Table of Contents

ToggleThe Complete Overview of Marg GST Billing Software

Marg Billing Software offers a complete all-in-one billing solution for your business. Speed up your billing process, organize your customer data, track payments, manage your inventory, and more. Do Billing & file easy GST returns with an affordable GST billing and invoicing software empowered with all the features required to manage your billing.

Here’s How Marg GST Billing Software Looks Like:

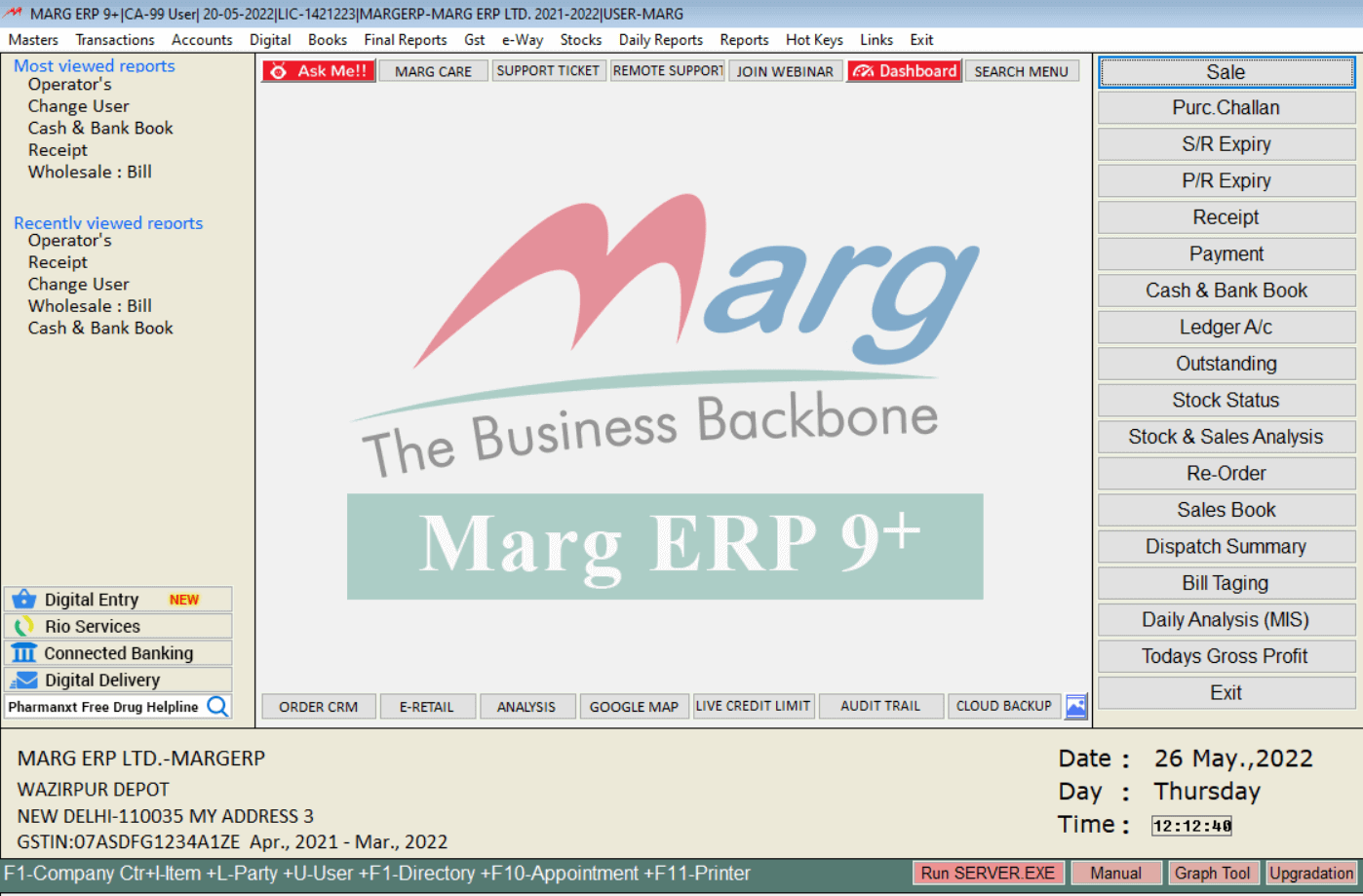

The main window in the Marg ERP Software has the following options: Title Bar, Menu Bar (Masters, Transactions, Accounts, Digital, Books, Final Reports, GST, e-Way, Stocks, Daily Reports, Reports, Hot Keys, Links & Exit).

On the left-hand side, you can see Mostly Viewed Reports, Recently viewed Reports, Digital Entry, Rio Services, Connected Banking & Digital Delivery.

On the right-hand side, you can see various shortcut keys that are used on the daily basis and these can create as per your convenience.

Update Dashboard: With the help of Update Dashboard, you can get a detailed overview of your business with accurate figures on tips and enables you to easily monitor, measure performance and metrics in real-time to increase productivity, manage all the complexities of running your business and make smart decisions.

Marg has designed different types of digital platforms through which you can get digital support from us and can find solutions to your every problem.

Ask Me: Ask me is a unique platform in Marg Software through which you can solve any of your problems related to the Marg Software.

Marg Care: With the Marg Care tab, you will get connected to our Marg Care Portal where we have shared FAQ’s along with their answers through all our customers i.e. we have provided all the answers of the questions at one place for your convenience.

Support Ticket: Through our Marg Support Ticketing system, you can easily generate a new ticket for any of your query related to the software and our executives will provide you an instant solution of that query and on which you can also provide your valuable feedback.

Remote Support: Through Remote Support, you can share your system online with our executives and can get solution to your every problem from them.

Join Webinar: By using Join Webinar feature, you can connect with our online training sessions and can take training of our new and beneficial business features which you can further implement them in your business and you will be able to manage your business smoothly.

MASTERS MENU

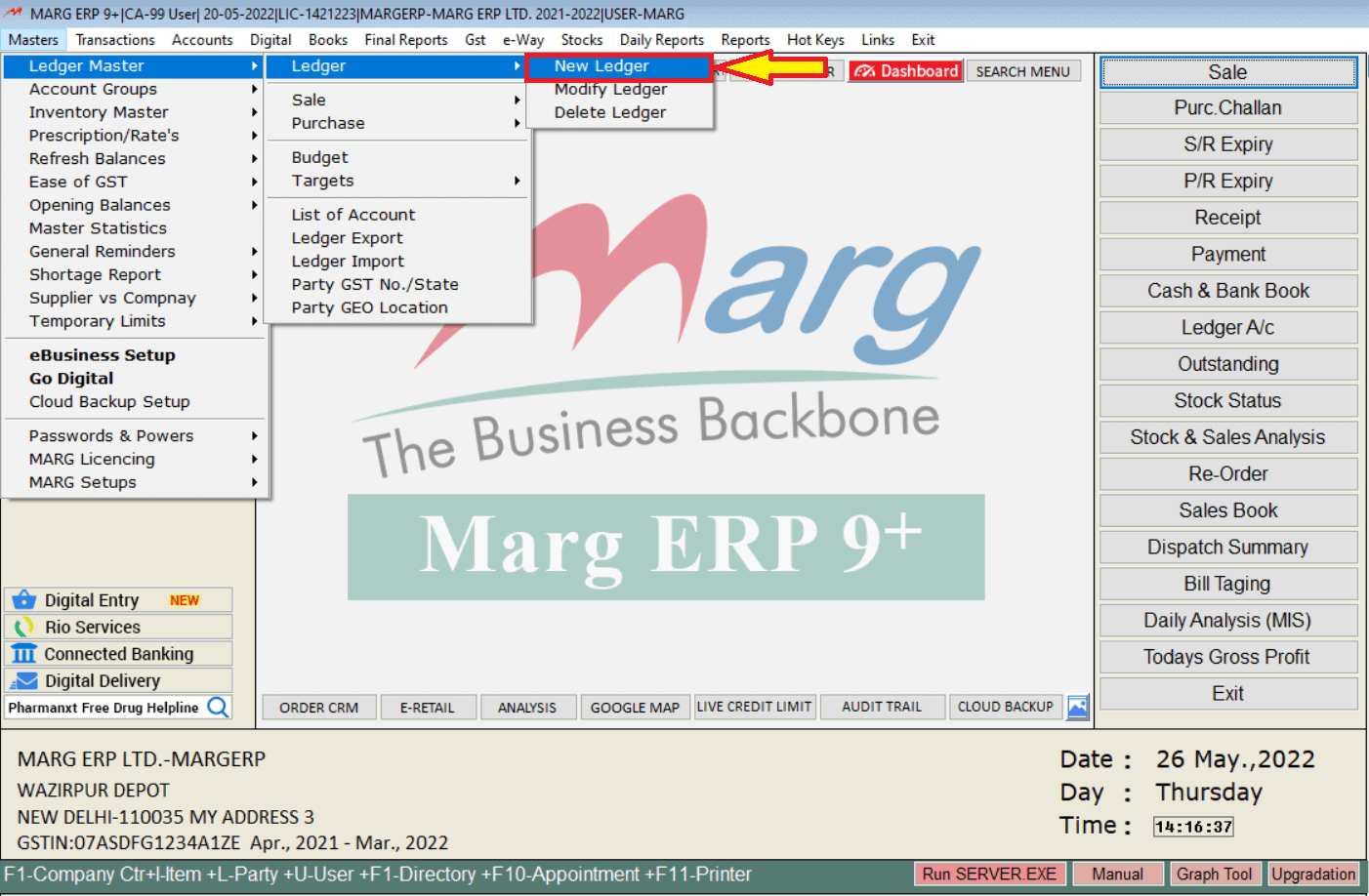

Ledger Master: From the Master’s Menu, you can create Ledger Master. A ledger can be stated as an authenticated account record that can categorize a transaction.

The basic purpose of the creation of Ledgers in Marg ERP Software is to maintain records of any type of transactions concerning Sale/Purchase/Cash received etc. Ledgers can be made as and when it is required or at the time when the transactions are being occurred.

With the help of ledgers, it becomes easier to view any transaction that has taken place with the specified date.

- Go to Masters >> Ledger Master >> Ledger >> New.

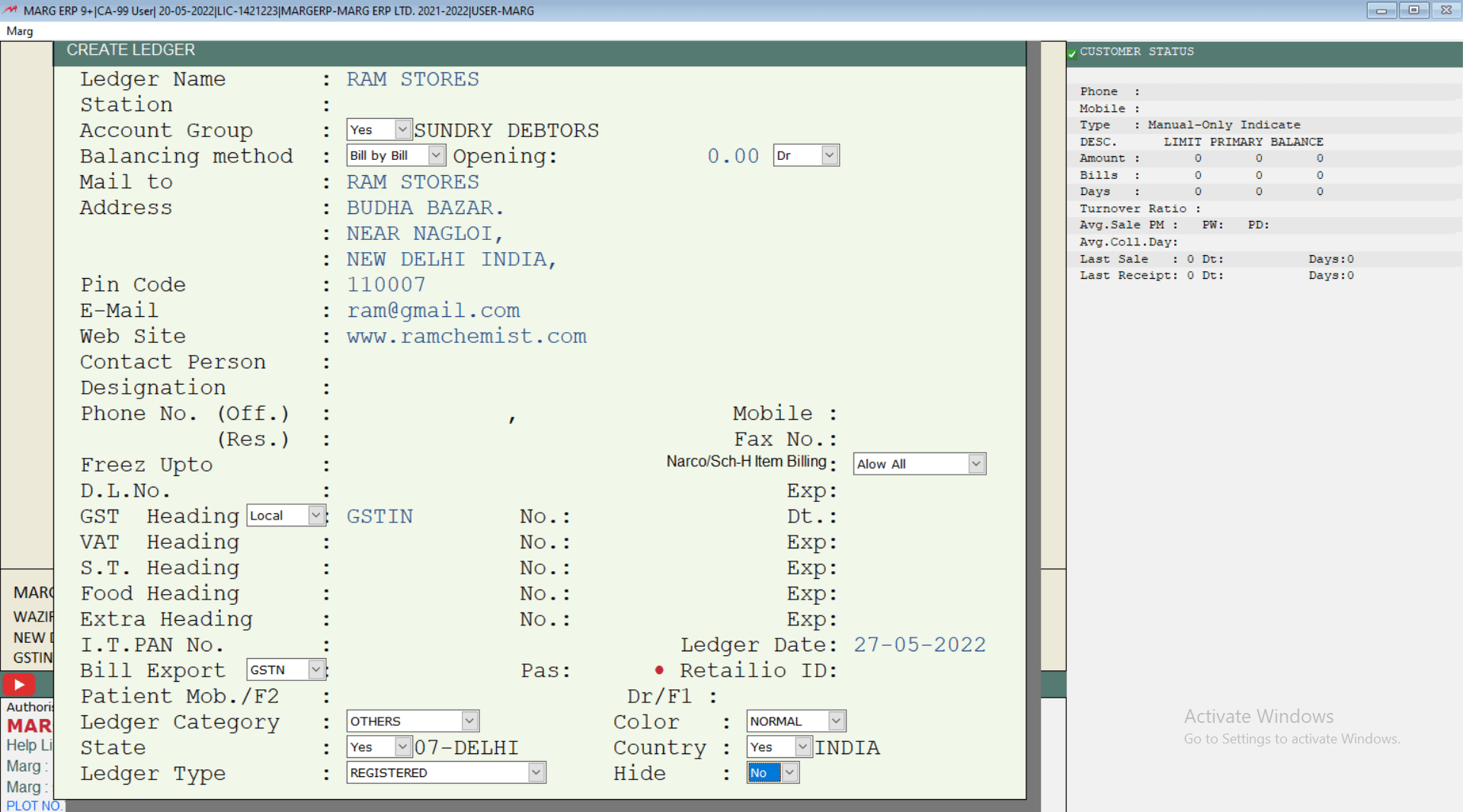

Select Account Group under which ledger to be created >> Suppose Select ‘Sundry Debtors’ >> Mention the details related to this ledger.

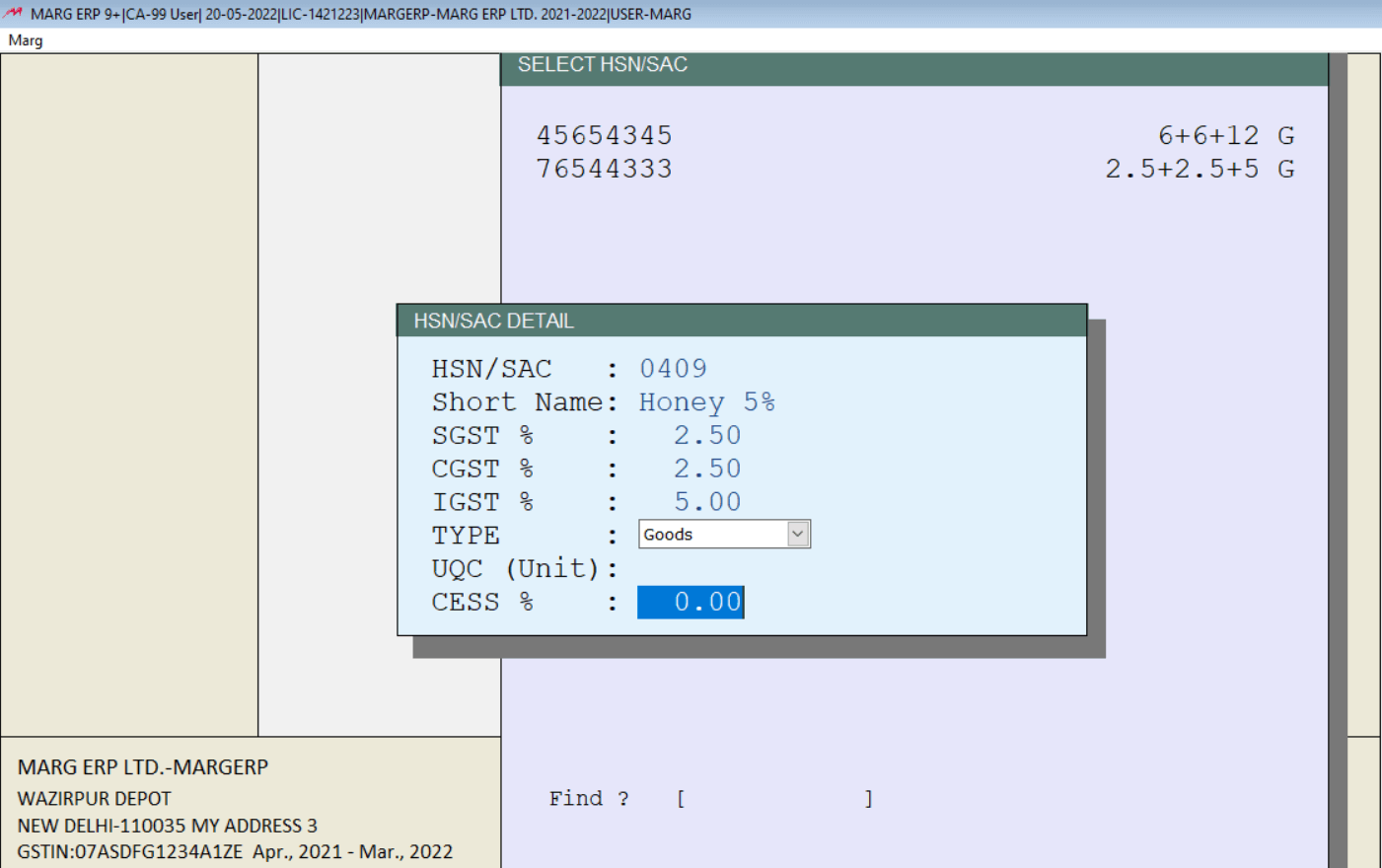

HSN/SAC Master: HSN code is an internationally accepted method for classifying and identifying goods whereas the service accounting codes (SAC) is a unique code which is provided for measurement and taxation of services.

Both HSN / SAC code is needed when anyone register for GST, on invoices and on all the GST returns which is required to be uploaded on the GST portal.

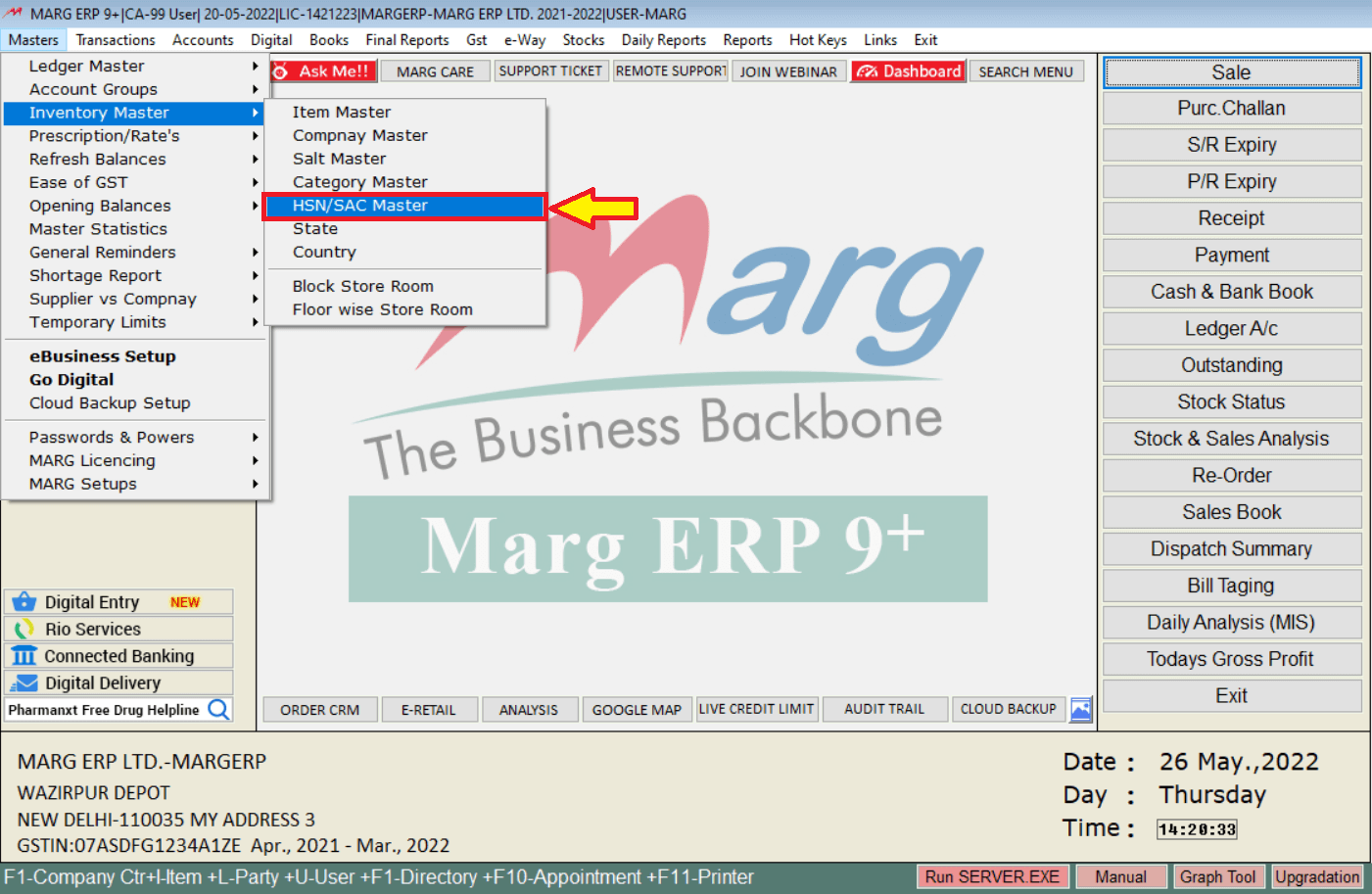

- Go to Masters >> Inventory Master >> HSN/SAC Master.

Press the‘ F2’ function key to create New HSN >> Specify the Code of the HSN >> Mention the Short Name & Other details.

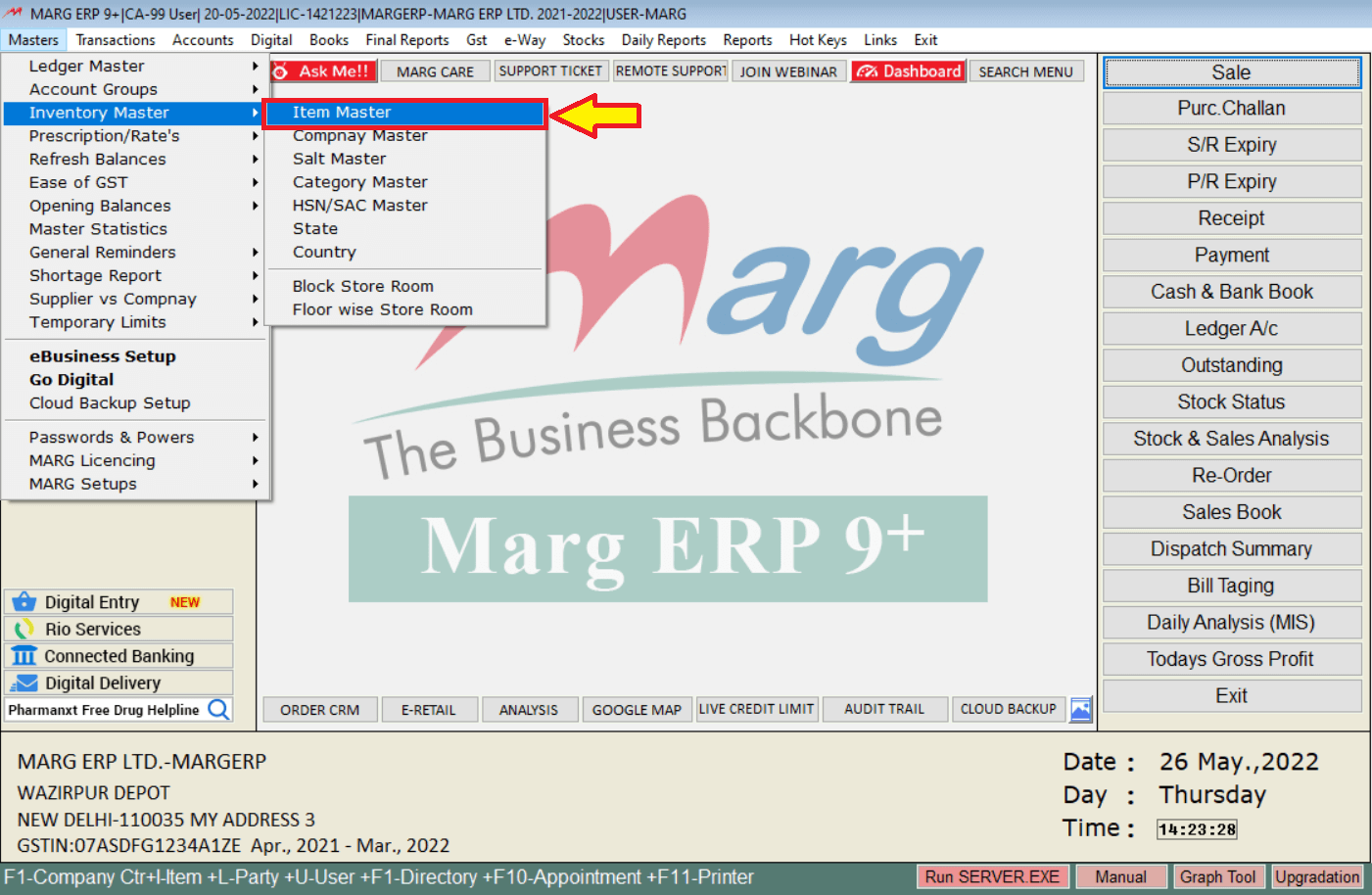

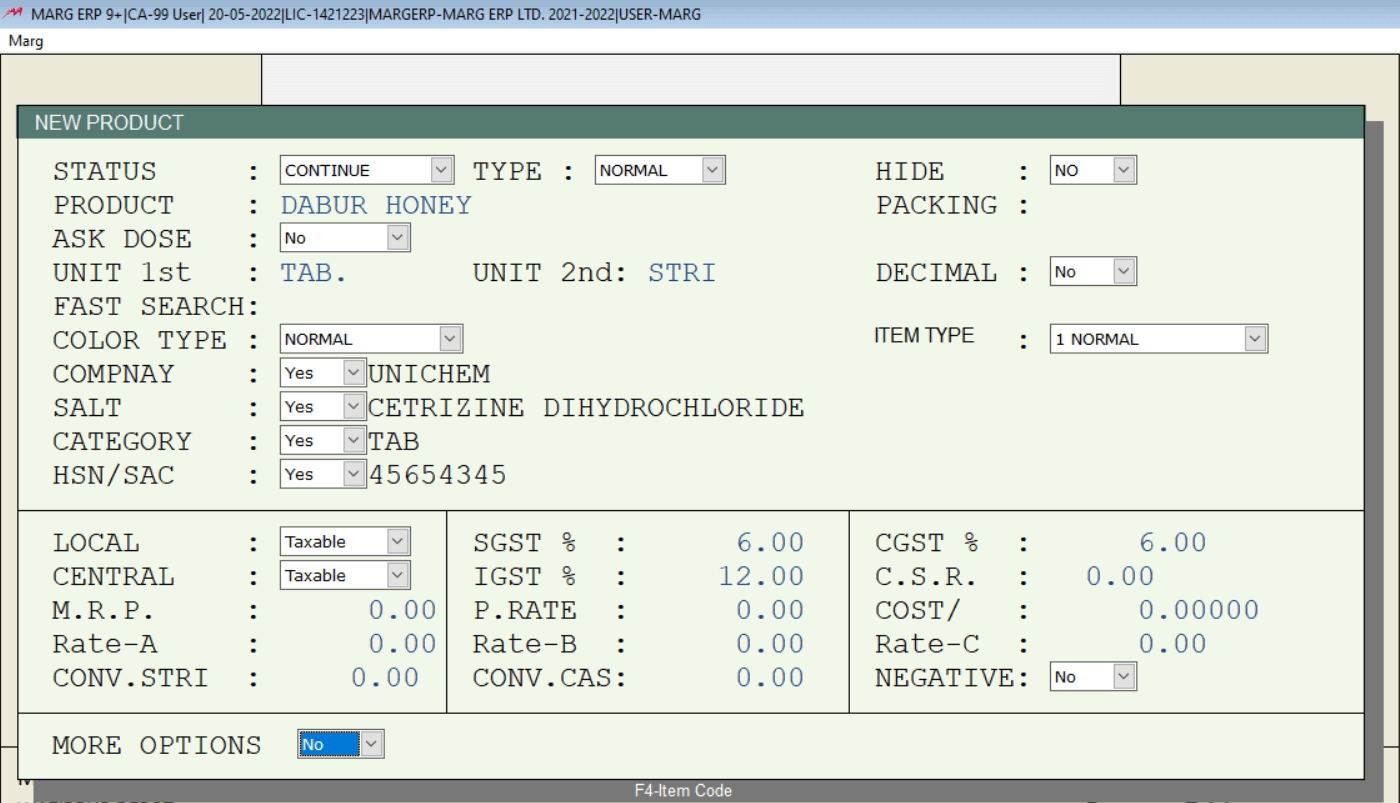

Item Master: You can create an Item master from the master’s menu to maintain your inventory.

Press ‘F2’ to create a new item >> Specify the name of your product >> Select its respective HSN Code >> Specify other details >> Save the item master.

TRANSACTIONS MENU

A quick look at all the business transactions you’ve made up to this point.

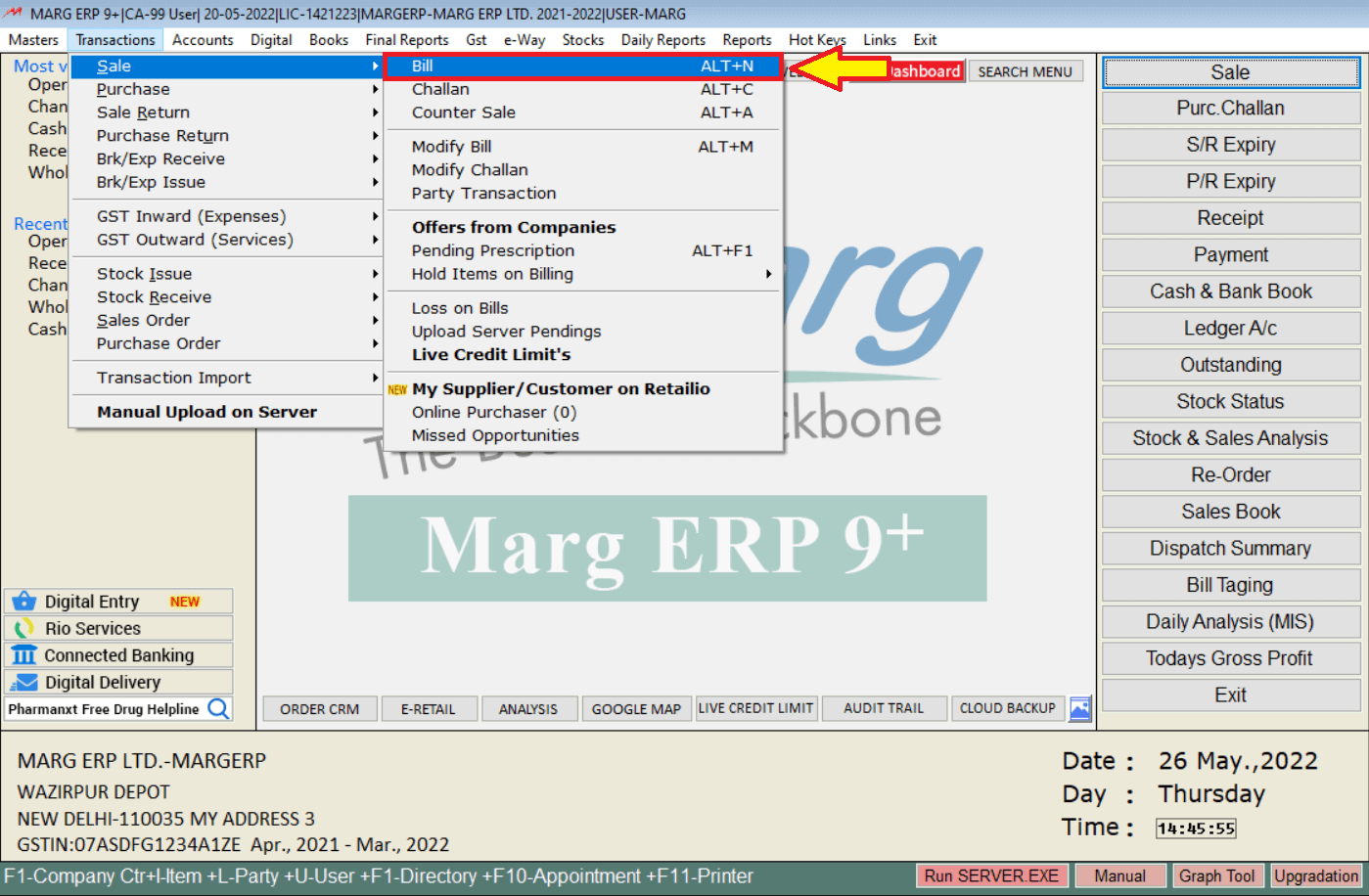

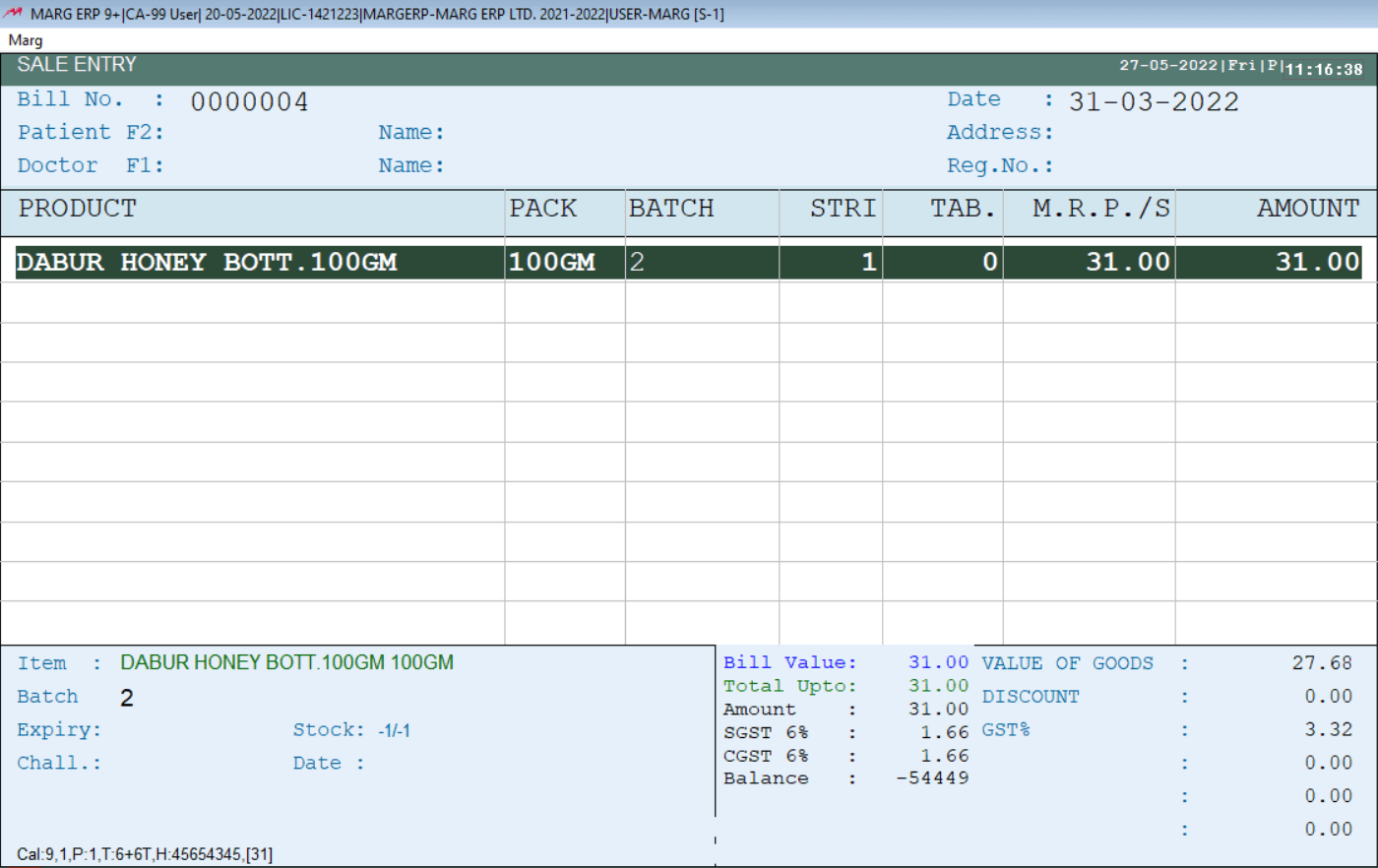

Sale: From the transaction menu, you can do the entry of Sale.

Press enter >> Select the ledger of cash if you are doing cash billing or the customer’s ledger >> Press enter twice >> Select the product which you are selling >> Specify the quantity of the product and the sale rate >> Press enter >> Below you will find GST related details of the bill >> Press the end key to save the bill >> Press Enter to print the bill.

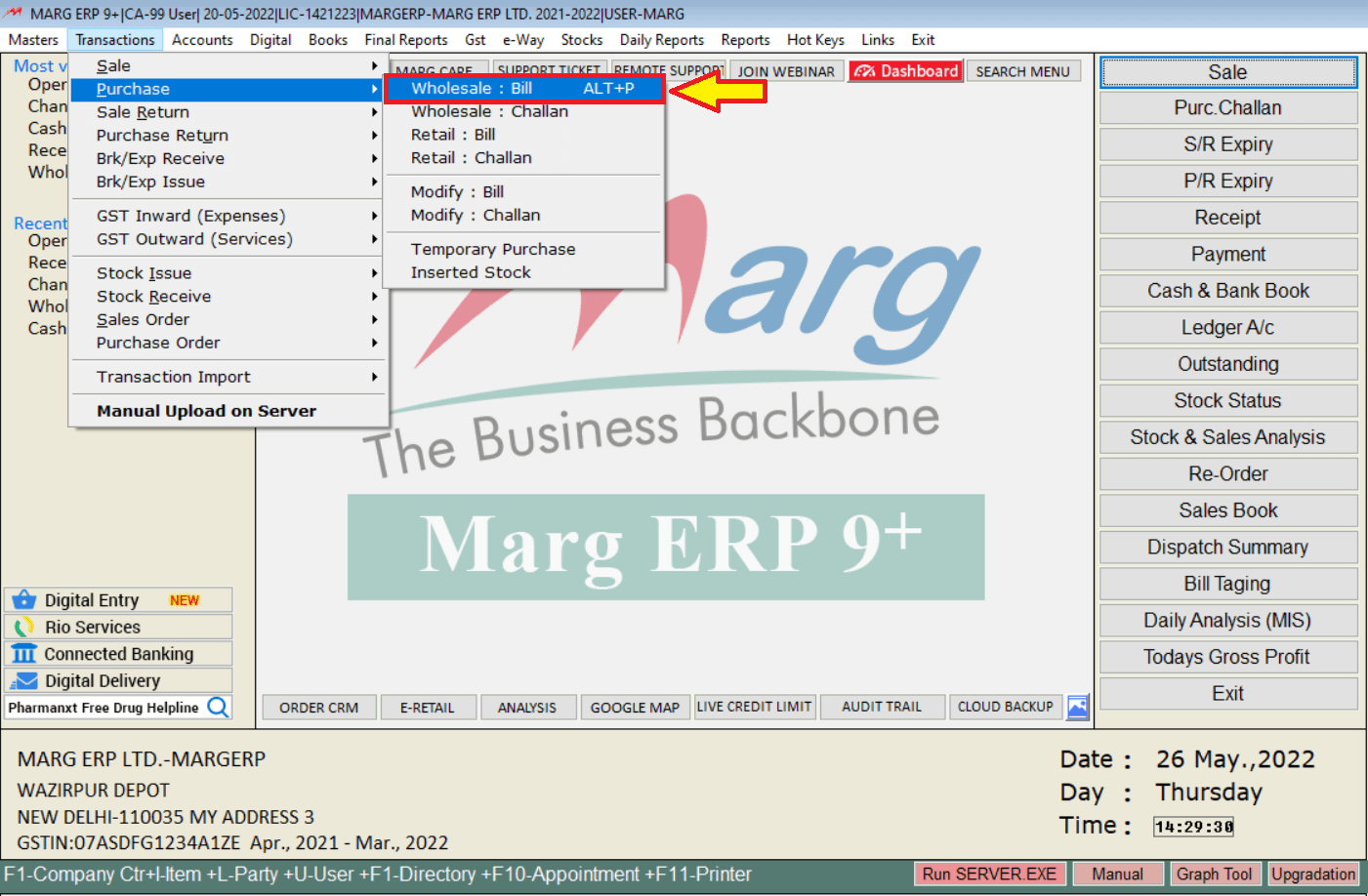

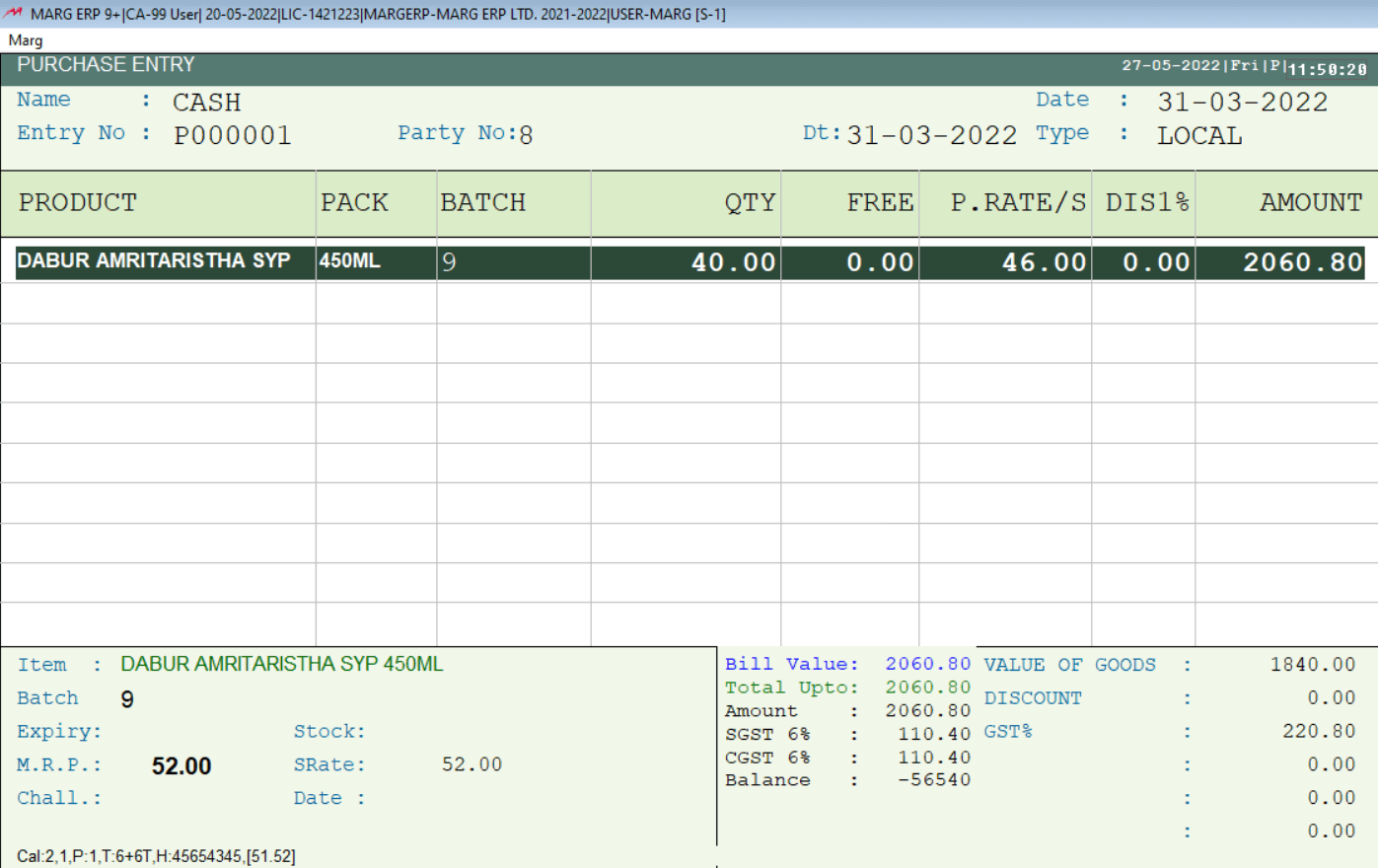

Purchase: From the transaction menu you can generate Purchase Entries and Sale Entries.

Press enter >> select the ledger of the supplier >> Keep pressing enter until the items window will appear >> select the product which you are purchasing >> Specify how the quantity and the purchase rate of the product >> Keep pressing enter >> Below you will be able to see all the GST related details of the bill >> press the end key to save the bill >> press enter to print the bill.

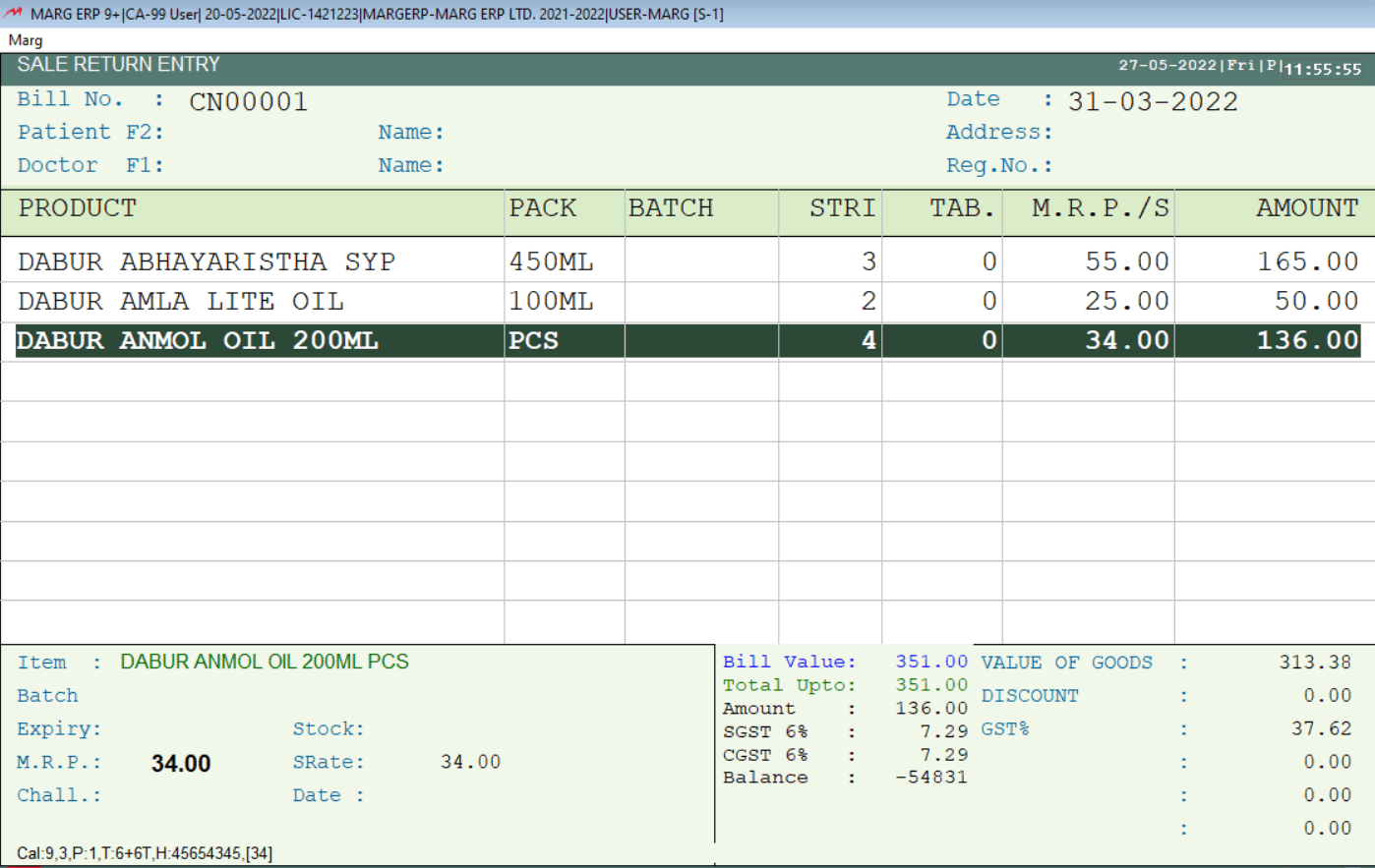

Sale Return: View all returned sale orders as well as the credit notes associated with them. When your sold products are returned, create new credit notes.

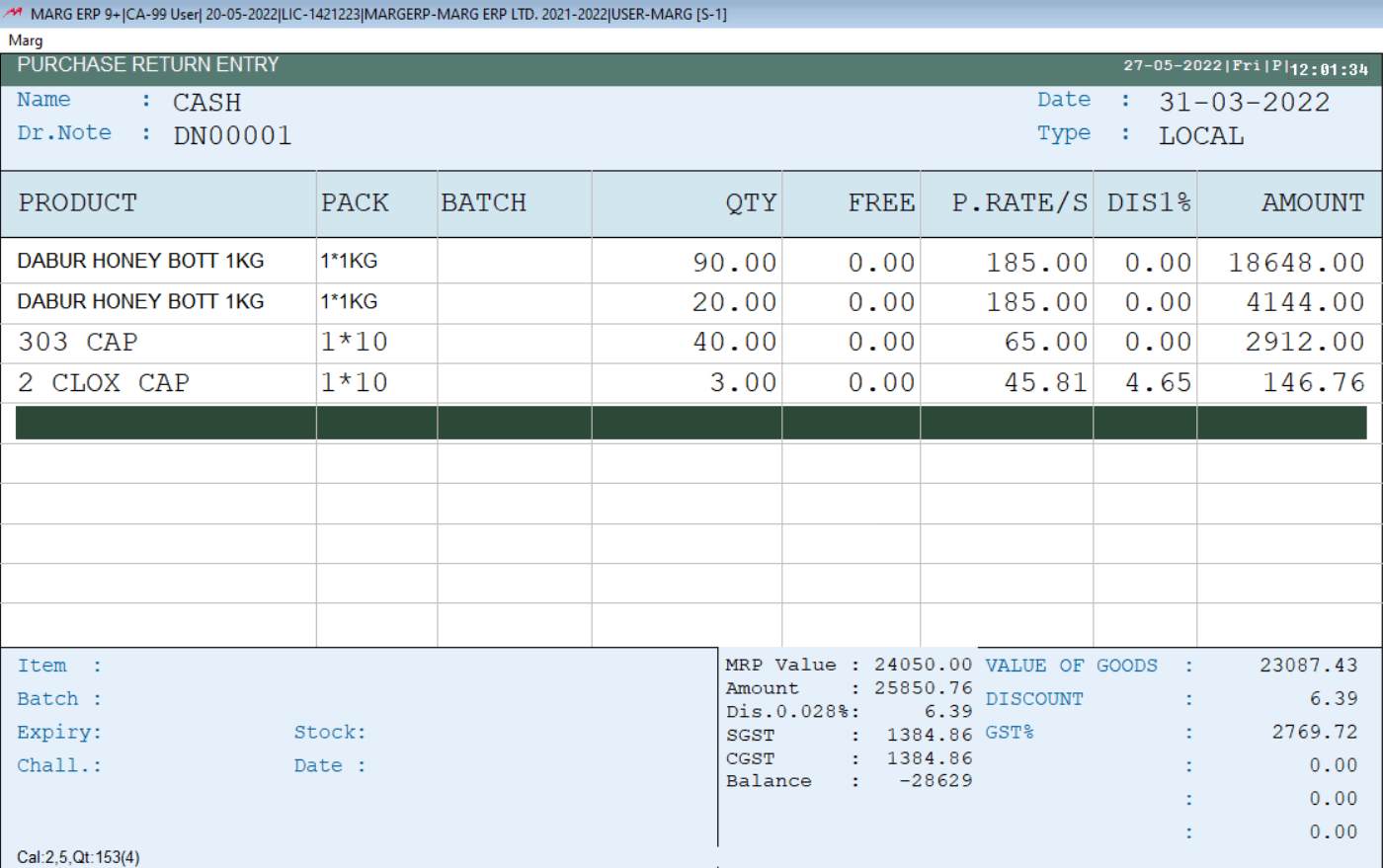

Purchase Return: View all of your returned items (if you have any). When you return a purchase, you can create a debit note from here.

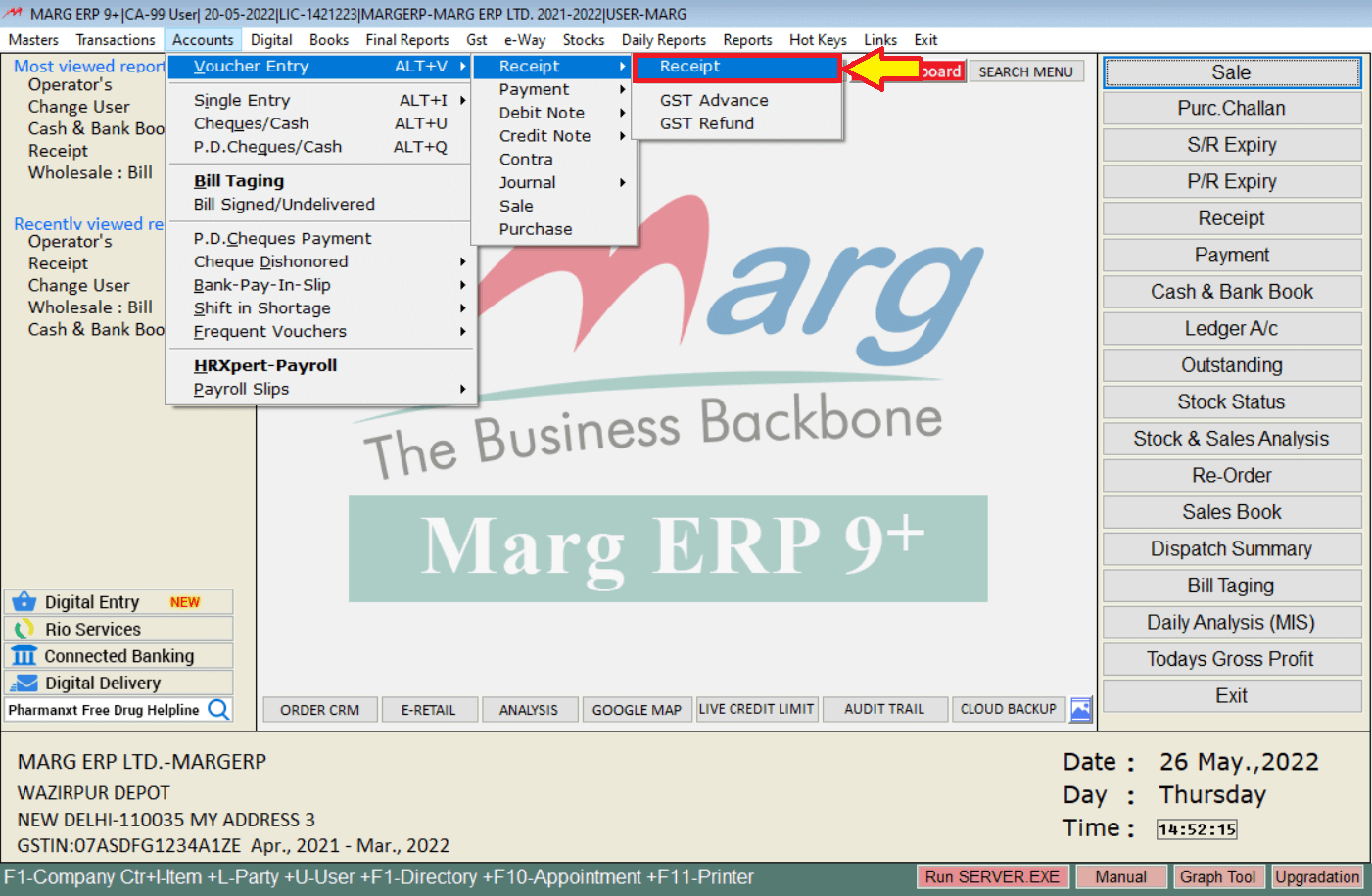

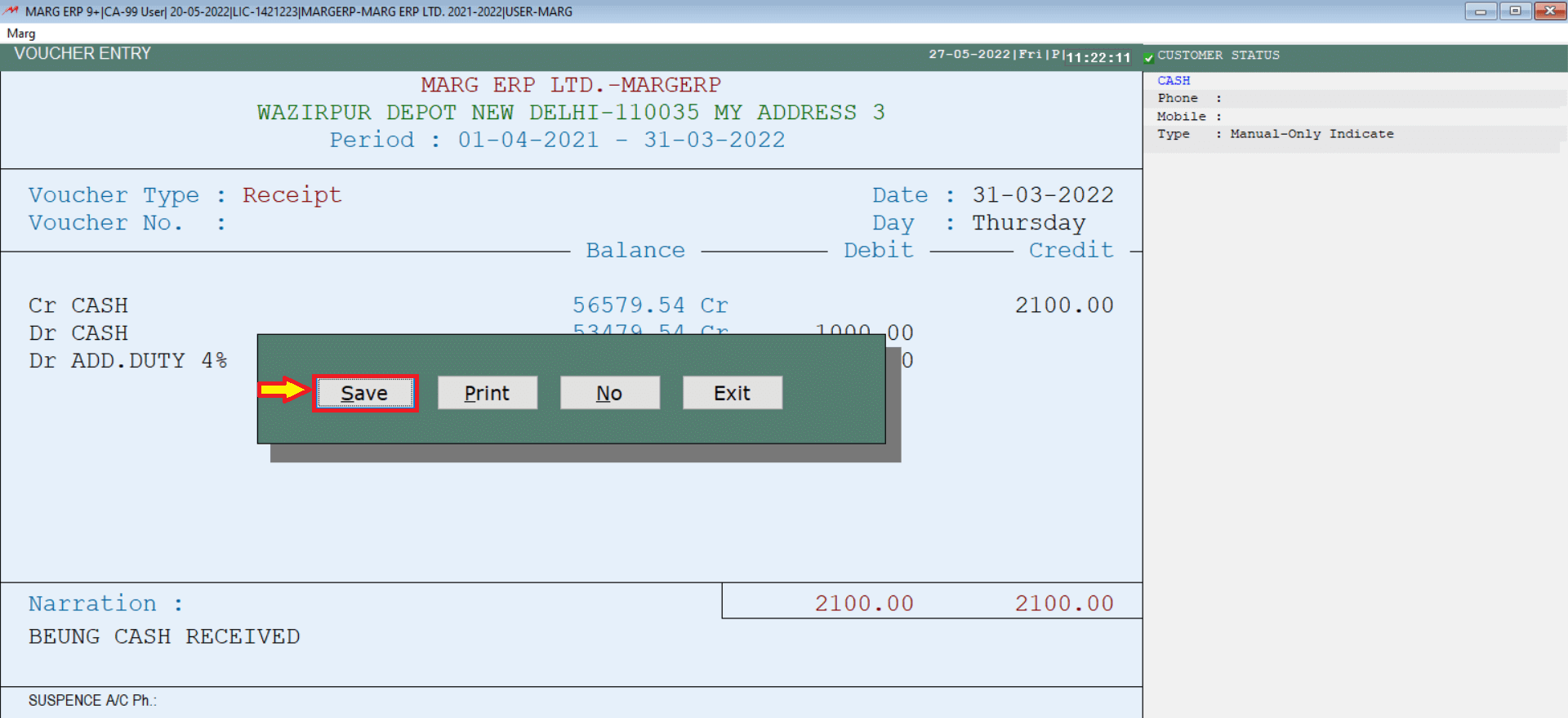

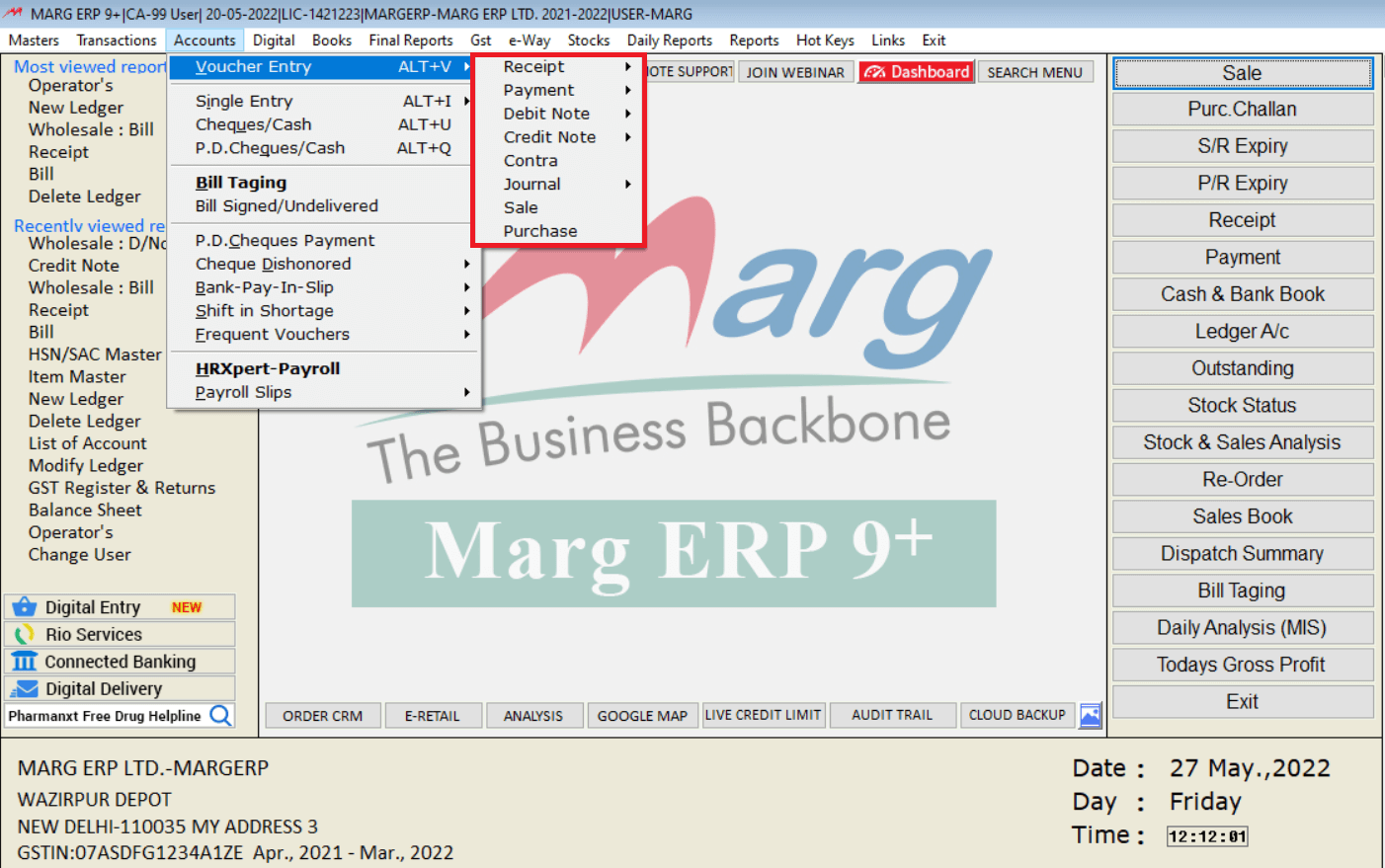

Voucher Creation: From the accounts menu, you can do voucher entries of receipt.

Press ESC if you are generating a new reference adjustment or spacebar to select the bill against which the receipt is made >> Press enter.

Similarly, you can do the entry of payment, Debit Note, Credit Note, Contra Entry, and Journal Entry.

Books

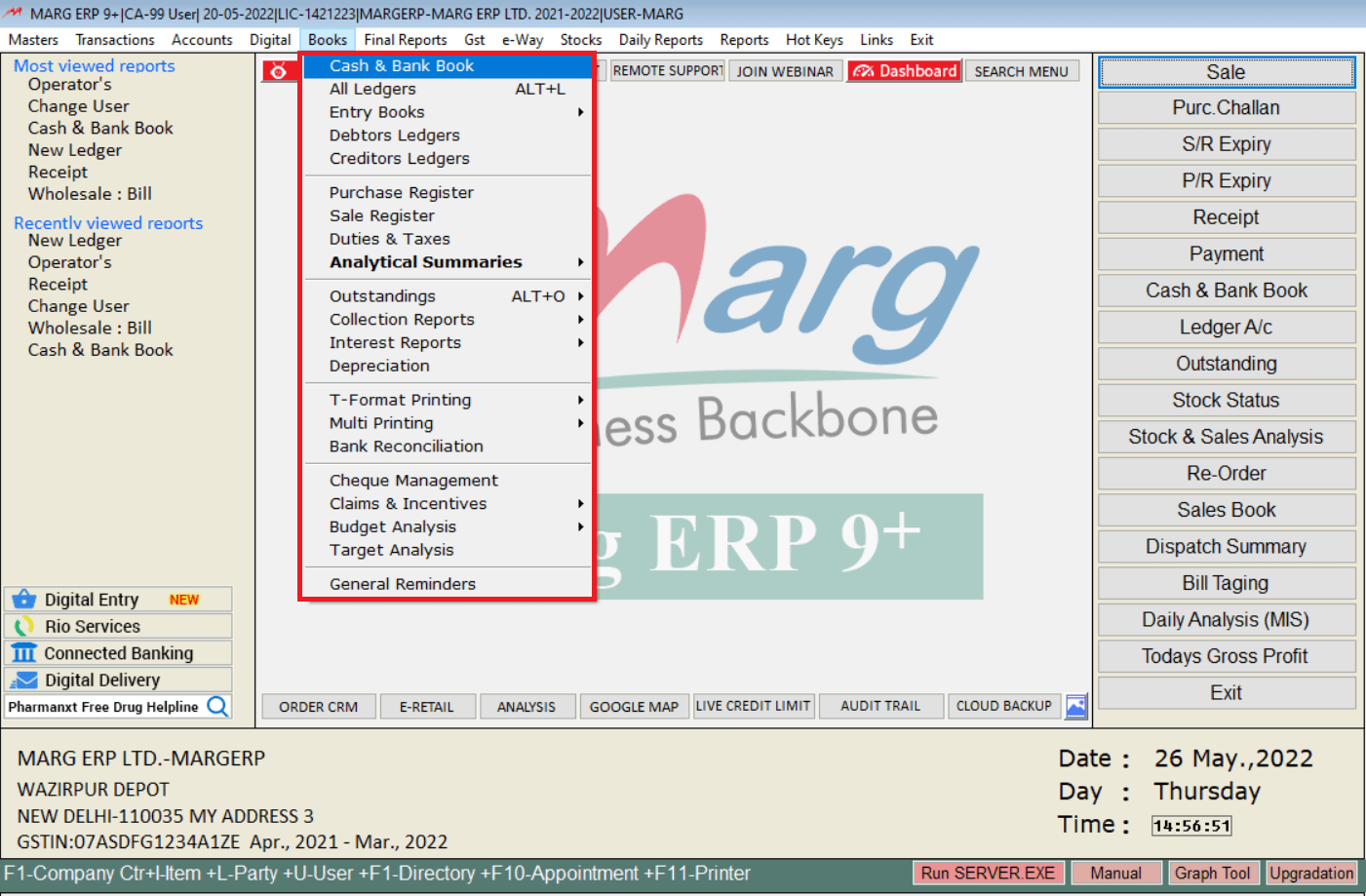

BOOKS: The books menu allows you to look at your Cash & Bank Book, Sale register, Purchase registers, Ledgers, Duties and Taxes, outstandings, etc.

REPORTS

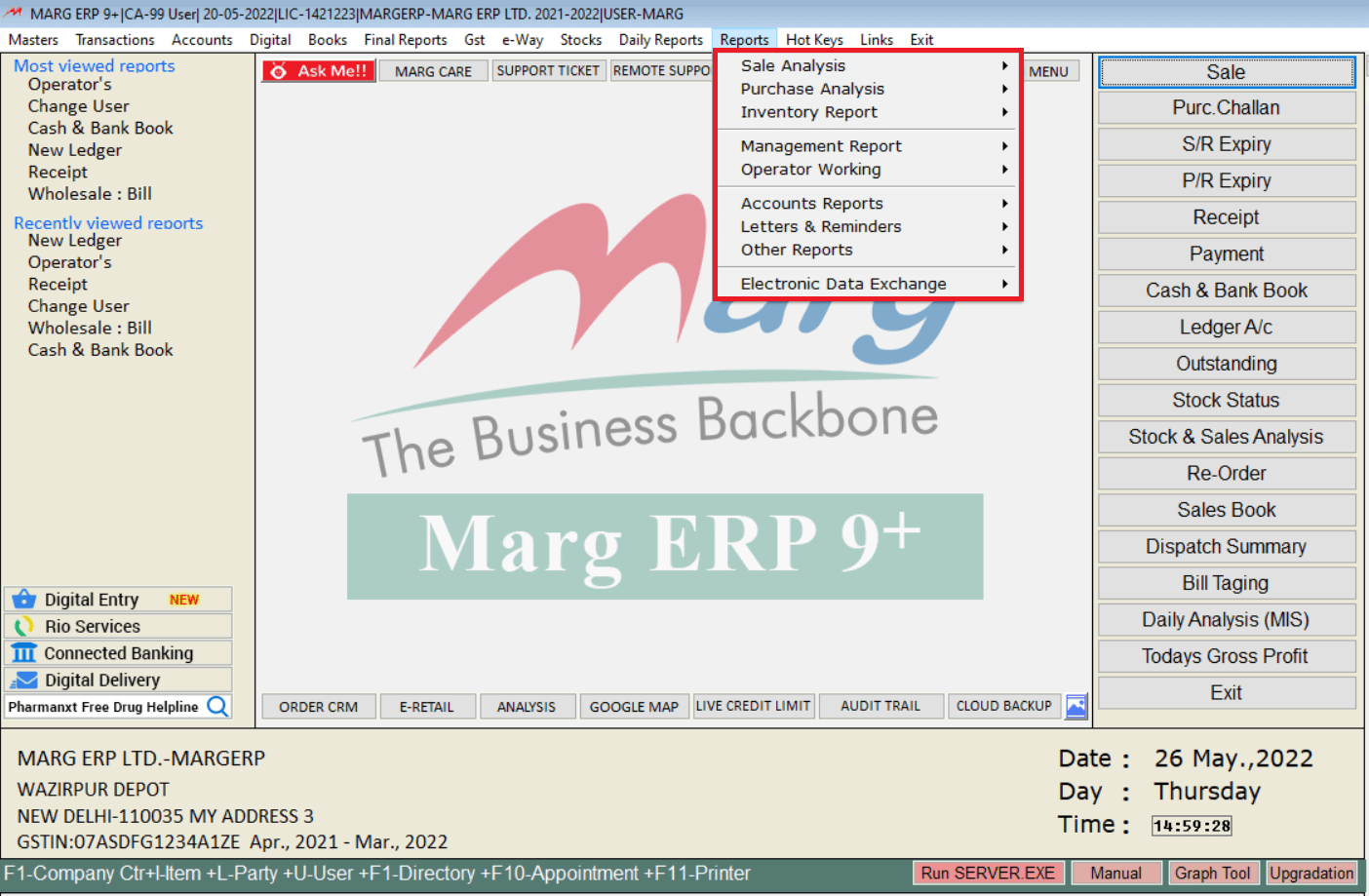

Reports: In the Reports menu you can take a look at Sale Analysis, Purchase Analysis, and Inventory Report.

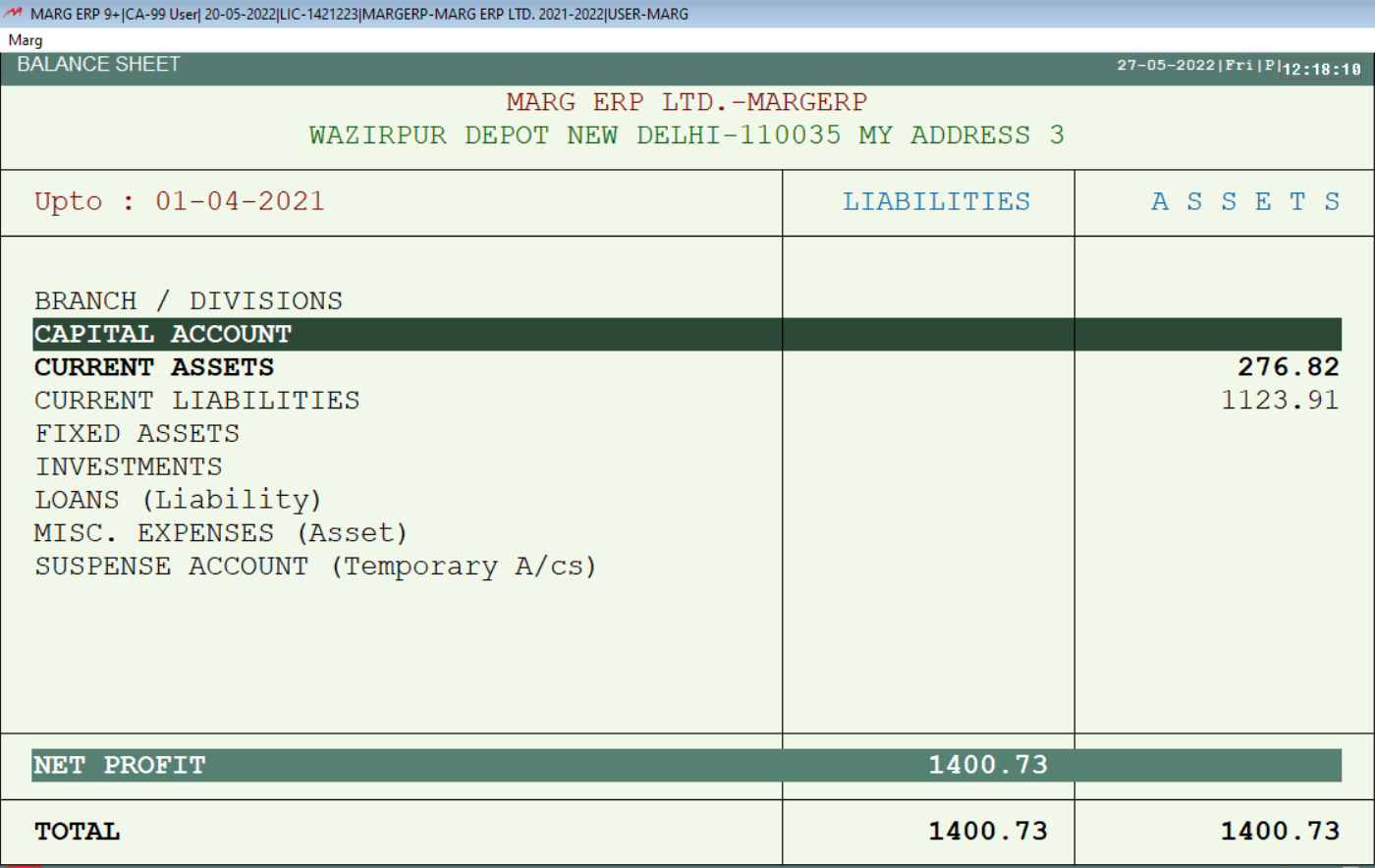

FINAL REPORT

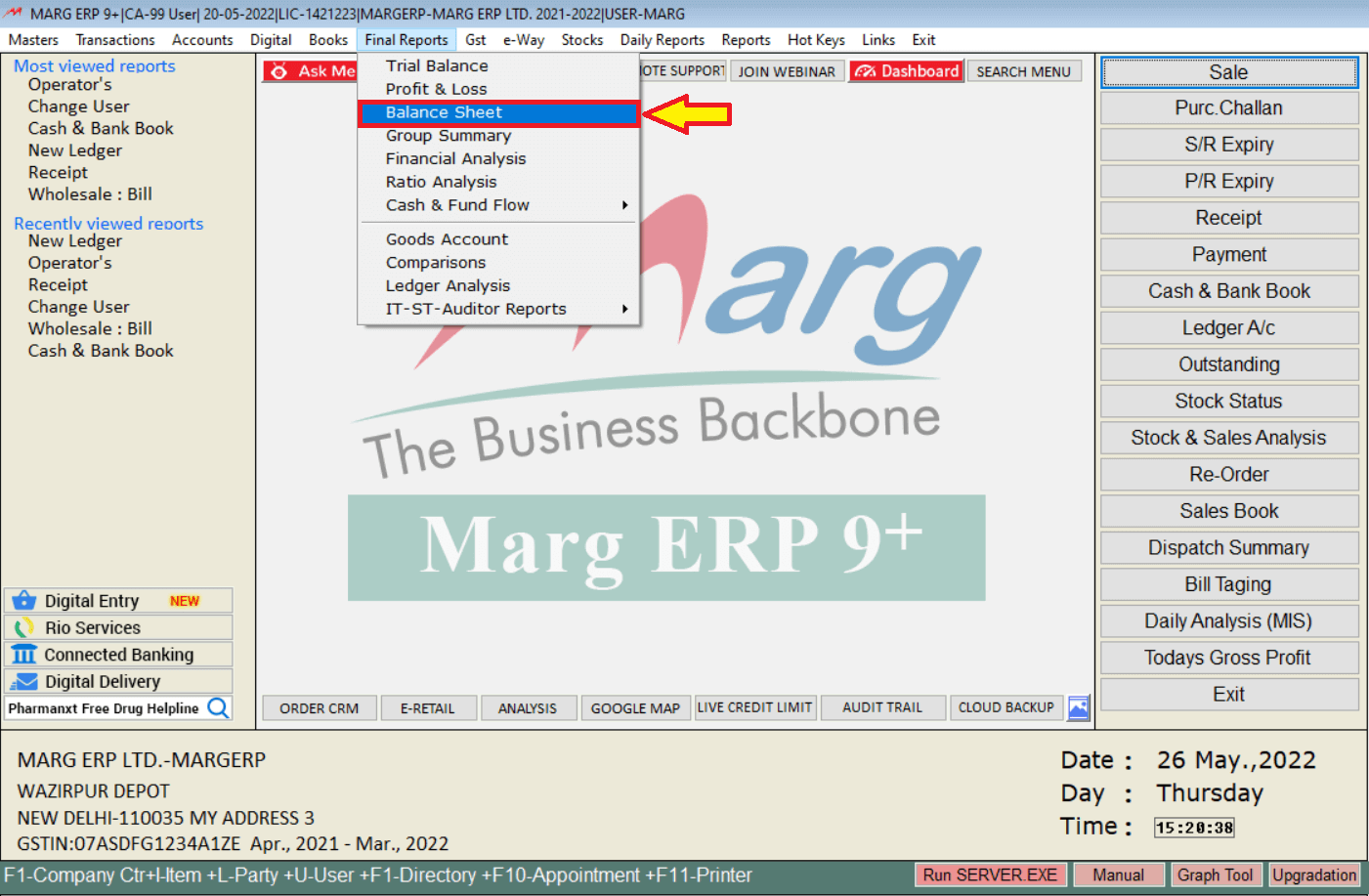

In Final Reports, all types of Final Reports are available like Trial Balance, Profit, and Loss, Balance Sheet etc.

Let’s take a quick look at the balance sheet. You can keep pressing enter to view the balance sheet in detail.

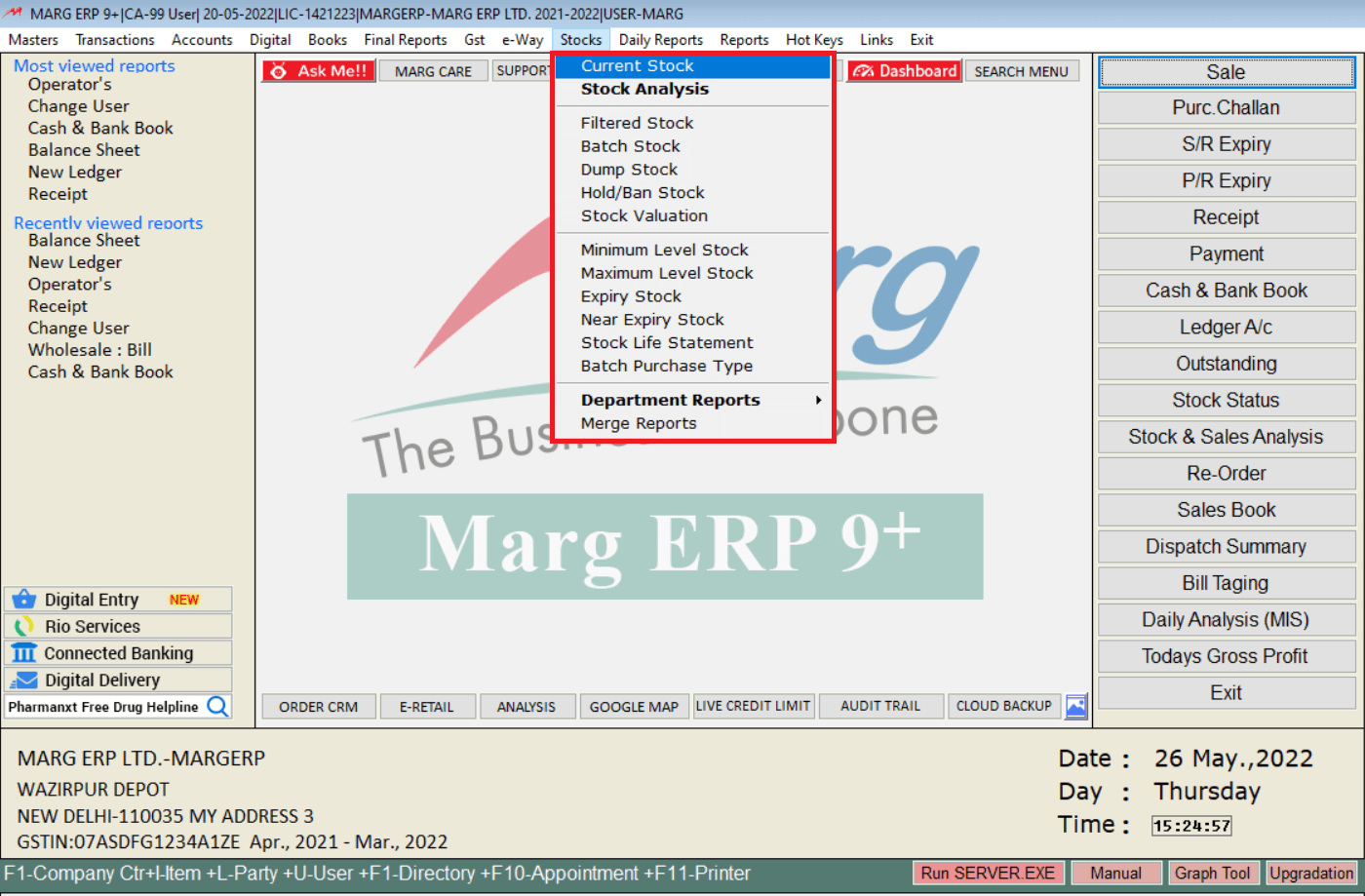

STOCKS

In the stock menu, you can generate all types of stock reports.

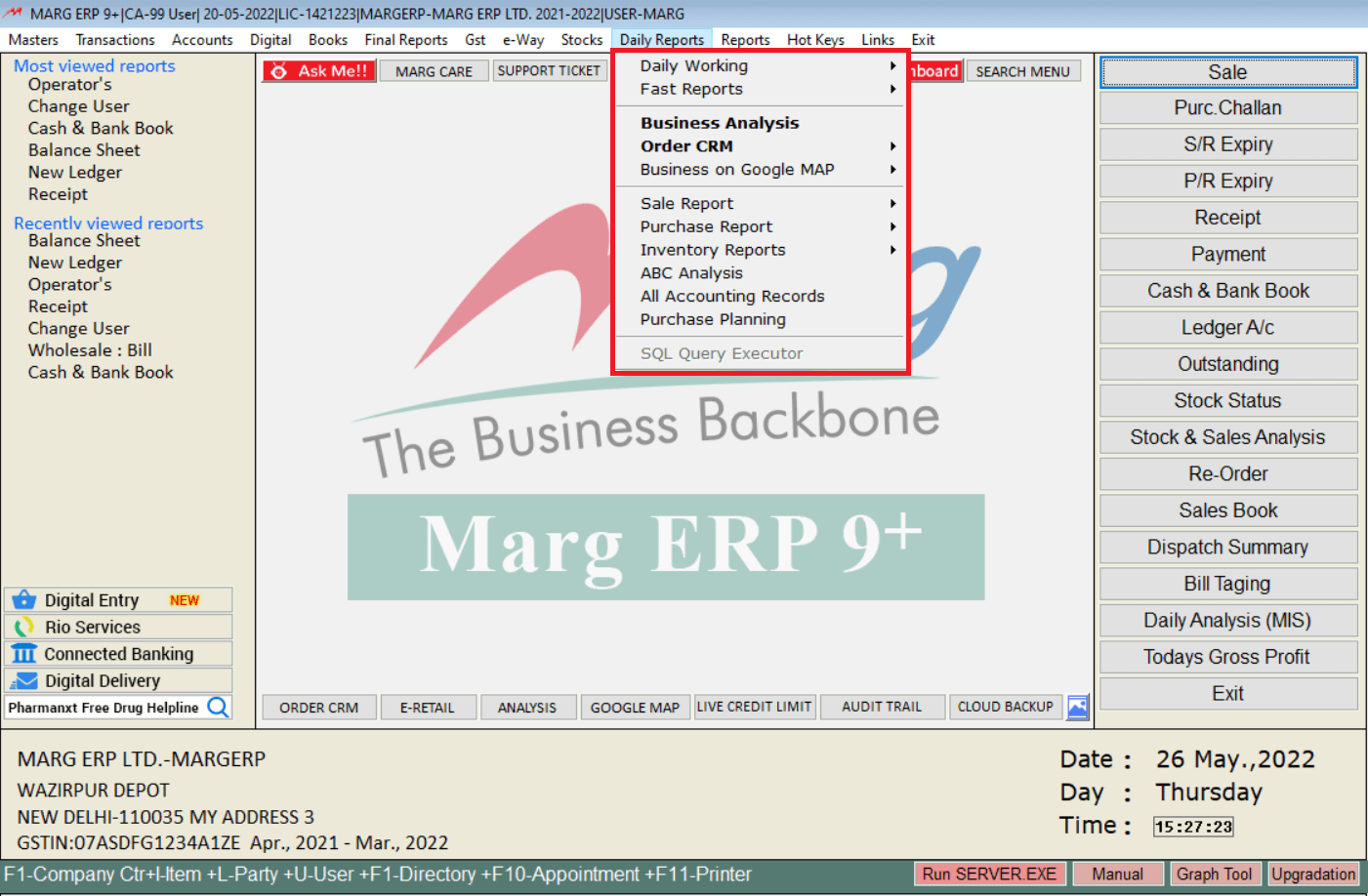

DAILY REPORTS

In the daily reports menu, there are 99% of reports are available and are used or viewed on daily basis.

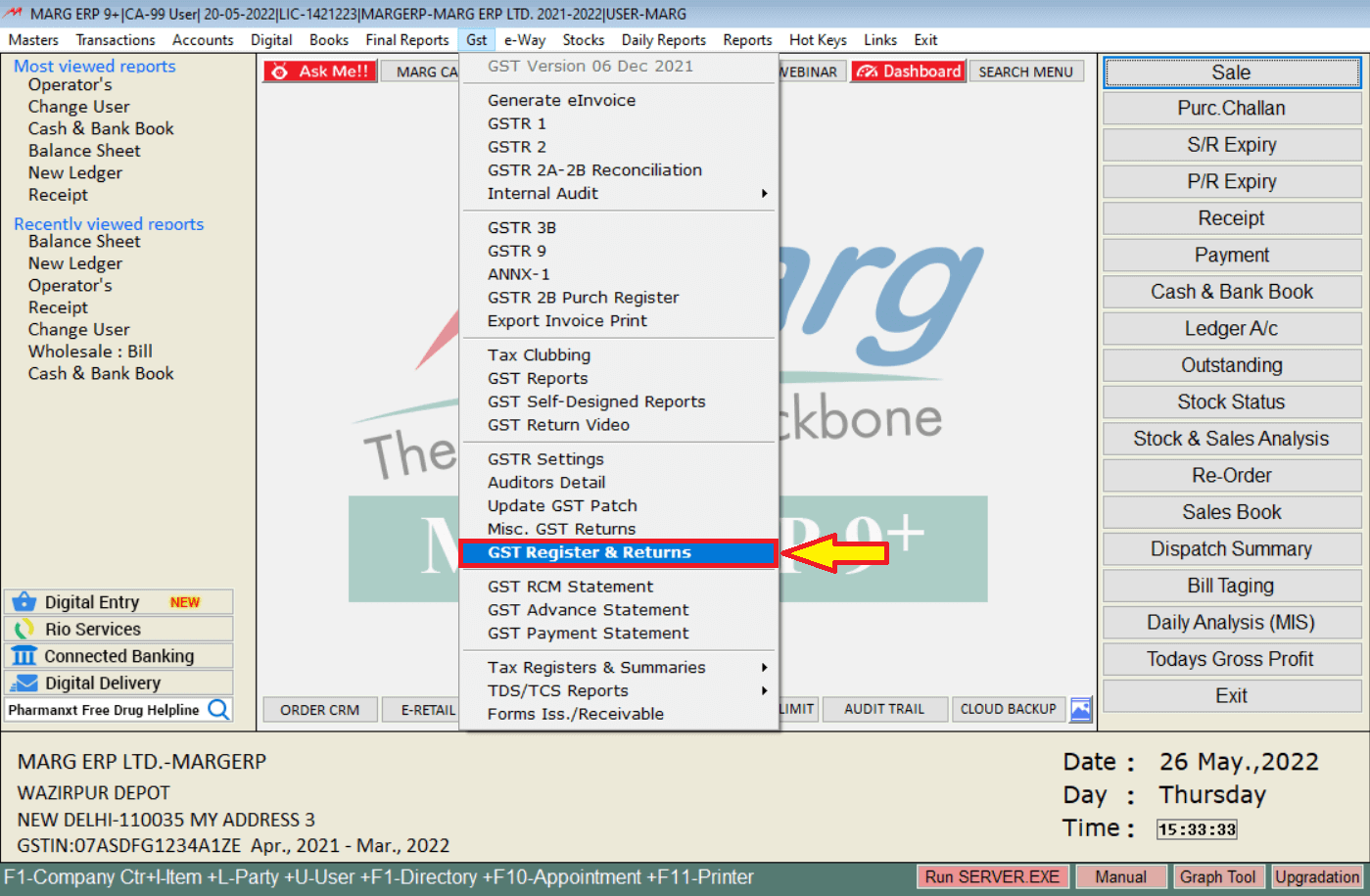

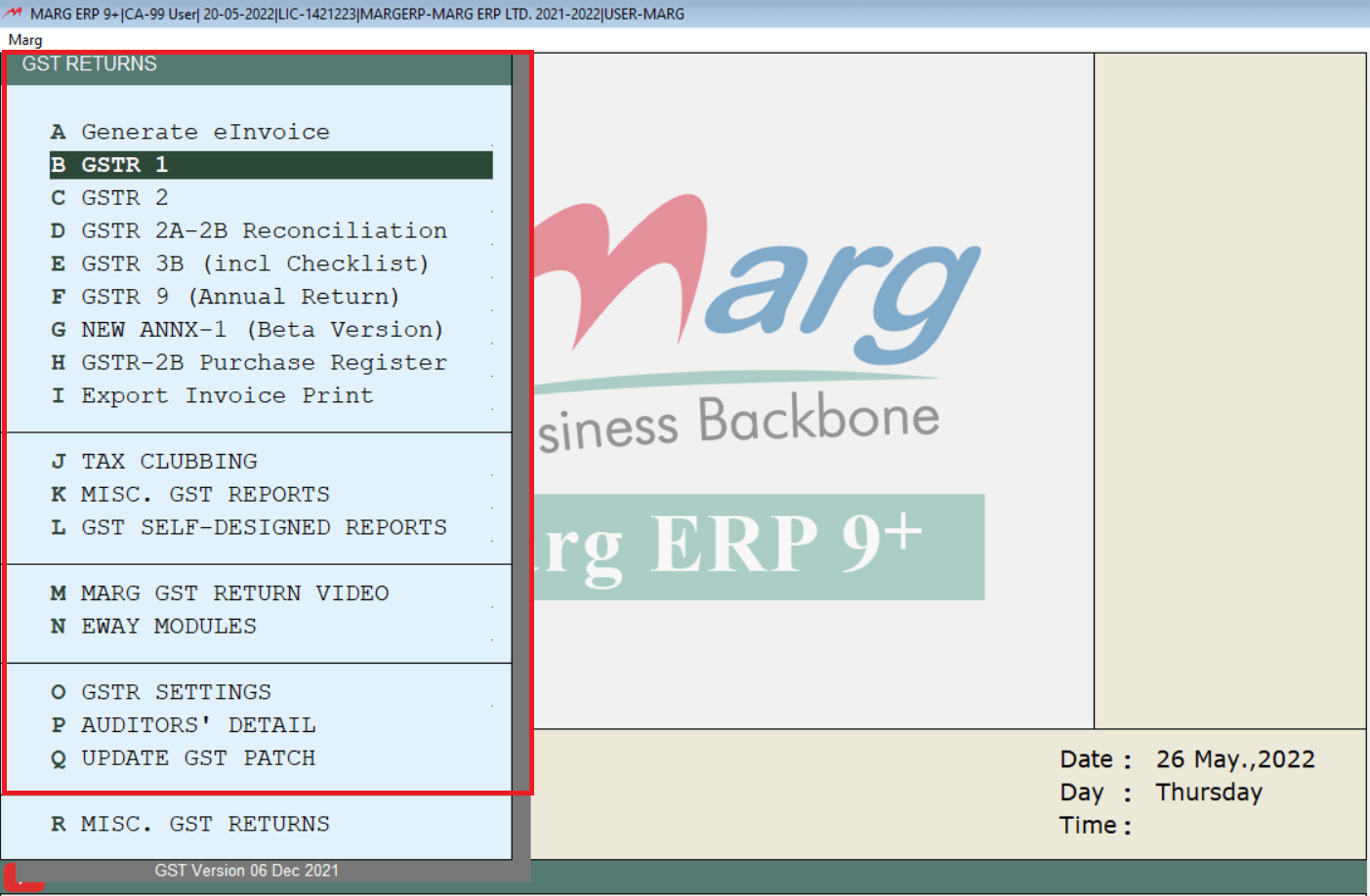

FILING GSTR WITH MARG ERP

like Gstr 1, gstr2, GSTR3b etc.

GSTR-1: Provides a summary of all sales for the month.

GSTR-2: Provides a summary of all purchases made during the month.

GSTR-3B: Provides a summary of the month’s sales and purchases.

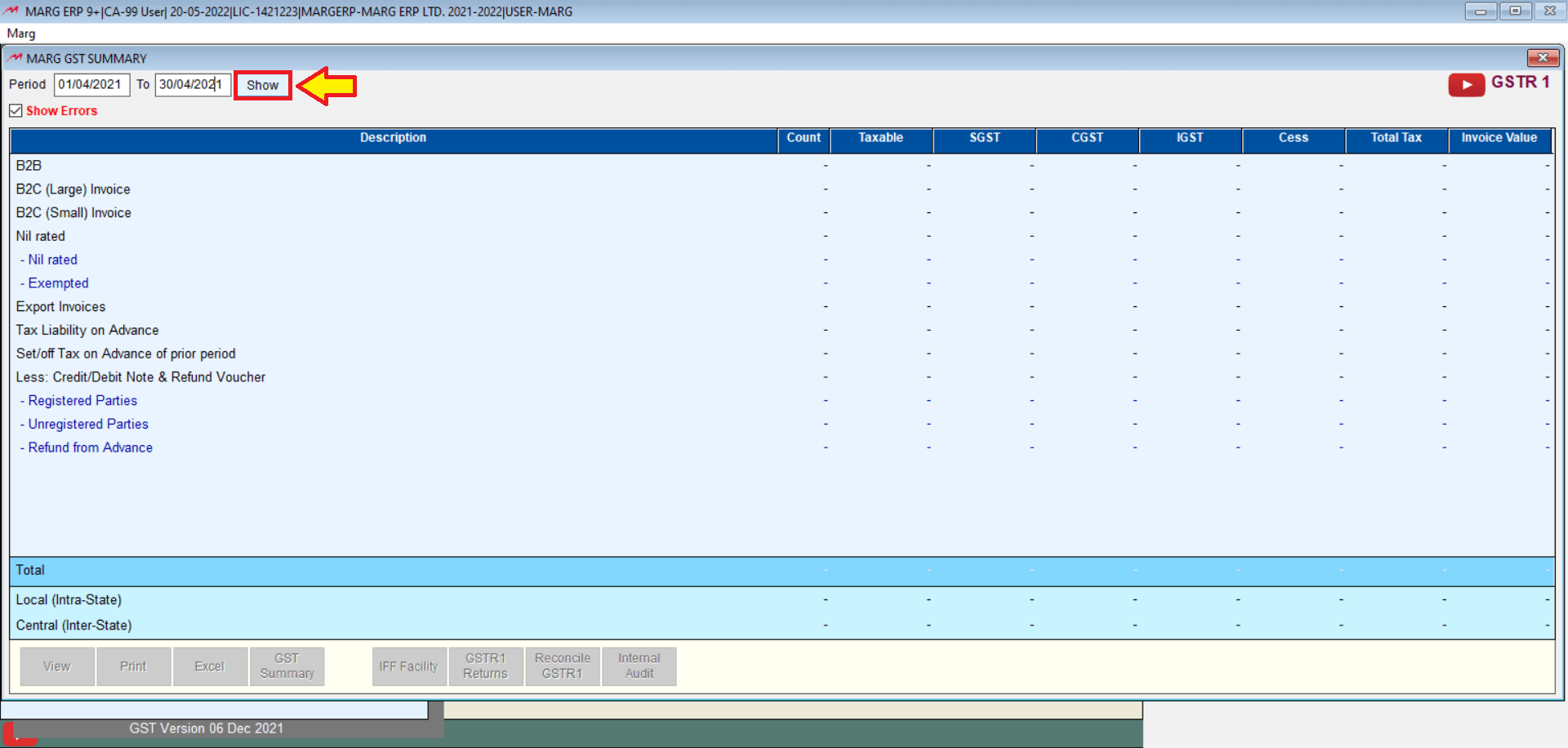

Let’s have a look at how to file gstr1.

Enter the time period in which returns you are filing >> Then click show

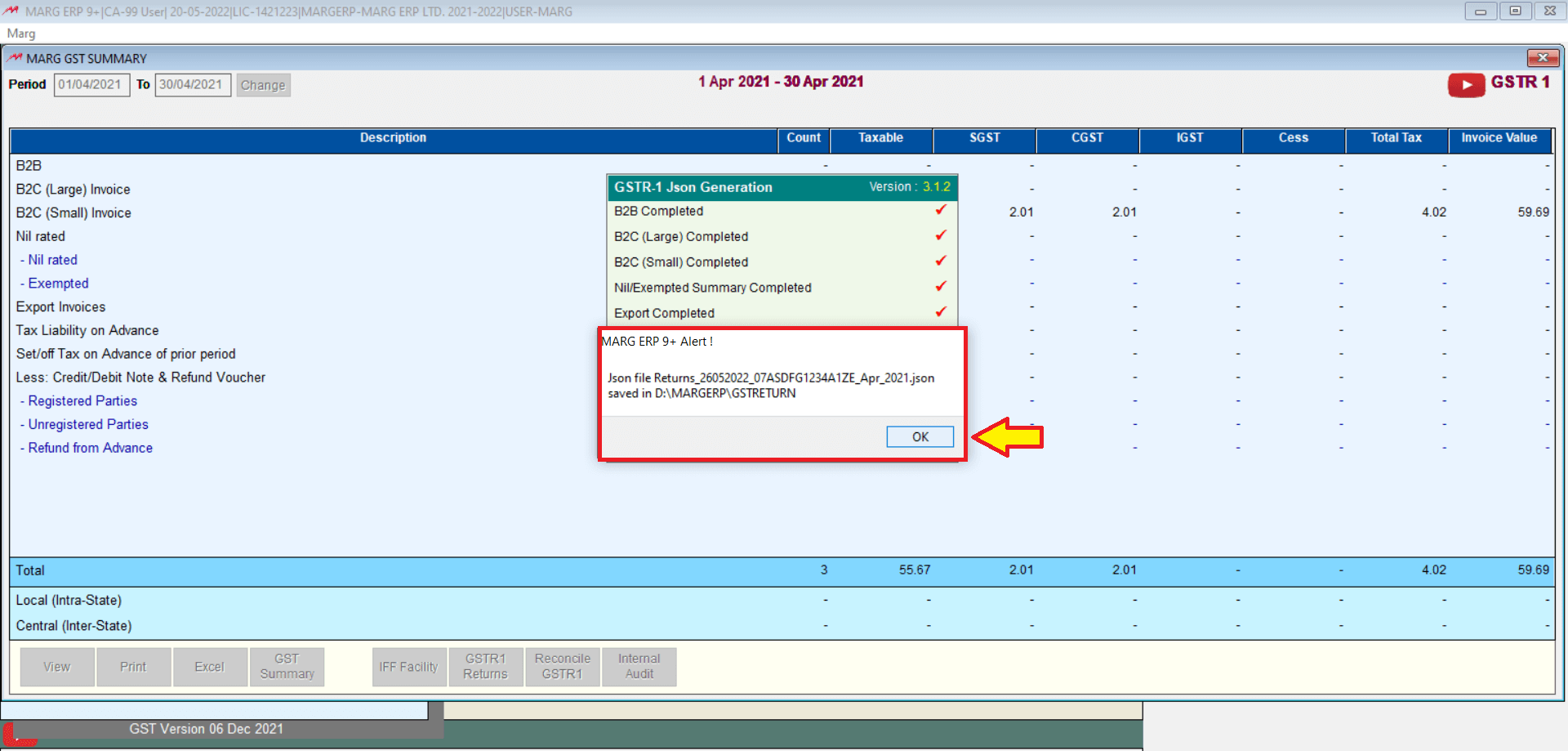

You can generate j-son file directly from marg software, which gets saved in the GST returns folder of the marg folder. This j-son file can now be uploaded to the GST portal.

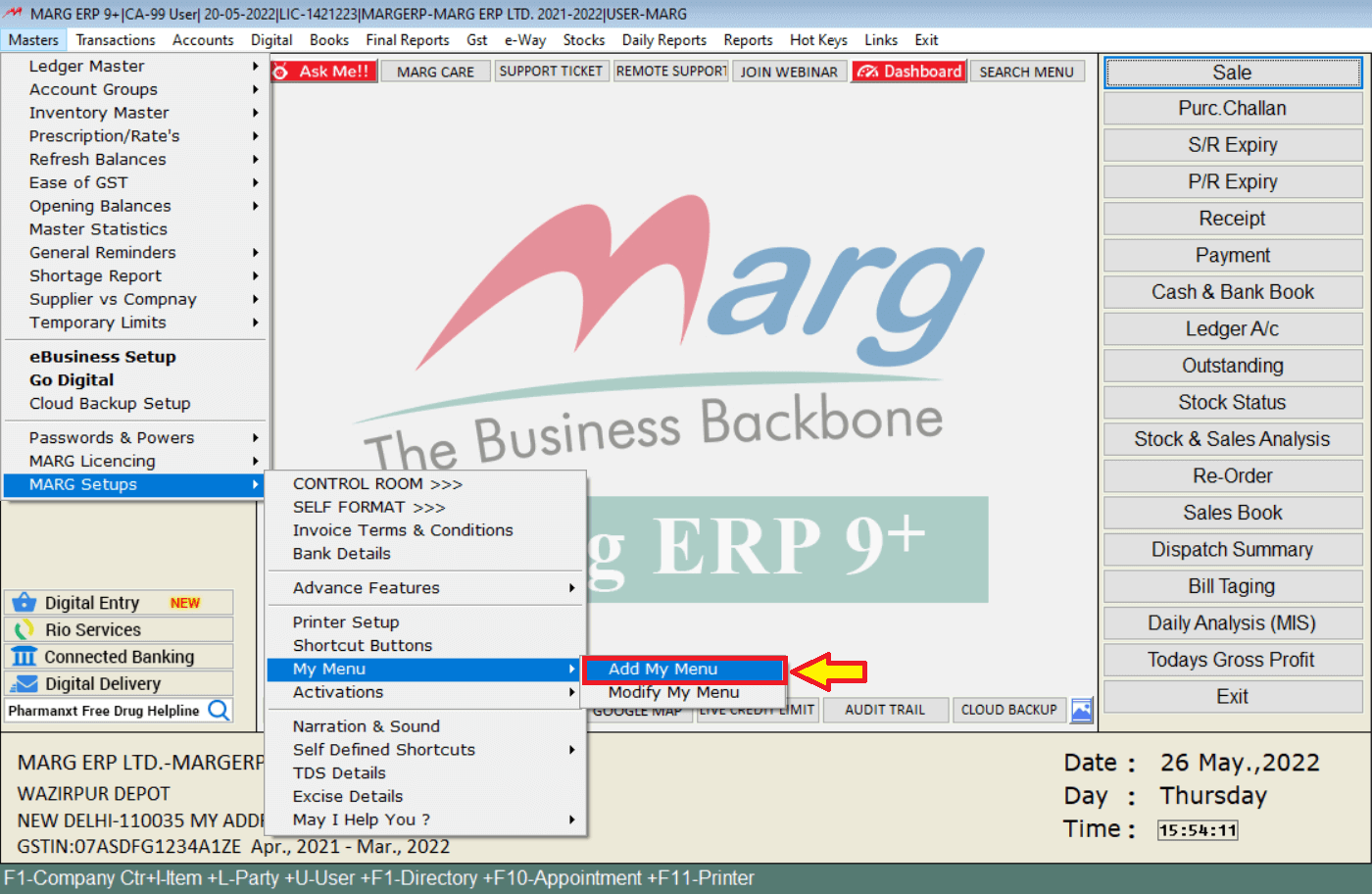

CUSTOMIZED MY MENU: In marg software, you can create a customized menu for an easy & fast workflow.

From the Master’s menu, you can click to My setup, click to My menu, and then click to Add My menu.