Latest News:

Deadlines for filing belated ITR has also been extended by the Finance Minister Nirmala Sitharaman. This decision was taken as most of the taxpayers would have failed to file the ITR asked by the Income Tax Department within the lockdown period and that could cause a heavy penalty on individuals.

Income Tax Department made income tax filing too easy. In the traditional way, people have to file income tax physically that takes much time and effort, now by e-filing, one can file income tax from any place. Before knowing how to efile income tax, you should know the necessary basic information.

Guide on efiling Income Tax Return

Age Limitation According to Gross Income

If your gross income is more than 2.5 lacs and your age is under 60 years, you are liable to file Income Tax Return. For age group, if you are in between 60 years to 80 years of age, and your gross income is more than 3 Lacs, OR if you are above 80 years of age having income more than 5 lacs, you are liable to file Income Tax Return.

Except this, if you have other income from property, you earn from foreign investment, you are a company or a firm, you want to get income tax refund claim or you want to apply for loans or visa, you should file income tax.

What is Assessment Year(AY) and Financial Year(FY)?

In India, the financial year is a period between 1st April to 31st March. And Assessment year (AY) is the period between next year when income tax is liable. Suppose your gross income is 10 lacs from 1st April 2019 to 31st March 2020, your Financial year will be FY2019-20 and Assessment year will be AY2020-21.

What is the last date of efiling income tax?

The 31st of July is the last date for efiling Income Tax Return. If your gross income is for FY2019-20, you have to file tax between 1st April 2020 to 31st July 2020. If you fail to file income tax before this deadline, you have to pay late fees that vary according to time delay and total tax. Even if, you are under taxable income, however, you should file zero-return filing.

How to efile income tax return?

Step 1 – Open www.incometaxindiaefiling.gov.in, It is easy to register. After registration, collect all income data with proof. And Login now…

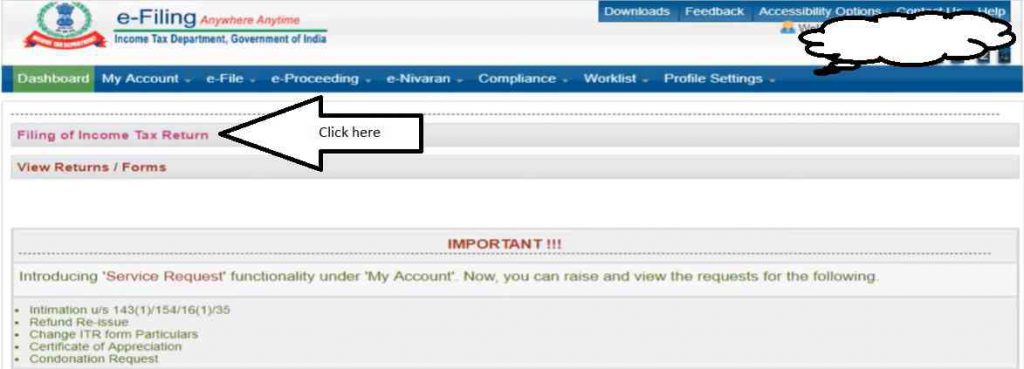

Step 2 – Click as shown in the screen below. Click on “Filing of Income Tax Return”.

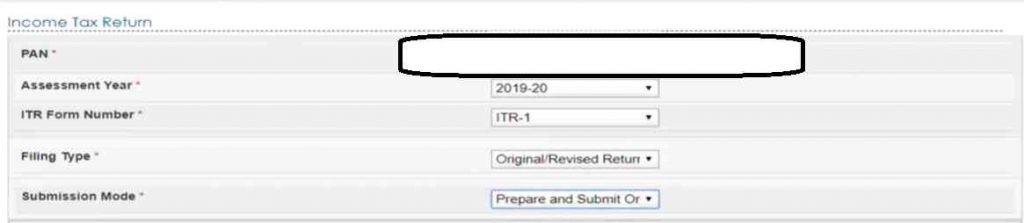

Step 3 – You will go to this screen below, here your PAN Card number will be filled automatically. You have to select Assessment year(AY), select ITR-1 form, the filing type will be “Original/Revised Return” and Submission mode will be Prepare and Submit.

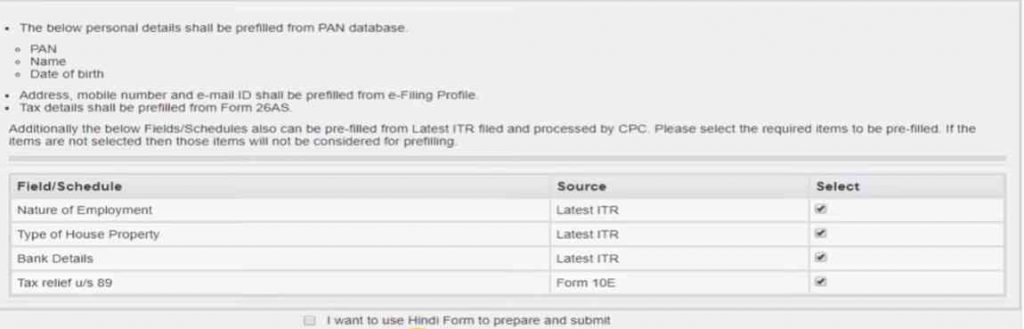

After selecting “Prepare and submit” few options will be opened below, it says some fields will be filled automatically according to your latest ITR, for this you have to click on checkboxes. If you want to use the Hindi form for filing income tax, you can click the checkbox below the image. Confirm and continue…

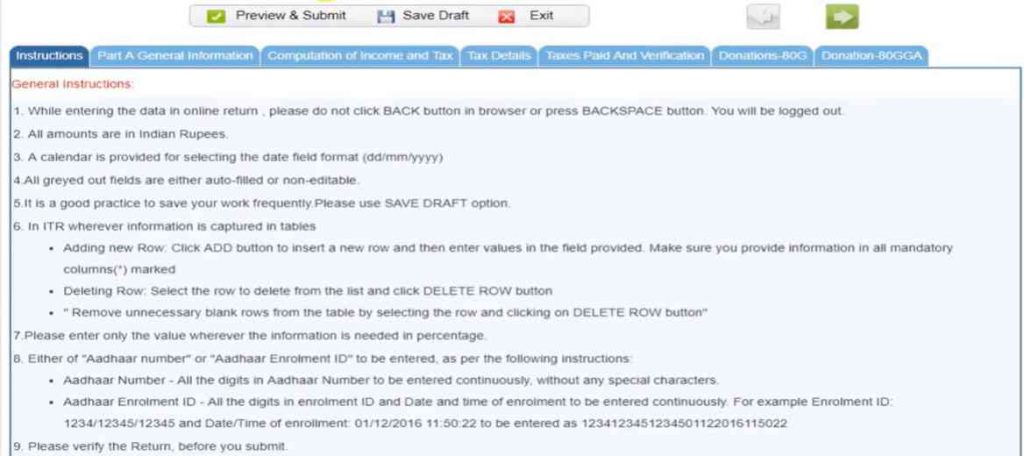

Step 4 – This is the main form, before starting to fill the form. Read the information, do not click the back button of the browser and save draft after filling a few details. Now let’s move to part 1 “General Information”.

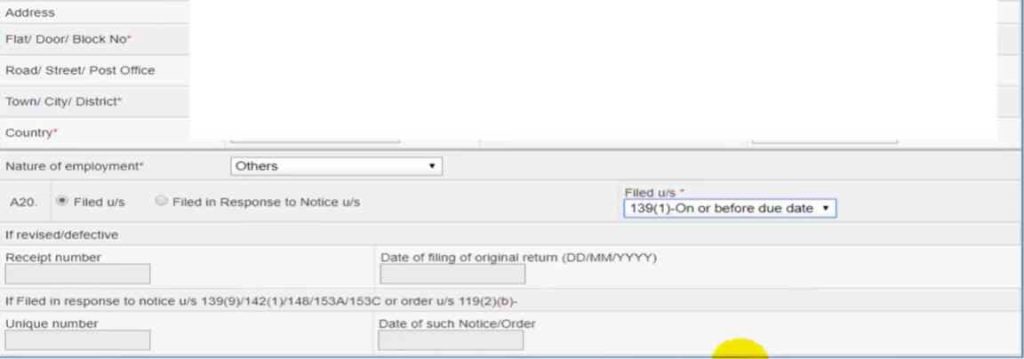

Step 5 – At the “General Information” section, most of the information would be filled automatically. The information is not there, you have to fill. Aadhar card number is mandatory.

At the last of the form, you will see “Nature of Employment”, fill accordingly. And you will see “A20 filled u/s”, here u/s means “under the section”. If you are filing after the due date, select “Filled u/s” otherwise leave this and click on “Save Draft” and click on the right arrow key to proceed further.

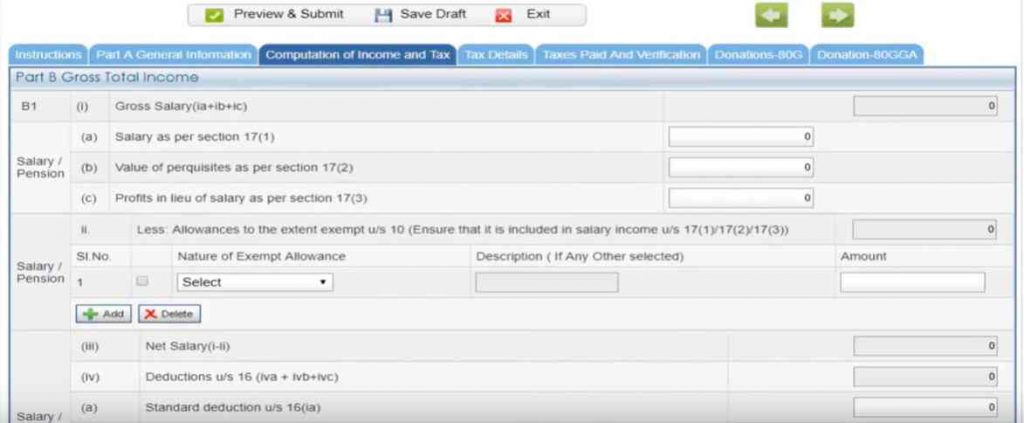

Step 7 – In this section, you have to get Form 16 from your employer, this form is lengthy, just follow all columns and fill the details. Make sure, you are clicking on “save drafts”.

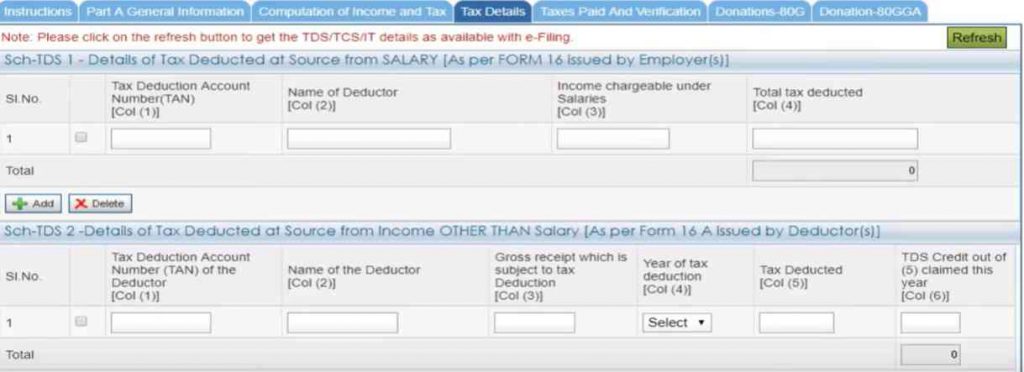

Step 8 – Here, you have to fill Tax details. Here, you can see your TDS details.

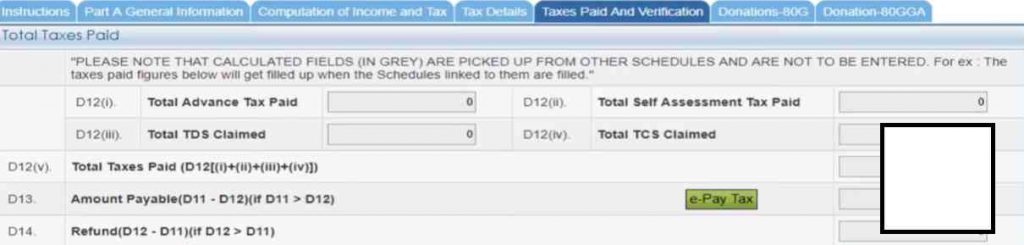

Step 9 – Here, you can see all the tax. You can pay tax easily through e-pay Tax and fill the challan information in the form then only submit your tax. If any refund will be there, it will be looked at the refund column. Fill details of all the banks you have, and mention that bank in the first column, where you want your refund to be transferred.

Step 10 – Check the verification box, click at the “Preview and Submit” button, check all the form in preview, you can also download pdf. If everything is correct, submit the form. You have successfully filed your income tax return.