- How to register for SBI net banking?

- How you can login to SBI net banking?

- How to check SBI account summary Online?

- How to transfer funds from SBI bank net banking?

- What are The Transaction Limits and Charges Applicable of SBI Online Banking?

- How to reset the password for SBI net banking?

- What is The Customer Care Number for SBI Net Banking?

- What are The Services Available in SBI Net Banking?

- Frequently Asked Questions

Table of Contents

ToggleSBI (State Bank of India)

State bank of India (SBI) is one of the largest government banks in India. SBI offer internet banking facilities to both its retail customers & corporate customers. State Bank of India also leads 5 other public sector banks namely:

- State Bank of Mysore

- State Bank of Hyderabad

- State Bank of Patiala

- State Bank of Travancore

- State Bank of Bikaner and Jaipur

Below are The Mentioned Details of SBI:

State Bank of India (SBI)

| Owner | Government of India |

| Chairperson | Mr. Rajnish Kumar |

| Head Quarters | Mumbai |

| Customer Care Number | 1800 425 3800 |

| Date of Foundation | 1st July 1955 |

How to Register for SBI Net Banking?

To register for SBI Net banking user must fulfill the following conditions to register for SBI net banking.

- Having a savings account with SBI is mandatory

- Mobile number must be linked to the bank account

- Must be having an ATM Card

If you satisfy the above conditions you can follow the below-written steps to register for SBI personal banking facility.

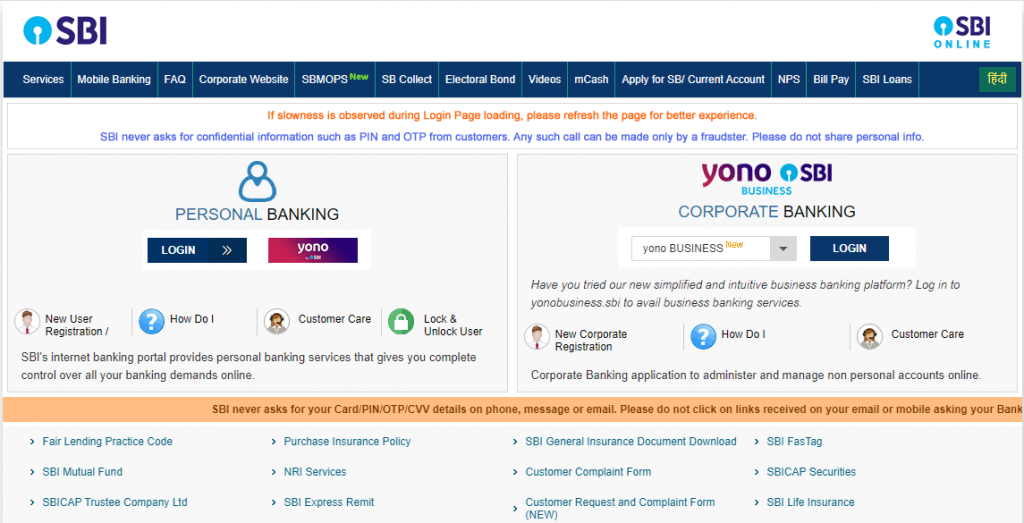

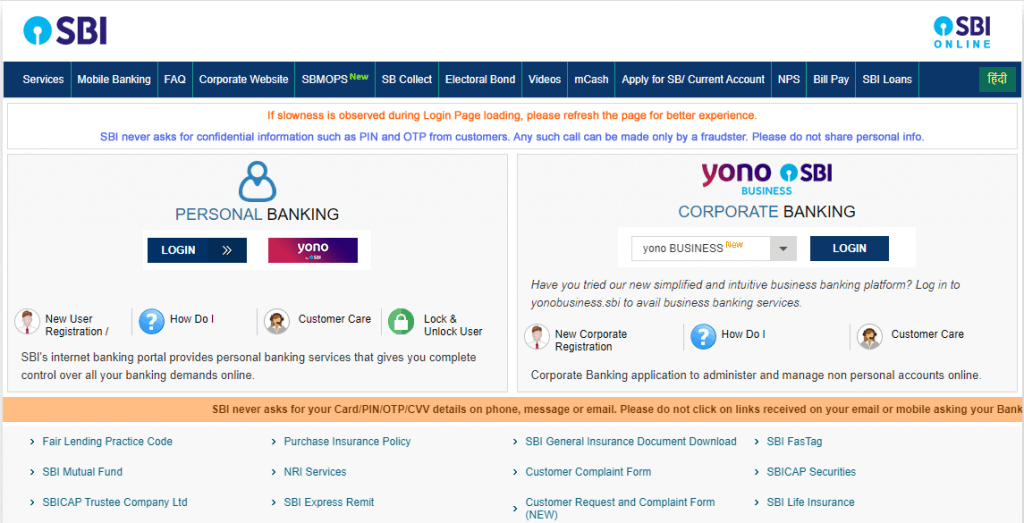

Step-1: To Log in to sbi online banking visit the official website of SBI at https://www.onlinesbi.com/

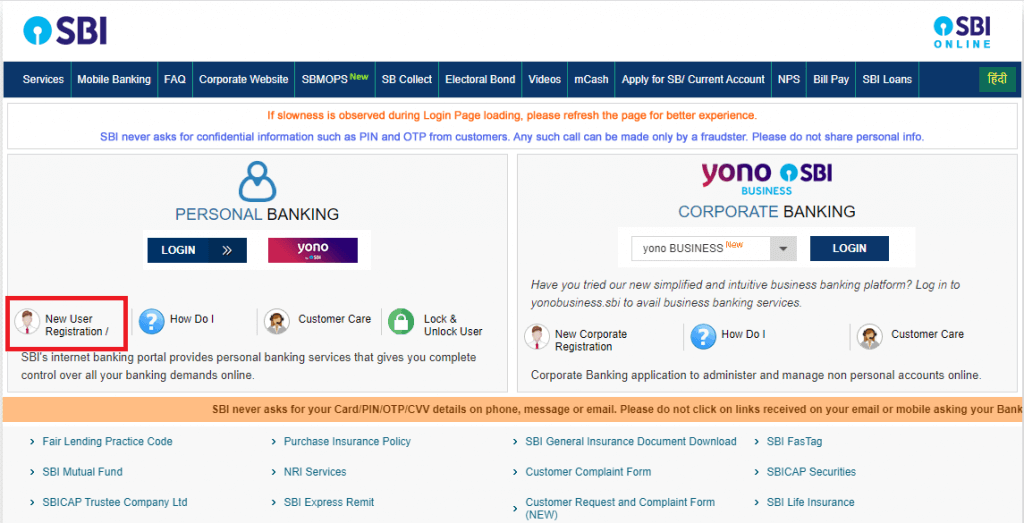

Step 2: Click on ‘New User Registration’ button

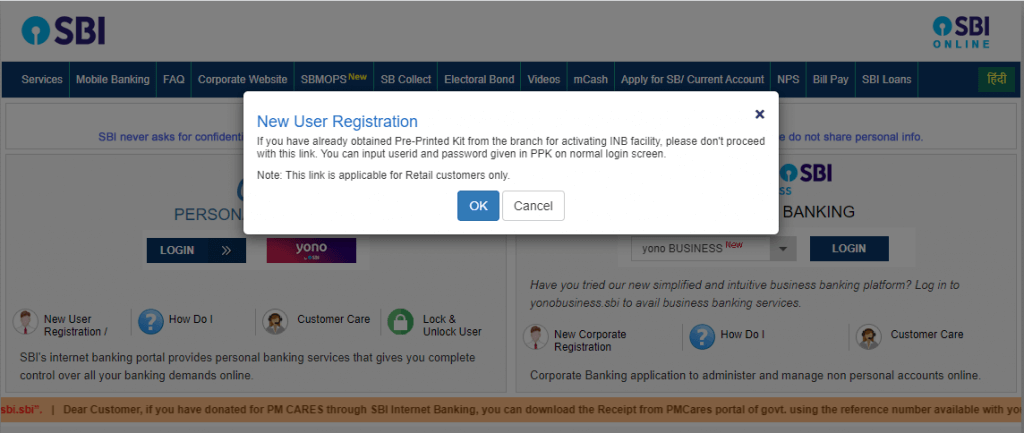

Step 3: A pop-up window to ask for the confirmation that you have not received SBI online banking kit will appear on the screen. Click on ‘OK’ to confirm.

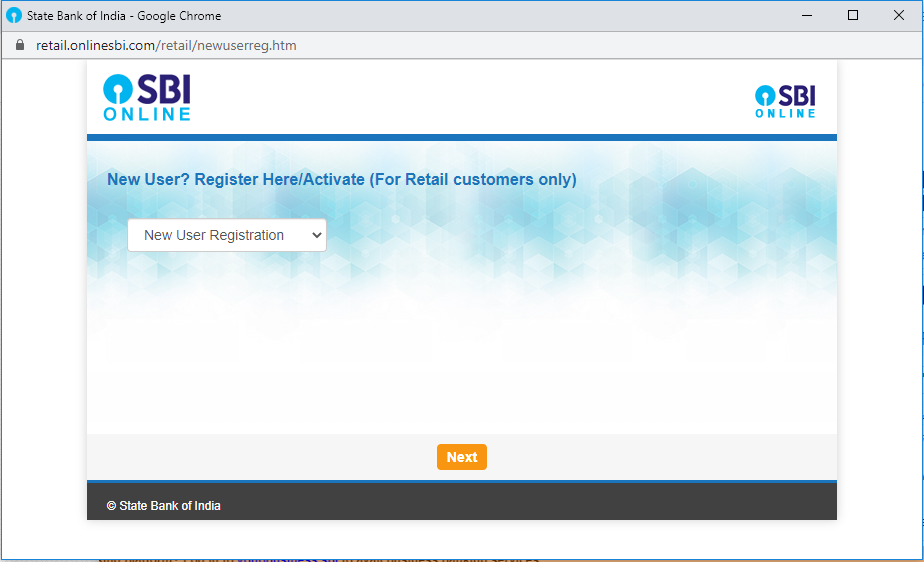

Step 4: Select the ‘New User Registration’ option from the drop-down menu and click ‘Next’.

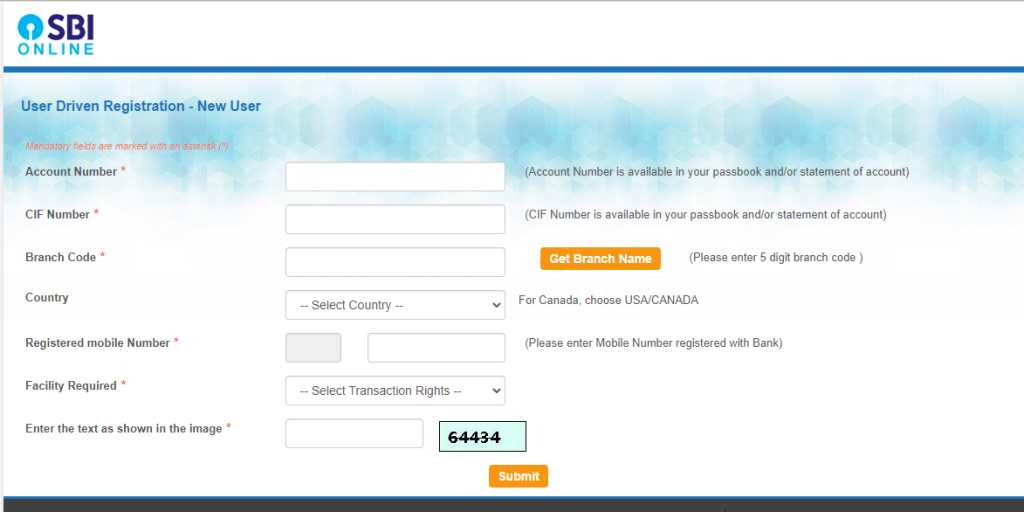

Step 5: In the next screen, fill up the details required:

- Account number

- CIF number

- Branch code

- Country

- Registered mobile number

- The facility that you want

After filling in all the details, enter the ‘Captcha Code’ correctly & proceed.

Note: you will find all the details written on your passbook at first page. If you don’t know the branch code you will get it on the passbook. Or you find it under ‘Get Branch Code’ option. You have to enter the state & branch name to know the branch code.

Step 6: Under the ‘Facility Required’ field, you can select one of the following options: View, limited transactions, and full transactions.

Step 7: Click on ‘Submit’.

Step 8: After submitting, you will receive an OTP on the registered mobile number. Enter the OTP and click ‘Confirm’.

Step 9: To register with ATM card details, select the option ‘I have my ATM card’ and click ‘Submit’.

Step 10: Enter the ATM card details- Card Number, Expiry & ATM pin on the screen and click ‘Submit’.

Step 11: On the screen, you will get a temporary username, note the username.

Step 12: Enter a new password (completing all the conditions of the password). When it says ‘Strong’ click on ‘Submit’ to complete the registration process.

Remember your password but you can always change it later.

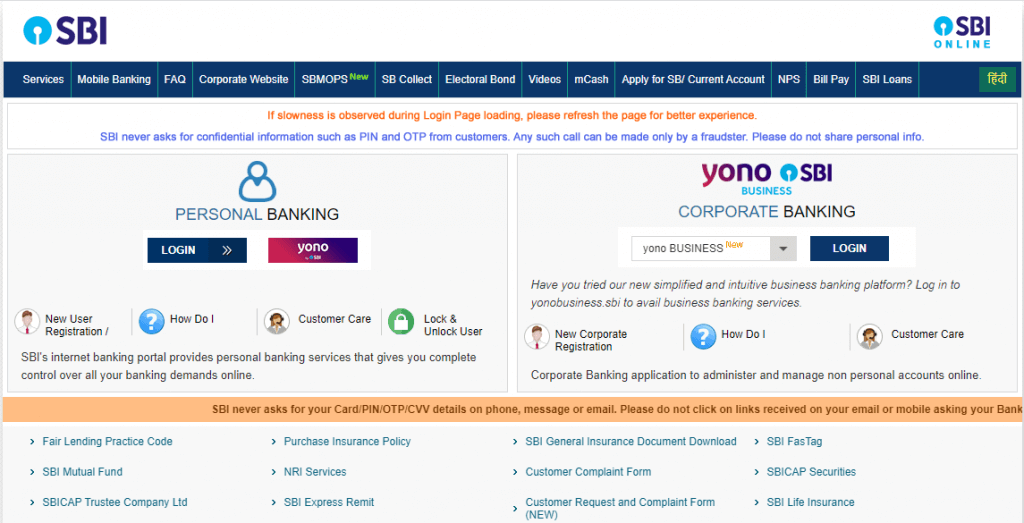

How You Can Login to SBI Net Banking?

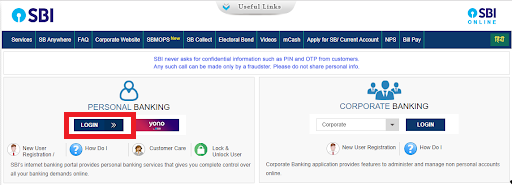

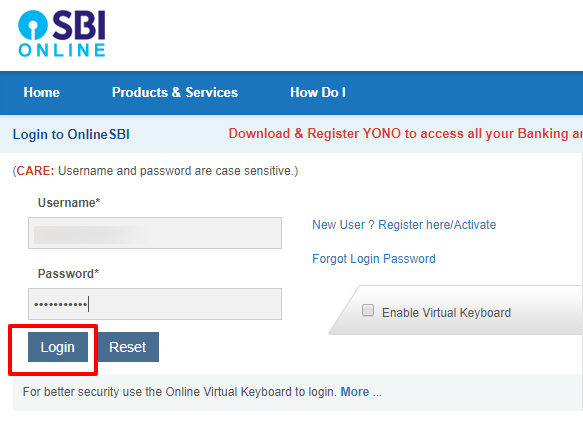

Step 1: Log in from the official website https://www.onlinesbi.com

Step 2: Click on the ‘LOGIN’ button under the personal banking section.

Step 3: Now simply enter your username and password details in the box and click ‘Login’ to access your account.

Step 4: Login successful! You will be redirected to a page with all account information.

How to Check SBI Account Summary Online?

Step 1: Log into your SBI online internet banking account

Step 2: After you log into your account you need to click on the ‘Account Summary’ option in the ‘Quick Links’.

Step 3: The list of all accounts that you hold will be displayed on the screen.

Step 4: Then click on the account’s ‘Click here for balance option’ to view the details.

How to Transfer Funds From SBI Bank Net Banking?

To transfer money through SBI Online banking you have to first add the recipient account as a beneficiary. You will require the detail of the recipient account like Account holder name, account number, bank name, and IFSC.

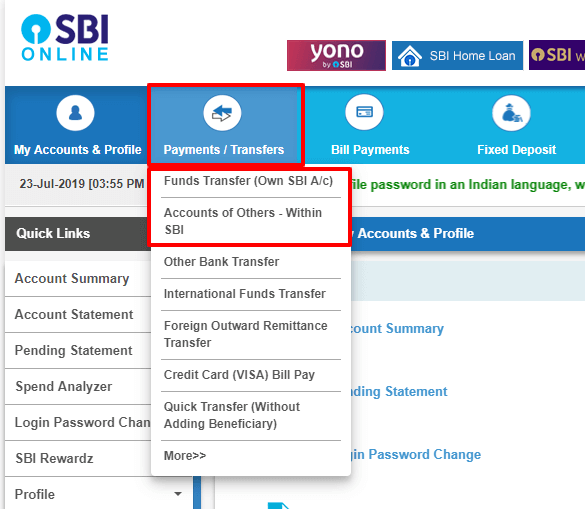

Follow the Below Steps to Transfer Money Through SBI e-Banking:

Step 1: Log in to the SBI online account.

Step 2: To transfer the money to any other bank account under the ‘Payments/Transfer’ tab click on ‘Other Bank Transfer’

Step 3: To transfer money to a SBI account, click ‘Accounts of Others – Within SBI’.

Step 4: A screen will appear according to your selection, choose the type of transaction you would like to make, and click ‘Proceed’.

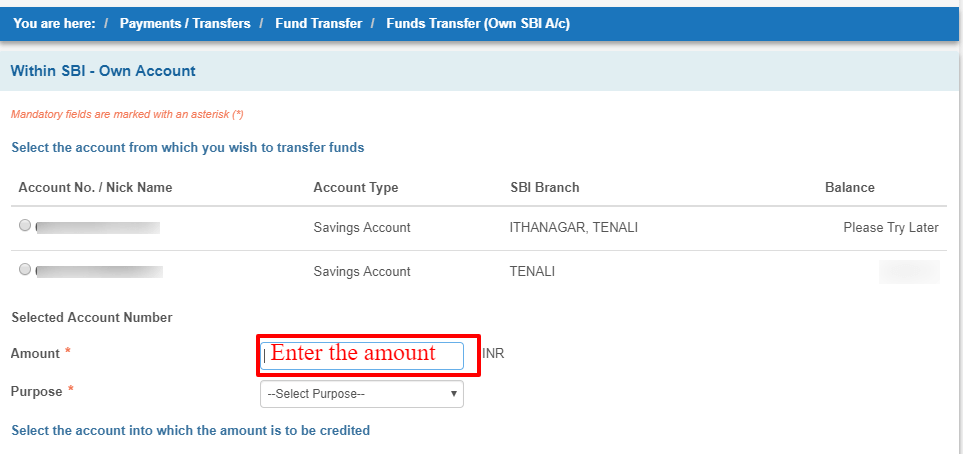

Step 5: From your account list, select the account you wish to make the fund transfer from.

Step 6: Now, enter the amount you want to transfer and add remarks if any in the next section.

Step 7: From the added beneficiary accounts choose the account to transfer the money.

Step 8: Select the method of transfer & time of transfer from the available options.

Step 9: Selecting the checkbox to agree to the terms and conditions and click ‘Submit’.

Step 10: Read all the detail you entered carefully & confirm by clicking on the ‘Confirm’ button.

Step 11: You will receive the OTP on the registered mobile number. Enter the OTP & complete the authentication process.

Step 12: A confirmation message will be displayed on the screen to confirm the process.

What are The Transaction Limits and Charges Applicable of SBI Online Banking?

What are The Transaction Limits and Charges Applicable of SBI Online Banking?

| Transaction Type | Per Day Limit | Overall Daily Limit | Easy PIN Overall Category Limit | Easy PIN Individual Overall Daily Limit | Charges |

|---|---|---|---|---|---|

| IMPS | Per Transaction Limit: Rs.2,00,000; Overall Daily Limit: Rs.2,00,000 | Rs.10,00,000 | – | Rs.1,00,000 | Nil |

| Quick Transfer | Per Transaction Limit: Rs.10,000; Per Day Limit: Rs.25,000; Overall Daily Limit: Rs.2,00,000 | Rs.10,00,000 | Rs.1,00,000 | Per Transaction Limit: Rs.10,000; Per Day Limit: Rs.25,000 | Nil |

| NEFT | Rs.10,00,000 | Rs.10,00,000 | – | Rs.1,00,000 | Rs.1,00,000 |

| RTGS | Rs.10,00,000 | Rs.10,00,000 | – | N/A | Nil |

| UPI | Rs.1,00,000 | Rs.10,00,000 | – | Rs.1,00,000 | Nil |

| Transfer Within Self Accounts | Rs.2,00,000 | Rs.2,00,000 | – | Rs.1,00,000 | Nil |

| Transaction Limit for a New Beneficiary (First 4 Days) | Rs.1,00,000 | Rs.1,00,000 | – | Rs.1,00,000 | – |

| Third-Party Transfer within SBI | Rs.10,00,000 | Rs.10,00,000 | – | Rs.1,00,000 | Nil |

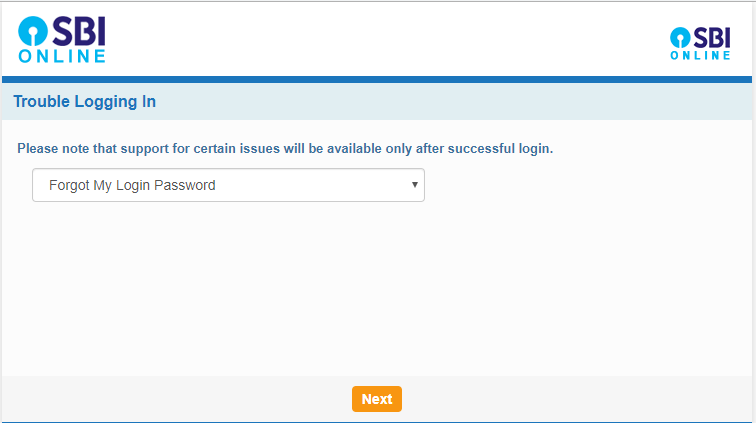

How to Reset The Password for SBI Net Banking?

Step 1: Visit https://www.onlinesbi.com/.

Step 2: Under the ‘Personal Banking’ section click on the ‘Login’ tab.

Step 3: Click on the ‘Continue to Login’ button.

Step 4: In the next screen, click ‘Forgot Login Password’.

Step 5: Select ‘Forgot My Login Password’ option from the pop-up window with a dropdown menu and click ‘Next’.

Step 6: In the next screen, enter the mandatory details such as username, account number, date of birth, mobile number, country. Enter the ‘Captcha code’ carefully.

Step 7: Click ‘Submit’

Step 8: An OTP to reset the password will be sent to your registered mobile number. Enter this OTP in the dialogue box and click ‘Submit’.

Step 9: Enter the new password in the redirected page.

What is The Customer Care Number for SBI Net Banking?

For any queries related to SBI net banking, you can call SBI’s 24X7 helpline number.

Dial SBI’s Toll Free Number

1800 11 2211 or 1800 425 3800

What are The Services Available in SBI Net Banking?

In order to stay ahead in the today’s time, to ensure that the customers receive privilege services, SBI provide many facilities through its online banking portal. Customers with SBI online banking available can make financial transactions easily from home.

Following facilities are available through SBI net banking:

- Check Account Details

- Nomination & PAN Card details

- Account statements

- Checking CIBIL Score

- Last 10 transactions

- Change login password

- Update profile details

- Fund transfer within SBI

- Demand draft request

- Update Aadhaar Card in the bank account

- Fund transfer outside of SBI

- NPS Payment

- Demand draft request

- SBI Collect

- SBI mCash

- Western Union money transfer

- View/Add Biller

- Mobile recharges

- SBI Life Premium Payment

- SBI General Premium Payment

- SBI MF SIP Registration

- Fixed Deposit Investment

- Recurring Deposit

- Issue of Interest Certificate

- Pay taxes

- View Form 26AS

- e-Filing/e-Verify Income Tax

- ATM Card services

- Sovereign Gold Bond

- Online locker

where I Can Download SBI Mobile app