Post-implementation of Goods and Service Tax (GST), it has become necessary for every small or big company supplying goods or services — annual turnover of more than Rs 20 Lacs — to get GST registration. Registration under GST ensures that proper taxes are paid by the organization for the goods and services.

After successful registration, taxpayers will be issued with a 15-digit unique GSTIN (Goods and Service Tax Identification Number) by the Central Govt. of India. Once you register for GST, you can start availing its underlying benefits provided by the gov.; for instance, you will be identified as a supplier by the gov. and can avail ITC and collect tax from the purchasers.

Process of GST Registration- Offline

Make sure all the below mentioned documents are ready is your wish to register for GST

- PAN card of the applicant

- Partnership certificate

- PAN cards, voter IDs or Aadhaar cards of promoters and/or partners

- Address proof of the business. This could be in the form of electricity bill, rent or

- documents issued by the government

- Bank account statement

Process of GST Registration- Online

New GST Registration can be done online & offline. For initiating the process offline, you have to visit GST Seva Kendra along with all the documents but for GST enrollment online, visit www.gst.gov.in.

Steps to be followed for GST Registration Online.

1. Visit GST portal

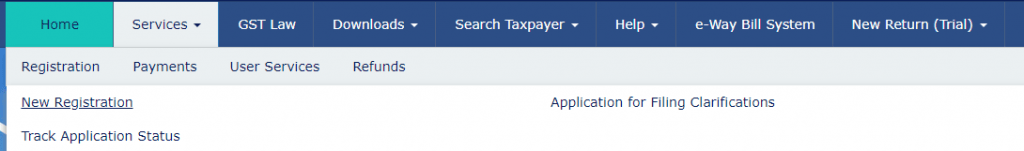

2. Move your cursor on the ‘Services Tab’ and click on ‘Registration’ under the tab and then click on ‘New registration’.

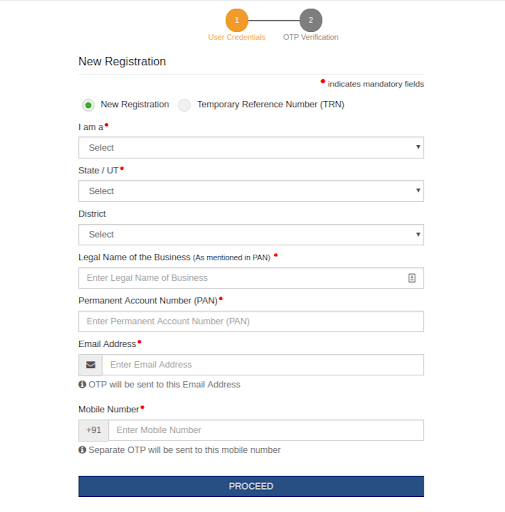

PART A: GST Registration Online

3. In the first section ‘I AM A’, select ‘taxpayer’ from the drop-down. Fill other details required in the process like the legal name of your business, state, email address, mobile number and PAN card.

4. You will receive a one-time password on your mobile number and email ID for verification. Enter the OTP and click on ‘Proceed’.

5. After completing the process you will get a Temporary Reference Number (TRN) after verification. Save the number for future reference.

PART B: GST Registration Online

- Enter your TRN and CAPTCHA code to log in and start GST Registration process Part B. Get your mobile number and email Id verified by providing the OTP sent on both. After successful registration, you will get redirected to the next page.

- Submit exact information of your business like name of the organization, PAN, name of the state you are registering your business and the date when your company got registered

- In the next step, you have to submit the details of the partners associated with your business. For a proprietorship firm, you have to submit authentic details of the proprietor like his name, designation, DIN (Director Identification Number), PAN and Aadhaar number

- In case you wish to authorize someone else to file your GST returns, submit the details of the person.

- Add rest of the details like principal place of the business, address, official contact details and nature of possession. In case you wish to add additional branches of business, details of goods and services, the bank account details of the company you can add them too.

- Upload the relevant documents which support your type of business

- Click on ‘Save and continue’. After submitting your application authenticate it by signing digitally.

- Click on ‘Submit’.

- Save the Application Reference Number (ARN) you received via email or SMS to confirm your registration.

You can also Track GST Registration Status from www.gst.gov.in. Enter the TRN you received at the time of registration and check the status.