Every business needs finances to operate smoothly, and hence the management should have sound knowledge of the financial statements to manage them efficiently in the business. Let’s discuss the same subject in-depth.

Article Content

- What Are Financial Statements?

- Types of Financial Statements

- Other Financial Statements

- How Financial Statements Help Businesses?

- FAQs Of Financial Statements

What Are Financial Statements?

DEFINITION: Financial statements are formal records that convey the records of all financial transactions & activities of a business. Every business activity can lead to a change in financial status in the form of an asset or liability. Financial statements are also documents prepared to convey these business activities by following global standards which are often audited by government officials, accountants, firms, etc. Financial statements include:

- Balance Sheet

- Income Statement

- Cashflow Statement

Also known as a statement of financial position Which helps the shareholders, management, government authorities, and investors to find the financial status of the organization.

Types of Financial Statements

- Balance Sheet: This report represents the current financial position of a company on the report date. The information is aggregated into the classifications of assets, liabilities, and equity.

- Income Statement: It begins with sales and then subtracts out all expenditure incurred during the reporting period to calculate net profit or loss.

- Cash Flow Statements: Basically, these statements contain the details of cash inflows and outflows in an organization during the reporting period. These include operating activities, investing activities & financing activities.

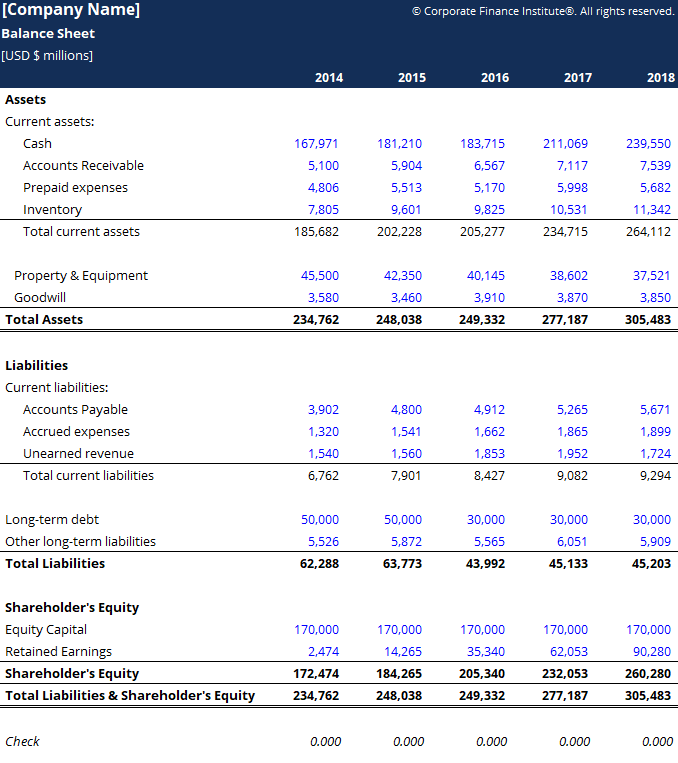

1) Balance Sheet

It provides an overview of current assets, liabilities, and equity present in the company.

It is a financial statement that is prepared after compiling data of the following:

Assets:- Including current assets like cash, inventory, accounts receivables, etc., and non-current assets like property, goodwill, machinery, and similar ones.

Liabilities:- Consisting of current liabilities like accounts payable, accrued expenses, deferred revenue, and non-current liabilities like long-term lease obligations, long-term debt, etc.

Shareholder’s equity:- Things like common stock, treasury stock, retained earnings, etc., are added to calculate shareholder’s equity.

Importance of Balance Sheet

- This statement of financial position helps in getting an insight into the financial health of the business

- Shareholders of the company are interested in this financial statement to understand the solvency ratio and performance of the business that may affect their decision.

- A collective report of balance sheets can help analyze the growth rate, which sets the parameters of the growth projection (of the future).

- Unforeseen risks and expenses can also be determined from this statement.

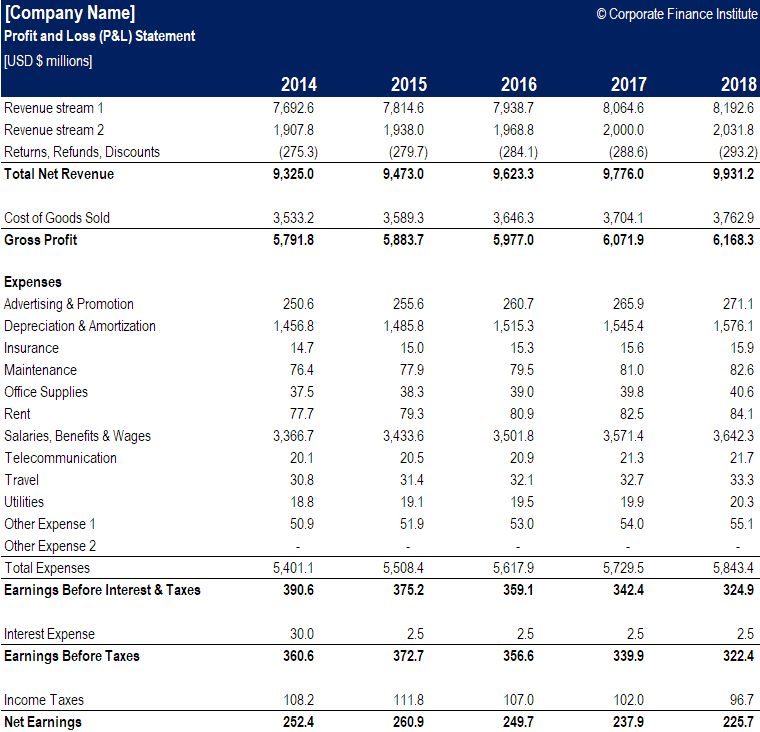

2) Income Statement

Other than this, there is Income Statement which is also known as the Profit and Loss Statement. This financial statement helps the management to make decisions by determining potential risks. This financial statement is important for filing taxes to comply with regulations. It acts as evidence of success in the business.

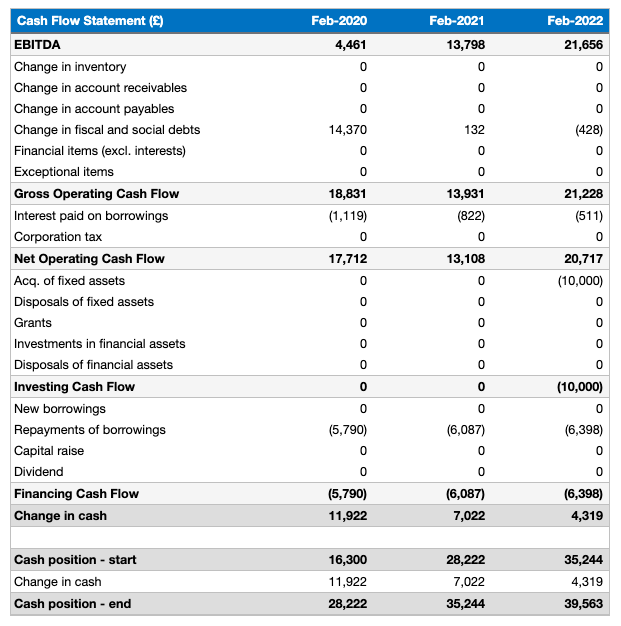

2) Cash Flow Statement

This financial statement helps in understanding how much cash is coming into the business in the form of revenue (including long-term loans) and how much cash is going from the business in the form of expenses. It helps in understanding the credibility of the organization and how the firm is managing to pay off the expenses. It complements P&L statements and Balance sheets.

This statement of financial position consists of three sections:

- Operating activities:- Includes activities like production, sales, the amount spent for sales or production like delivery of the products, etc.

- Investing activities:- sale or purchase of assets, debt received from the customers or made to the suppliers, etc.

- Financing activities:- Inflow or outflow of funds from/to investors like shareholders or banks.

- Other non-cash investing & financing activities are mentioned in the footnotes

Importance of Cash Flow Statement

- As cash is the most liquid asset in the business, tracking its inflow and outflow help in preparing a short-term plan for the business.

- Tracking the source of expenditure becomes easier as all the payments are mentioned collectively in other statements.

- It also helps in focusing on creating the sources of inflow to manage sufficient funds in the business.

- Analyzing the working capital becomes way far simpler.

Other Financial Statements

There are other two financial statements that can play an important role in managing the books of accounts. These are:

1) Account Receivables Statements

This statement helps in cash management as it provides information on all the accounts from which income is expected. If you want to expand your customer base, it is important to offer your goods or services on debt. But at the same, monitoring these account receivables is important; otherwise, the calculation of the income statement may be affected. Moreover, you may not be able to timely remind customers about their payment which may lead to a possibility of turning debtors into bad debts.

There are many methods to analyze this financial statement. These are:

- Use accounts receivables-to-sales ratio:- determines how much sales in the business is not paid

- Evaluate the method of fixing allowance for bad debts: it helps track all the bad debts as growth in this aspect indicates the inability to collect raised bills from the customers.

2) Budget And Actual Report

Every business sets a budget for different business activities, and it is important to keep track of it. It will help identify the expenditure and revenue against the financial projection included in the budget. So the budget and actual report help management to understand if their planned strategy is working as per the expectation or not. There are many types of budget reports like master budget, operating budget, cash budget, financial budget, labor budget, and static budget. The core components of any budget report are estimated cost, revenue, and cash flow.

How Financial Statements Help Businesses?

Financial statements provide financial records to the decision-makers of the company that’s necessary to make plans & choices. Accurate balance sheets, profit-and-loss records, balance statements and cash flow reports can give decision-makers up-to-date with the necessary information that can empower them to steer the organization. Moreover, these can help in managing the assets well to generate more revenue and also help in measuring financial performance and solvency.

On the analysis of these statements, one can make a better decision that contributes to an individual’s or company’s growth.

FAQs Of Financial Statements

[sp_easyaccordion id=”8585″]People also search for :