Article Content About Pan Card

- What is PAN Card?

- Eligibility To Attain a Pan Card

- Documents Required For The Pan Card

- Pan Card Costs

- Enrollment Method Of Pan Card

- How Pan Card Can be Edited?

- Do’s or don’ts while filing for Pan Card

- Pan card validity

- Pan Card Application Tracking

- Structure of a Pan Card

- Requirement of Pan Card

- PAN Card KYC

What is Pan Card?

PAN card stands for the permanent account number. PAN cards are given to those people who are earning and paying tax to the Government. It is a kind of identification for the taxpayers. PAN Card is a sort of electronic system by which all the tax-related information is recorded. It is a simple process done against the PAN Number. The PAN Number is the first source from where the information about the tax is collected and shared throughout the country. The PAN Number of any individual is unique which can have no similarity to anyone’s PAN Number.

Who Is Eligible To Attain a Pan Card?

Every individual, company, and non-resident of the country are eligible to attain a PAN card. It is just that, they have to be a taxpayer to the Government. If they are paying taxes, they are eligible to attain the PAN card.

What Are The Types Of Documents Required For The Pan Card?

When you go for a PAN card apply online, you need to have POI and POA. POI means proof of identity, whereas POA means proof of address. After these two documentations, the other documentation required on the base of the situation, such as:

| In the case of an individual | POA and POI are a must. Along with these two Documents, the individual requires an Aadhar Card, Passport, Voter Id or Driving License. |

| In the case of the hindu undivided family | An affidavit of HUF required from the head of HUF called Karta along with POI and POA. |

| Company registered in India | The registration certificate provided by the registrar. |

| In the case of firms or partnership (LLP) | Registration certificate from the registrar of firms and LLP. |

| In case of trust | A xerox of the trust deed. The registration certificate is given by the charity commissioner. |

| In the case of society | The registration number certification by the charity commissioner or by the co-operative society. |

| In the case of foreigners | OCI and PIO cards given by the government. Residential country’s bank statement. A copy of the NRE bank statement is essential in India. |

How Much A Pan Card Costs?

The cost of the PAN card online in India is Rs. 110 and if it has to be dispatched outside India then it will cost Rs. 1020 (Approximately).

The Enrollment Of Pan Card:-

When it comes to avail of the PAN card, it can be done in two ways, either online or offline.

Online Method:

- Visit UTIITSL and NSDL

- Just fill the PAN card form, enter the required entries, submit it and pay the fee to proceed

- After this, the PAN card will be delivered to the given address

Click Here to Apply Online for PAN Card

Offline Method:

- Get the PAN card application form the PAN center

- Fill the form and attach the required documents to it. Submit with the processing fee

- PAN card will be delivered to the given address

Click Here to Download Form 49A

How To Fill Pan Card Application Form

The PAN card will be delivered to the given address within 15 days in both the online and offline case.

How the PAN Card Can Be Edited?

- Visit the NSDL website and choose the update PAN section

- “Correction” option is to be selected for making the correction

What To Do And What Not To Do While Filling The Pan Card Form?

- Use capital letters to fill the form

- To update, fill up all the fields

- Mention a working mobile number

- Fill in relevant details in the form

- Make sure of the complete address mentioned in the form

- If self-attesting, make sure to mention the name and sign properly

- Attach the relevant documents required. Check everything after attaching

For How Long The Pan Card Is Valid?

An individual can use the PAN card for a lifetime.

How To Track The Pan Card Application?

The Income-tax Business Application (ITBA) offered the facility to track the PAN card now. The transactions and applications can be tracked easily with the given link for tax purposes.

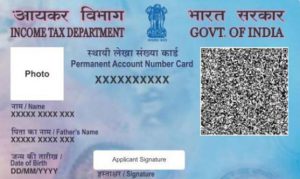

What is the structure of a Pan Card?

- Cardholder Name

- Father’s Name of the Cardholder

- PAN Number

- Date of Birth

- Signature

- Photo of the Cardholder

Why Pan Card Is Required?

PAN Card is a must-have for every taxpayer individual for:

- Proof of address

- Proof of identity

- Business registration

- Must to pay the Income tax returns

- An individual is able to open and operate bank accounts

- Gas and phone connection

- Mutual funds

After the union budget 2019, it is said that the taxpayers can use their Aadhaar card to pay tax returns.

PAN For E-KYC

KYC stands for know your customers. Now the Aadhar and PAN are compulsory to get linked with e-KYC. There are many benefits of e-KYC for PAN, such as:

- Documents can be managed digitally. Paperless work

- The information can be shared quickly with a secure channel

- The information is fully secured in a digitized way

- The working is paperless, so it is cost-effective also