Tag: featured

EPFO – What is EPFO, EPFO Latest News, Services & Functions

EPFO Latest News:

The EPFO has integrated a new option in the UAN portal, where the employees can themselves enter the date of leaving the previous company or employer. This will ensure the smooth transfer of the provident fund (PF) withdrawal if it is getting stuck by any technical issues or missing date of exit. Till now, only the employer was enjoying the privilege of entering the date the employees are leaving the organization. However, after the introduction of this facility in the Unified Portal, the employees will be able to enter the date by themselves and there will be no restriction from the employer. Sometimes employers fail to enter the exit date which leads to the delay in the settlements of PF claims. This facility has come as a savior for the employees, as from now they can ensure their hard-earned money is safe and secure with PF.

17, December 2020 - EPFO is likely to credit 8.5% interest rate for 2019-20 in the employees' provident fund (EPF) accounts of around six crore subscribers in one go by the end of December.

Article Content:

EPF Applicability

EPFO Structure

EPFO Functions

EPFO Services

EPF Applicability

The Indian Constitution stipulates that based on the “National Policy Guidelines”, the State should provide effective provisions within its economic capacity to guarantee the right to labour, education and public assistance. If you are unemployed, old, or sick. Obstacles and undue shortages. The need for active social security applications in a changing environment, in accordance with the spirit of this bureau, has led to pension fund laws as an effort to provide a dignified life once for employees and their dependents. They stopped getting their normality. Food

The Employee Pension Fund came into effect in 1951 when the Employee Pension Fund Ordinance (EPF) was promulgated. The EPF regulations were succeeded by the EPF Fund Act of 1952. The EPF Act was announced in parliament in 1952 and provided pension funds to employees in factories and other facilities. Currently, the law governing employee pension funds is known as the Employee Pension Fund of 1952 and other regulatory laws (also called laws). The law applies to all of India except Jammu and Kashmir.

EPFO Structure

The law and all its schemes are governed by a tripartite committee called the Central Council (EPF). There are government delegates, company & representatives.

The Central Management Committee (EPF) operates three schemes:

1952 Employee Pension Fund Plan (EPF)

Yes 1995 Employee Pension Plan (EPS)

Insurance plan linked to 1976 employee deposit (EDLI)

The EPF Organization (EPFO) is an organization established to support the Central Management Committee (EPF) and is under the control of the Indian Government's Ministry of Labour and Employment.

EPFO Functions

EPFO supported the Central Management Committee (EPF) in managing pension fund plans, pension plans and insurance plans for facilities registered in India and was covered with employees of such facilities. EPFO portal operations include national legislation (excluding Jamu and Kashmir), personal account maintenance, bill settlement, investing funds, guaranteeing immediate pension payments, and record updates & EPFO Login.

Even the EPF companies are one among the biggest protection associations of India, equally in terms of transactions of exemptions foundation and amount. EPFO's highest decision-making body is the Central Management Committee.

EPFO takes several steps to simplify the operation of both employer and employee EPF accounts by employing IT-enabled tools and technologies. EPFO has recently implemented many digital initiatives.

In general, the EPFO serves a dual role of managing and overseeing the enforcement of the law, and also serves as a service provider for both employers and employees, the target beneficiaries including members.

You can access the EPFO website, which provides access to a variety of information and online EPFO services.

EPFO Services

☞ Universal Account Number (UAN)

EPFO introduced UAN. It acts as an umbrella with multiple member IDs assigned to individuals by different employers. It functions as an umbrella with many IDs delegated to folks from companies. Even the UAN application was started as a part of Pandit Deen Dayal Upadhyay Shramev Jayate Karyakaram in Oct 2014.

This is probably the most exceptional step taken by a recent EPFO. UAN is a unique number (12-digits) assigned to an employee by EPFO. It allows you to link multiple EPF (Member ID) accounts assigned to a single member. UAN, dynamically updated UAN card, updated PF notebook with all transfer details, ease of linking of the previous member ID and current ID, monthly SMS of PF account donation credit, Automatic activation transfer request in employment quota.

Employees need to enable UAN in the UAN portal to take advantage of the wide range of online services offered by EPFO.

☞ Inoperative Account online Support

The February 2015 online support service for inoperable accounts in the EPFO website configuration facilitated the monitoring of old or inactive EPF accounts that received no additional interest (no 36-month donations). EPF members can track, clear, or transfer an old inoperable...

EPF Withdrawal Online – How to Fill EPF Withdrawal Form Online?

Latest Update!

Interest rate on PF deposits increased to 8.65% from 8.55% for the FY 2018-19.

What is EPF?

Employees’ Provident Fund (EPF) is one of the oldest schemes offered by the Centre to ensure a safe and secure retirement of employees. Under this scheme, employees contribute 12% of their basic salary every month during their time under service and an equivalent proportion is contributed by the employer; together forming a corpus to the provident fund. According to the EPF Act, the employee can withdraw an approximate amount after attaining his 58 or during their course of employment under certain conditions.

There’s a whole lot of benefits under EPF and according to the latest update, the Interest rate on PF deposits has been increased for the fiscal year 2018-19 from 8.55% to 8.65%.

It is well known that every employee covered under the PF Scheme is allocated with a unique Universal Account Number (UAN). This 12-digit UAN is assigned to both the employee and the employer by the Employees' Provident Fund Organisation (EPFO), by virtue of which both of them could make a contribution to EPF. The UAN stays the same of life and thus the employee need not request for another number whenever he switches a job.

In this blog we will assist you in understanding the complex process of withdrawing EPF and how you can avail its benefits both Online & Offline.

Process of EPF Withdrawal

Online

Offline

Understanding the process of EPF withdrawal

Employees can withdraw their EPF amount in either of the two ways-

By submitting an application to the respective jurisdictional EPFO office

By submitting an online application through EPF Portal

Offline submission of the application to avail EPF withdrawal

Step 1: Visit EFPO India Portal, and download the updated composite claim (Aadhar/ Non-Aadhar).

Case 1: If the employee downloads- new composite claim form (Aadhar), he/ she is supposed to submit the filled form to the respective jurisdictional EPFO office. It is not mandatory to get the form attested by the employer.

Case 2: If the employee downloads- new composite claim form (Non-Aadhaar), he/ she must get the form attested from the employer after filing all the required fields and then submit it to the jurisdictional EPFO office.

Note: In case the employee wishes to withdraw a partial amount of EPF, he/ she can opt for a self-certification.

Online submission of an application to avail EPF

The massive campaign named ‘Digital India’, launched on 1st July 2015 introduced a large number of electronic government services to make the governmental processes easy for all the citizens. Just like others, one such online facility is recently given by EPFO. The entire online process of withdrawing EPF is simple to understand, execute and comparatively time-saving.

To apply for EPF withdrawal online, make sure that the following necessary conditions are met-

Check the status of UAN (Universal Account Number). It must be activated and the mobile number registered with it must be in working condition

The Universal Account Number must be linked with the KYC i.e. Aadhaar, PAN and bank details.

Note: In case of absence of any of these conditions, approval from the employee’s previous employer is required.

Step 1: Visit the MEMBER e-SEWA portal to initiate the process.

Step 2: Enter your UAN, password and case-sensitive captcha code. Then click Sign In.

Step 3: A new screen will appear. Click on the ‘Manage’ tab and select KYC to check the correctness and verification of details mentioned like Aadhaar Card, PAN Card and Banks information.

Step 4: After complete verification of KYC details, click on the ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’ from the drop-down list.

Step 5: After clicking the Claim (Form-31, 19 & 10C), a screen will appear, displaying all the KYC details and member details. To verify, enter the last 4 digits of your bank account number and click on the ‘verify’ button. Then click on “Proceed for Online claim”.

Step 6: A warning pop up will appear, click on “Yes” to agree to the terms and conditions and to sign the undertaking certificate and click on “Proceed for Online claim” button.

Step 7: Open the claim form and select the type of claim you require under the ‘I Want To Apply For’ tab. The options available with you are:

Full EPF Settlement

Part EPF withdrawal (loan/advance)

Pension withdrawal

Note: There are certain situations in which these options don’t appear if the member is not eligible for any services like PF withdrawal or pension withdrawal.

Step 8: If the required option is available, select “PF Advance (Form 31)” for fund withdrawal. Enter the amount you want to withdraw, give a relevant reason for your withdrawal in advance and enter your verified address.

Step 9: Submit your online application by clicking on the certificate.

Note: In certain situations, employees are asked to attach relevant proof of documents along with the application and get the approval from the employer before making a...

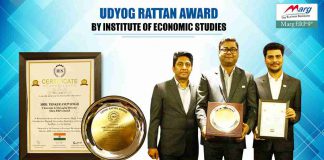

Marg ERP’s CMD Shri. Thakur Anup Singh Awarded Udyog Rattan Award

New Delhi: Marg ERP Ltd’s Chairman and Managing Director Shri. Thakur Anup Singh was awarded the Udyog Rattan Award- 2019 by the ‘Institute of Economic Studies’ for his exceptional work in transforming the Indian industry landscape how MSMEs can accelerate their business using technology.

The seminar held on October 19, 2019, at India Habitat Center, New Delhi and was packed with countless moments where industry leaders and scholars shared their intriguing views and beliefs. In this exclusive session, Thakur Anup Singh, CMD Marg ERP Ltd., shared his esteemed opinion & observations on ‘Better industrial Growth for MSMEs’. Progressing on the road to growth, he also presented his idea of expansion and the milestones Marg has set to achieve in upcoming years.

The “Udyog Rattan Award” was presented to Marg ERP Ltd. in recognition of its highly esteemed contribution through outstanding dedication towards the industrial development in India, by bringing technological innovation among 2,50,000 SMEs and are geared up to increase this number to 6,00,000 in the next few years.

Marg ERP Ltd., pioneer inventory management software for Pharma & FMCG Sector and second-largest player in providing accounting software in the country is looking to strengthen its foothold with peers and leaders to make India sparkle in both sector and the Udyog Rattan Award is a recognition of its efforts.

The Udyog Rattan Award presented every year to Indian citizens, for outstanding contributions to the economic development of the country. The award is conferred by the Institute of Economic Studies, India (IES), affiliated to the Government of India. Nominations are suggested by the existing members, and absolute care is taken there is no favoritism. Usually, there are hundreds of nominees and it takes several weeks time to shortlist & finalize the winner. The winners are selected by a panel of judges who are usually eminent citizens with economic backgrounds.

Marg ERP was started with the dream to work closely with MSMEs in the country and use the technical knowledge to create value & growth proposition from small to medium enterprises. Marg ERP believes that MSMEs are by far the richest pool of talented entrepreneurs and ideas. The key business technology & ongoing trends in a holistic manner will definitely deliver results in a fast-paced environment.

Marg ERP is committed to serving the MSME Sector and increasing the presence by strengthening the core to help the customers in a better way. Beyond knowledge and opportunities, Marg ERP has been closely associated with partners. Such a strong partner network helps to share ideas among small businesses, understanding their challenges and providing solutions heading towards economy & business growth.

Switch To An Invoice Software That Saves Your Time

The first and foremost step after selling a product or providing a service is generating an invoice to get paid. The action which is supposed to be the easiest and the happiest part turns out to be tedious if done manually. If we see way back in time, payments were made mostly via cash, even the books of accounts were managed manually, making this process way more hectic, erroneous and time-consuming. Fortunately, with the advancement in technology, we discovered invoice software, a software solution conquering all our invoicing issues and helping us with hassle-free invoicing and payments.

Sending and receiving payments doesn't have to be this much hard and due to regular innovations and development in technology, today, we can enjoy vast benefits but still many organisations are unaware of these new trends. It has come to the fact that electronic invoice processing is 3.5 times more efficient than paper processing. The number of invoices processed per employee by a company is 42 in a day whereas, the number of invoices processed per employee by a company processing invoices electronically is 479. From the stats above, we can easily conclude that companies relying on traditional ways of invoicing continue to face problems associated with it. So, here is why invoicing software is a must-have for every SME & MSME and what are its benefits.

Benefits of Invoicing Software

Aside from managing all invoice-related tasks like generating customizable invoices, sending invoices, making electronic payment transfers through integrated banking, multiple-currency setting and generating reports efficiently, good invoicing software extend the following benefits also:

No more delay in payments – An appropriate software solution can help in setting up an organised billing & invoicing process for your business, allowing you to make and receive payments on time. Get automated reminders whenever your payment is due to avoid unnecessary delays and send payment reminders to the ones that owe you to smooth the collection process and boost the profitability of your business.

Zero chances of missing payments – Do not tolerate missing payments if you wish to see your business growing profits. Accurate monitoring and tracking of bills are paramount. Allow your customers to pay you via various modes of payment considering which one is feasible for them, giving them no scope for making excuses. Likewise, you get to receive a faster payment of invoices and increase cash-flow. Ensure you spend your time making money rather than collecting it.

Improved brand image – Invoices makes the first impression. Impress your clients with a range of beautiful invoices in a spectrum of colours, customized logos and attract more business. Be ready to try an organized and prompt approach to exude a professional image with your clients.

Streamlines Accounting – Invoice software helps in streamlining your accounting and financial processes by automating important tasks. It helps in analysing businesses’ financial health, keeping an eagle eye on the cash-flow and consequently in better decision making and forecast revenues.

Cost-cutting – You can shift your focus on other crucial tasks and manage your manpower effectively. Thus, ensuring reduced labour costs, follow up costs and time wasted in following up with the clients with overdue.

Strong Data Security – A good software solution for invoicing assures security at every level from billing-to-payment as it doesn’t involve manual editing or transfer of invoices via email attachments. Levelled manual intervention reduces chances of errors improving security and protection from hacks or prying eyes.

Invoicing software makes business process and operations much faster… especially the one that rings cash to your ears, i.e, collection. Despite all the thought-provoking facts stated above, companies are not investing in invoice software only because of lack of awareness. Analyse your cash-flow with the help of an invoice software and see your business increase its profits exponentially.

Payroll Software: Simplifying the complexity of Payroll

Introduction

Payday is fun for all except one; people ran into before and after the payday. Yes, we are talking about the payroll administrator.

If you are a payroll officer, you must be aware of how deadline-driven this process is. Paying employees (or freelancers and off-role employees) is the most complex and onerous element of any accounting software. The payroll administrator has to calculate every penny, produce cheques or make deposits in the bank with 100% accuracy. These underlying calculations also involve—calculation of taxes, bonus, arrears, etc. so the only thing that can be helpful to a payroll officer is an expertly crafted 360° HR Payroll Software. An application that ensures precise and automatic calculation of salaries and deductions within the time limits.

Precision is the Key to Everything

Are you still using Excel for payroll or managing the complete payroll process manually? If yes, you must be familiar with the challenges, complexity, and drawbacks of this common practice. It might seem more like a cost-saving technique but if truth be told; this process is time-consuming, prone to manual errors and never assists in pursuing the deadline. Precision is inevitable when it comes to payroll but it is compromised when a general software is implemented in an organization.

With payday coming at the start or end of every month comes a lot of expectations from the payroll administrator. Employees count on them to reward them with their paychecks on scheduled paydays as paydays not only affect the predetermined plans/ schedules of an individual but also harms every other individual associated with the employee.

For instance, if taxes aren't received by the tax agencies at scheduled dates they assess stiff penalties; if the health insurance companies don’t receive their installment on time they charge penalties or even cancel the policy at certain times and if you don’t wish to face legal consequences of delay In Salary Disbursement a smart payroll software is a sure bet.

Free Download Payroll Software

Efficiency with Ease

HR payroll software brings efficiency in an organization directly and indirectly. It simplifies the complex process of payroll by automating time and shifts management, leaves management, increment and arrear management assuring no delay. Today's payroll software has an interactive user-interface and inbuilt step-by-step wizards to guide employees and payroll officer with each and every information needed for withholding. This eases and fastens the adoption process, reduces any chances of manual intervention and increases the overall efficiency of the system.

No more Frustration

Software's used for payroll have inbuilt templates of reports which are often used by the HR professionals so, one can use them directly or customize them according to his/her own requirement, saving time and minimizing frustration. They are also equipped with a smart record management system which makes it easy to store/ alter/ update the records of employees easily and access the record whenever needed instantly. On the other hand, these services are capable enough to solve your compliances problems as well. Using these services, you are much likely to invest less time in the complex calculation of PF, ESI, PTax & LWF, Bonus Calculations, Gratuity Calculations, and Overtime Calculations everything seems smooth.

Free Download Payroll Software

Transparency is the Best Disinfectant

What's going on under the hood of the payroll department is hard to mitigate. To bring transparency between the HR department and employees, integration with Biometric and Employee Self service (ESS) portal is essential. Integration of a Biometric system like eSSL, Real-time, etc., and Biometric software via SQL, MS Access, Text or Excel reduces the possibility of errors by automating the complete process, whereas, ESS assures that employee has all his information at one place and keeps him aware of the modifications in the HR policies.

Conclusion:

The gist of this article is that if you are running an organization of more than 5 employees, HR payroll software is must-have in order to ease the pain of payroll and to keep your employees happy and productive; resulting in the boost inefficiency of the organization.

Why most shoppers still choose brick-and-mortar stores over e-commerce?

Despite the technological advancements in the e-commerce sectors and the availability of a wide range of products to choose from, online shopping has never been accessible by the middle-income group, as they are more fascinated and comforted by the tactile experiences offered by brick-and-mortar stores.

Out of a number of possible reasons why shoppers choose to shop more from the physical stores in comparison to online e-commerce websites/ shopping apps is the convenience to have a visual experience of the products. It helps shoppers with better and quick decision making. In fact, female consumers tend to purchase the items instantly when they see, touch and feel it. Be it a man/woman of any age or region, the urge to ‘See & Try First’ before buying rank highest among Indian customers and ultimately become their primary motivation for shopping in retail stores.

Other Parameters which influence their likeliness to shop at physical stores are ‘Shopping in less time’, ‘Quality’, and Guarantee. It is witnessed that Males in comparison to Females tend to invest less time in shopping, they just focus on quality and pricing and reach the billing counter in very less time.

Now that we know shoppers of all gender, age spectrum, and location prefer to shop at stores, let’s understand what modifications/ improvements we must do at the retail store to give our prospective buyers a sense of contentment and ease their buying process.

Implementation of a new-age software:

We all accept the need for speed. Nothing could be better than retail software to speed up all the operations at the retail store. Irrespective of the trade you are dealing in, retail software is capable of handling all the end-to-end operations and growing your business. It’s important for small retailers to not lose sight of their business strategy and manage inventory properly to ensure that the desired product is in stock as it can make or break physical retailers and this can be of ease only if you have a Retail Pos implemented at your store.

Integration with POS:

Long-time back, retailers used to keep electric and manual money registers to record information of offers/ schemes and discounts they are offering to their customers. But now everything is managed through a single solution i.e., electronic POS. A POS machine is situated at any place where exchange happens, in almost every retail store. It is beneficial for retailers as well as their customers. A retail pos software helps in providing a compelling in-store shopping experience to the customers as it fastens the billing process, reduces long queues and helps in making transactions with ease. Most of the retailers are not aware that Retail POS helps in managing inventory also. They have a fear that their data might be misused by the third party companies but they can rely on them. This will only ease the process of managing inventory.

Conclusion:

Small retailers can easily compete with the big giant e-commerce companies because of the preferences Indian consumers have. With a back of business software solution providers that support SMEs & MSMEs to grow, they can do much more than they can imagine. Undoubtedly, the implementation of a Retail POS Software is a smart move for the retail industry.

GSTR-9 & GSTR-9C: How to File GSTR 9C Online?

From the moment GSTR-9 & GSTR-9C forms have been enacted by the Central Board of Indirect Taxes and Customs (CBIC), the taxpayers are perplexed partly about what’s the difference between both the forms, which form belongs to them, when is the last date, and what are the details required. Well in this blog we tried to clear up the confusion prevailing today.

What is GSTR-9 and GSTR-9C?

Irrespective of the annual turnover, every GST registered taxable person is liable to file GSTR-9 form, a consolidation of all GST Returns every year. Whereas, GSTR-9C is to be filed by taxpayers with a turnover above 2 crores. GSTR-9C is a reconciliation statement between GSTR 9 for the financial year and the audited financial reports of the taxpayer. This statement must be audited by a CA.

When is the last date to file GSTR-9 and GSTR-9C?

The last date of filing GSTR-9 for FY 2017-18 is extended from August 31st 2019 to November 30th 2019 according to a statement by the Ministry of Finance. GST software implemented in the companies is helping businesses with the compilation task in spite of the best efforts a few traders are finding it difficult to comply with the same.

On the other side, the last date for Filing for return Form GSTR-9C could be either with GSTR-9 or after filing GSTR-9 for FY 2017-18.

Now, let’s divulge into the process of filing Form GSTR-9C and check out the steps to be taken by taxpayers.

Chartered Accountant and cost accountants play a significant role in the filing of Form GSTR-9C. They have to prepare and certify the form before the taxpayer uploads it either on the GST portal or file it in a facilitation center. Other documents required with the GSTR-9C form is a copy of all the accounts audited by their CA and annual returns.

Mandatory Steps to be taken by every taxable person to file Form GSTR 9C

A valid (not expired) Digital Signature Certificate (DSC) in format PKCS7.

It is mandatory that the taxpayer files the GSTR-9 Annual Return GSTR-9 before GSTR-9C

At first, Form GSTR-9C has to be prepared by the chartered accountant or cost accountant using the Offline Tool ‘emSigner’ available on the GST portal.

Note: Any observations/ comments must be entered in an excel tool directly and must not be copy/pasted from anywhere else.

Steps to be followed for Filing Form GSTR 9C

Where and How to perform the Actions

i. The taxpayer is supposed to compile all his data and send it to the Auditor.

A. Download the GSTR-9 Form that you already filed on the GST portal in PDF format.

ON GST Portal

B. To download GSTR-9C Tables, click on “initiate filing” available under GSTR 9C tab. The tables must be having some pre-filled fields like-

i. Turnover

ii. Taxable turnover

iii. The total amount of tax paid

iv. ITC

ON GST Portal

C. Share the GSTR 9 file and tables of GSTR 9C with your Auditor for preparing GSTR-9C Statement.

Email

ii. Your auditor will prepare GSTR-9C Statement using an Offline Utility.

Offline

D. Download GSTR-9C Offline Utility from the “Downloads” section on the GST portal.

ON GST Portal

E. Download & Install emSigner

ON GST Portal

F. Open the GSTR-9C Offline Utility Excel Worksheet and add table-wise details in it.

Offline

G. Generate a JSON File

Offline

H. Auditor needs to affix his/her DSC.

Offline

I. Get the Signed JSON File from your Auditor.

Offline

iii. Upload GSTR-9C Statement (prepared by Auditor) on GST Portal

J. Click “initiate filing” and upload other relevant documents and by clicking on “prepare offline” Upload the Signed JSON File on GST Portal and Save the form.

ON GST Portal

K. Sign the Form and complete the filing of Form GSTR-9C.

ON GST Portal

According to the data shared by state commercial tax department, Out of 7.7 lakh taxpayers, barely 2.11 lakh taxpayers have filed the annual GST return through the forms GSTR-9 and GSTR-9C as of now. Implement a GST Software to your business which is ready with form GSTR 9 & 9C to avoid any penalties for late filing of the returns.

Source: https://www.gst.gov.in/newsandupdates

5 Business Boosters Guaranteed to Give You a Competitive Advantage

One of the biggest misconceptions new businessmen fall for is that an inventory management software is designed and developed only for big-giant companies and will cost them huge bucks if they plan on implementing it in their business which they can’t afford.

However, the truth is,

“Implementation of a business software solution is not an expense; it’s an investment.”

In fact, this statement is even more accurate and precise when your software manages your billing, inventory, accounting, and taxation as well; ensuring significant growth in your business.

Misled by the fallacy based on assumptions, many businessmen fall into pitfalls even lose hope to compete in the market. Staying in the competition with old/big brands is not a tough row to hoe with the right business strategy and an inventory software, customizable according to the business needs.

In this blog, we will unveil some of the striking features that your inventory software must have to fulfill your dream of having a profitable business.

Collaborative Commerce: The term ‘Collaborative Commerce’ is basically used for a tool inbuilt in the software to import e-invoices from the distributors' system on the basis of GST number or eBusiness code. To enjoy extreme benefits of this time-saving feature, operators have to activate online purchase feature in their software. After activation, whenever the supplier generates a bill, it gets automatically uploaded on the server, and the retailer could easily download it.

Click here to learn how to activate Collaborative commerce in Marg ERP 9+

2. Push Sales: As the term suggests, ‘Push Sales’ refers to the identification of the best ways to improve sales at the time of billing of items. This option observes a customer’s buying behaviour and displays a list of items at the side of the billing screen of the operator that the customer might be willing to purchase. These noteworthy items include:

Focused Items i.e. those items which the distributor, supplier, retailer or any businessmen targets to sell the most. Focus items comprise- Items with high-profit margin

Items available in stock in large quantity

Item in demand because of seasons or festivals

Dump Items i.e. those commodities/ items that have not been sold for a very long time.

Near-Expiry Items i.e. those products that are near their expiry dates and can’t be sold if the expiry date exceeds.

Click here to learn how to take maximum benefit of Push Sales in Marg ERP 9+

3. Connected Banking: Wouldn’t it be great to enjoy banking facilities integrated in your software. Even though, every businessmen are wearing so many hats today; they can track the cash flow in their business from within their software in a few clicks. With an integrated banking solution, a businessman can make bank transactions via. NEFT, RTGS, Bank Transfer, GST Tax Payment, etc. He can also schedule his payments and Reconcile Bank-statements automatically.

Click here to learn about Connected Banking

4. Suggested Item: Involving smart moves in the business ensure rapid growth in business with suggested item option, the salesperson can sell related items to his customer which he might be looking for and increase his sales. For example: If a customer purchases an item ‘Mobile’, then a list of products related to the item Mobile will be displayed on the billing screen like Screen-guard, flip cover & phone case.

5. Alternate item: Watch your productivity soar by selling alternate items. Using an alternate item feature in your inventory software, the user can define multiple substitutes in the item master and can search for items as per defined substitute at the time of billing. The suggested product list is displayed on the right side of the dashboard on the selection of any item. This feature will also assist in inventory management & timely re-ordering of products.

Conclusion: In the aforementioned information, you learned about all the features that you must have in your inventory software, only and only if you wish to compete in the growing market and reduce your loses to zero. We assure the presence of these extremely productive features will help you to escape the rat race and lead in the competition which you always dreamt of.

Budget 2019: A Boost to the Nation’s Entrepreneurial Spirit

The MSME sector plays a crucial role in creating employment opportunities as well as in the industrialization of the rural and backward areas. Those who understand market dynamics well can run a successful enterprise and grow it. Some move up the value chain - from a few employees to several hundred, moving from small scale to medium. And they rely on support from MSME stakeholders such as government bodies, banks, and financial institutions.

Our MD Mr Sudhir Singh says in a reputed interview with Zee Business, "SMEs and MSMEs will play the most significant role in achieving India's ambitious target of becoming a $5 trillion economy by 2025. To give a positive push and create a productive environment for this segment to flourish, there is a need for perfect ease of doing business environment, nurturing a demand-based skilled manpower and wide adoption of technological advancements in SME and MSME sector. Allotment of Rs 350 Crore for 2% interest subvention for all GST-registered MSMEs under the interest subvention scheme is a step in the right direction."

"The new age jobs across economies will require a huge change in skill sets. India can take advantage of this and fill up the shortage of relevant and high-tech skilled labour in the near future. India can lead the world in meeting this huge demand with a focus on new age and industry relevant skills such as Artificial Intelligence, Big Data, Robotics, etc. Even the adoption of such technologies to strengthen SME ecosystem is not a herculean task, provided we have the right will and intention to make it affordable and easily accessible. It is time for Skill India’s curriculum to follow advance technologies and skills which are highly in demand, both on a domestic and global map." He further added.

The Budget has also given a boost to the Nation’s entrepreneurial spirit by extending Standup India scheme till 2025, setup of 80 Livelihood business incubators and 20 technology business incubators to develop 75,000 skilled entrepreneurs in agro-rural industries, encouraging women entrepreneurs and several other measures to streamline labour laws, education, and rental housing segment which will have a direct impact on startups in the country.

With the government also approaching technological innovations for the MSMEs, the sector is embracing the power of technology to scale and become more efficient in India. Owing to this, the opportunities for startups and tech giants are set to grow multifold. Tech giants are keenly working with the MSMEs to understand its market, opportunities, and challenges to help them efficiently penetrate into this vibrant sector and support it in its scaling-up journey. This includes addressing the fundamental problems in financial inclusion, technology penetration as well as hiring and skilling.

Read More: Budget 2019: Nirmala Sitharaman proposal on corporate tax may boost MSMEs, jobs creation

What we can expect from Budget 2019?

Expectations among Indian citizens are already reaching great heights as Finance minister, Mrs Nirmala Sitharaman is all set to announce her first union budget on July 5, 2019. Summing up the key factors that are in focus by the BJP government, here's what the experts are expecting from the finance minister this year.

The demands that have been proposed in the interim budget pertain to lower taxation, benefits the middle-income group, increases overall tax exemption, introduces tax breaks, reduce expenses for SMEs and much more.

Economists stated that some of the demands proposed in the run-up may be honoured and the government may introduce some tax sops to boost demand and speed up economic growth.

Budget 2k19 can be full of surprises for the SME & MSMEs sector

We have witnessed too many ups and downs in GST for the last two years. SMEs & MSMEs are the sectors which are highly affected by the changes in GST tax regimes. It is likely to witness some beneficial changes in the GST tax system in the upcoming budget as GST has been the key focus area for the BJP government. Experts believe that some good news is waiting for the SMEs & MSMEs sector in Budget 2k19.

What banking sector can expect?

The primary expectation of the banking sector is from the changes in the tax system. The government would likely to encourage mutual funds, insurance and other investments plans. It may introduce new incentive measures such as e-KYC to help financial institutions.

Some of the proposed amendments in the financial system are stated below:

Income tax exemption limit to be revised-

A rebate up to Rs. 5 lakh was introduced in the interim budget which is not likely to be considered by the government because it will affect the taxes to a great extent. On the other hand, the citizens can expect a shift from Rs. 2.5 lakh to Rs. 3 Lakh in the exemption threshold.

People can save more taxes under section 80(C) which includes investment towards EPF, PPF, fixed deposits etc, as the tax deduction currently at Rs. 1.5 Lakh may be raised to Rs. 2 Lakh or above.

Tax-free bonds may revive-

The key focus of the government will be to promote infrastructure projects to increase job opportunities. In such a scenario, it would not be an astonishment to observe the revival of tax-free bonds.

Proposed amendments for the housing sector-

With Pradhan Mantri Awas Yojna promising a ‘housing for all by 2022,’ the BJP government is expected to pay more attention to this sector. It will be initiated by simplifying ECB (External Commercial Borrowings) norms, introducing REITs (Real Estate Investment Trust), and government bonds to provide low- cost funds to housing companies. Apart from this, standardisation of property registration costs, the introduction of tax exemptions on an eco-friendly property purchase. Availability of land is also a major issue in implementing the real estate projects that might be rectified in the budget 2019 to make it viable for the private players, thus fueling their finances.

This year budget seems to be really promising. We can only wait now to witness what it brings to the citizens.