Latest Update

TDS on purchase of goods under section 194Q of the Income Tax Act recently came into effect with the finance Act, 2021. This Act takes effect from 01.07.2021.

Article Content

- Introduction

- Who is Liable To Pay TDS On Purchase Of Goods Under Section 194Q?

- Guidelines By Government For TDS On Purchase Of Goods Under Section 194Q

- What is The Rates Of TDS On Purchase U/S 194Q?

- When Will The Deductions Under TDS On Purchase Take Place?

- What Points Should Be Kept In Mind While Paying TDS On Purchase Of Goods U/S 194Q?

- Different Example’s Related To TDS On Purchase U/S 194Q

- How To Maintain TDS On Purchase Of Goods In Marg Software?

- Practical Faq’s Of TDS On Purchase Of Goods

Introduction

Till date, TDS was only being deducted on the selected nature of payments but from 1st July, 2021, businesses are required to deduct TDS on purchase of goods. The responsible person needs to pay a sum to any resident for purchase of goods (according to the liability).

The person whose total sales, gross receipts, or turnover from the business exceeds ten crore rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out. But TDS on purchase of goods will not be deducted only with the fulfillment of the above-mentioned condition but also the buyer needs to pay the TDS amount if the purchase of goods by him from the seller is of the value or aggregate of value exceeding fifty lakh rupees in the current financial year (considering the opening value of the current financial year).

Who is Liable To Pay TDS On Purchase Of Goods Under Section 194Q?

Any person who is a buyer is responsible to pay any sum (according to the terms & conditions) to the seller (being a resident) after the fulfillment of two conditions i.e. aggregated turnover value of Rs 10 crore or for the purchase of any goods (including capital goods) from the single party in the same financial year (from 1.4.2021) is exceeding Rs 50, 00,000 (considering the opening value of the current financial year) shall need to pay TDS amount.

Guidelines By Government For TDS On Purchase Of Goods Under Section 194Q?

Click to download the Guidelines for TDS On Purchase Of Goods (By Government) Under Section 194Q.

What is The Rates Of TDS On Purchase U/S 194Q?

- A Buyer needs to pay 0.1% TDS (Having PAN card) of the purchase value exceeding Rs 50, 00,000.

- A buyer needs to pay 5 % TDS (Without PAN card) of the purchase value exceeding Rs 50, 00,000

When Will The Deductions Under TDS On Purchase Take Place?

The deduction takes place in the following conditions (whichever is earlier).

- When the credit of such sum to the account (even if Suspense A/c) of the seller.

- At the time of payment by any mode.

What Points Should Be Kept In Mind While Paying TDS On Purchase Of Goods U/S 194Q?

The tax shall be deducted only when the following conditions are fulfilled.

- When the buyer will purchase goods from a resident seller.

- Goods are being purchased by the single party having the transactional value of Rs 50, 00,000 in the current financial year.

Different Example’s Related To TDS On Purchase U/S 194Q

Example 1

Suppose, Mr. A has purchased goods from the seller of the total value of Rs 70,00,000 in the current financial year.

So in this case the TDS would be deducted on 20, 00,000 (70, 00,000-50, 00,000)

Hence, the value on which the TDS will be deducted is the value after deducting Rs 50, 00,000/-

Example 2

Suppose, Mr. A has purchased goods of Rs 20, 00,000 from the seller having the opening value of Rs 30, 00,000.

So the purchase value of the current financial year will be considered as Rs 50, 00,000 (including opening) itself.

Hence, the value on which the TDS will be deducted will also consider the opening balance of the party (from which he is buying the goods).

How To Maintain TDS On Purchase Of Goods In Marg Software?

So let’s check the process how easy it is to maintain transactions with the TDS purchase on goods in the Marg software.

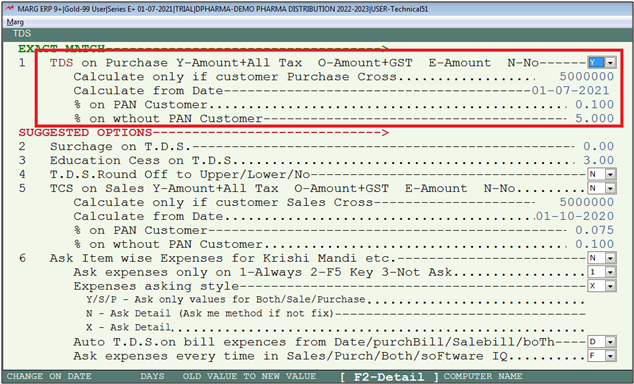

Software Configurations of TDS

- TDS on Y-Amount + All Tax, O-Amount + GST, E-Amount, N-No: This means that whether the user needs to collect the TDS on purchase on what basis. So, select it as per the requirement.

- Calculate only if Customer Sales Crosses: It means that if the sale of the customer crosses 50 lakhs then TDS on the purchase will get calculated on it.

- Calculate from Date: As TDS is applicable from 1st July 2021 so, by default that date will already been mentioned in it i.e.01-07-2021.

- Percentage on PAN/Aadhaar Card Customer: This means that if the customer provides their PAN Card/ Aadhaar Card then 0.1% TDS will get collected.So, mention 0.1 here.

- Percentage on Without PAN/Aadhar Card Customer: If the customer does not provide a PAN Card / Aadhaar Card then 5% TDS will be charged.So, mention 5% here.

Now click on “Yes” to save the changes.

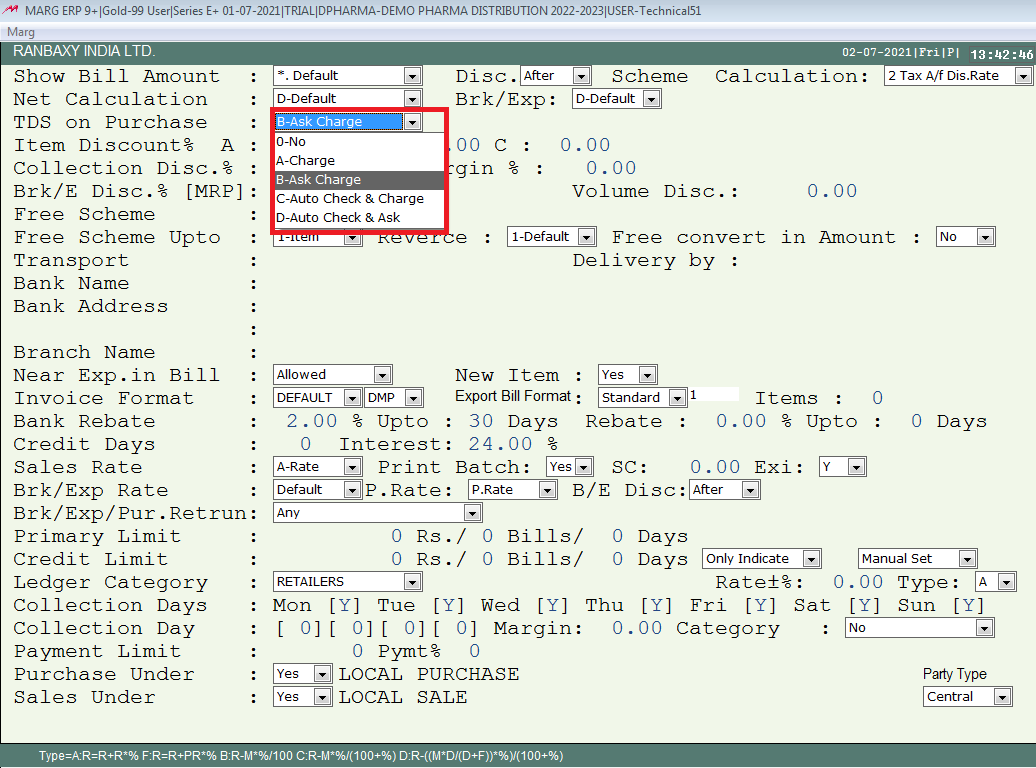

Party Ledger Configurations in Marg

In the ‘TDS Applicable’ field, there are 4 options i.e.:

- Charge: It means that if the user needs to charge TDS on the bill amount for this particular party then select ‘Charge’.

- Ask Charge: It means that if the user needs that the software must ask before charging TDS on the bill amount for this particular party then select ‘Ask Charge’.

- Auto Check & Charge: It means that if the user needs that if the Total sales crosses 50 lakhs then the software must first auto check and then charge TDS on the bill; select ‘Auto Check & Charge’.

Once the software has auto-checked and charged TDS on the bill amount then from next time it will directly charge TDS on the bill amount for this particular party. - Auto Check & Ask:It means that if the user needs that if the Total Sales crosses 50 lakhs then the software must first auto-check and then ask whether to charge TDS on the bill or not for this particular party; select ‘Auto Check & Ask’.

Once the software has auto-checked and Ask TDS on the bill amount then from next time it will directly charge TDS on the bill amount for this particular party.

Suppose,select ‘2-Ask Charge’.

Then Press the ‘Page Down’ key and Save it.

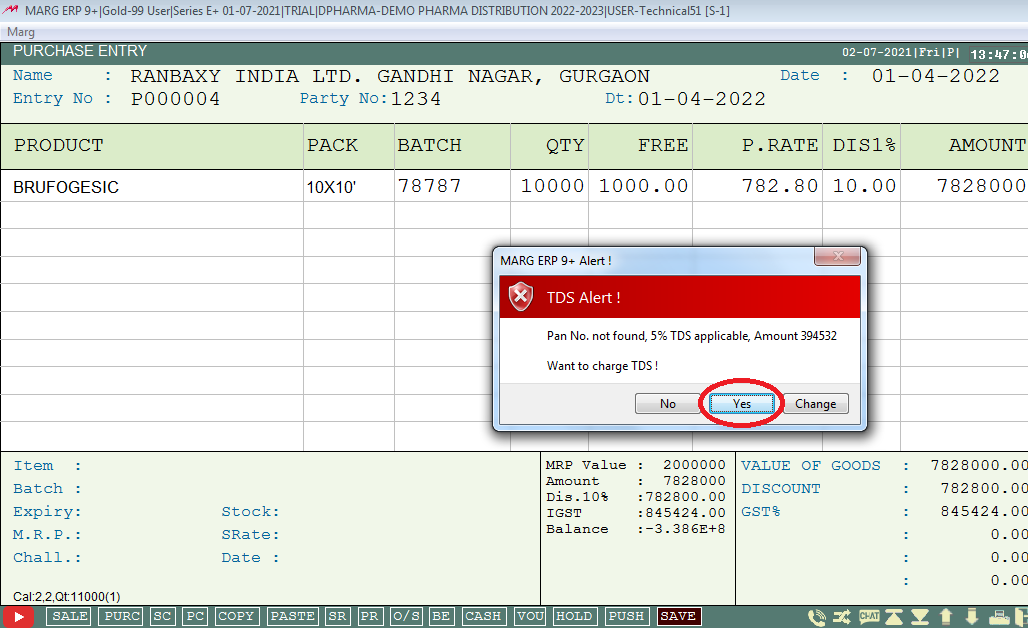

Recording Transaction Along with TDS

As in our case, Software had charged 5% of tax (Without PAN) at the time of purchase of goods.

Practical Faq’s Of TDS On Purchase Of Goods

[sp_easyaccordion id=”8627″]