Table of Contents

ToggleAmendment & Cancellation- Overview & Procedure

E-Invoice can only be cancelled on the IRP within 24 hours of generation of the IRN. This mainly happens because the IRP servers do not store e-Invoices for more than 24 hours. However, if an e-Way Bill has already been generated against the IRN, it can’t be cancelled.

Partial cancellation of e-Invoice is not possible; hence, the complete invoice could be cancelled. Moreover, no amendments to the e-invoice can be done. In case, any changes required for the invoice details uploaded on the IRP, then; it can be only done through the GST portal while filing GSTR-1. However, these changes will be moved forward to the concerned officer, who may request further information from the taxpayer.

Procedure to Cancel an E-Invoice on IRP

There may be various reasons for the cancellation of the e-invoices and some of them are as follows:

- Cancellation of the order by a buyer

- Incorrect entry of any goods mentioned in the bill

- The duplicate entry of the same bill etc.

To cancel an e-Invoice on the IRP, a taxpayer needs to follow the given steps:

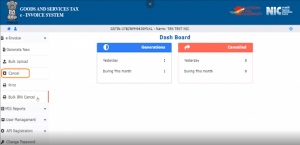

Step 1: Firstly, Log in to the e-Invoice portal, thereafter in the left section of the portal select the option ‘E-invoice’.

Now in ‘E-invoice’ Tab select ‘Cancel’.

Step 2:

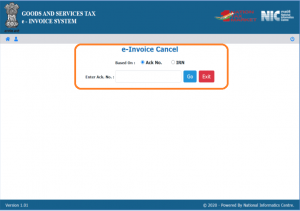

E-invoice cancel window will appear

- Mention the basis of cancellation of the e-invoice i.e. ‘Ack No or IRN’

- Select ‘Ack No’

- Now in ‘Enter ACK no’ mention you acknowledgement no of your invoice

- Click on ‘Go’

Thereafter the portal will display that the invoice has been successfully cancelled. And the cancelled e-Invoice will be displayed with a ‘Cancelled’ watermark.

Points to Remember

- If an IRN will be cancelled, then, the same invoice number cannot be used again to generate another IRN. If it will be used again, the invoice will be rejected by the IRP, when reported. This is because, IRN is a unique reference number for invoices generated based on the GSTIN, document/ invoice number, type of document & financial year it has been issued in.

- If an e-way bill for an IRN has been generated then cancellation of IRN will not be permitted by the IRP.

- In case an IRN will be cancelled, then GSTR-1 will also be automatically updated with ‘cancelled’ status.

- If an invoice has to be cancelled after 24 hours, the taxpayers can only cancel the same manually on the GST portal before filing the GST returns.

- Amendments in the e-Invoice are allowed only through the GST portal as per the provisions of GST law.