Unlike the old tax regime which involved hectic hand-operated processes, the new tax reform of the country, the Goods & Service Tax (GST) assures tax administration using strong backing technology and therefore, turns out to be beneficial for SMEs and the government in every aspect. It’s an online taxation system thus, reduces the extra burden of managing all the documents and then visiting tax departments in person to submit the applications or filing of returns.

The government has provided an official GST website www.gst.gov.in, well known as the GST portal facilitating all taxpayer services.

Table of Contents

ToggleThe GST Portal assists in:

- GST Registration

- GST Return Filing

- Obtaining Refunds

- Cancellation of GST Registration

Via the online GST site, taxpayers can get information on the latest reforms and updates brought by the government.

Let’s take a quick tour of www.gst.gov.in dashboard and understand how easy it is to use the Goods and Service Tax website.

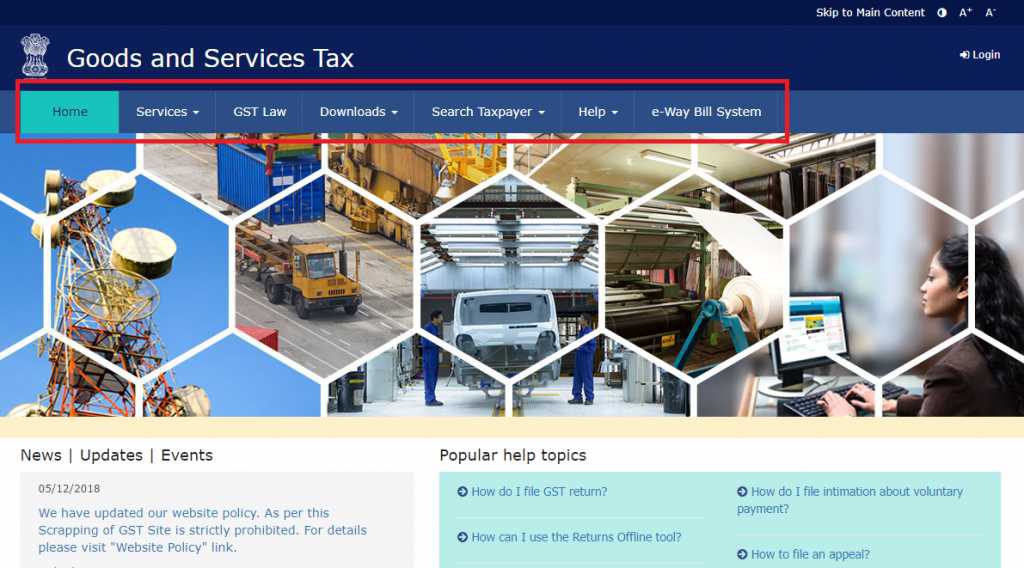

GST Website (www.gst.gov.in) Homepage Layout :

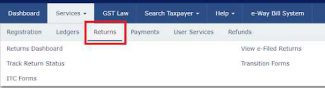

Navigation Bar on GST Portal Homepage

Let’s check what can be done on the GST website Before and After the GST login.

a.) Before Logging in to GST Portal

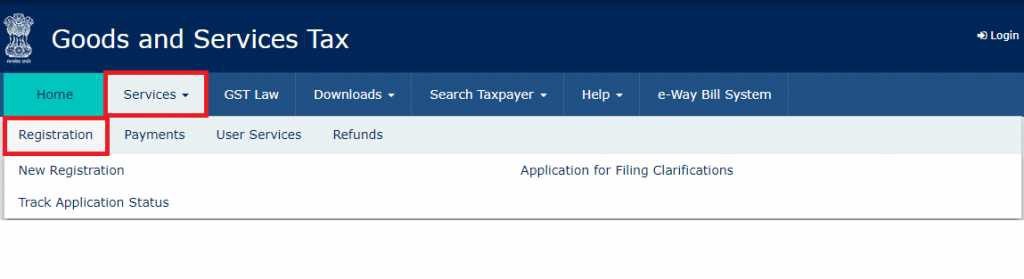

1. Services Tab

Under the ‘Service’ Tab on the GST site, you will find the link for GST ‘New Registration’ and if you have already applied, you can ‘Track Application Status’.

‘Service’ Tab also helps in GST Challan Creation, Searching nearest GST Practitioner, Tracking of Refund Application Status using ARN number.

2. GST Law Tab

Post-implementation of GST, the gov. has made several changes in the policies to improvise the taxation system and to make its adoption easier for Indian SMEs & MSMEs. All the latest updates, amendments and notices are available under this tab. ‘GST Law’ tab is especially used to understand CGST & SGST Act and Rules relevant to GST.

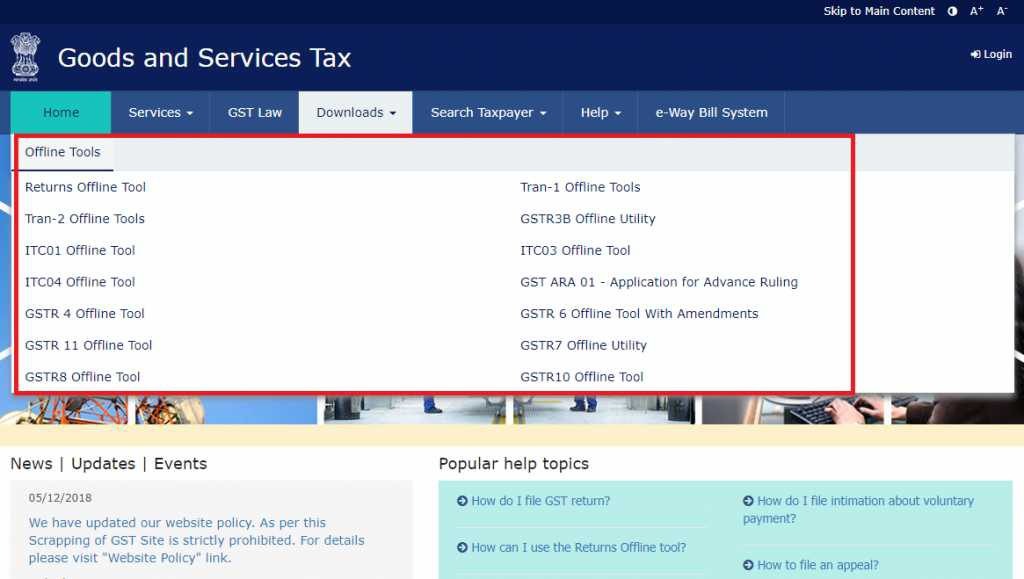

3. Download Tab

As the name suggests, you can download all the offline utility tools from the ‘Download Tab’ on the GST portal. You can get GST Return Filing forms and other forms for completing the offline process.

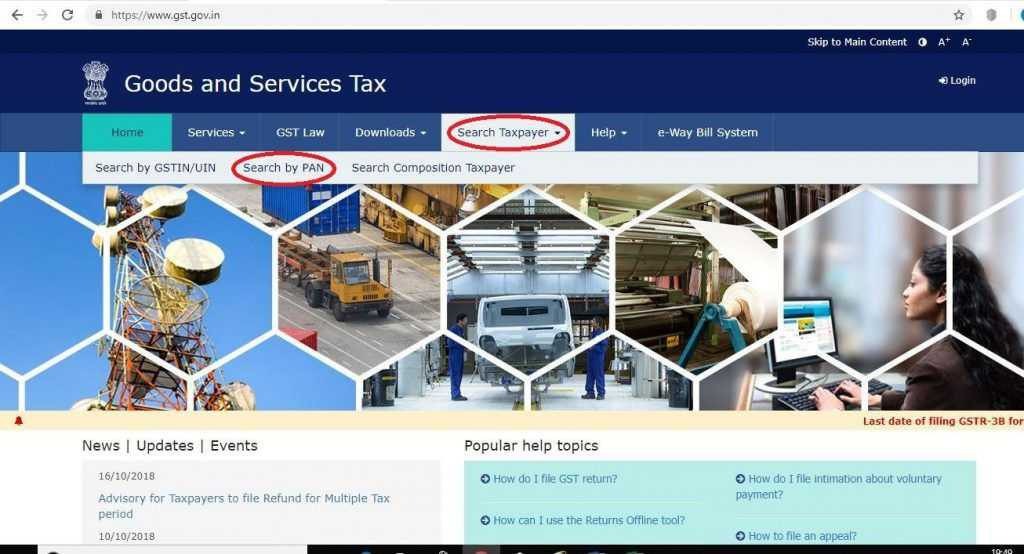

4. Search Taxpayer Tab

‘Search Taxpayer’ tab on the menu bar allows you to search a taxpayer on the basis of GSTIN Number & PAN Number. You can also look for a composition dealer who has Opted In or Opted out by entering either the GSTIN or his registered State.

5. Help Tab

Get instant access of user-manuals, clarification on system requirements for smooth GST adoption, Videos and FAQ’s to resolve any query related to the registration under GST, and return filing process etc.

6. E-way bill system Tab

Click on the ‘E-way bill system’ tab and it will redirect you to the e-way bill portal. Get all the necessary information, FAQs, User manual related to e-way bills via e-way bill portal.

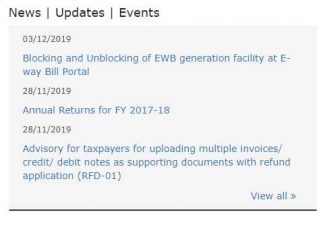

7. News | Updates | Events

While we scroll down, we will see all GST news| updates | events section which shows every important and updated information.

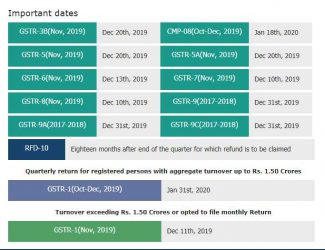

8. Important Dates

Under the ‘Important Dates’ section, taxpayers can get the list of the upcoming GST returns deadlines so they can never miss the deadlines and suffer the GST penalties.

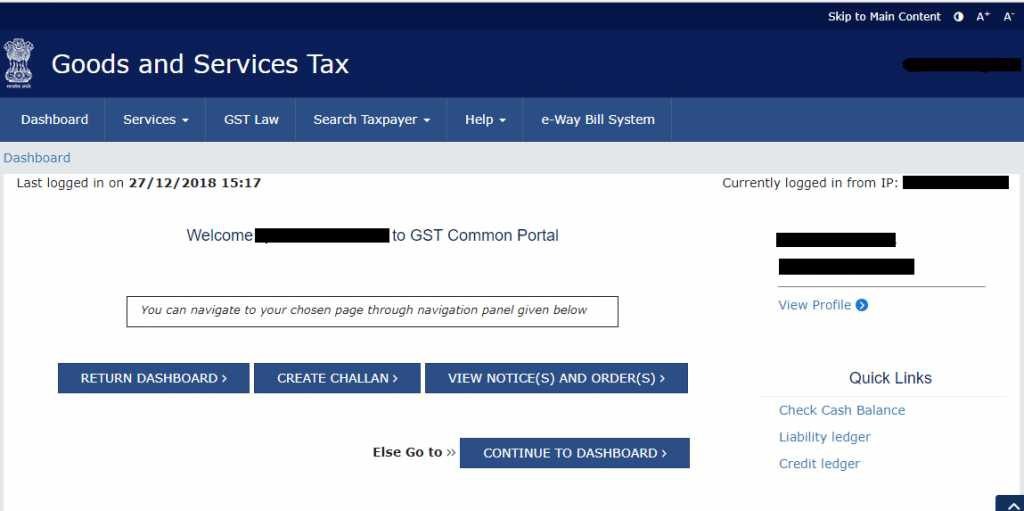

b.) After Login on the GST Portal

1. Dashboard Menu

The first screen that appears after you log in to the GST portal is the ‘Dashboard’. You can see a consolidated view of your profile, your notice(s), order(s) in one click on this single page.

As the screen shows, taxpayers can also create challans and file returns from this page.

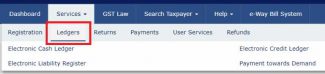

2. Services

GST Portal offers all the functionalities which a taxpayer might need in order to ease the GST taxation system for him.

Right from ‘Registration’ to ‘Refunds’ in the ‘Services’ tab provides everything that a taxpayer needs.

- Under “Registration” tab you can explore the following:

- “Ledger” tab:

- “Returns” tab:

- “Payments” tab:

- After logging in, you can access to “User Service” tab:

- “Refunds” tab:

It is said that for easy GST adoption, taxpayers don’t need any GST Practitioner or CA to handle the process. The gst.gov.in has made it so easy that any small businessman can file his returns on his own from www.gst.gov.in

Click Here to Login in Government GST Portal

Even if you climb to the highest mountain, you can only take a step on the ground