Recent Updates on e-Invoicing:

4th July 2022

According to a government official, in order to lower the barrier from the existing Rs 20 crore, the government intends to make GST e-invoicing mandatory for businesses with a turnover of Rs 10 crore and higher from 1-10-2022.

24th February 2022

According to Notification No. 1/2022, the e-Invoicing system will be made available to businesses with an annual turnover of more than Rs. 20 crore and up to Rs. 50 crore as of April 1, 2022.

30th June 2021

The CBIC has issued a notification proposing to waive the penalty imposed for non-compliance with dynamic QR code regulations for B2C invoices between December 1, 2020, and September 30, 2021.

1st June 2021

A government department and local authority are exempt from the e-invoicing system, according to CBIC’s Central Tax Notification No. 23, dated June 1, 2021.

30th March 2021

The CBIC has published a notification to waive the fine for failing to follow the rules for dynamic QR codes for B2C invoicing between 1 December 2020 and 30 June 2021, provided that the person in question complies with the notification’s requirements starting on 1 July 2021.

Introduction To e-Invoicing with GST

The submission of “e-Way Bills“ on a single GST site simplifies the mobility of products from one location to another. Similarly, the GST Council voted to adopt an e-Invoicing system that will only apply to a certain group of people during its 35th meeting. The generation of invoices on the GST site is not a requirement of electronic invoicing. The idea would be false. Instead, e-invoicing entails submitting a pre-produced standard invoice via a widely used e-invoice gateway. By automating multi-purpose reporting, invoice information is only ever input once. Through Notification No. 69/2019 – Central Tax, the CBIC informed several similar portals to produce e-invoices.

Businesses may use the Marg ERP e-invoicing software. Additionally, Marg ERP has an e-Invoicing Tally Connector that enables taxpayers to complete e-invoicing tasks without exiting the tally page. Your previous data won’t get altered during a secure migration to a new user interface.

Taxpayers can produce e-invoices using various methods provided by Marg ERP, including FTP, SFTP, Excel mode, and connectors for Tally and smooth API connections. The user can benefit from several value enhancements, including:

- Per minute 5000 e-invoices are generated automatically.

- Integration with a 99.999% uptime high-fidelity solution.

- 100+ data validations are performed to guarantee a smooth and error-free e-invoicing process.

- Increase the success rate of EWB production by automatically retrying unsuccessful EWBs (with distance error).

- After IRN creation, the e-way bill is automatically generated without any data input.

- Faster loading of up to 1 lakh electronic invoices and electronic way bills on the screen.

- Data preservation, informative reports, customized print templates for e-invoices, reconciliation between an e-way bill and GSTR-1 data, etc.

To Whom and When e-Invoicing will be Applicable?

| Phase | Applies to taxpayers having an aggregate turnover of more than | Applicable date | Notification number |

| 1 | Rs 500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| 2 | Rs 100 crore | 01.01.2021 | 88/2020 – Central Tax |

| 3 | Rs 50 crore | 01.04.2021 | 5/2021 – Central Tax |

| 4 | Rs 20 crore | 01.04.2022 | 1/2022 – Central Tax |

If taxpayers’ turnover surpasses the stipulated maximum in any fiscal year from 2017-18 through 2021-22, they must use e-invoicing. Additionally, the total turnover in India will comprise the total turnover of all GSTINs that fall under a single PAN.

If the turnover in the previous fiscal year (FY) was below the threshold limit but grew over the threshold limit in the current year, then e-Invoicing would begin to apply from the start of the next fiscal year.

Let’s say XYZ Limited has the following aggregate turnover:

FY 2017–18: Rs. 15 crore

FY 2018–19: Rs. 17 crore

FY 2019–20: Rs. 24 crore

FY 2020–21: Rs. 19 crore

FY 2021–2022: Rs. 18 crore

XYZ Ltd. must issue electronic invoices as of April 1, 2022, regardless of the total revenue for the current year, as it exceeded the limit of Rs. 20 crore in FY 2019–20.

According to CBIC Notification No.13/2020 – Central Tax, however, regardless of turnover, e-Invoicing shall not be applicable for the time being to the following registered people categories:

- A bank, an NBFC, an insurance company, or another financial institution

- A Goods Transport Agency (GTA)

- A licensed individual offering passenger transportation services

- A licensed individual who offers services for admittance to the screening of motion pictures in multiplexes

- An SEZ unit (excluded under Central Tax CBIC Notification No. 61/2020)

- Local authorities and government agencies (excluding those under CBIC Notification No. 23/2021 – Central Tax).

What Does e-Invoicing Mean in Terms of GST?

A technology known as “e-Invoicing” or “electronic invoicing” allows B2B invoices to be electronically verified by GSTN before being used on the shared GST site. Every invoice issued under the electronic invoicing system will get an identification number from the GST Network-managed Invoice Registration Portal (IRP) (GSTN). The first IRP was made available by the National Informatics Centre at einvoice1.gst.gov.in.

The GST portal and the e-way bill portal will get real-time transfers of all invoice information from this site. Since the data is sent directly from the IRP to the GST site, it will also eliminate the requirement for manual data entry for filing GSTR-1 returns and creating part- A of the e-way invoices.

What Would Be The Current Mechanism in Place For Issuing Invoices?

Currently, companies produce invoices using various tools, and the data from these invoices are manually submitted in the GSTR-1 report. When the relevant suppliers submit the GSTR-1, the invoice data appears in the GSTR-2A for the receivers’ exclusive inspection. On the other hand, the consignor or the carriers must manually import the invoices again in Excel or JSON to create the e-way bills.

The procedure for creating and uploading invoice data will not change under the new electronic invoicing system, which will go into effect on October 1, 2020. It will be imported directly or through a GST Suvidha Provider, utilizing the Excel tool, JSON, or API interface (GSP). The information will automatically transfer to the creation of the GSTR-1 and the e-way bill as well. The primary technology to make this possible will be the e-invoicing system.

What are The Steps Involved in Receiving an e-Invoice?

These are the steps that go into creating or increasing an e-invoice.

- The taxpayer must guarantee that the modified ERP system is used per PEPPOL guidelines. He might work with the software service provider to include the e-invoice standard set, i.e., e-invoice schema (standards), and must at the very least have the CBIC notify him of the necessary parameters.

- Generally speaking, a taxpayer has two possibilities for IRN generation:

(1) On the e-invoice portal, the IP address of the computer system can be whitelisted for integration using a direct API or a GST Suvidha Provider (GSP) like Marg ERP. (2) To upload invoices in bulk, download the bulk generation program. To produce IRNs in mass, a JSON file may be created and published to the e-invoice gateway. - The taxpayer must then provide a regular invoice for that software. He must include all pertinent information, including the billing name and address, the supplier’s GSTN, the transaction’s value, the item’s GST rate, the amount of tax, etc.

- Once one of the above methods has been selected, create the invoice using the appropriate ERP or billing program. After that, submit the invoice’s data, particularly those about the required fields, to the IRP using a JSON file, an application service provider (app, GSP, or direct API), or both. The central registrar for e-invoicing and its validation will be the IRP. Other ways to connect with IRP include SMS-based and mobile app-based methods.

- IRP will verify the essential information on the B2B invoice, look for any duplications, and create an invoice reference number (hash) for future use. The IRN is produced using the following four criteria: the seller’s GSTIN, the invoice number, the fiscal year (YYYY-YY), and the document type (INV/DN/CN).

- IRP creates a QR code in Output JSON for the supplier, generates the invoice reference number (IRN), and digitally signs the invoice. On the other hand, the supply supplier will be notified by email when the e-invoice is generated (if provided in the invoice).

- For GST returns, IRP will transmit the authenticated payload to the GST portal. If necessary, information will also be sent to the e-way bill gateway. The seller’s GSTR-1 is automatically filled out for the applicable tax period. It then establishes the tax obligation.

A taxpayer can continue to print his invoice with a logo as he does now. All taxpayers are only required to record invoices on IRP in e-invoice format under the gst system.

What Assets Does e-invoicing Offer to Businesses?

Employing the e-invoice system introduced by GSTN will give businesses the following advantages:

- To decrease mistakes caused by mismatches, e-Invoice closes and plugs a significant gap in data reconciliation under GST.

- Interoperability and a decrease in data input mistakes are made possible by the ability of different applications to read electronic invoices.

- E-invoice enables the supplier’s invoices to be tracked in real-time.

- The tax return filing process would be backward integrated and automated; the pertinent information from the invoices would be pre-populated in different forms, particularly for creating the part-A of e-way bills.

- Increased speed of actual input tax credit availability.

- Less likelihood of tax authorities conducting audits or surveys since the data they need is available at the transaction level.

Will e-Invoicing Help to Reduce Tax Evasion?

The following are some ways it will assist in reducing tax evasion:

- Due to the mandatory need for the e-invoice to be created through the GST system, tax authorities would have access to transactions as they happen in real-time.

- Since an invoice is created before completing a transaction, there will be fewer opportunities for manipulation.

- As all invoices must be created through the GST system, it will reduce the likelihood of fake GST invoices and allow for the claim of the only real input tax credit. The ability to correlate input credit information with output tax information makes it simpler for GSTN to identify fraudulent tax credit applications.

What are the Mandatory Fields of an e-Invoice?

Mainly, the GST invoicing regulations must be followed using e-Invoice. In addition, it should take into account the policies or invoicing practices used by each business or sector in India. For companies, certain information is required, while the rest is optional. Additionally, many fields are made optional so that users can choose to only fill out the necessary ones. For the benefit of users who might be interested, each field has also been documented and given sample inputs. One can observe that several necessary elements from the e-way bill format, like the sub-supply type, are now included in the e-invoice.

As announced on July 30, 2020, by Notification No. 60/2020 – Central Tax, the following highlights the updated e-invoice format’s contents:

- 12 segments (required and optional), six annexures, and a total of 138 fields.

- Five of the 12 portions must be completed, while the other seven are optional. There are two required annexures.

- Basic information, supplier information, receiver information, invoice item details, and document total are the five required sections. The item descriptions and the document total are the two required annexures.

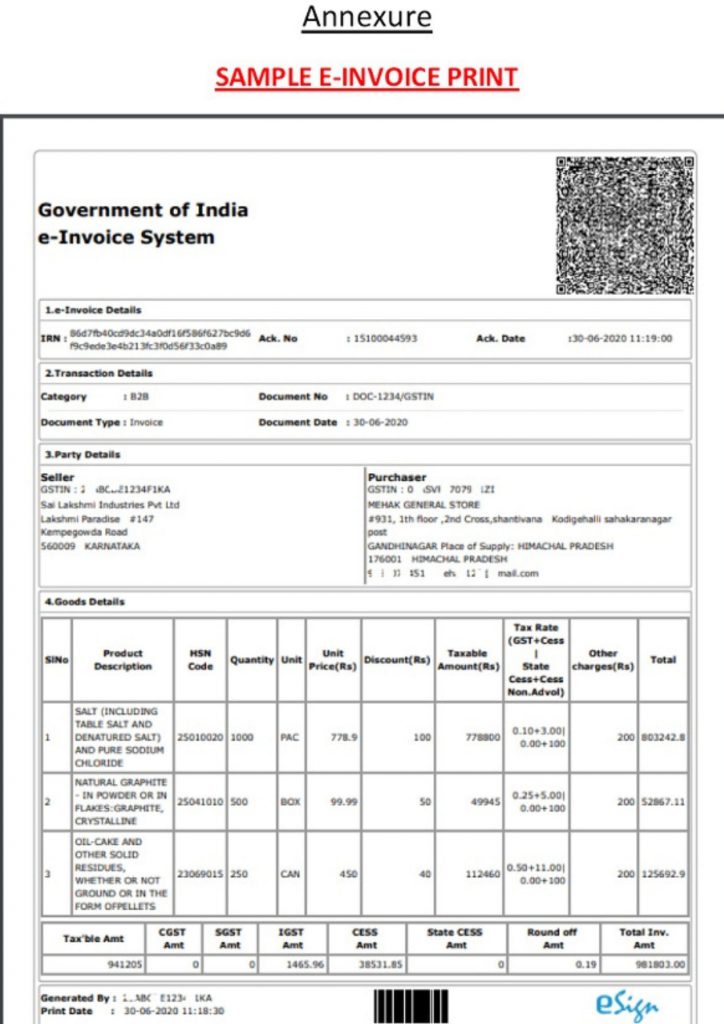

How Does The e-Invoice Look a Like?

Frequently Asked Questions on e-Invoicing GST

[sp_easyaccordion id=”11395″]