Introduction:

What is GST Payment?

Any person who is involved in purchasing or supplying of goods and services is required to file GST. To calculate your GST amount, you need to deduct the Input Tax Credit (ITC) from your Outward Tax Liability. In case of late fee charge or interest, add the amount to the total and then subtract the TDS or TDC charges.

Once you have calculated the amount, the next step is to make the payment.

GST Payment Rules

- According to the GST payment guidelines, monthly returns filed by the taxpayers without paying the requisite tax are considered as invalid returns.

- Taxpayers can not file returns for the subsequent months is they skip paying tax for a month.

- In fact, missing on tax payment also leads to heavy interest rates. Taxpayers have to bear interest applicable, from the GST payment due date.

Therefore, if you wish to avoid unnecessary penalties, understand the GST Payment process and make the payment before the scheduled dates.

How to Make GST Payment Online — Step By Step Guide

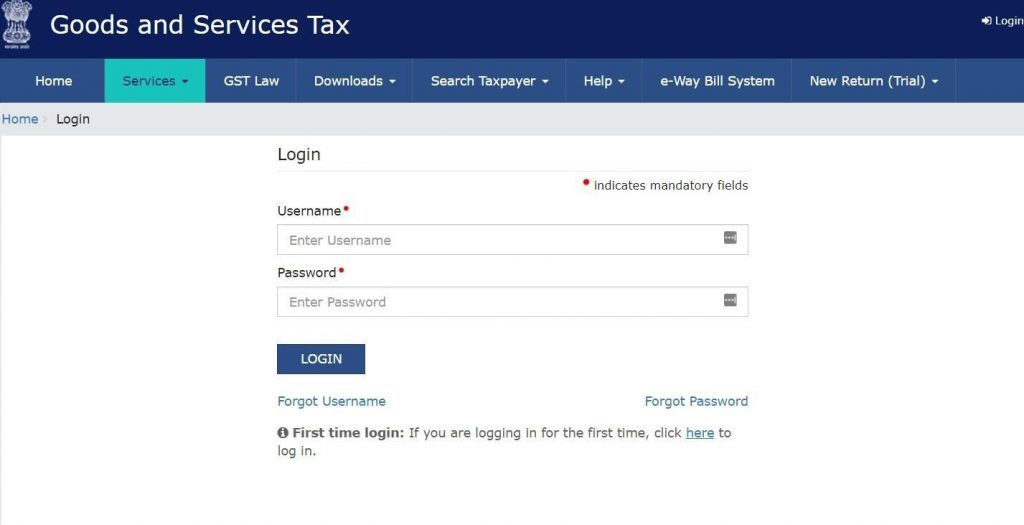

To fulfil all GST dues, you can go to the GST Portal (gst.gov.in) website. Here click at this link https://services.gst.gov.in/services/login

Step 1- Proceed to the official GST website www.gst.gov.in and login to your account using your username and password.

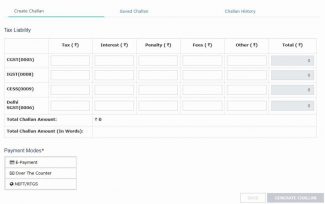

Step 2- Once you have logged in, click on the ‘payment’ section under the service option. Then select the ‘create challan’ option.

Step 3- Here, you can see three options, Create Challan, Saved challan and all Challan History. Now fill the details and you get three payment modes E-payment, over the counter and NEFT/RTGS.

Click on your desired payment method, and Generate Challan. Check the image below!

Step 4- In the next step, you need to enter the amount correctly under each head like CGST, IGST, Cess, among others, and then proceed to select the method of payment.

Step 5- Once you have filled in the particulars, click on ‘create challan.’ However, if you have any doubt, you can save and retain the challan for later. It allows you to make changes to the GST challan as many times as you want and when you become entirely sure of the details, hit the ‘create challan’ button

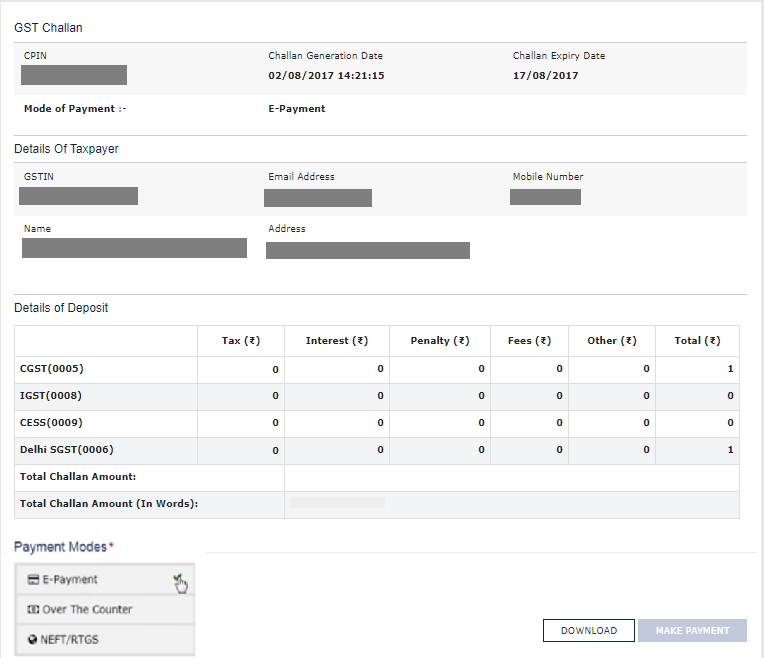

Step 6- After the challan is generated, you will need to select the mode of GST payment.

We have 3 modes of GST payment

- Through Internet banking and debit/credit cards

- Counter payment through authorized banks– Counter payments have a limit of Rs. 10,000/- per challan

- Payment through NEFT/RTGS

Step 7 – A summary page will appear on your screen which contains information of the challans. Select your ‘Mode of Payment’ suitable for you and proceed.

Step 7– Log in to the Net-Banking account and make an online payment, one can also take a printout of the challan and make payment by visiting the bank personally.

Irrespective of how you make the payment, you will get an acknowledgement slip and will be able to download the challan online.

There are different GST payment forms to pay GST online:

- Form GST PMT-01 — It maintains the electronic tax liability register

- Form GST PMT-02 — It is for the electronic credit ledger

- Form GST PMT-03 — This form contains the order of rejection of the claim for refund of balance in electronic cash ledger or electronic credit ledger, issued by an authorized officer

- Form GST PMT-04 — If you notice any discrepancy in your electronic credit ledger, you can make use of this form to communicate the same

- Form GST PMT-05 — It maintains the electronic cash ledger

- Form GST PMT-06 — You will find GST challan for payment of tax, penalty, fees, interest, or any other charges

- Form GST PMT-07 — This form is used to inform if the bank account has been debited, but CIN has not been created or CIN has been generated but not reflecting on the GST portal

Great article. I appreciate you effort to such a wonderful information