Recent Updates on e-Invoicing:

10th May 2023

The 6th phase of e-invoicing has been announced by the CBIC, which will require companies with a turnover of ₹5 crore or more in any financial year from 2017-18 to generate e-invoices starting from 1st August 2023. This is part of the government’s ongoing efforts to transition towards a more digitized economy.

11 October 2022

E-invoicing is now required for enterprises with a turnover of more than Rs. 10 crores, but starting in 2023, the goods and services tax (GST) may require all businesses with an annual turnover of more than Rs. 5 crores to switch to e-invoicing.

16 August 2022

As per the goods and services (GST) new guidelines, From October 1, businesses with a revenue of more than Rs 10 crore will need to use e-invoicing.

To use the e-invoicing system, GST-registered individuals must upload all B2B invoices to the invoice registration portal (IRP). A digitally signed electronic invoice, a specific Invoice Reference Number (IRN), and a QR code are all created by the IRP and sent to the user.

4th July 2022

According to a government official, in order to lower the barrier from the existing Rs 20 crore, the government intends to make GST e-invoicing mandatory for businesses with a turnover of Rs 10 crore and higher from 1-10-2022.

24th February 2022

According to Notification No. 1/2022, the e-Invoicing system will be made available to businesses with an annual turnover of more than Rs. 20 crore and up to Rs. 50 crore as of April 1, 2022.

30th June 2021

The CBIC has issued a notification proposing to waive the penalty imposed for non-compliance with dynamic QR code regulations for B2C invoices between December 1, 2020, and September 30, 2021.

1st June 2021

A government department and local authority are exempt from the e-invoicing system, according to CBIC’s Central Tax Notification No. 23, dated June 1, 2021.

30th March 2021

The CBIC has published a notification to waive the fine for failing to follow the rules for dynamic QR codes for B2C invoicing between 1 December 2020 and 30 June 2021, provided that the person in question complies with the notification’s requirements starting on 1 July 2021.

Article Content:

- What is E-Invoicing Portal?

- How E-Invoicing Portal Works?

- How to Generate E-Invoice in GST Portal

- Here’s what you will access after logging in to the E-Invoice API Developer Portal

- About E-invoice1-trial.nic.in Portal

- E-Invoicing System under GST Applicability in E-invoice Portal

- Content of E-Invoicing Portal

- Frequently Asked Questions

As of April 1, 2020, an Electronic Invoicing or E-Invoicing portal has been approved in phases by the GST Council to generate and authenticate B2B invoices and upload to GST portal.

What is E-Invoicing Portal?

Considering the lack of proper e-invoice standard, a draft was kept in the public domain after consulting with ICAI and industry/trade bodies to create the same. It is very important to have a standard to ensure e-invoices to be operable well in the whole GST eco-system. This way, e-invoices generated by a program can be accessed by other e-invoicing software and there is no need to enter data manually.

Uniform interpretation and machine readability are the main objectives. In return, it is also important to report the information to the GST portal. Along with the GST portal, having a standard also ensures eliminating all manual errors and transparency in the whole eco-system by sharing an e-invoice from the seller.

GST council has approved e-invoice in GST Portal on September 20, 2019, in its 37th meeting. Apart from the schema, the standard is also published on the GST portal. It is common to raise doubts in standards. Hence, an explanation document has also been published in layman’s language. There are also plenty of myths related to e-invoice portals. The current document is aimed to clear the doubts related to the concept.

How E-Invoicing Portal Works?

- E-invoice is generated by taxpayers on their own billing/ERP/accounting system

- After preparation, they report the e-invoice on Invoice Reference Portals

- A dedicated Invoice Reference Number (IRN) is generated by the e-invoicing portal that will be attached on e-invoice. The system will make a digital signature and return the same to the recipient and supplier.

- A QR code will be generated in the e-invoicing portal, including the IRN with some major parameters like GSTIN of buyers and suppliers, date, invoice number, invoice value, HSN code, and total tax amount.

- Taxpayers can verify QR code with a mobile app.

How to Generate E-Invoice in GST Portal?

Registration has been opened by GSTN in the E-Invoicing portal for taxpayers with turnover of over 5 Cr. Here are the steps to sign up for E-Invoicing –

- Log on to https://einvoice1.gst.gov.in

Note – This link is mainly dedicated for E-Invoicing systems and for developer’s testing purposes. Currently E-Invoice portal is available for taxpayers having over 500 Cr. of turnover. It will open shortly for taxpayers who have lesser turnovers.

- Enter GSTIN and the Organization Name will be filled automatically under “Trade Name”. Enter your Email address and registered mobile number with Captcha.

- An OTP will be sent to your GST registered mobile number and email from the e-invoice portal.

- Click “Validate”. If your details are found correct and you have turnover of above Rs. 500 Cr, your details will be verified.

- Click “OK” to proceed on the pop-up.

- Click “OK” after clicking the “Send OTP” button.

- Enter the “OTP” given.

- Enter the user and password.

- Click “Create”.

- You will get the Client ID and Password to your phone number and email.

Note – The credentials for the e-invoicing portal will not be the same for E-Way bill portal and Government portal.

- Login with Client ID and Password to the E-Invoicing Portal

- Enter the Client ID, GST number, User, Password, and Captcha.

- Click “Submit”.

Here’s what you will access after logging in to the E-Invoice API Developer Portal:

- API endpoints to make URL request

- Sample Payloads

- Public Key

- Tools for JSON validation

About E-invoice1-trial.nic.in Portal

There are different phases to implement the e-invoicing system. This e-invoice portal is open for taxpayers only on a trial basis to be familiar to use it.

Latest Updates on E-Invoice Portal

July 30, 2020

- The CBIC has notified a new and redesigned e-invoice format by deleting 13 fields and adding 20 new fields. There are also some changes in some fields in terms of character length.

- Taxpayers with Rs. 500 Cr. as annual turnover will be able to use an e-invoicing system.

- E-invoices are also exempted in Special Economic Zones

March 23, 2020

QR code and e-invoice were implemented on October 1, 2020. Exemption from QR code and e-invoicing has been granted to several sectors like banking, insurance, NBFCs, financial institutions, GTA, movie tickets, and passenger transportation.

Free Download E-invoicing Software

E-Invoicing System under GST Applicability in E-invoice Portal

Taxpayers having turnover of more than Rs. 500 Cr can use e-invoicing system at einvoice1-trial.nic.in. It would broadly consist of the following features –

- Validate IRN

- Generate IRN

- Cancel IRN

- Generate MIS Reports

- Print e-invoice

- Authorize sub-user to cancel IRN, generate IRN, or generate reports based on IRN

Content of E-Invoicing Portal

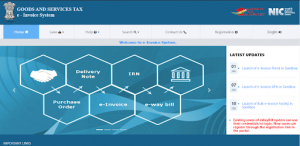

Front End of E-invoice Portal

- The home page of the website has a section with updates related to e-invoicing where you can get the details about new features.

- The “Laws” section consists of various forms, rules, circulars, and notifications related to e-invoicing.

- The Help section consists of FAQs, user manuals, and tools, such as bulk generation tools.

- Search section has the following information –

-

- Taxpayers can enter GSTIN to see the details.

- Taxpayers can enter HSN Code to enter services and product details.

- E-invoice status of the taxpayer

- Verification of the invoice.

-

- The Contact Us section consists of phone numbers and email for support.

- Registration section allows users to register on the website for using an e-invoicing portal. Different types of users can use the registration facility, including GSP based, mobile-based, SMS-based, and API-based. The mode of e-invoice generation is available as per the selection at registration.

- After registration, a user can enter login id and password in the Login section.

After Login in E-invoice Portal

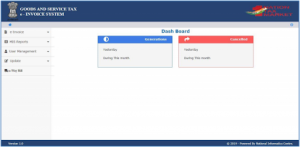

After GST e-invoice login, here’s how the Dashboard screen is going to be like –

There are five options available in e-invoice portal:

-

- E-Invoice – It consists of the following sub-sections –

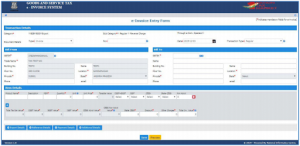

- Generate IRN – Taxpayer can generate the Invoice Reference Number by manually entering debit note/invoice/credit note data.

The JSON of your e-invoice would be signed digitally by the IRP/website and a QR code will be generated to access invoice data. A unique 64-character IRN would be generated for each invoice.

- Generate Bulk IRN – Instead of uploading each invoice details manually, you can upload several invoices in a JSON file and it can be generated in the website. A unique IRN would be assigned to every invoice in JSON.

- Cancel IRN – If you feel that you have made any mistake in uploading invoice details, you can also cancel the generated IRN in 24 hours. Keep in mind that you cannot delete the IRN and it would also remain unique after cancellation. You need to enter an acknowledgment number to cancel the e-invoice.

After cancellation of e-invoice, it would show the pop-up “e-invoice cancelled successfully”.

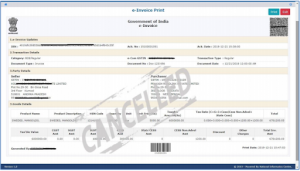

- Print e-invoice – Enter the e-invoice/IRN number to print e-invoice.

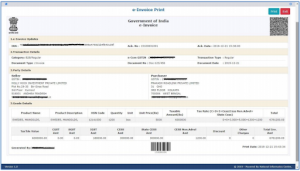

Here’s how the printed invoice would look like –

2. MIS Reports – MIS report can be generated with this option. Select the dates and other details to get the invoices listed which have been uploaded. You can also export this list with the “Export to Excel” option.

2. MIS Reports – MIS report can be generated with this option. Select the dates and other details to get the invoices listed which have been uploaded. You can also export this list with the “Export to Excel” option.

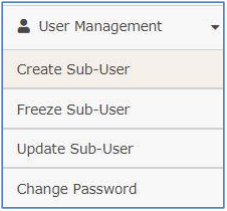

- User Management – This option is especially helpful for large businesses which have assigned various roles to various people. Businesses can control user access according to the given roles in this portal.

Under User Management, other options are “Freeze Sub-User”, “Create Sub-User”, “Update Sub-User”, and “Change Password” in the above figure. Here are the permissions are given to each of these sub-users –

- Cancel IRN

- Generate IRN

- Generate a report of IRN

Each sub-user would have a unique login ID and main user ID would be the same, except the suffix.

- Update – It may not be easier to enter business info all the time when preparing an invoice. So, this option can auto-fill some fields while pulling all the information from GST portal to generate e-invoice.

- E-Way Bill – You can fill the Part A with this option in e-way bill with vehicle number only and enter the rest of it in Part B.

Frequently Asked Question

[sp_easyaccordion id=”5449″]