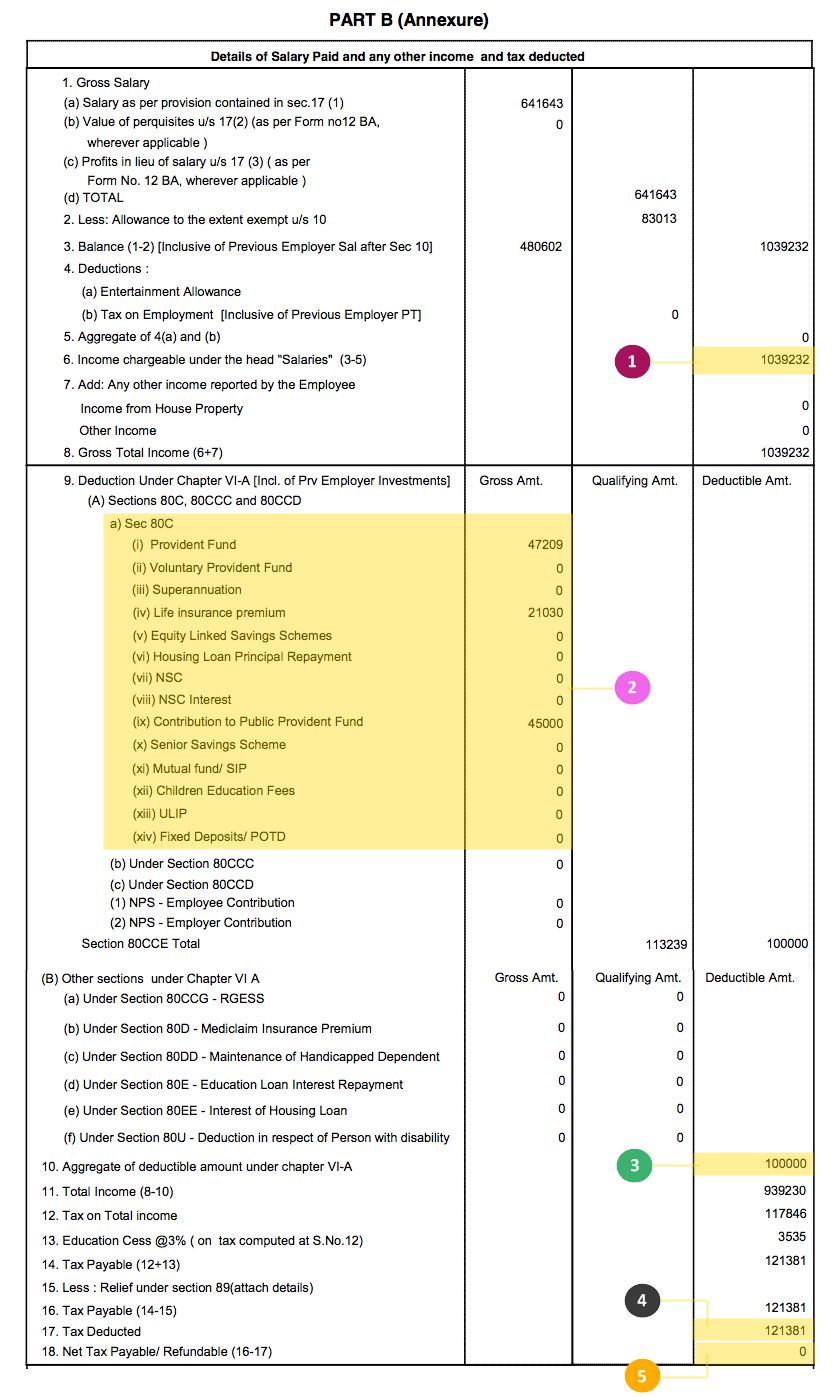

Form 16 – Part B

Part B contains:

- Total salary received by the employee till that period

- Exemptions under section 10, If any such as housing rent, tuition fee, medical bills, etc

- Gross income (salary plus other income disclosed to employer)

- Deductions from salary before tax paid (life insurance, PPF, etc)

- Net taxable salary

- Education cess and surcharges, if applicable

- Rebate and relief under sections 87 and 89 respectively, if applicable

- Tax payable on income

- Tax deducted at the source

Types Of Form 16

Income tax form 16 includes three types of forms.

- Form 16

- Form 16A, and

- Form 16B

Now, when you already understand what Form 16 is. Let’s get you familiar with Forms 16A and 16B.

Form 16A:

Form 16A is also a type of income tax certificate for the deduction of the TDS on the income earned by other sources but salary. Form 16A is applicable on all other sources of income such as interest collected from the bank, rent, insurance, commission, and interest earned on fixed deposits.

It requires information like the name and address of deductor and deductee, PAN and TAN number, and challan details of the TDS deposited when you will ask for the income tax return.

Form 16B:

Like Form 16A, form 16B is also proof of the TDS deduction and deposit for the amount deducted at the sale of the property. Buyer deducts the TDS on sale of property from seller’s account and submits it to the Income-tax department.

The seller can ask for an income tax return by submitting form 16B at the end of the fiscal year. The buyer can deduct 1% of the total sale amount of the immovable property and submit it to the government and give form 16B to the seller as proof of TDS deduction.

Who is Eligible For Form 16?

The purpose of issuing the form 16 by an employer as a certificate and proof of the tax deducted and deposited to the government for the specific period.

Therefore, the eligibility criteria form 16 according to the regulations issued by the Finance Ministry of Government of India are if a salaried employee falls under the taxable bracket of that particular financial year then TDS will be deducted by the employer or company. Thus, form 16 will be issued.

If your income from the salary doesn’t fall under the bracket then you automatically don’t require form 16. However, some companies still issue this form to all of their employees as it contains all the details of the salary break up, reliefs, and exemptions for the specific period.

What is the Benefit of Form 16?

Income tax form 16 is beneficial for so many reasons such as:

- Form 16 acts as proof of the tax deducted and deposited to the income tax department by the employer from your salary for the specific period.

- It is an important and necessary document at the time of filing for income tax returns as it contains all the details of the TDS.

- Form 16 plays a crucial role while applying for loans from banks and other financial institutes

- It can be used as a supporting document for issuing Visa

- It also represents the stable and continuous income source

- Form 16 alone can provide clarity on an individual’s salary, tax computation, and refunds

How to file Income Tax Return with Form 16?

As you are already know that Income Tax Form 16 is used for filing the Income Tax Return. As it contains all the details of your income from salary, tax deducted at source, and exemptions/allowances.

Things that you will need to file the income tax return with form 16 are:

- Taxable salary

- Tax deducted at source by the employer

- Employer’s TAN and PAN information

- Name and address of the employer

- Name and address of the employee or taxpayer

- PAN details of the employee

- Assessment year for which TDS has been paid

- Allowances that falls under section 10 of the Income Tax Act

- The breakup of the deductions according to section 16 of the Income Tax Act

- Income from other resources as disclosed to an employer by an employee such as rent from house property, interest, commission, and many more

- The breakup of the deductions from gross salary based on chapter VI-A of the Income Tax Act under section 80C,80CCC, and 80CCD(1), 80CCD(1B),80CCD(2), 80D, and 80E.

- Information of TDS deducted at every quarter under chapter VI-A including the deductions under section10 (a,b,c,d,e,f,g,h,I.j, and 1) of the Income Tax Act.

- Net tax payable or refund due

You only need to submit form 16 while filing for ITR instead of all separate documents. This will make the process of income tax returns much easier and faster.

How To Download Form 16 Online?

Now, you can even download form 16 for salaried employees from the official website of the Income Tax Department. The procedure of form 16 download is very simple.

Follow these steps to download form 16 for salaried employees:

- Step 1- Go to the official website of the income tax department (https://www.incometaxindia.gov.in/pages/default.aspx) or click on the button given below.

- Step 2- Choose the “Income Tax Forms” option under section “Forms/Download”

- Step 3- Once you find form 16, you will see two options – form 16 download pdf and fillable form

- Step 4- Click on the option of your choice

- Step 5- Click on download and you have your Form 16.